Cheap business insurance

Insuring your small business doesn't have to cost a fortune. At Insureon, we help you find affordable coverage that meets the unique needs of your small business, through a single online application. That way you can get peace of mind without breaking the bank.

How do I get cheap business insurance?

It's easy to find affordable small business insurance that matches your risks and your budget. One way is to compare rates from different insurance carriers, such as through Insureon's easy online application that retrieves quotes from several companies.

You can also bundle insurance policies for a discount, choose cost-saving options on your business insurance coverage, and manage your risks to avoid insurance claims and pay less for insurance.

Table of contents

1. Shop around to find the best business insurance and reduce costs

As with other items you buy for your business, you'll want to see what different companies are offering before you make a decision. Policies vary in both their coverage and their cost, and not every company will be a good match.

Insureon works with top-rated providers to find the best small business insurance for your needs. Our easy online application retrieves quotes from the biggest names in the industry, such as Hiscox, Travelers, Chubb, The Hartford, and others with proven financial strength.

Our licensed insurance agents are available to help you find policies to satisfy client requirements, comply with state laws, or obtain a license for your profession. They can help you get the right policy limits, coverage options, and cost-saving bundles that you might not find shopping on your own.

Once you choose a policy, you can get coverage and a certificate of insurance in less than 24 hours.

Find cheap business insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

How much does small business insurance cost?

Small businesses with low risks don't have to pay a lot for insurance.

Average costs for Insureon's customers are:

- General liability: $42 per month

- Business owner's policy: $57 per month

- Commercial auto: $147 per month

What determines the cost of small business insurance?

Small businesses pay different premiums depending on the type of business insurance and their risk of a claim. Factors that affect business insurance costs include:

- Your industry and risks

- Business operations

- Number of employees

- Policy limits and deductibles

- Location

- Revenue

- Business structure (sole proprietor, LLC, etc.)

2. Bundle policies for broader coverage at a lower cost

A business owner's policy protects small, low-risk businesses

Small business owners can often bundle two common types of coverage in a business owner's policy (BOP) for a discount:

General liability insurance is often the first policy purchased by a small business. It protects against costs related to everyday customer accidents, such as a slip-and-fall injury that leads to a lawsuit. It also covers accidental copyright infringement and other advertising injuries.

Commercial property insurance covers costly repairs or replacement of business property and equipment. It can help your business recover quickly after a fire, storm, or burglary.

It may be tempting to cut costs by buying only a general liability insurance policy, but that exposes your business to risks. By paying a little more for a BOP, you gain protection against the most common and costly insurance claims, such as a burst pipe that destroys your business's inventory.

Additionally, a business owner's policy often includes business interruption insurance, also called business income coverage. It helps pay for financial losses if a fire or other covered property claim forces your business to close.

Tech errors and omissions coverage provides specialized protection for IT and tech companies

Tech companies can often combine two important types of coverage in a bundle called technology errors and omissions insurance, or tech E&O. This policy includes the following protection:

Cyber insurance helps companies recover from cyberattacks and data breaches. It can also cover legal fees if your business is sued for failing to prevent a cyberattack or data breach.

Errors and omissions insurance helps protect against lawsuits from dissatisfied clients. It can cover the resulting legal expenses if you miss a deadline or make a mistake in your work. This policy is also called professional liability insurance or malpractice insurance, depending on the profession.

3. Customize your business insurance policies to match your needs

Commercial insurance products aren’t one size fits all. The right coverage will meet all aspects of your business needs but not exceed it.

For example, when purchasing business property insurance, your coverage limits should match the value of your business equipment. If that amount changes, you’ll need to change your policy too.

Some companies may choose to purchase inland marine insurance, which protects business equipment while in transit or stored off site. For others, it may not be needed.

You can also choose to add business interruption insurance to cover expenses related to forced closure.

Commercial umbrella insurance is a good way to save money and extend liability coverage limits if you’re concerned about escalating legal costs.

Workers' compensation insurance is required in almost every state if you have employees. This policy helps pay for medical expenses if an employee or yourself gets injured. Policyholders may be able to save money on their workers' comp with a pay-as-you-go policy or ghost policy.

In addition to workers' comp, some businesses may consider employment practices liability insurance (EPLI), which provides protection when a worker sues over employment-related issues.

Finally, most states require commercial auto insurance for small businesses that own a vehicle.

Choose policy options that provide the right amount of protection

An agent can prevent you from paying for coverage you’ll never use or that exceeds your needs. Here are a few variables to keep in mind:

Deductible. A high deductible can make your insurance premium more affordable. But you’ll have to pay more before you can collect insurance benefits.

Policy limits. A policy limit is the amount your insurer will pay on claims. A lower limit usually means a cheaper premium, but it also means less coverage. Ask your agent how much is enough for you.

Inclusions and exclusions. Inclusions are the events a policy covers, and exclusions are the ones it doesn't. Cheap insurance isn't a good deal if common risks aren't covered.

Actual cash value versus replacement value. You can insure your business property for its actual cash value (depreciated value) to save money. Or you can insure it for the replacement value if you want to be able to purchase a new item after a loss.

4. Manage your risks to keep insurance coverage affordable

Insurance providers may charge more if they think you run a high-risk operation. The good news? You may qualify for cheaper business insurance if you address trouble spots.

Here are a few risk management strategies for small businesses.

Install security alarms and fire suppression systems

Many insurance companies offer a discount on commercial property coverage for businesses that invest in a central burglar alarm or sprinkler system.

Insurance carriers are particular about what qualifies for a premium reduction. Check first to make sure your upgrade will count for a cheaper policy.

Learn other ways to save money on commercial property insurance.

Communicate clearly with clients and customers

An easy way small business owners can reduce the risks of errors and omissions claims is keeping in regular contact with customers.

Make sure you communicate often and honestly with your clients to resolve issues before they turn into a lawsuit. If everyone’s on the same page, you’re much less likely to end up in court.

Discover more ways to save money on errors and omissions insurance.

Create a safe workplace

Implementing safety practices at your business can reduce the chance of general liability claims and workers’ compensation insurance claims. To reduce the chance of visitor and employee injuries:

- Clean spills immediately

- Keep walkways clear of clutter

- Add lighting to dark areas

- Install handrails on stairs

- Remove loose rugs and other tripping hazards

With effective risk management, you can reduce your chances of financial losses. Plus, fewer accidents save your business money even beyond lower insurance costs.

Learn how to save money on general liability coverage and workers' compensation.

Cheapest states to purchase small business insurance

| State | General liability insurance cost | Workers' comp insurance cost | Professional liability insurance cost |

|---|---|---|---|

$42 per month | $32 per month | $71 per month | |

$42 per month | $38 per month | $83 per month | |

$49 per month | $44 per month | $59 per month | |

$44 per month | $46 per month | $66 per month | |

$40 per month | $45 per month | $70 per month |

Cheapest industries to purchase small business insurance

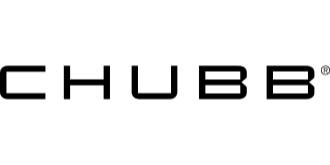

Businesses with a low risk of injuries pay less for general liability

With general liability insurance, industries that have a lower risk of third-party bodily injuries or property damage can expect to pay a lower premium. For example, photographers and companies that offer professional services have minimal risks compared to more hazardous industries like construction and installation.

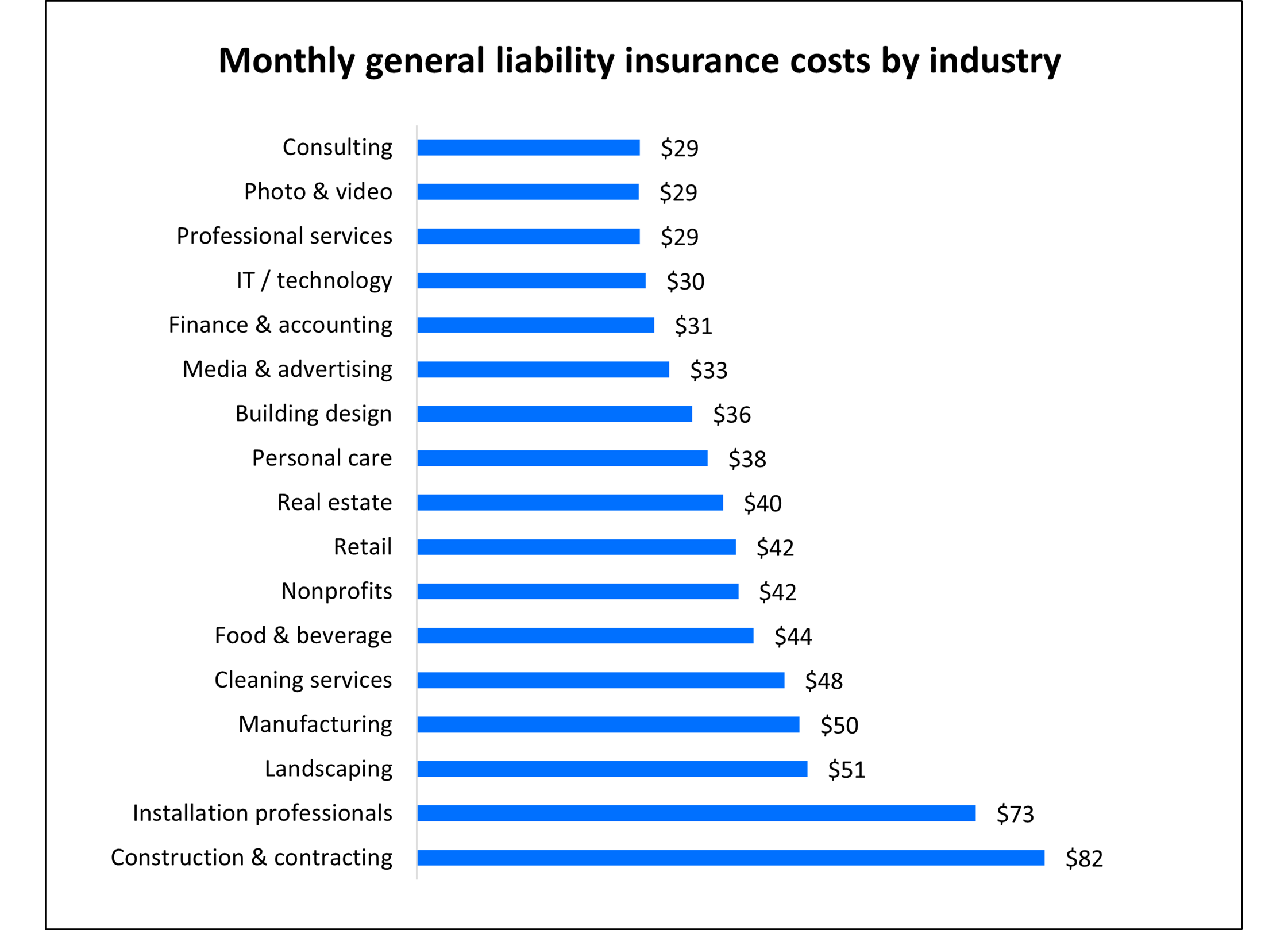

Workplace injuries drive the cost of workers' compensation insurance

As with general liability, businesses with a low risk of bodily injuries can expect to pay less for workers' compensation insurance. It will cost far less to insure accountants, IT consultants, and other office workers than roofers, general contractors, and other workers who are often injured as a result of their work.

