Commercial package policy cost

A commercial package policy (CPP) combines general liability and commercial property coverage into one policy, usually at a lower cost than if you purchased these coverages separately. CPP premiums are calculated based on the policy limits you choose, business property value, and more.

What is the average cost of a commercial package policy?

Small businesses pay an average premium of $90 per month, or about $1,075 annually, for a commercial package policy.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

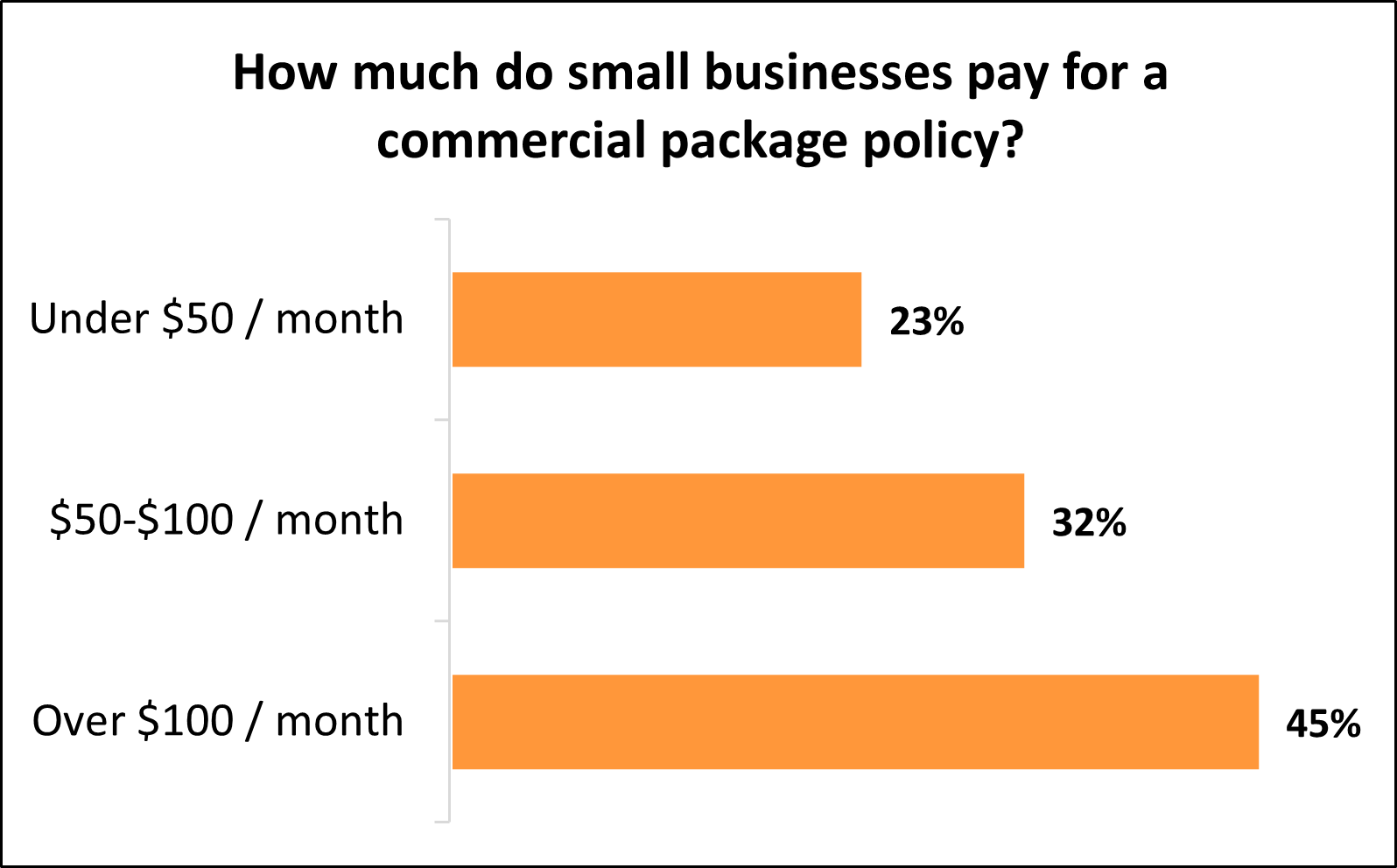

Typical commercial package policy costs for Insureon customers

While Insureon's small business customers pay an average of $90 monthly for a commercial package policy, almost a quarter (23%) pay less than $50 per month for their policies, and almost a third (32%) pay between $50 and $100.

The cost varies for small businesses depending on their risks, the value of their business property, and the insurance coverage they choose.

Understanding commercial package policy cost factors

Insurance companies consider several factors when determining how much to charge for a commercial package policy premium, including:

- Industry risks

- Property value

- Coverage limits and deductible

- Coverage options

- Location

- Revenue

- Number of employees

How do industry risks impact commercial package policy costs?

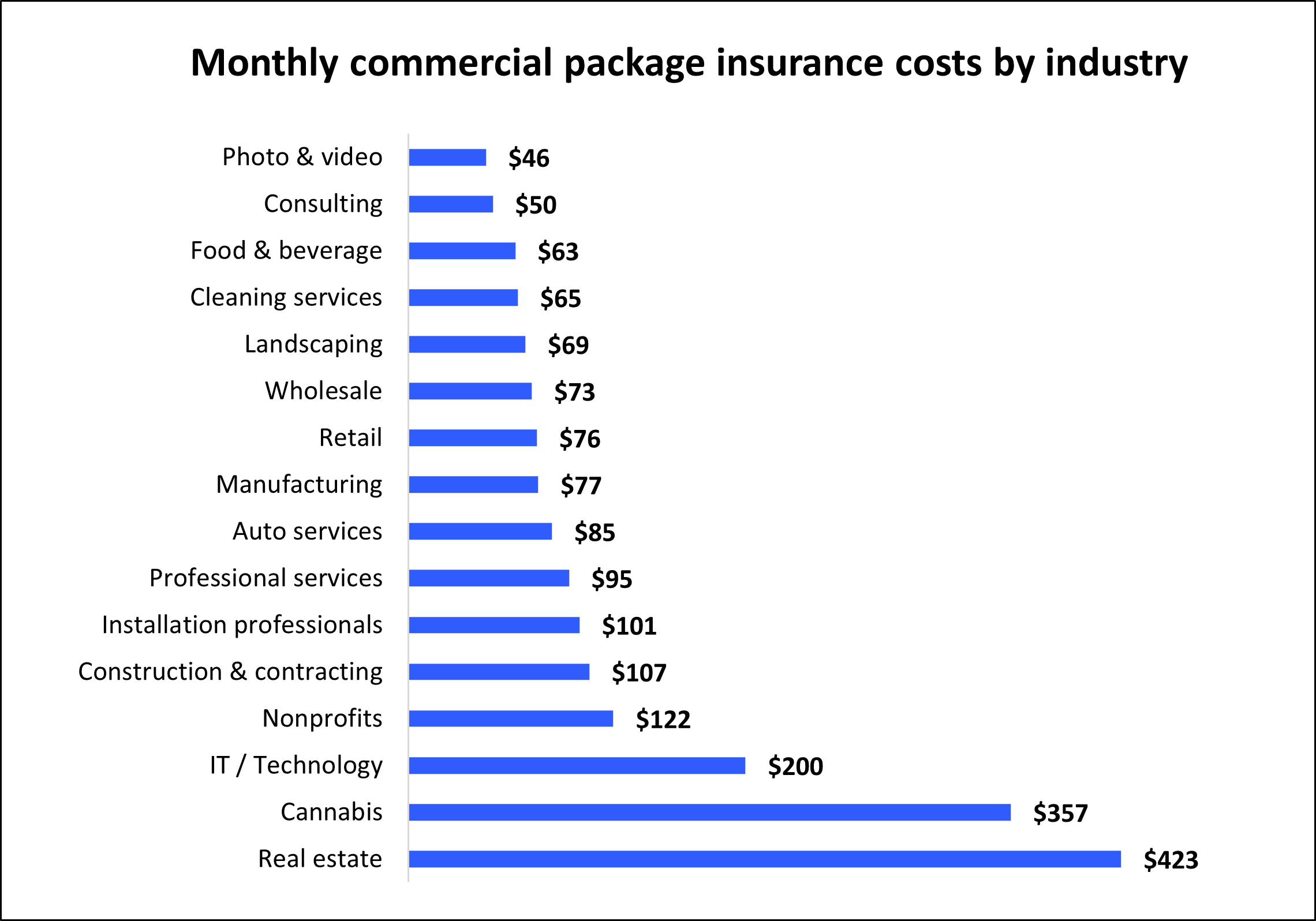

For the general liability insurance portion of a CPP, your industry has a significant impact on policy costs. Generally, high-risk industries pay higher premiums, while low-risk industries enjoy lower rates.

For example, a real estate agent who takes house hunters on tours every day is exposed to a higher risk of customer injury than a consultant who works out of a home office.

Cannabis businesses and technology professionals also have high liability coverage costs because these industries often have valuable equipment or inventory, as well as increased third-party liability.

The graph below illustrates how the type of business affects what you'll pay for a commercial package policy, with average monthly costs for each industry.

Top industries we insure

Don't see your profession? Don't worry. We insure most businesses.

How does property value impact commercial package policy costs?

For the commercial property insurance portion of a CPP, the cost of insurance depends on the value of your business property, its location, and how you choose to protect it.

Business personal property (BPP) value

To protect your property, the first step is knowing what it’s worth. You'll need an estimate of your business personal property. The amount will help you determine appropriate limits to make sure your insurance can cover the cost of replacing or repairing stolen, lost, or damaged items.

Location and age of your building

The value of your building and subsequent insurance costs vary dramatically depending on where your business is located. For example, a small retail shop in rural Pennsylvania would cost much less to insure than a similar retail shop in urban California. Older buildings may also incur higher insurance rates as they are more susceptible to damage.

Replacement value versus actual cash value

The cost of a CPP varies depending on how you choose to insure your business personal property. You can insure it for its replacement value (cost when new), or save money by insuring it for its actual cash value (depreciated value).

How do coverage limits affect commercial package policy costs?

If you want car insurance that pays for a wide range of damage, you have to pay more for it. The same rule applies to business insurance. If you want a policy with higher policy limits, expect to pay more than you would for basic coverage.

The most popular commercial package policy among Insureon customers is the $1 million / $2 million policy. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

- $2 million aggregate limit. During the lifetime of a policy (usually one year), the insurer will pay up to $2 million to cover claims.

The average deductible for a commercial package policy is $1,000.

A commercial package policy (CPP) can provide flexible protection to meet your business needs

A commercial package policy is a must-have for small businesses that interact with customers and own business property.

At any business, a visitor could trip and suffer an injury. If the visitor sues, legal costs can escalate to the point where they could sink your business.

Even if no one outside your company visits your office, someone could still hold your business liable for damages. For example, businesses that run advertising campaigns or post on social media could face a lawsuit if they post content that doesn't belong to them, or make a false claim about a competitor.

When someone sues your business – even if it's a frivolous lawsuit – you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

A general liability policy covers all of these costs, which could save your business from bankruptcy. Commercial property insurance covers your building, computers, equipment, tools, and furniture in the event of theft, storm damage, or a fire. A commercial package policy includes both, safeguarding your business against the most common lawsuits and losses.

Because the premium is based upon your level of risk and the value of your business property, small businesses usually pay only a small monthly premium for a CPP.

How can you save money on a commercial package policy?

It's possible to reduce your commercial package policy premium through a couple simple steps:

Your commercial package policy premium can typically be paid in monthly or annual installments. Policyholders who pay the full premium can sometimes save money because insurers may offer discounts for annual premiums.

Proactively manage your risks

If your small business has no insurance claims history, expect to pay lower rates. An effective way to do this is to create a comprehensive risk management plan. For example, you might:

- Develop a thorough training program for employees

- Invest in a security system to help prevent vandalism

- Compile rules for posting to social media

- Create procedure checklists and reviews

- Minimize hazards on your premises to minimize bodily injuries

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies based on their insurance needs, and manage their coverage online.

By completing Insureon’s easy online application today, you can get free quotes for a commercial package policy and other business insurance policies from top-rated U.S. insurance companies.

Once you find the right type of policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

What our customers are saying

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. See our small business insurance cost overview or explore costs for a specific type of coverage.