How much does small business insurance cost?

You can get a good idea of what to expect by looking at cost data from the thousands of businesses that found policies with Insureon, the leading online marketplace for small business insurance.

What is the average cost of small business insurance?

The first policy that most small business owners need—and also the least expensive one—is general liability insurance. In an analysis of 30,000 small businesses that purchased commercial insurance through Insureon, the average cost of a general liability insurance policy is $42 per month or $500 per year.

General liability coverage is often bundled with commercial property insurance at a discount in a package called a business owner's policy (BOP). A BOP provides financial protection against the most common lawsuits and property losses at an affordable price, making it the best choice for a small business. The average cost of a business owner's policy is $57 per month or $684 annually.

The table below shows average monthly costs for our top small business insurance policies. These figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Average monthly small business insurance costs

| Business insurance policy | Average monthly cost |

|---|---|

$42 / month | |

$57 / month | |

$61 / month | |

$45 / month | |

$75 / month | |

$145 / month | |

$67 / month |

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

How is the cost of small business insurance calculated?

Your insurance provider will typically calculate your premiums based on several different factors about your business. The factors that impact your cost can vary depending on the types of coverage that your business needs.

The size of your business, its location, and the type of work you do are all key factors in determining your insurance rates. The average monthly premiums, listed above, can give you a general idea of how much you could pay for coverage.

Here's a quick look at the factors that affect the cost of general liability insurance coverage and other types of small business insurance:

Policy limits and deductibles

If you want car insurance that pays for a wide range of damage, you have to pay more for it. The same rule applies to business insurance. If you want a policy that covers more expensive accidents and lawsuits, expect to pay more than you would for basic coverage.

General liability insurance is an occurrence-based policy. It pays for losses that occur during the policy period and has two limits:

- Per-occurrence limit. The insurer will pay up to this amount to cover claims related to a single incident.

- Aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to this amount to cover claims.

The limits can run from $250,000 to $2 million and more. Most Insureon customers choose $1 million / $2 million general liability insurance limits.

Professional liability or errors and omissions insurance (E&O) policies are claims-made and only cover claims filed while your insurance is kept active.

When buying a policy, it's a good idea to make sure the deductible is something you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your liability claim. The average deductible that Insureon customers select for general liability insurance is $500.

The right amount of insurance coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

Your industry

When deciding how much to charge for a policy, your industry is a top consideration for insurance companies. Insurers take into account any risks that might increase the chance of an expensive claim, such as hazardous machinery that could injure workers, or a greater likelihood of malpractice lawsuits.

Businesses in high-risk industries are more likely to file an insurance claim, which results in higher premiums. Here are a few examples:

- Businesses that engage with the public typically pay more for general liability insurance, which covers third-party bodily injuries and property damage. That means general liability insurance costs are higher for retailers, but lower for consultants who work on their own.

- Similarly, commercial auto insurance costs depend on the type of driving you do. Trucking businesses can expect to pay more for this coverage, as opposed to small businesses that own a company car.

- Professional liability insurance costs depend on the type of professional services or advice you provide. If other businesses like yours have a history of claims, that means increased costs for your business too.

- Healthcare and finance businesses that store medical records, credit card numbers, or other personal information may pay more for cyber insurance, which covers costs in the event of a data breach or cyberattack. This is also true for IT consultants and other tech companies that need a specialized form of this policy, technology E&O, to protect against data breach lawsuits.

- Retailers, restaurants, and others that depend on a physical location to conduct business face bigger losses in the event of a forced closure from a fire or storm, which is why they can expect higher premiums for business interruption insurance.

You might also run into insurance requirements for your industry. For example, businesses in the construction and cannabis industries are often required to carry general liability insurance.

Learn more about recommended insurance policies and costs for your industry:

Business location

Your location can also influence the cost of business insurance. For example, businesses in an area with high crime or increased foot traffic may pay more for insurance that covers theft or customer accidents.

You’d also face higher insurance costs if you’re in a district with expensive real estate, as it could increase your cost of claims.

State laws also play a role. Most states require workers' comp insurance for businesses with employees. The majority of states also require commercial auto insurance for business-owned vehicles.

Finally, you may need a certain policy to work in a specific location. For example, businesses in real estate, insurance, or healthcare may need professional liability insurance (also called errors and omissions insurance) in order to get licensed in their state or work in a specific setting like a hospital.

Find business insurance requirements in your state

Classification codes

Insurance companies use a system of class codes for reference when determining the premiums for some policies. These codes group similar types of work together to give the insurer an idea of the level of risk your business faces.

One example is general liability class codes, which group businesses by their industry. Construction businesses face higher risks of injuries and property damage claims. Professional services and consultants are considered less risky for general liability claims, and have different class codes to represent this.

Insurance providers also rely on class codes for workers' compensation. Clerical office workers across different industries may share the same workers' comp code, which designates them as low risk for work-related injuries and illnesses.

What other factors affect business insurance costs?

The factors listed above aren't the only ones that affect the cost of small business insurance. Insurers will also look at:

- Business property. The premiums of policies that cover property damage and theft primarily depend on the value of the insured property and its condition, such as inventory, equipment, and your building if you own it.

- Business income. In general, businesses with higher revenue incur more risks and pay more for insurance. For example, a manufacturer that expanded its factory and hired more people would see an impact on its general liability and workers' comp rates.

- Number of employees. With more employees comes a higher risk of work-related accidents and associated medical expenses.

- Types of business insurance purchased. Different policies come with different costs, with general liability insurance being the most affordable policy.

- Business experience. The longevity and financial stability of your business will be noted by the insurance company in setting your premiums, as more experience within your industry can often mean less risk.

- Business structure. Whether your business is classified as a sole proprietorship, limited liability company (LLC), or S corporation can impact how much coverage you need and your subsequent insurance costs.

- Claims history. A history of claims will drive up your insurance rates, which is why risk management is essential.

How can you get affordable business insurance?

Business insurance companies offer a variety of products for different premiums, which is why it's important to compare their offerings. You could contact each individually—but it's faster and easier to work with an insurance agent or broker, like Insureon.

With Insureon, you can fill out our easy application to get quotes from top-rated insurance companies. A licensed insurance agent will help you find coverage that matches your risks, at a price you can afford.

In addition to shopping around, there are a few other ways to save money on business insurance:

- Choose cheaper options. You can opt for a higher deductible or lower coverage limits to save money on your premiums.

- Pay the annual premium. Insurance companies often offer a discount when you pay the full yearly amount instead of the monthly premium.

- Manage your risks. Installing a security system, providing equipment like goggles and gloves, and eliminating clutter can reduce your risk of accidents and lawsuits.

- Bundle policies. A BOP isn't the only option. Some professionals can combine general liability and professional liability insurance for a discount, or buy errors and omissions and cyber liability insurance together.

Save a bundle with a business owner's policy

The most common bundle is a business owner's policy, which includes general liability coverage and commercial property insurance. The average cost of a BOP is only $57 per month for Insureon's small business customers.

Bundle up. A business owner's policy includes both general liability and commercial property insurance.

It costs about $57 per month, less expensive than if these policies were purchased separately.

Don't put your business at risk. Apply for your policy today. Oh-oh!

General liability insurance

Business owner’s policy

Workers’ compensation insurance

Professional liability insurance

Cyber insurance

How do you buy small business insurance with Insureon?

Insureon partners with top-rated U.S. insurance companies to find the right coverage for your small business. To get started, fill out our easy online application with basic information about your company, such as revenue and number of employees, and get free business insurance quotes from the nation's leading carriers.

You can consult with a licensed insurance agent at any point in the process. Compare quotes and choose the coverage that fits your business needs and your budget. Once you pay for your policy, you can download a certificate of insurance to show clients and others that your business is protected.

Obtén más información sobre precios de seguros para negocios (en español).

Our methodology

Insureon is the number one online marketplace for small business insurance. We have helped everyone from software developers to house cleaners, management consultants, and general contractors with their business insurance needs.

We partner with 30+ leading insurance carriers, such as The Hartford, Liberty Mutual, and Acuity, to find the best possible coverage for your business. Our expert agents can guide you through your options and answer any questions along the way.

The average costs on this page were derived from our data on 30,000 small business owners who purchased policies through Insureon. To understand how your business compares to our typical customer, it's helpful to get an idea of who we insure. The majority of our small business customers have:

- One to four employees

- Annual revenue ranging from less than $50,000 to more than $200,000

- Five years or less in business

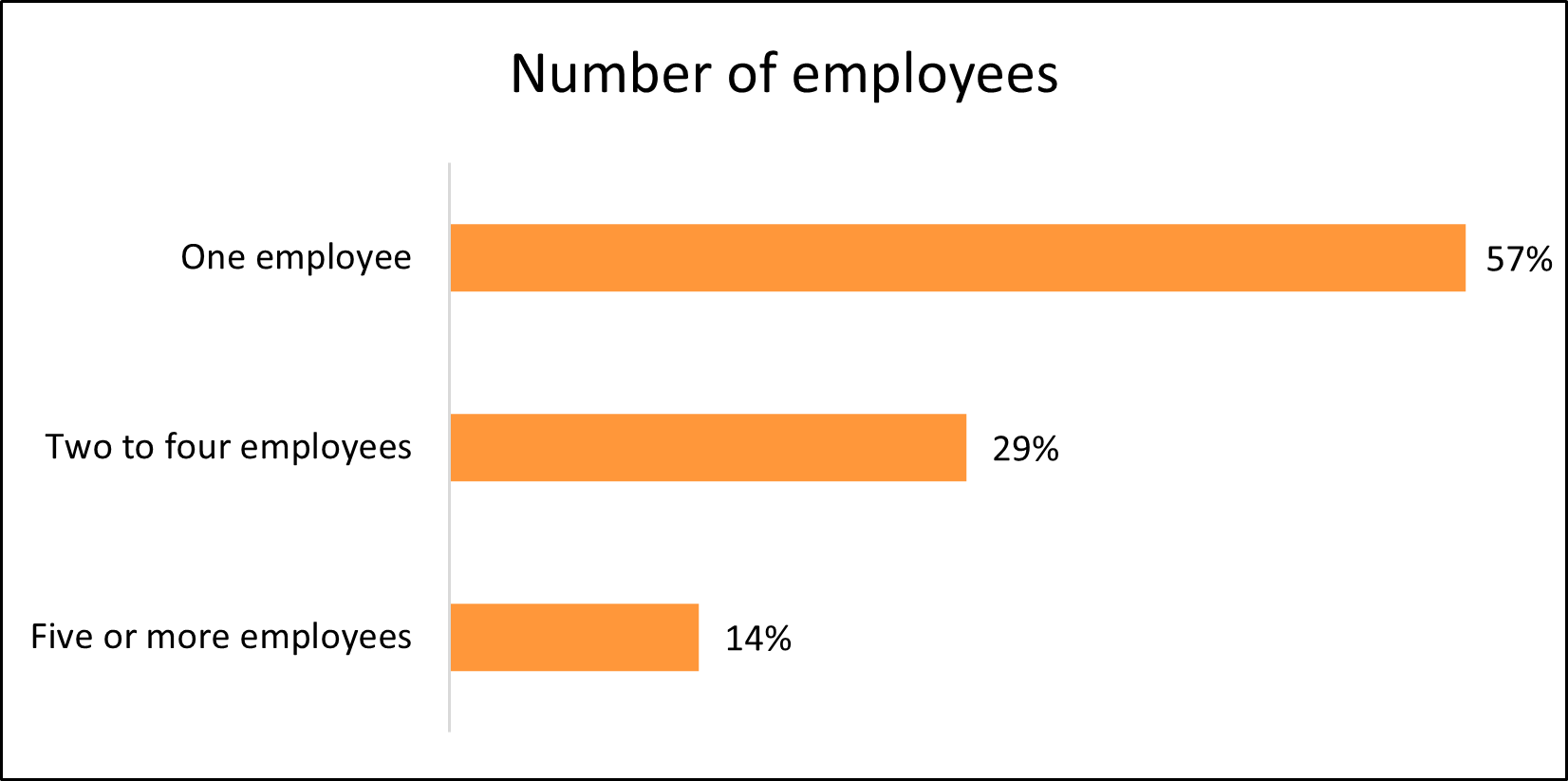

Most businesses have only one employee

The number of employees can impact the cost of business insurance coverage, especially for policies like workers' compensation insurance.

The majority of small businesses in this analysis (57%) have only one employee. That means most of our customers are sole proprietors, independent contractors, and freelancers. Another 29% of businesses have two to four employees, and others employ five or more.

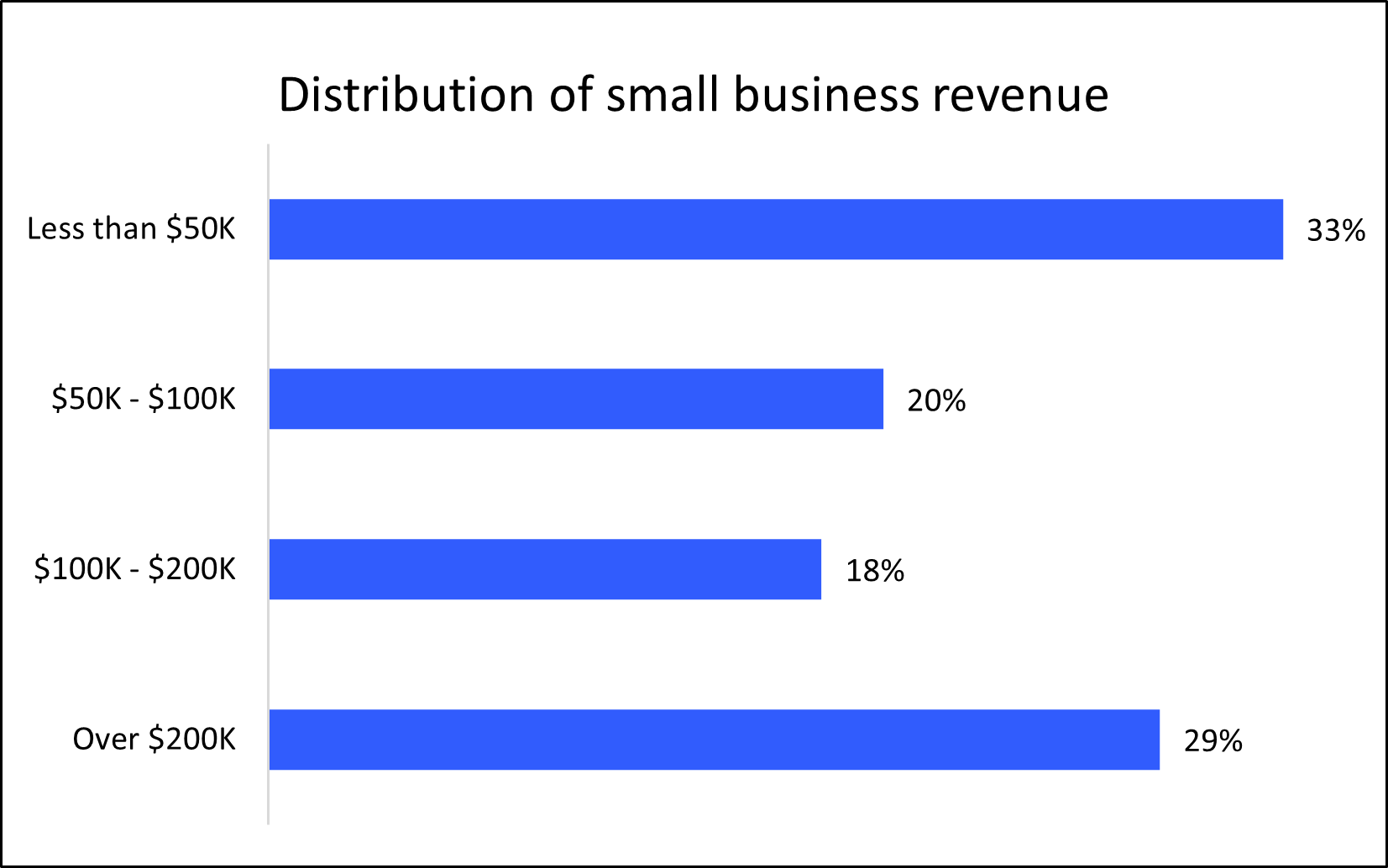

53% of businesses earn less than $100,000 annually

Your revenue also impacts the cost of small business insurance. For example, a small business that earns less than $1 million in annual revenue may be eligible for a cost-saving business owner's policy.