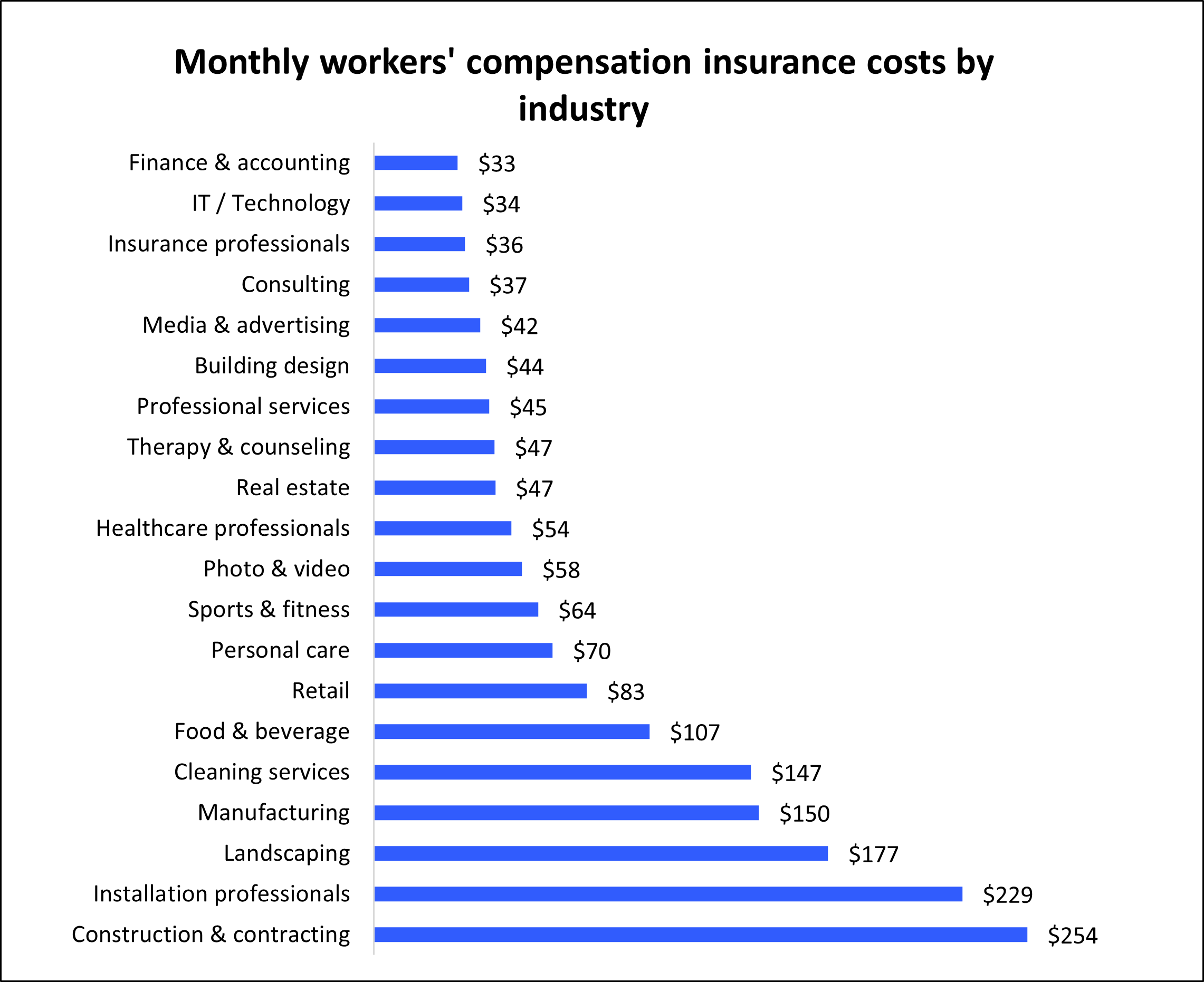

The odds of a client lawsuit affect professional liability costs

For professional liability insurance, the relevant factor isn't physical injuries but financial damages. If your work directly impacts how much money a client makes—or how much they might lose—then you can expect to pay more for this policy.

Architects and other building design professionals can expect higher costs for this coverage, as a flaw in a building could end up costing the owner or developer a fortune.

Get affordable insurance with Insureon

Insureon makes it easy for small business owners to get insured. Fill out our free application to get quotes from top-rated insurance companies. Our licensed agents will help make sure you get the right coverage for your needs at a price you can afford. Once you choose a policy, you can get coverage and a certificate of insurance within 24 hours.