Professional liability insurance cost

The cost of professional liability insurance, also called errors and omissions insurance (E&O), varies based on a number of factors about your business. Your premium is directly impacted by the type of work you do, industry risk, and more.

What is the average cost of professional liability insurance?

Small businesses pay an average premium of $61 per month, or about $735 annually, for professional liability insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

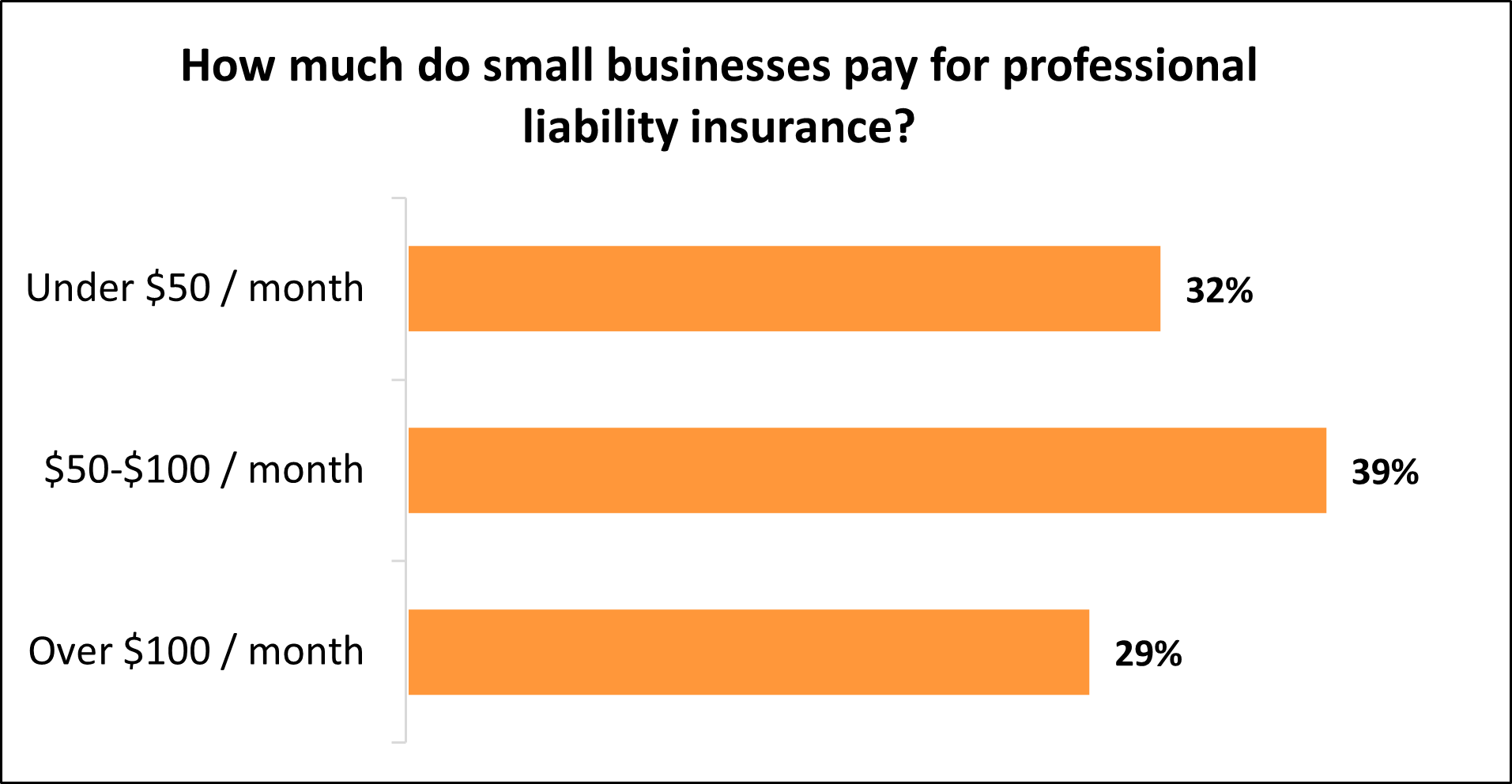

While Insureon's small business customers pay an average of $61 monthly for professional liability insurance, 32% pay less than $50 per month for their policies, and another 39% pay between $50 and $100.

The cost varies for small businesses depending on their risks and the coverage they choose.

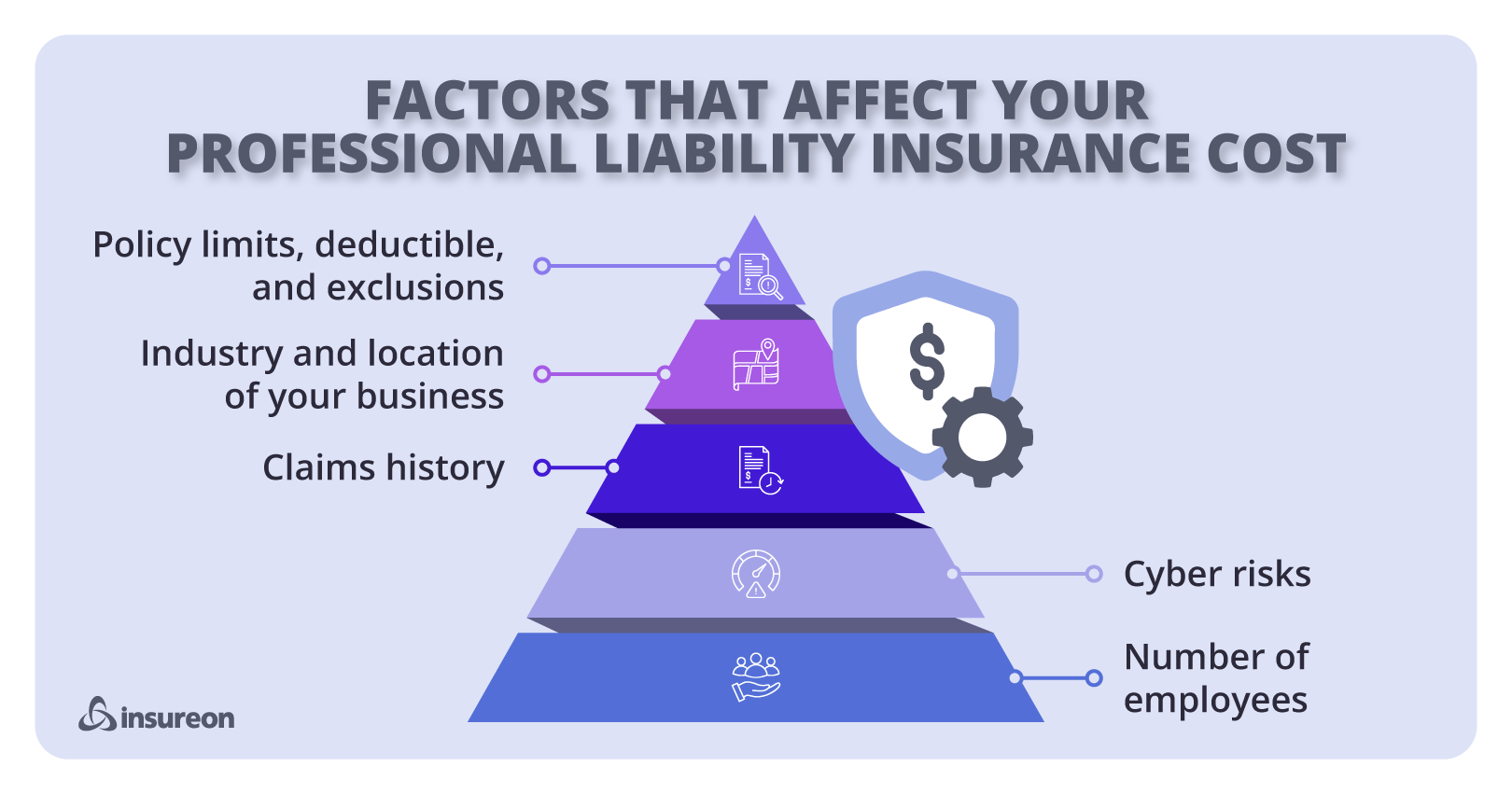

Factors that impact professional liability insurance rates

- Policy limits and deductible

- Types of coverage

- Location

- Claims history

- Number of employees

- Business income

- Industry risks

Policy limits and deductible

Suppose you want a professional liability insurance policy that covers more expensive lawsuits. In that case, you’ll need to increase your coverage limits – which means you’ll pay a higher premium to your insurance company.

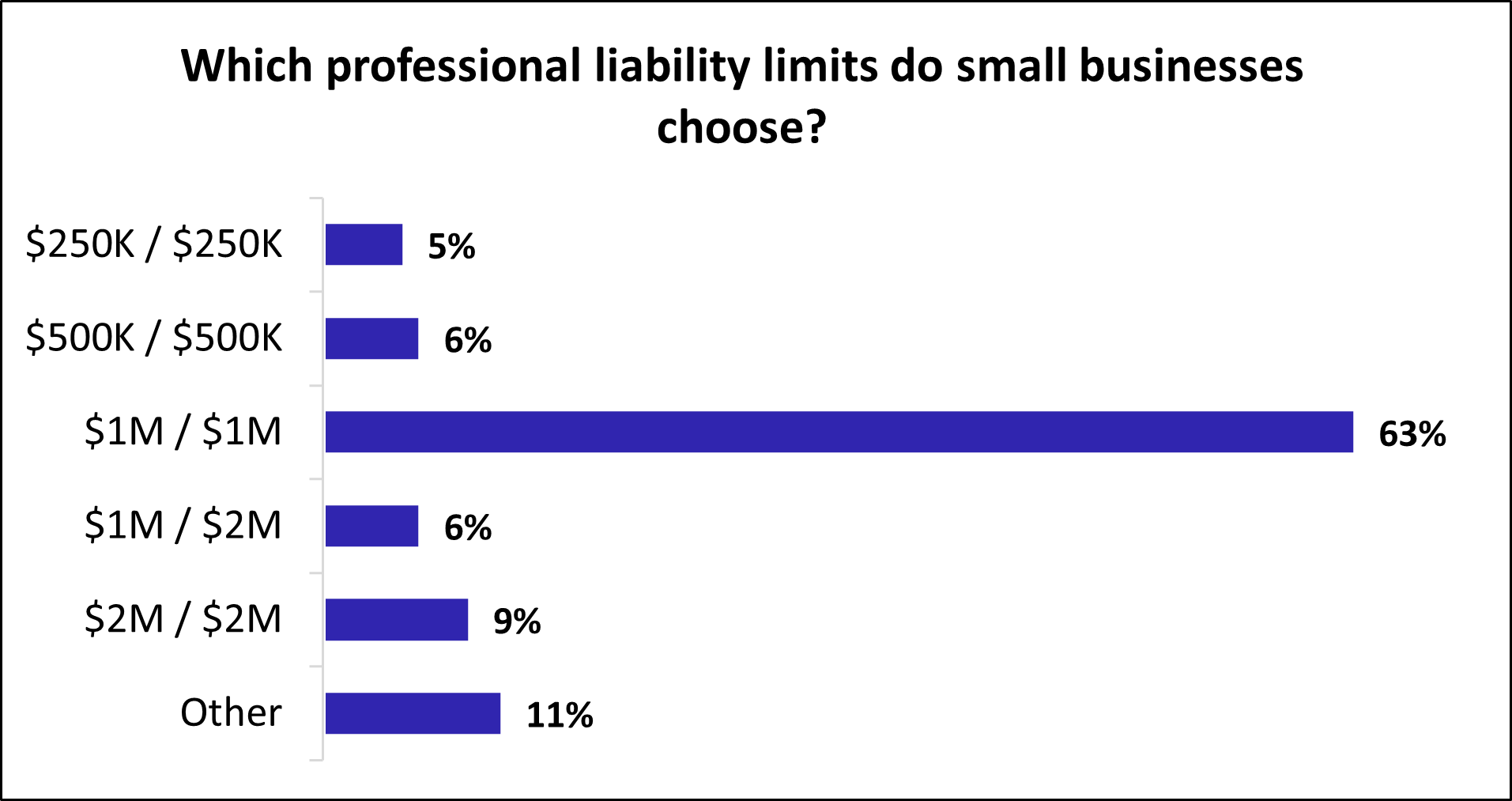

The limits on professional liability coverage vary significantly, from $250,000 to $2 million. Professional liability insurance coverage with $1 million / $1 million limits is the most popular option for small businesses. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

- $1 million aggregate limit. During the lifetime of the policy, the insurer will pay up to $1 million to cover claims.

The majority of Insureon customers (63%) choose a professional liability policy with $1 million / $1 million limits. Nine percent of our customers choose a policy with $2 million / $2 million limits, the next most popular choice.

When buying a policy, you can choose a higher deductible to save money. However, if you can’t pay the deductible, your insurance won’t activate to cover your claim. The average deductible that Insureon customers select for professional liability insurance is $2,500.

Additionally, you could add excess liability coverage, which would also increase your policy limits (as well as your costs).

The right amount of coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

Types of coverage

The type of professional liability coverage options you purchase can impact your costs. Professional liability is often purchased as an endorsement to a general liability policy.

However, certain industries may need more protection or different types of policies, depending on their risk factors.

For example, technology businesses often bundle professional liability with third-party cyber liability coverage into a policy referred to as technology errors and omissions insurance, or tech E&O.

Your cyber risk relates to your business and industry's likelihood of exposure to things like data breaches.

Your business may also need a specific limit or additional endorsements if it's required for a special project, and this can impact your insurance costs.

Business location

Your business location can impact your professional liability insurance rates.

States often mandate specific professional liability coverage minimums for different industries, such as healthcare and law, which can impact cost.

Real estate is another industry that is often mandated to carry professional liability. For example, real estate agents in Wyoming and Colorado are required to carry E&O in order to practice.

Below are some examples of the average cost of workers' compensation insurance across different states among Insureon policyholders:

| State | Professional liability insurance cost |

|---|---|

$82 per month | |

$71 per month | |

$71 per month | |

$83 per month | |

$78 per month | |

$67 per month | |

$72 per month | |

$70 per month | |

$62 per month | |

$63 per month |

Professional liability insurance requirements in your state

Claims history

One major factor that contributes to how much your professional liability insurance will cost is your claims history. This includes both the frequency and the severity of your claims.

Your claims history refers to how many times you've had incidents covered by insurance in the past. Frequent and expensive claims will often mean higher premiums since insurance companies will see your business as a higher risk.

Risk management and avoiding claims is critical to keeping your costs low. Insurance companies often reward those businesses with fewer claims by giving them the lowest rates and other discounts.

Focusing on employee training, regular maintenance, safe businesses practices, and quickly managing safety risks can keep your overall insurance costs as low as possible.

Number of employees

The number of people in your employ can impact your insurance costs.

The more employees you have, the higher the likelihood of an incident that may require an insurance claim.

Insurance companies view more employees as opportunities and potential for incidents, accidents, and other claims-causing risks.

Self-employed and independent contractors often have lower premiums for professional liability than businesses with employees.

Business income

Higher business income often equates to higher professional liability premiums for the average small business.

For example, the more jobs and contracts you take on, the higher your likelihood is of running into an error, accident, or other misstep, which can cause a lawsuit or professional liability claim.

Smaller, less profitable companies will often have lower insurance costs than larger, highly profitable businesses.

Taking on more work, increasing your business capabilities, and generally growing your profits will often result in the potential for increased professional liability insurance costs.

Industry risks

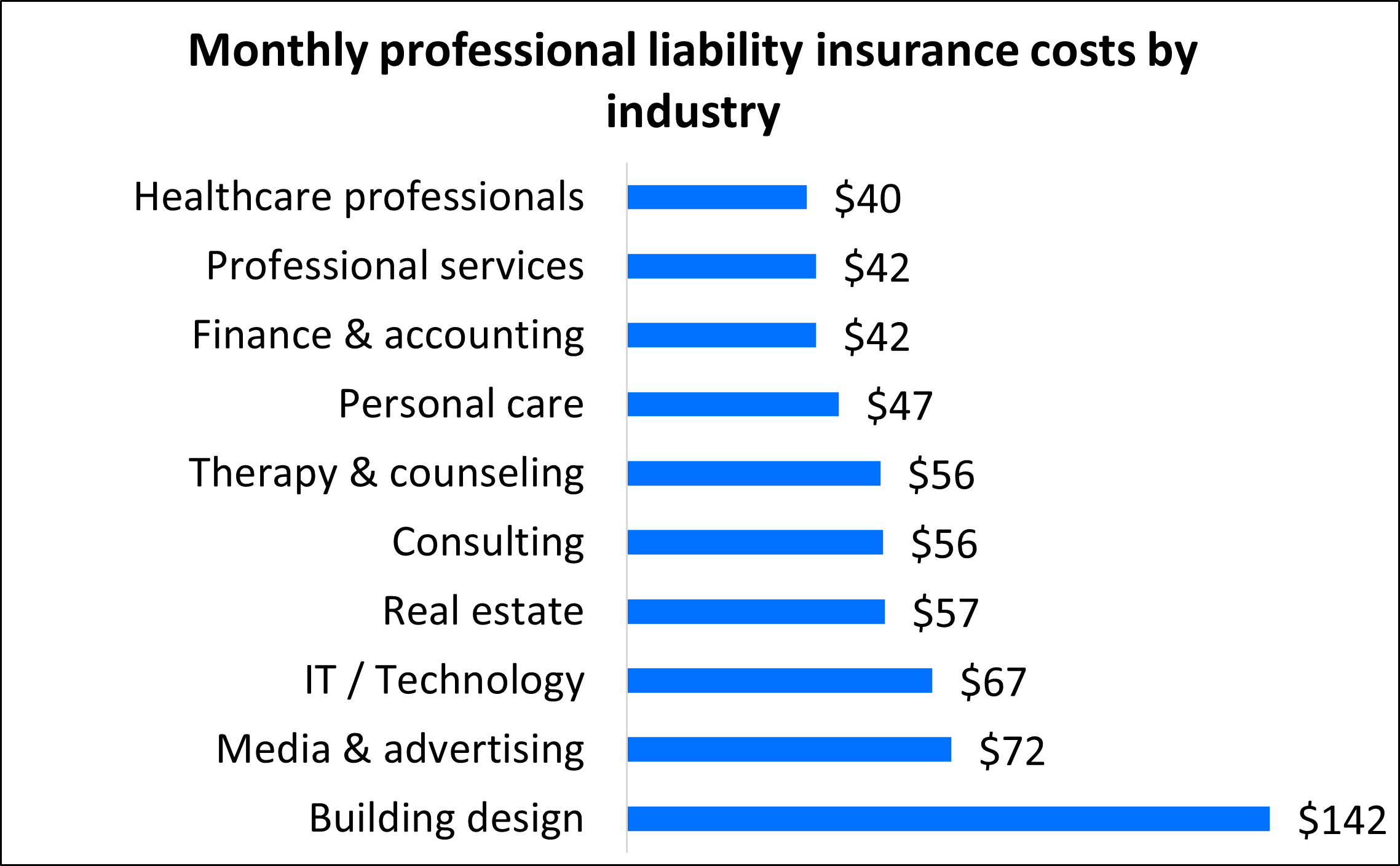

Our analysis of professional liability insurance costs reveals that for small businesses, your industry has the biggest impact on your premium. Generally, insurance companies charge higher premiums to higher-risk industries, while lower-risk industries enjoy lower rates.

For example, building design professionals, such as architects and engineers, pay $142 on average per month. While lower-risk professional services businesses, such as photographers or accountants, pay $45.

Depending on your state and your profession, you may need professional liability insurance to get licensed or to work in your field, as different states have different requirements. That can include real estate agents, insurance agents, lawyers, and doctors.

The graph below illustrates how the type of business affects what you'll pay for a professional liability insurance policy.

Top industries we insure

Don't see your industry? Don't worry. We insure most businesses.

Does my business need professional liability insurance?

Professional liability insurance is a must-have for small businesses that provide expert advice or services, such as IT consultants or professional services. You may see it referred to as errors and omissions (E&O insurance), professional indemnity insurance, or malpractice insurance depending on the industry.

Experienced professionals can still make mistakes or oversights, or give advice that causes financial loss for a client. If the client sues, legal costs can escalate to the point where they could sink your business.

Even if you've done nothing wrong, you're not immune to lawsuits. For example, your business could lose a key individual who you need to complete a project on time, or a client could sue over a budget overrun that was out of your hands.

When someone sues your business – even if it's a frivolous lawsuit – you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

A professional liability policy covers all of these costs, which could save your business from bankruptcy. Because the premium is based upon your level of risk and your industry, many small businesses pay only a small monthly premium for this type of insurance.

For more about professional liability, check out Insureon's professional liability FAQs.

How can you save money on professional liability insurance?

There are a few steps you can take to help reduce your professional liability premium and avoid more expensive rates:

Shop around. Insurance companies offer a range of professional liability premiums and coverages. Get quotes from different carriers with Insureon's easy online application.

Pay your entire premium upfront. Policyholders can choose to pay insurance premiums once a month or once a year. While making a smaller payment each month requires less money upfront, it may cost more in the long run. Insurers often offer discounts to businesses that pay an annual premium.

Bundle policies. Depending on your industry, it's sometimes possible to bundle professional liability insurance with another policy, such as general liability insurance. An insurance bundle often costs less than purchasing each policy separately.

Keep continuous coverage. Continuous coverage is key if you don't want to pay out of pocket for professional liability lawsuits. While it’s possible to purchase coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire for professional liability and other claims-made policies. To file a claim, your insurance must be active:

- When an alleged mistake occurs

- When the claim is filed

Reduce your risks. Your professional liability claims history is a big factor when calculating your premium, which is why it's important to avoid lawsuits in the first place. Many professional liability lawsuits stem from client disputes. To reduce the risk of a lawsuit, you can:

- Strive to meet the standard of care for your industry

- Communicate clearly, especially when an issue arises

- Document all contracts and communications with clients

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing Insureon’s easy online application today, you can get free quotes for professional liability insurance and other business insurance policies from top-rated U.S. insurance companies.

Our licensed insurance agents can help you look into a variety of other policies including commercial auto insurance, general liability coverage, and workers' compensation insurance. The right policies can protect your business from expenses related to common issues such as bodily injury and property damage.

Once you find the right policies for your small business, you can begin coverage and receive a certificate of insurance for your small business, often within 24 hours. You'll have peace of mind knowing your business is protected from some of the biggest small business risks.

Verified professional liability coverage reviews

Learn more about business insurance costs

Don't see your profession? Don't worry. We insure most businesses.