Florida workers’ compensation insurance

Workers' compensation insurance covers the cost of work-related injuries and illnesses. In Florida, businesses with four or more employees must carry workers' comp. Construction businesses must have coverage for every employee.

Who needs workers’ comp insurance in Florida?

Florida law states that workers’ compensation insurance is required when a business has four or more employees, either full-time or part-time.

There are special considerations for some employees, including corporate officers:

- Sole proprietors and partners are automatically excluded from workers’ comp law, but they can purchase coverage by filing for election of coverage.

- Construction businesses are required to carry workers’ compensation insurance for every employee, including yourself if you are the only employee. They can exempt up to three corporate officers if each can demonstrate ownership of at least 10 percent of the company. In addition, contractors are responsible for ensuring that their subcontractor provides coverage for their workers.

- Agricultural businesses with six or more regular employees and/or 12 or more seasonal employees that work for more than 30 days are required to provide coverage.

So, do you need workers’ comp for part-time employees? Unless they fall into one of the three exemptions above, the answer is yes. Independent contractors are not considered employees, and an employer is not required to carry workers’ compensation insurance for those individuals unless they are in the construction industry.

The Florida Division of Workers' Compensation regulates workers' compensation, assists with claims, and enforces compliance with the state's laws.

Why is workers' compensation insurance important for businesses?

Workers’ compensation is a crucial part of small business insurance because it can pay for medical bills, recovery costs, and disability benefits if an employee is injured at work. It can also cover funeral costs and death benefits for an employee’s family in the event of a fatality on the job.

By mandating this insurance coverage, Florida officials provide an incentive for businesses to keep employees safe and reduce the risk of lawsuits against business owners. That means that your small business insurance can:

- Cover medical expenses if an employee is injured

- Provide disability benefits while the employee is recovering, or if permanently disabled

- Pay legal expenses if an employee files a lawsuit related to a work injury or illness (because workers' comp includes employer's liability insurance)

- Comply with applicable workers’ comp laws

Insureon helps a variety of industries compare quotes and buy Florida workers’ compensation insurance policies. Whether you own a dental practice, photography studio, convenience store, or something altogether different, we can help you find a policy to meet your business needs.

Do you need workers’ compensation if you are self-employed?

Whether or not sole proprietors, independent contractors, and other self-employed individuals are required to have workers’ compensation insurance depends on the nature of the work being performed.

The state of Florida requires that even self-employed workers in the construction industry carry workers’ compensation insurance. If you’re in an industry that has less risk of workplace injuries and you have no employees, you might still decide that it’s a good idea to have coverage.

Though you may have health insurance, if you get injured on the job, workers’ compensation coverage can help with lost wages and other expenses that would not be covered under your regular medical policy.

In Florida, businesses with four or more employees must carry workers' comp. Construction businesses must have coverage for every employee.

What does workers' comp cover for Florida businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- A clothing store employee slips on a wet floor and breaks their wrist. Workers' comp covers their doctor's appointment and pain medication, and provides disability benefits to replace part of the wages they miss while they are recovering.

- A security guard is assaulted on the job and suffers cuts and abrasions. The company's workers' comp policy pays for their visit to the emergency room and a follow-up doctor's appointment.

- A registered nurse develops a back injury from lifting and turning patients. Workers' comp covers their surgery, medications, and physical therapy. It also provides temporary disability benefits until they have recovered.

- A house cleaner suffers from respiratory problems after years of using harsh cleaning chemicals. After filing a workers' comp claim, they receive permanent disability payments for their ongoing lung issues.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers’ compensation insurance cost in Florida?

The average cost of workers’ compensation in Florida is $54 per month.

Your workers' compensation premium depends on several factors, such as:

- Payroll

- Location, such as Miami, Orlando, or Jacksonville

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

How do you buy workers' compensation insurance in Florida?

There are three ways to buy a workers' comp policy in Florida:

- You can buy it from a private insurance company. You could contact each insurer independently to compare their products and rates, but that's where agents and brokers like Insureon come in. As the nation's leading digital insurance agency, Insureon partners with 40+ top-rated insurance carriers to deliver the right coverage for your business. Fill out an easy online application to get started.

- If denied coverage, you can buy it from the state fund. Florida has a "last resort" state fund for employers who have difficulty obtaining coverage elsewhere, overseen by the Florida Workers' Compensation Joint Underwriting Association (JUA).

- You can self-insure your business. Employers who meet certain requirements can apply for self-insurance. This is mostly an option for large corporations and others with the financial resources to handle claims themselves.

Verified workers' compensation insurance reviews

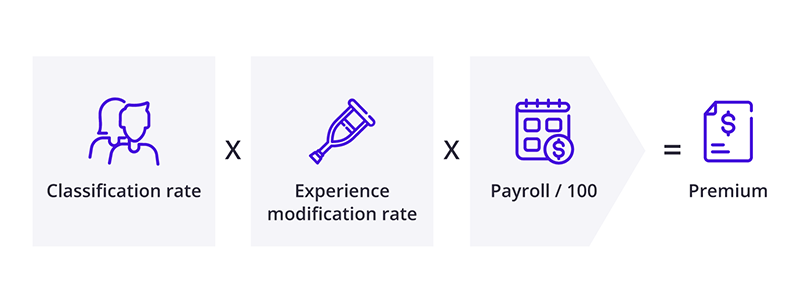

Insurance providers use a specific formula for calculating workers' comp premiums: Classification rate x Experience modification rate x (Annual payroll / $100).

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for general contractors, tree trimmers, and others with a higher rate of injuries. Like most other states, Florida relies on the National Council on Compensation Insurance (NCCI) database.

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rate is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to come up with your workers' comp premium. Workers' compensation audits are typically done each year to ensure your business pays the right premium for this coverage.

How can Florida business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure. This also helps you avoid misclassification fines.

In some cases, small business owners can choose to buy pay-as-you-go workers' compensation. This type of workers' comp policy has a low upfront premium, and lets you make payments based on your actual payroll instead of estimated payroll. It's useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is another cheap option, though it's only permitted in certain circumstances. A ghost policy is a workers' comp policy in name only. It provides no protection, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers’ compensation work in Florida?

Florida's workers' compensation system protects both employees and employers. In the event of a workplace injury, the employee receives reimbursement for their medical treatment and time lost from work, while the employer is protected from lengthy and expensive litigation.

Most policies include employer's liability insurance, which covers legal expenses if an employee blames their employer for an injury. However, the exclusive remedy provision in most workers' comp policies prohibits an employee from suing their employer once they accept workers' comp benefits.

The state of Florida requires coverage to include workers' compensation benefits for:

- Medical care

- Temporary total disability

- Temporary partial disability

- Impairment income benefits

- Permanent total disability

- Fatal incidents

In most cases, the benefits are two-thirds of the employee's average weekly wage before the injury.

The Florida Department of Financial Services regulates workers’ compensation insurance. Florida employers and workers can find resources for all aspects of workers' compensation claims and laws through the agency’s Division of Workers' Compensation.

What are the penalties for not having workers’ compensation in Florida?

Florida employers that operate without the required workers’ comp coverage risk civil penalties.

Usually, that means that the business would be subject to a stop-work order that requires all operations to stop until it complies with the law and pays a penalty. The fee is typically equal to twice the insurance premium the employer would have paid for the preceding one- or two-year period.

If the employer does not comply with a stop-work order, the action could result in criminal charges. You could also be subject to a stop-work order if:

- Payroll is understated or concealed

- Employees’ duties are misrepresented or concealed

- There is any attempt to avoid paying workers’ compensation premiums

Death benefits under Florida workers’ compensation law

If an employee dies as a result of a work-related accident within one year of the date of the accident or within five years of continuous disability, death benefits could be owed to the employee’s survivors. The family of the deceased employee could be entitled to:

- Up to $7,500 to cover funeral expenses

- Education benefits to a surviving spouse

- Up to $150,000 in compensation benefits to dependents (paid at up to 66.67 percent of the decedent’s weekly wage)

Workers’ comp settlements in Florida

In some cases, an employee might try to negotiate for a workers’ comp settlement.

If an injured employee decides to escalate a claim to a larger settlement negotiation, the employer should remain involved in that discussion to reduce liability in a lawsuit if one arises.

Before an insurance company will settle a claim, it will ask the employee and their attorney to calculate the total amount of anticipated related expenses. However, the insurance company won’t simply pay a settlement based on all of these calculations.

The insurance company and the employee’s attorney will often spend some time negotiating before reaching a settlement that is agreeable to all parties. If they can’t reach an agreement, there could be a hearing or lawsuit.

In Florida, settlements are voluntary; neither party can be forced to sign. The settlement is received as a single lump-sum payment.

Statute of limitations for workers’ compensation claims

Statutes of limitations are designed to protect against claims that are filed too long after an injury has occurred. Florida laws state that an employee cannot claim benefits, receive medical treatment, or sue for lost wages if the period is more than two years from the date of injury.

There are exceptions to the two-year statute of limitations:

- If the injured worker is a minor

- If the injured worker is mentally incompetent

- If the worker was misled by the employer about coverage entitlement

- If the insurance carrier did not properly inform the worker of their rights

- There is no statute of limitations in Florida for care associated with medical prosthetic devices

Get free workers’ comp quotes with Insureon

If you are ready to buy a workers' compensation policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy