Ohio workers' compensation insurance

Ohio law requires every business with employees to provide workers’ compensation insurance purchased through a state agency. This policy covers medical bills and partial lost wages for work-related injuries.

Who needs workers’ compensation coverage in Ohio?

Ohio imposes stringent workers’ compensation insurance rules on its employers. Any business that employs even one person must carry workers’ compensation insurance.

The state of Ohio workers’ compensation system is different than in most other states. Ohio uses what is called a monopolistic state fund, which means that workers’ compensation insurance can only be purchased through a government-operated fund – not through a private insurer.

It’s crucial that employers correctly classify individuals as employees or independent contractors. If the employer manages working hours, materials, travel routes, and quality of performance, then the worker is an employee and the business owner is required to provide workers’ comp coverage.

The exception is domestic workers, such as housekeepers, babysitters, and gardeners, who earn less than $160 per calendar quarter. If the worker is paid more than that amount during a 13-week period, then the employer is required to have workers’ comp coverage.

Volunteers are also exempt from workers’ comp insurance requirements, unless their work is for a public employer, such as a volunteer firefighter or emergency medical technician.

Out-of-state workers are subject to workers' compensation laws in their own states. Ohio employees working in other states may need additional coverage.

Do you need workers’ compensation in Ohio if you are self-employed?

A sole proprietor or member of a partnership must carry workers’ compensation insurance for any employees of the business, but it is optional for owners to have insurance for themselves. However, it's still a good idea to buy coverage for yourself.

Without workers' comp, you may end up paying for expensive medical bills out of pocket, as personal health insurance plans often won't cover work-related injuries. Workers' comp also pays for part of the wages you miss out on while recovering, which can be a huge loss if an injury sidelines you for an extended period.

Is workers’ comp mandatory in Ohio for part-time employees?

Ohio employers are required to carry workers’ compensation insurance for part-time employees. However, if an injury occurs, the part-time employee’s benefits would be calculated according to a specific formula that takes into account how many hours the person usually works.

What does workers' comp cover for Ohio businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- A fast food worker burns themselves while preparing an order for a customer. Workers' comp would cover their medical treatment and pain medication.

- A registered nurse develops a shoulder injury from lifting and turning patients. Workers' comp would cover their surgery, medications, and physical therapy. It also provides temporary disability benefits until they can return to work, including a percentage of their average weekly wage.

- A wholesale stocker develops a back injury from many years of lifting and moving heavy stock onto pallets and trucks. Workers' comp would cover their medical provider appointment, medications, and then two months of physical therapy to help them recover.

- A retail store employee slips on a wet floor and hits their head. In this instance, workers' compensation would cover their emergency room trip, head MRI, and any follow-up medical expenses during their recovery.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers' compensation insurance cost in Ohio?

The average national cost of workers’ compensation for small business owners is $45 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as Columbus

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

Though Ohio workers' comp policies must be bought from the state fund, you can buy other forms of coverage through Insureon.

How is workers' comp coverage purchased in Ohio?

Ohio is one of the four states in the nation that uses a monopolistic state fund. This means workers’ compensation insurance in Ohio can only be purchased through a government-operated fund. Buying through a private insurer is not allowed.

Workers' compensation insurance in Ohio must be purchased through the Ohio Bureau of Workers' Compensation (BWC). In limited cases, businesses can qualify for self-insurance.

Any Ohio workers’ compensation claims go through the BWC or the Industrial Commission of Ohio.

Verified workers' compensation insurance reviews

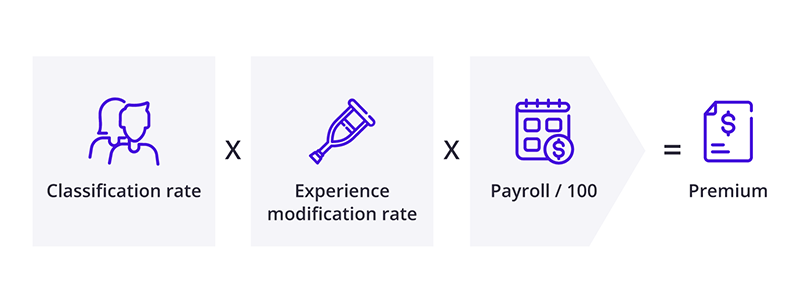

Insurance providers use a specific formula for calculating workers' comp premiums: Classification rate x Experience modification rate x (Annual payroll / $100).

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, tree trimmers, and others with a higher rate of injuries. Ohio relies on their Workers' Compensation Bureau to determine rates, unlike other states that rely on the National Council on Compensation Insurance (NCCI).

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rate is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers by your payroll divided by 100 to determine your workers' compensation rate. Workers' compensation audits are typically done each year to ensure your business pays the right premium for this coverage.

How can Ohio business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of workplace injuries cost less to insure. This also helps you avoid misclassification fines.

