Top building design professionals we insure

Don't see your profession? Don't worry.

We insure most businesses.

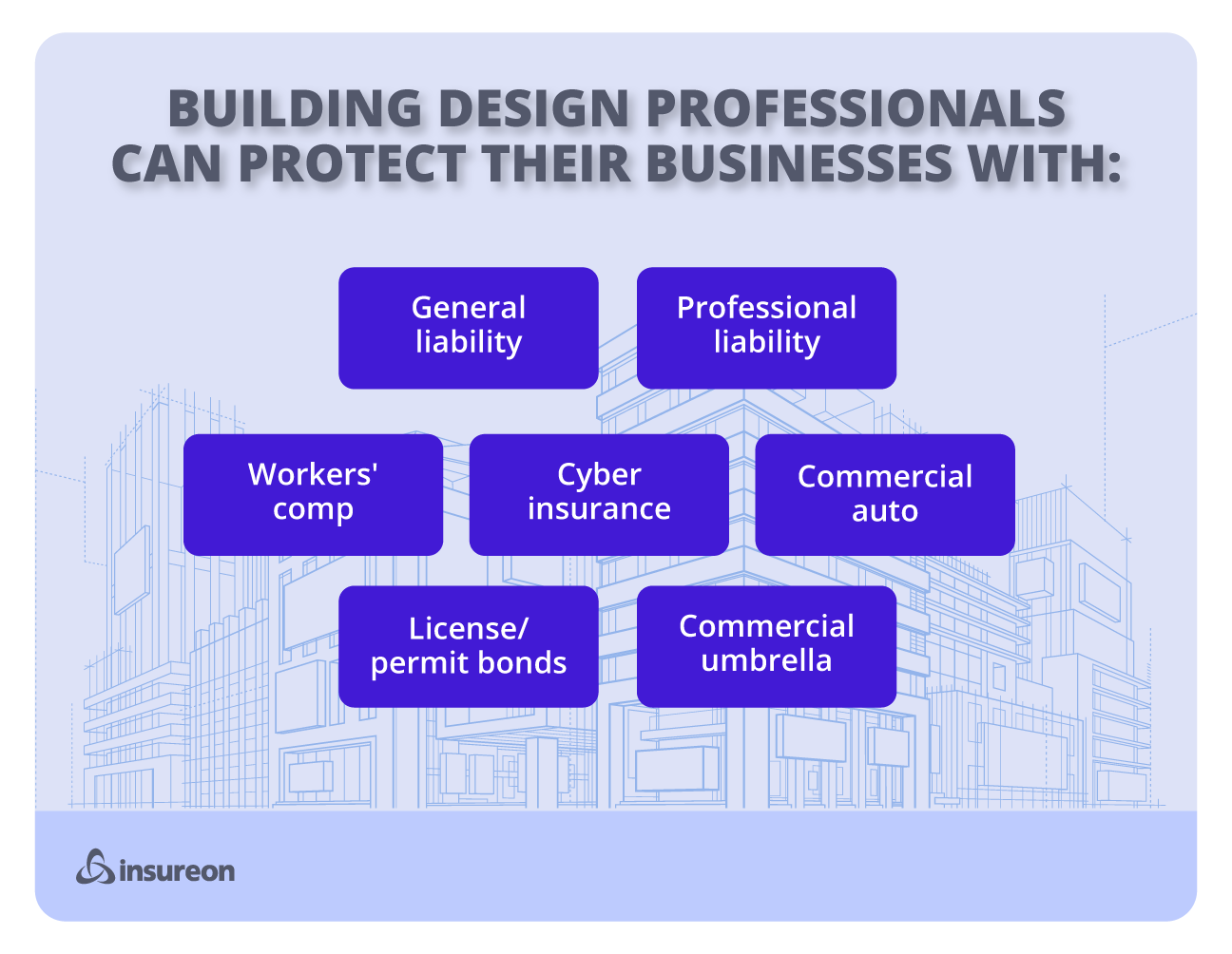

Recommended business insurance policies for building design professionals

Building design projects involve multiple stakeholders and dependencies, resulting in unique risks. Insurance provides the protection you need to withstand financial loss from an unexpected lawsuit, fire, or work injury.

General liability insurance

This policy covers common building designer risks, including customer property damage and personal injuries. Bundle with property insurance for savings in a business owner’s policy.

- Slip-and-fall accidents

- Damaged customer property

- Libel or slander lawsuits

Business owner's policy

A BOP bundles commercial property insurance and general liability insurance under one plan. It’s often the most cost-effective commercial insurance policy for small business owners.

- Customer injuries

- Damaged customer property

- Damaged business property

Professional liability insurance

This policy, sometimes called errors and omissions insurance (E&O), is important for building design professionals. It can cover legal costs related to your work performance.

- Errors in building design

- Accusations of negligence

- Failure to complete a project on time

Workers’ compensation insurance

Workers’ comp is required in almost every state for building design professionals with employees. It also protects sole proprietors from work-related injury costs that health insurance might deny.

- Employee medical expenses

- Partial missed wages

- Lawsuits over employee injuries

Cyber insurance

This policy, also called cyber liability, helps building design professionals recover from a data breach or cyberattack. It's strongly recommended for any small business that handles sensitive information.

- Client notification expenses

- Fraud monitoring services

- Data breach investigations

Commercial auto insurance

Commercial auto insurance can help cover the cost of property damage and injuries in an accident involving your business vehicle. Each state has its own requirements for auto liability insurance.

- Property damage caused by your vehicle

- Bodily injuries from an auto accident

- Vehicle theft and vandalism

How much does insurance cost for building design professionals?

Several factors will have an impact on design business insurance costs, including:

- Professional services offered

- Your business equipment and property

- Business revenue

- Location

- Years of experience

- How many employees you have

How do I get building design insurance?

It’s easy to find insurance for building design businesses. Whether you’re a construction project manager or land surveyor, you’ll need to have some basic information about your business available.

Our application will ask you for your annual revenue and payroll, among other details. You can buy a policy online and get a certificate of insurance with Insureon in three easy steps:

- Complete a free online application

- Compare free quotes and choose a policy

- Pay for your policy and download a certificate for proof of insurance

Insureon's licensed insurance agents work with top-rated U.S. providers to find the right insurance plan for your building design company, whether you’re a sole proprietor or run a small firm that employs several subcontractors.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Common questions about building design business insurance

Below are answers for frequently asked questions about design-build risks and insurance coverage.

Do architects and engineers need business insurance to get licensed?

In most cases, architects and engineers are not required to have insurance to obtain their license.

However, state laws and client contracts may stipulate specific insurance requirements to obtain jobs and work. Additionally, licensing requirements will vary by state as well.

Licensing requirements for architects often include:

- Obtaining a Bachelor of Architecture degree from an accredited school

- Completing a three-year internship through the Architectural Experience Program (AXP) or 5,600 hours with an architecture firm

- Passing the Architect Registration Examination (ARE)

Licensing requirements for engineers often include:

- Obtaining a Bachelor of Engineering degree from an accredited school

- Passing the Fundamentals of Engineering (FE) and Principles and Practice of Engineering (PE) exams

- Completing four years of supervised engineering experience

As a building design professional, do I need general liability and professional liability?

There are two main types of business insurance building design professionals should consider carrying as part of their risk management plan: general liability and professional liability.

- General liability insurance is often the first policy architects and engineers consider, and it may be required to sign a commercial lease. General liability coverage can protect your business from accidental damage to a client's property or accusations of breaking machinery on a job site.

- Professional liability insurance, also known as errors and omissions insurance, protects your business if a mistake in your building plans causes a financial loss to your client or if you're accused of not doing your job properly. This coverage will help pay for the legal costs to defend your business.

Additionally, if your business role is both the acting project manager and construction manager, carrying both general liability and professional liability policies will greatly protect you from many risks, including any vicarious liability you might face.

Insureon's certified insurance agents can work with you to determine which policies will best cover all parts of your role.

What other insurance policies should building design businesses carry?

To fully protect your building design firm from all risks and liabilities, you may need additional types of insurance.

This includes:

- License and permit bonds guarantee your business will complete a project in accordance with regulations and industry standards. Unlike insurance, you must then pay that amount back to the insurance company.

- Commercial umbrella insurance provides additional coverage for liability claims made on general liability, commercial auto, or employer’s liability insurance.

What's more, having the appropriate insurance coverage can make a difference in being able to undertake certain jobs, adequately protecting your business from financial risk, and building trust with your clients.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy

Read our blog posts

The licensing and insurance requirements for engineers vary by state. Having the right insurance and licensing can help keep you financially protected and may be required for some jobs within the...