The average revenue of the small businesses included in this analysis is $80,000. The majority of customers (53%) have less than $100,000 in annual revenue.

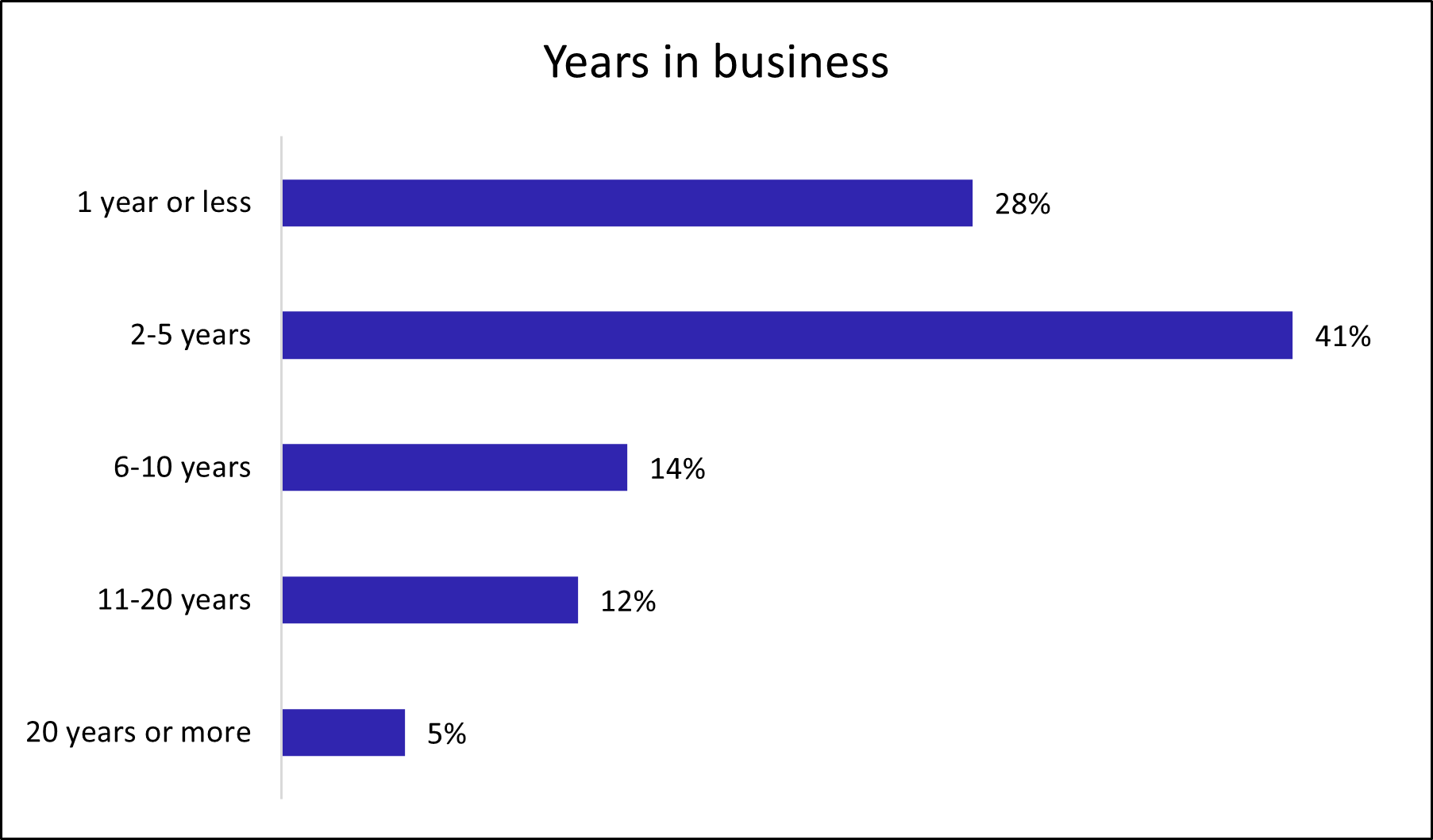

Most companies have been in business for five years or less

Business insurance premiums may be lower for companies that have been in business for many years without making a claim.

The majority of companies included in this analysis (69%) have been in business for five years or less.