General liability vs. umbrella liability insurance

What is general liability insurance?

- Third-party property damage, such as a computer repair technician accidentally dropping a customer's laptop and breaking it.

- Third-party bodily injury, such as a customer falling in a coffee shop and spraining their arm.

- Personal injuries and advertising injuries, such as libel, slander, and copyright infringement. For example, a medical spa gets sued by a competitor that claims the spa appropriated their copywritten logo.

Many general liability insurance policies also include product liability, which can protect your business if a customer sues, claiming they were harmed or incurred medical expenses resulting from your company's product.

What is umbrella liability insurance?

Generally speaking, your small business insurance policies will have sufficient liability limits to protect your business from the most common risks.

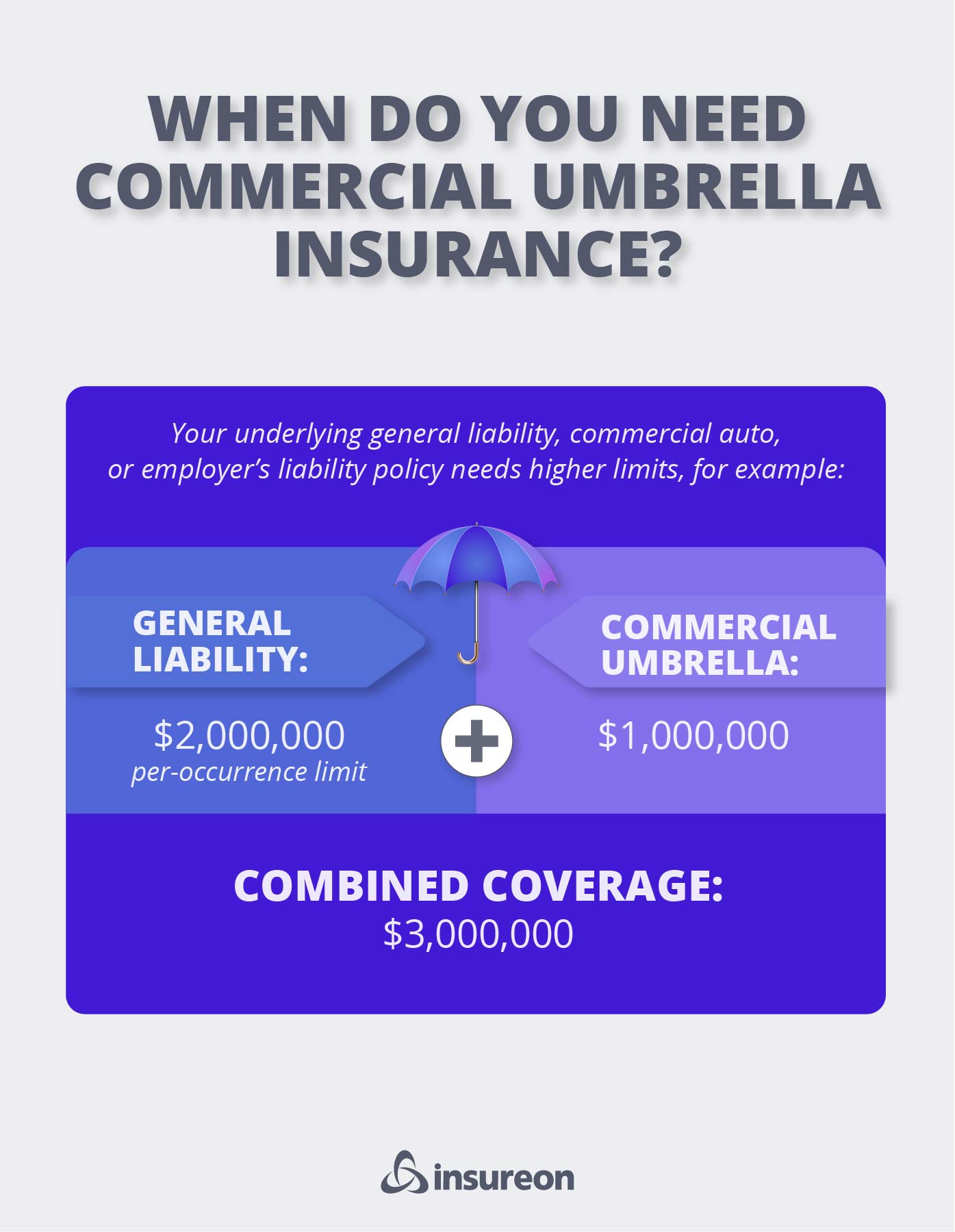

However, some businesses face greater risks or are required by their business contracts to carry higher limits, which is where a commercial umbrella policy comes in.

An umbrella insurance policy provides additional liability coverage beyond the traditional policy limits for the following:

- General liability coverage

- Employer's liability insurance (often included in workers' compensation coverage)

- Commercial auto insurance and hired and non-owned auto (HNOA) insurance

An umbrella liability policy can offer an extra layer of protection, typically in $1 million increments.

This coverage kicks in after the underlying policy limits have been reached. It requires that the policyholder already carry at least one of the primary policies covered by umbrella coverage.

Excess liability insurance is another policy option that can extend your coverage limits, but it only applies to one policy at a time. Umbrella insurance can be applied to multiple policies.

What is the difference between commercial umbrella insurance vs. general liability insurance?

The main difference between these policies is that umbrella insurance is an additional policy that extends coverage limits; it is not a standalone policy.

A general liability policy acts as standard insurance coverage against many third party risks. Umbrella liability protection provides peace of mind over the standard coverage limits on several common types of policies.

You can purchase both policies together to protect against common lawsuits beyond the standard general liability policy limits. You can also purchase just general liability insurance. However, you cannot purchase umbrella insurance (or excess liability insurance) by itself.

Do you need both umbrella insurance and general liability insurance?

General liability insurance protects against common third-party risks. Umbrella insurance extends the coverage limits of several important policies.

Whether you need both policies will depend on your business needs. General liability insurance is one of the most common small business insurance policies because it protects against so many common liabilities.

Businesses in more high-risk industries may need extended coverage limits. Some companies may also need an umbrella policy to bid on certain projects or to sign a contract.

While you can purchase general liability insurance as a standalone policy, umbrella insurance is not a standalone policy and requires an active primary policy to be purchased. So you can have both general liability and umbrella insurance, or just general liability, but you can't just have umbrella insurance.

Speak to a licensed insurance agent if you have further questions about whether you need both policies to protect your business.

Protect your business with the right insurance policies with Insureon

With Insureon's easy online application, you can get free quotes from the leading U.S. insurance companies.

Our licensed insurance agents can answer any questions you may have about the different types of insurance available.

Insureon can help you get started with a general liability policy and umbrella coverage, as well as other additional coverage options, such as commercial property and professional liability insurance.

Once you pick the right policies for your business, you can start coverage and obtain a certificate of insurance, often within 24 hours.

Verified general liability and umbrella coverage reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy