Commercial property insurance cost

The cost of commercial property insurance varies based on a number of factors about your business. Your property insurance (also called hazard insurance) premium is directly impacted by the size of your building, the value of your business equipment, and more.

What is the average cost of commercial property insurance?

Small businesses pay an average premium of $67 per month, or about $800 annually, for commercial property insurance. Almost two-thirds (62%) of customers spend $100 or less for coverage.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

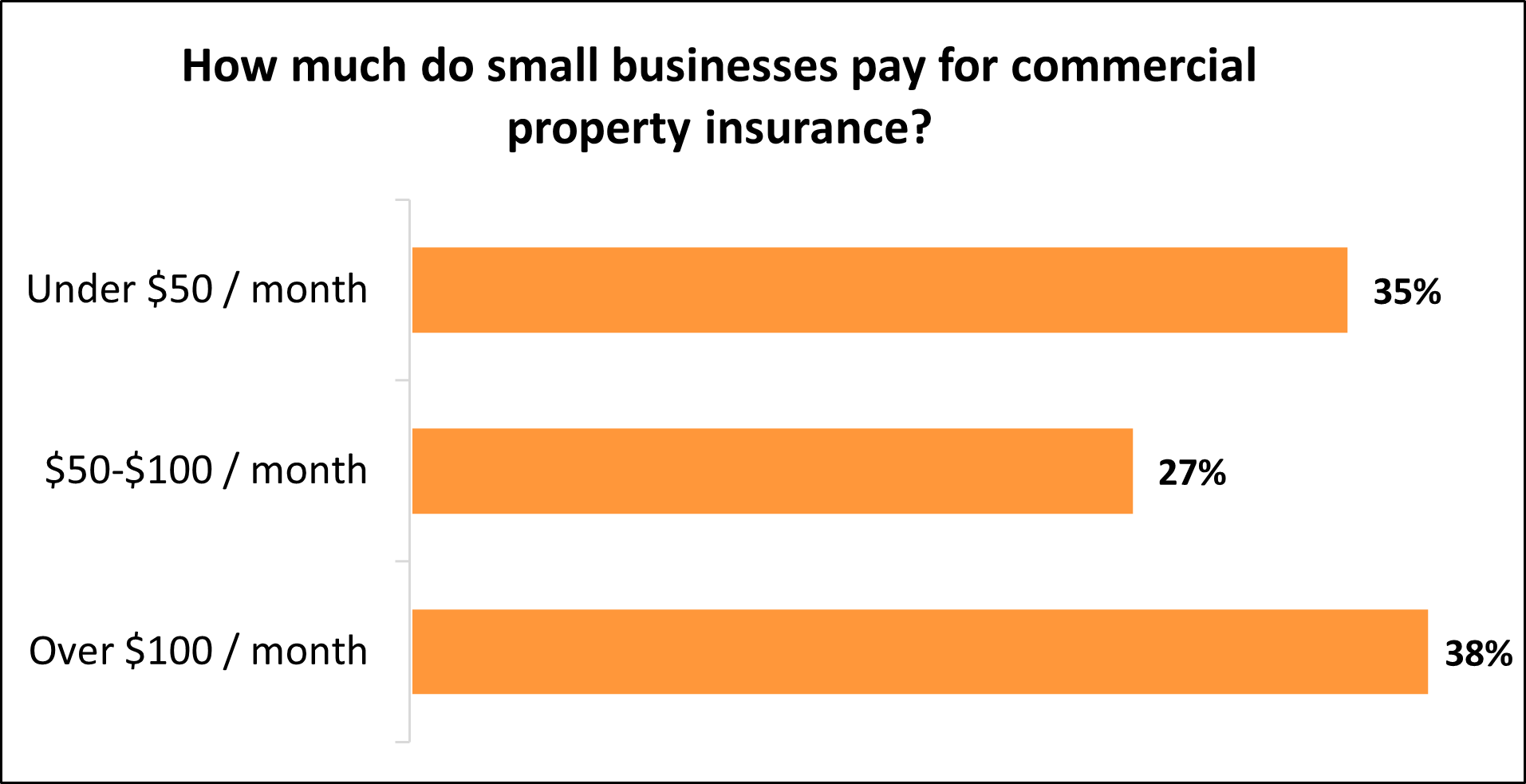

Typical business property insurance costs for Insureon customers

While Insureon's small business customers pay an average of $67 monthly for commercial property insurance, 35% pay less than $50 and 27% pay between $50 and $100 per month.

The cost varies for small businesses depending on their risks and the coverage they choose.

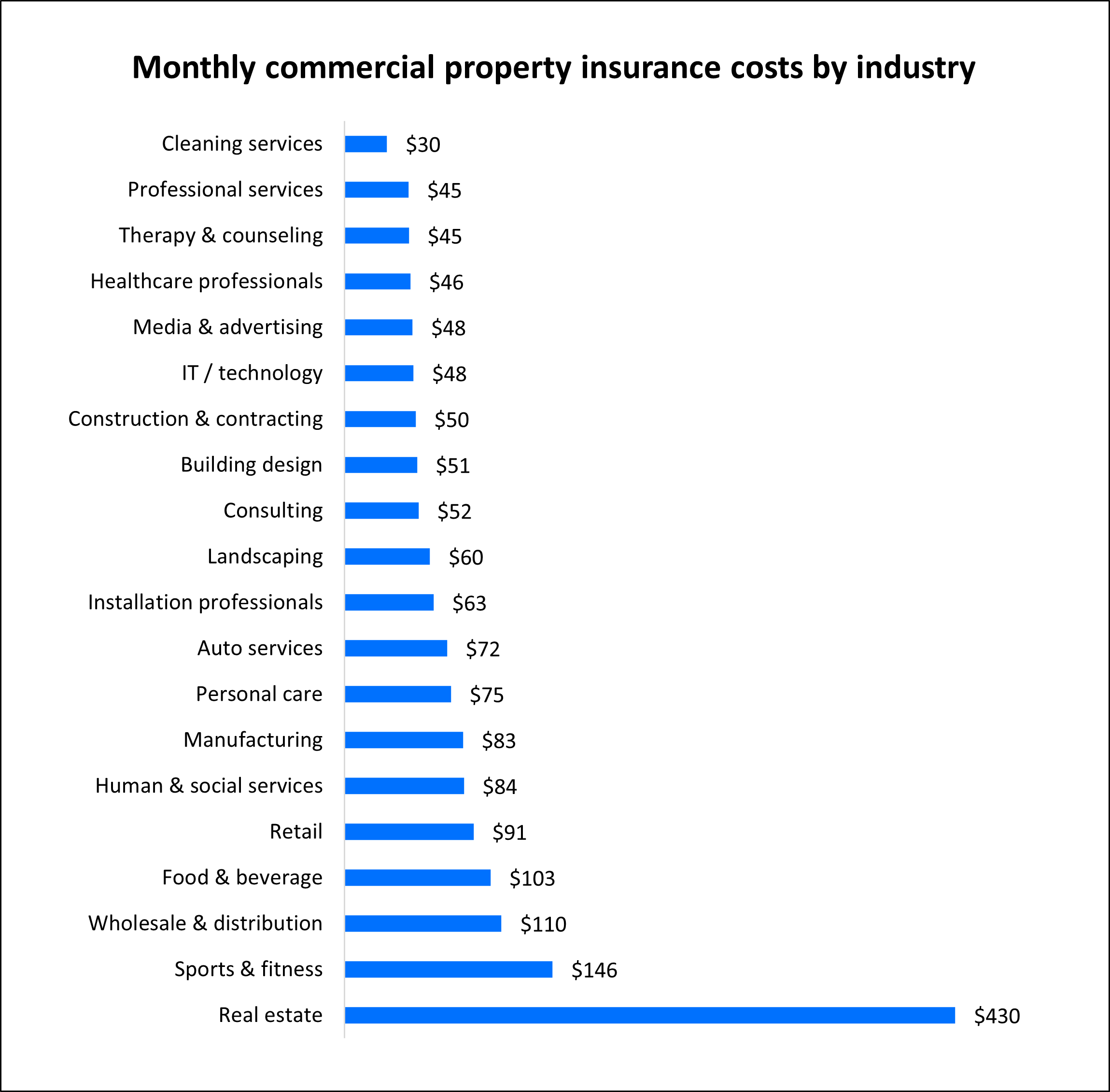

How does your industry impact the cost of commercial property insurance?

Our analysis of commercial property insurance costs reveals that for small businesses, your industry has one of the biggest impacts on your premium. Generally, insurance companies charge high-risk industries higher premiums, while low-risk industries enjoy lower rates.

For example, commercial landlords are exposed to more risk than IT consultants who work from a home office. The graph below illustrates how the type of business affects what you'll pay for a commercial property insurance policy.

Depending on the industry that you work in, such as sports and fitness, you may be required by a property owner to carry commercial property insurance coverage in order to rent a space.

For other businesses, such as those in insurance or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

Top industries we insure

Don't see your profession? Don't worry. We insure most businesses.

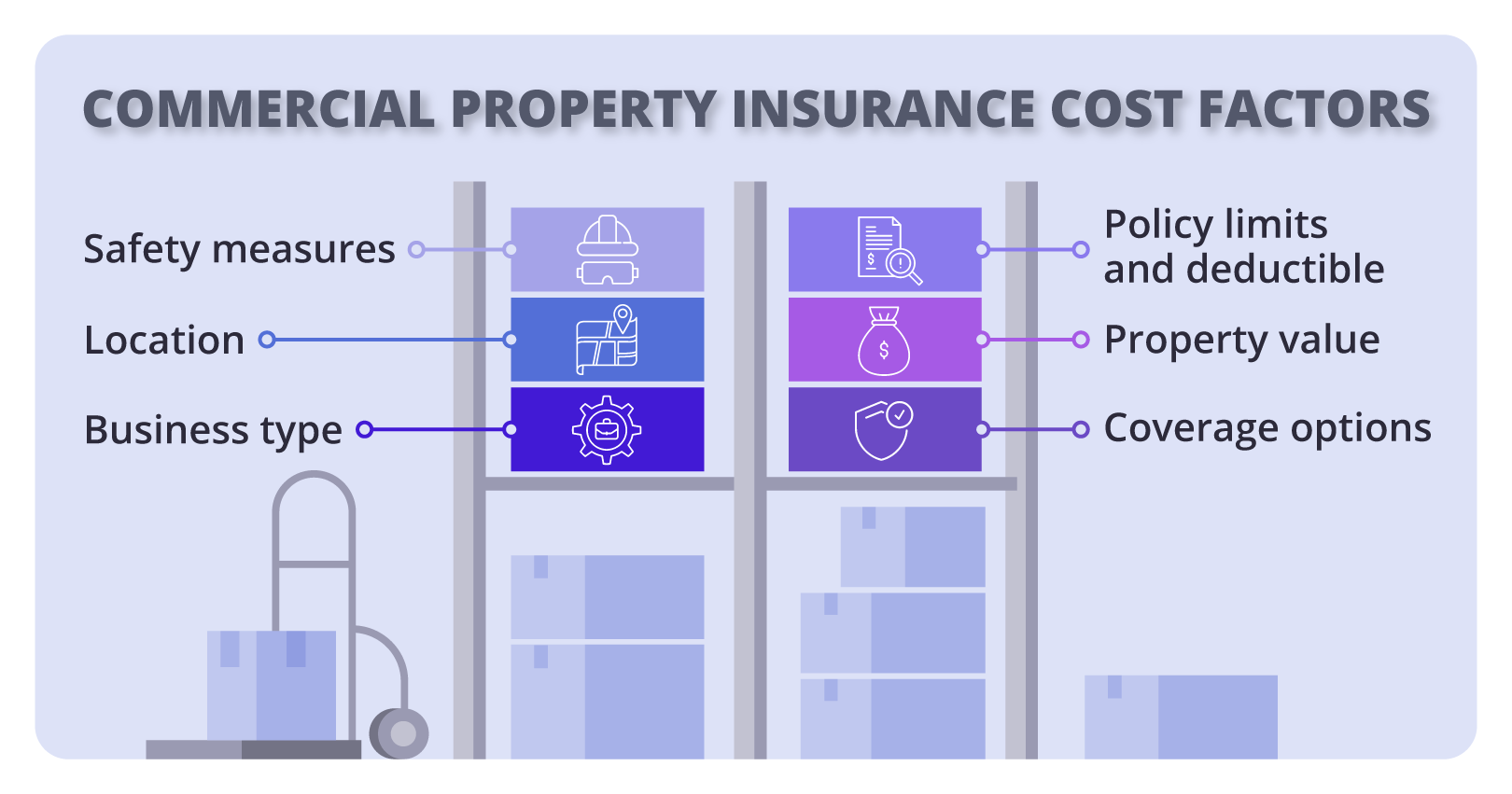

How are commercial property insurance rates calculated?

Insurance policies are not a one-size-fits-all product. Each company has different business needs based on a number of factors, and insurance companies will charge higher or lower rates depending on your company's coverage needs and the type of policy you plan to purchase.

For some policies, such as errors and omissions or workers' comp, insurers will look at factors like the number of employees and your business income when establishing your premiums. Property insurance is often determined by factors related to the building itself and the potential liabilities associated with your property.

Your insurance provider will look at the following when calculating your commercial property insurance rates:

Policy limits and deductible

The policy limits and deductible you choose will impact the cost of your commercial property insurance. Generally, the higher your limit, the more expensive your premium will be.

Many policyholders bundle their commercial property coverage with general liability insurance in a bundle called a business owner's policy (BOP). A BOP is often less expensive than purchasing each policy separately.

High-risk small businesses and medium-sized businesses are advised to get a commercial package policy (CPP), which also bundles general liability insurance with commercial property but offers more coverage options than a BOP.

General liability insurance with $1 million / $2 million limits is the most popular option for small businesses. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

- $2 million aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to $2 million to cover claims.

Almost all of Insureon customers (91%) choose a policy with $1 million / $2 million limits. Five percent of our customers choose a policy with $2 million / $4 million limits, the next most popular choice.

The deductible you select is another factor that will influence the cost of your commercial property coverage. You can save money on property insurance by choosing a higher deductible or lower limits. The average deductible that Insureon customers select for commercial property insurance is $1,000.

Types of hazards covered

Most commercial property insurance policies include hazard insurance in their coverage.

A policy that covers open perils costs more than a policy that covers named perils. Open perils coverage protects against all losses except those specifically excluded in the policy. Named perils coverage only protects against losses listed in the policy.

Property valuation method

Replacement value coverage costs more than actual cash value coverage. The former payouts the replacement cost of a brand-new item, while the latter payouts the item's depreciated value.

Age of building

Old buildings can be more susceptible to certain types of property damage, so they may cost more to insure. For example, a fire caused by old electrical wiring could translate into costly repairs.

Age and type of equipment

Heavy industrial equipment will cost more to insure than an at-home business's sewing machine.

You may also pay higher premiums if your equipment is hard to repair because of scarce parts, or if it's more susceptible to equipment breakdown because of heavy use. Alternatively, it might be cheaper to repair older equipment than buy state-of-the-art technology.

If you have equipment that you bring from one job site to another, you may need inland marine insurance or contractor's tools and equipment coverage. These policies protect your tools and other property while in transit.

Business owners who work out of their homes may want to consider business personal property (BPP) insurance. This is often a more budget-friendly option with lower insurance premiums for businesses that need coverage for things like laptops and office equipment, but not the entire building. It can be added as a general liability policy endorsement or as standalone coverage.

Size of business premises

Your building's size could play a role in determining your commercial property insurance cost per square foot, with larger properties increasing insurance premiums over smaller ones.

A large manufacturing warehouse will almost always cost more than a small bookkeeping office space, for example.

Location

Your business location can help your provider determine which environmental risks your company may face, such as severe weather or natural disasters like windstorms, flooding, wildfires, tornadoes, or hurricanes.

Real estate value and local law can also affect what premiums you pay. Your monthly cost could go up if your property value is higher, for example.

Here are some examples of the average cost of commercial building insurance across different states:

| State | Property insurance cost |

|---|---|

$63 per month | |

$103 per month | |

$85 per month | |

$36 per month | |

$179 per month | |

$42 per month | |

$77 per month | |

$104 per month | |

$87 per month | |

$110 per month |

Safety and security

Is your business located in a high-crime area? Does your business possess toxic materials or engage in dangerous activities like mining? Do you have loose security measures that don't protect your physical assets and encourage vandalism?

These are all higher risks and can affect your insurance rates. If you deal with toxic materials, it may be a good idea to obtain environmental insurance to provide liability coverage for pollution risks.

Fire protection

Property with easy access to a fire station and fire hydrants may cost less to insure. Sprinkler systems and fire alarms help reduce insurance costs, too.

How can you save money on commercial property insurance?

It’s easy to save money on your commercial property policy without compromising on coverage.

There are a few steps you can take to help reduce your property insurance premium and avoid more expensive rates:

- Bundle policies. To save money on out-of-pocket expenses, many small business owners opt for a business owner's policy (BOP) or commercial package policy (CPP), which combines commercial property insurance with general liability insurance at a lower rate than purchasing each policy separately.

- Pay the annual premium. When you purchase a commercial property policy, you can choose to pay your premium in monthly installments or annually. The annual amount is less expensive than paying by the month.

- Manage your risks. Claims on your insurance make your premium go up. You should try to reduce and/or prevent all types of risks to avoid claims and keep your premium down. This could look like investing in security systems and other preventative technologies to avoid claims. Not only will this assist with avoiding costly business interruptions, it will help keep insurance costs low.

- Choose a higher deductible. Selecting a more costly deductible is an easy way to save on your premium, but be sure to choose one that you can still afford. If you can’t pay your deducible, you can’t collect on a claim.

You can save money on commercial property insurance by limiting your property damage risks and by comparing insurance quotes from different providers.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage their different types of coverage online.

By completing Insureon’s easy online application today, you can compare free quotes for business property insurance and other types of insurance from top-rated U.S. carriers.

You can speak to a licensed insurance agent if you have questions about coverage limits or other helpful policies for your business.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified commercial property coverage reviews

Learn more about business insurance costs

Don't see your profession? Don't worry. We insure most businesses.