In some states, employers can choose to buy pay-as-you-go workers' compensation. However, this type of workers' comp policy is not allowed in Ohio.

Pay-as-you-go workers' comp coverage has a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll. It can be useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, but this is also not allowed in Ohio. A ghost policy is a workers' comp policy in name only. It provides no protection or medical benefits, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers’ compensation work in Ohio?

If an employee suffers a workplace injury or develops an occupational disease, they should submit a First Report of Injury form (FROI) to initiate a workers' compensation claim. This form will ask for the employee's personal details (name, phone number, address, etc.), the employer's information, details of the injury or illness, and relevant medical information.

If the claim is approved, the BWC will pay for medical care and lost wages. The employee can see any doctor for their first visit, but then must choose a medical provider certified by the BWC.

Workers' compensation benefits for injured employees in Ohio include:

- Medical benefits

- Temporary total disability benefits

- Scheduled loss awards

- Permanent total disability benefits

- Change of occupation awards

- Death benefits for fatal incidents

Workers' compensation in Ohio is a no-fault system, which means that employees are eligible for benefits regardless of who's responsible for the injury. For details, visit the BWC page on types of compensation.

Does Ohio workers' compensation protect against employee lawsuits?

Workers' compensation insurance usually includes employer's liability insurance, but that's not the case when it's purchased through a state fund.

Ohio employers who want this coverage, which protects against employee lawsuits over injuries, must purchase it as stop-gap coverage. They can usually add it to their general liability policy purchased through a private insurer.

General liability insurance and other small business insurance policies are available at competitive rates in the open market in Ohio. Start a free online application with Insureon to compare quotes from leading insurers today.

What are the penalties for not having workers’ comp insurance in Ohio?

The BWC closely monitors and enforces workers’ compensation law. Ohio has strict penalties for businesses that fail to comply or that allow coverage to lapse.

It’s up to the BWC to set a premium for each employer every year. It will then send the employer a payment schedule. These premiums are based on a company’s estimated payroll, which is then re-evaluated each July and adjusted to reflect the actual payroll amount. Employers pay premiums directly to the BWC.

If a company allows coverage to lapse by not paying premiums, or if it does not submit a payroll report on time, penalties are assessed as follows:

- Failure to file a payroll report on time is 1% of the premium due ($3 minimum to $15 maximum).

- Failure to pay a premium on time would result in a $30 flat fee, along with a charge of up to 15% of the premium due, depending on how late it is received.

- The BWC would file assessment liens for nonpayment of premiums and claim costs when there is a lapse in coverage.

If an accident occurs and a policy has lapsed, the employer can be sued by the injured worker for all damages and expenses or file a workers’ comp claim. The Ohio BWC would then require that the employer reimburse it for the entire cost of the claim.

Ohio workers’ compensation law for death benefits

Workers’ compensation death benefits in Ohio can be awarded to dependents – those who relied on the deceased worker for financial support. Dependents include:

- A spouse

- A child under 18

- A child under 25 who is a full-time student

- A disabled child of any age who cannot earn a living

There might be other family members who qualify as wholly or partially dependent, but that would be evaluated on a case-by-case basis.

Death benefits are 66.67% of the worker’s average weekly wage, within the state maximum and minimum, which changes annually. The BWC would decide how to allocate benefits among dependents. Generally, the spouse would receive benefits until he or she dies or remarries. Upon remarriage, the spouse would receive two years’ worth of benefits in a single lump sum.

The workers’ compensation death benefits also include up to $5,500 for burial expenses.

Ohio workers’ compensation settlements

In the event of a claim, an employer can clear itself from further time and costs by participating in a workers’ compensation settlement.

Ohio, like other states, accepts settlements as closure of a claim and the employee is not allowed to request additional benefits. Generally, a settlement is paid in a lump sum or a structured settlement, with the total sum paid out over time in increments.

There are four workers’ compensation Ohio requirements that must be met to have a claim lead to a settlement:

- There must be an employer / employee relationship that establishes that the individual was rightfully entitled to benefits and was not an independent contractor.

- The injury was “accidental in character and result,” which means that an employee must have been following workplace protocol and procedure and was not failing to follow rules, lacking common sense, or inattentive when the injury occurred.

- The injury was in the course of employment, which essentially means that it happened on the job.

- The injury arose out of the employment, which means that the injury was caused by a risk or hazard directly related to employment. Often, when the issue is something like toxic exposure, repetitive motion injuries, or similar, there can be disputes as to whether the job and work environment directly led to the injury.

A partial settlement could also be awarded to a claim, which is when the employee would settle disability and wage loss benefits but would retain the right to receive future medical treatment.

Ohio workers’ comp state law for statute of limitations

For both workers’ compensation death benefits in Ohio and regular benefits claims, the statute of limitations is one year from the time of injury or death.

Get free quotes and buy online with Insureon

If you are ready to buy a commercial insurance policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy