Employment practices liability insurance cost

The cost of employment practices liability insurance (EPLI) varies based on a number of factors about your business. Your premium is directly impacted by the type of work you do and the size of your business, including number of employees, and more.

What is the average cost of employment practices liability insurance?

Small businesses pay an average premium of $222 per month, or $2,665 annually, for employment practices liability insurance or EPL insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

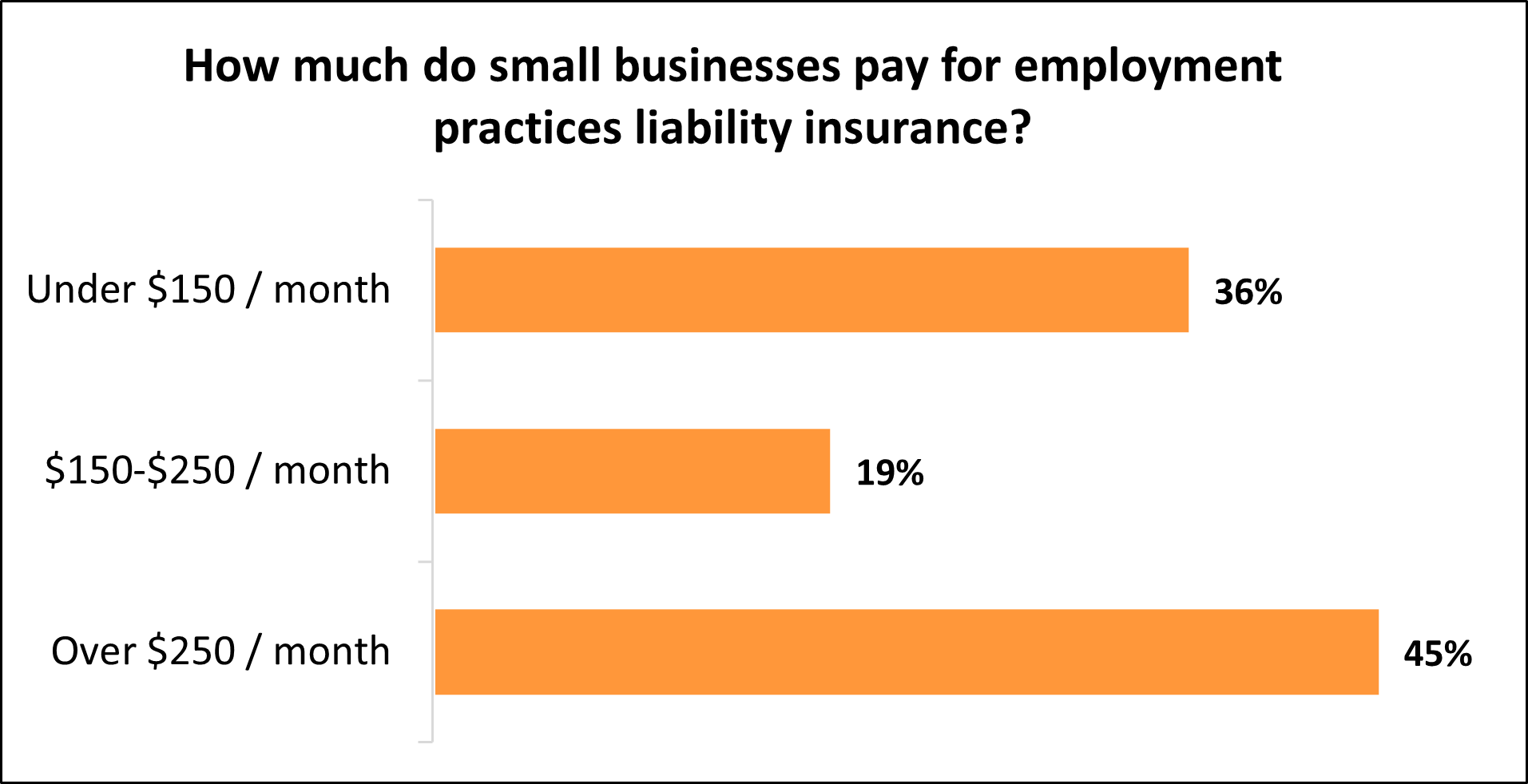

Typical employment practices liability insurance costs for Insureon customers

While Insureon's small business customers pay an average of $222 monthly for employment practices liability coverage, 36% pay less than $150 per month for their policies, and another 19% pay between $150 and $250 monthly.

The cost varies for small businesses depending on their risks, number of employees, past claims history, and other factors—such as lawsuits filed by current or former employees accusing the company of defamation, violating an employment contract, and similar claims.

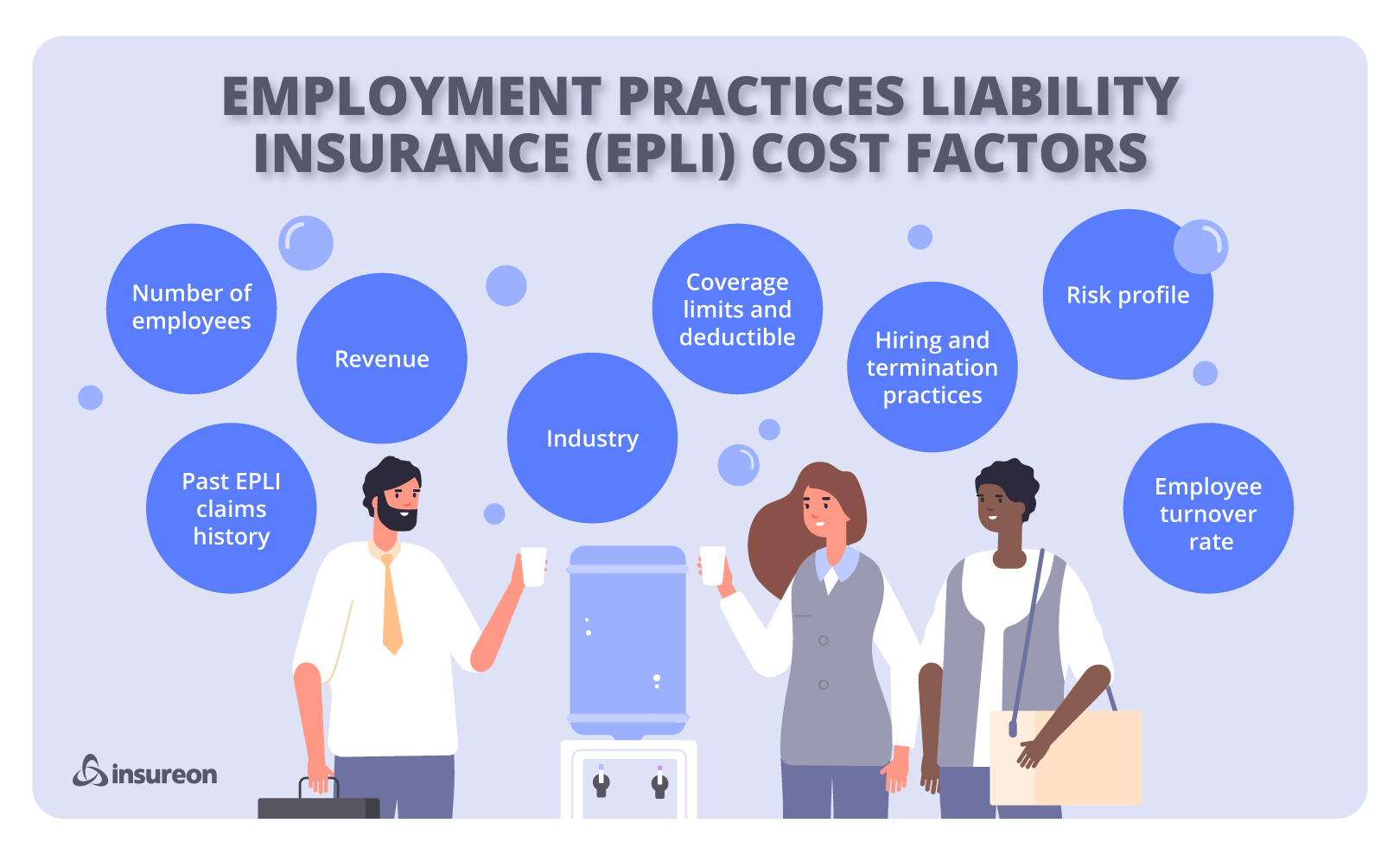

Understanding EPLI insurance cost factors

Insurance companies consider several factors when determining how much to charge for an EPLI premium, including:

- Coverage limits

- Deductible

- Industry risks

- Number of employees

- Location

- Employee turnover rate

- Hiring and termination practices

- Risk management

- Annual revenue

- Claims history

Coverage limits

If you want an EPLI policy that covers more expensive lawsuits, you’ll need to increase your insurance coverage limits—which means you’ll pay a higher premium to your insurance company.

The employment practices limit of liability can vary significantly. Each policy has a per-occurrence limit and an aggregate limit:

- Per-occurrence limit. While the policy is active, the insurer will pay up to this amount to cover any single incident.

- Aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to this amount to cover claims.

Deductible

When buying your policy, it's a good idea to make sure the EPLI insurance deductible is something you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your claim. The average deductible that Insureon customers select for EPLI is $10,000.

The right amount of coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which deductible and policy limits are right for your business.

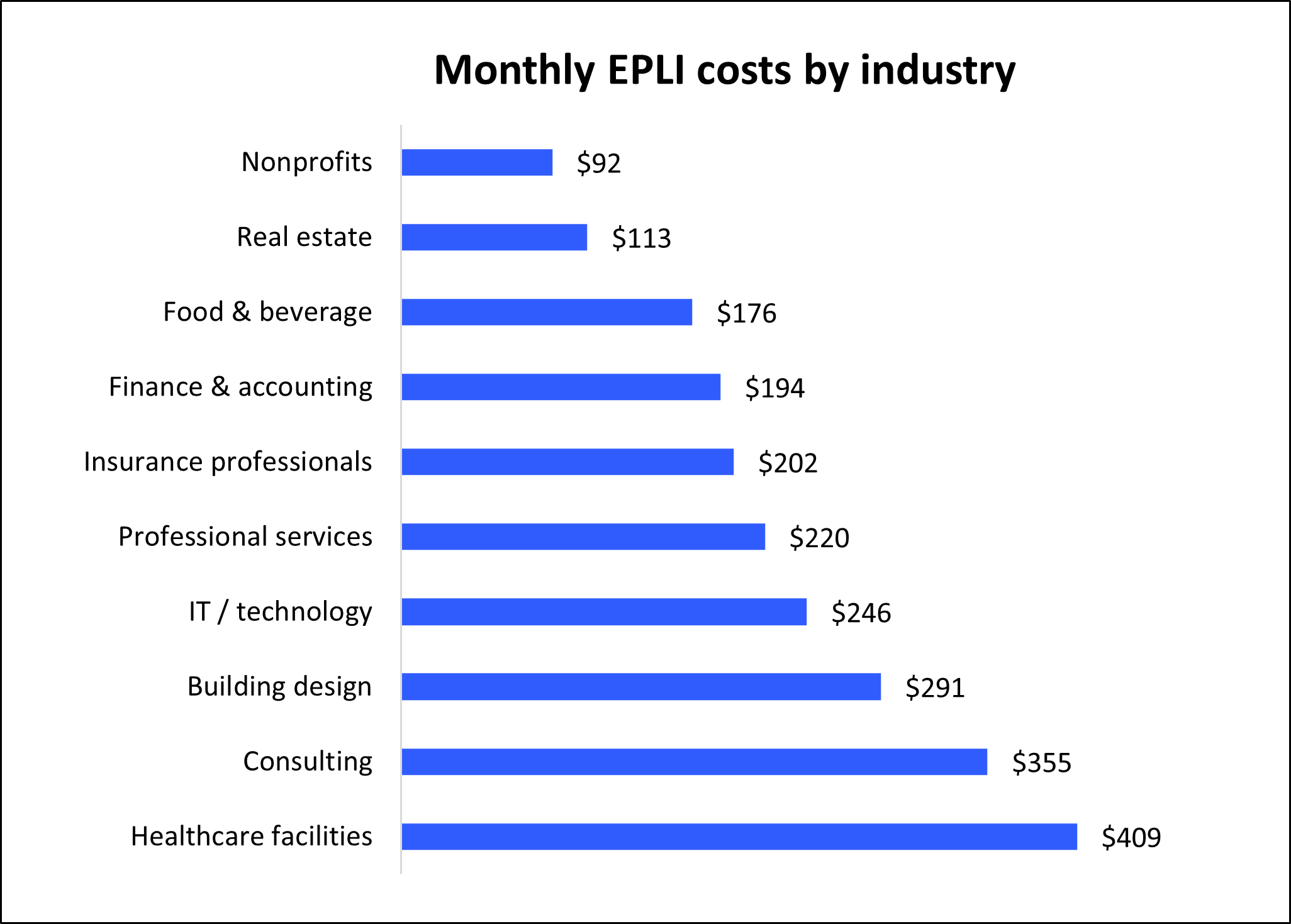

Industry risks

Your industry has a large impact on your premium. Generally, industries with a higher rate of employment-related claims get charged a higher premium, while lower risk industries enjoy lower rates.

For example, healthcare facilities pay a monthly average of $409 and consulting firms pay $355 per month, which is typically more for this coverage than other industries. On the lower end, nonprofits pay an average of $92 a month, while insurance professionals pay a monthly average of $202.

These industries often have to deal with lawsuits related to violations of employees' rights, so insurance providers take this into account when underwriting their policies.

The chart below illustrates how the type of business affects the cost of EPLI.

Top industries we insure

Number of employees

The number of employees at your business is one of the key factors insurers consider when determining your employment practices liability insurance premium. Generally, the more employees you have, the higher your risk of facing an EPLI claim.

Each employee interaction—whether related to hiring, promotion, pay, discipline, or termination—creates the potential for disputes. With more employees, there are simply more opportunities for claims involving discrimination, harassment, wrongful termination, or other employment-related issues. As a result, businesses with larger workforces tend to pay higher EPLI premiums than those with only a few employees.

Location

Where your business operates plays a big role in your EPLI premium. Some states have stricter employee protection laws or higher rates of employment-related lawsuits, which increases risk for insurers. That means businesses in these areas often pay more for coverage, such as:

- California: EPLI insurance in California is among the most expensive, largely due to the state’s extensive labor laws and high volume of employee claims.

- New York: Known for a litigious environment, New York businesses also tend to see higher EPLI costs.

- Massachusetts: Strong employee rights protections contribute to above-average premiums in this state.

- Florida: Higher claim rates and legal activity drive up EPLI costs for Florida employers.

- Texas: While not as expensive as California or New York, Texas still has elevated claim activity that can impact premiums.

In contrast, businesses in states with fewer regulations or historically lower claim activity often benefit from more affordable EPLI insurance.

Employee turnover rate

Your employee turnover rate can also influence your EPLI premium. A business with frequent hiring and firing is generally considered higher risk because each change in employment creates more opportunities for disputes.

High turnover may lead to claims of wrongful termination, discrimination during the hiring process, or retaliation after termination. Even if a claim doesn’t result in a payout, the increased likelihood of legal action makes insurers view these businesses as riskier to cover. As a result, companies with high turnover often pay more for EPLI insurance than those with stable, long-term workforces.

Hiring and termination practices

How you handle hiring and termination can have a big impact on your EPLI premium. Businesses with inconsistent or poorly documented practices are more likely to face claims of discrimination, wrongful termination, or unfair hiring practices.

For example, failing to use clear job descriptions, skipping background checks, or not following established termination procedures can increase the risk of disputes.

Insurers see these gaps as warning signs a business may face more frequent or costly claims. On the other hand, companies that maintain standardized, transparent, and well-documented hiring and termination processes are often considered lower risk and may pay less for coverage.

Risk management

Strong risk management practices can help lower your EPLI premium. Having clearly stated policies, employee handbooks, and documented procedures shows your business takes compliance seriously. Regular employee training—especially around anti-harassment, diversity, and workplace conduct—also helps reduce the likelihood of claims.

Additionally, maintaining formal anti-harassment and anti-discrimination policies demonstrates proactive steps to protect employees and reduce risk.

By building these safeguards into your operations, you not only create a safer and more respectful workplace, but may also qualify for lower EPLI premiums.

Annual revenue

A company’s annual revenue is another factor underwriters use when determining EPLI premiums. In general, the higher your revenue, the more you may pay for coverage.

That’s because higher revenue often signals a larger business with more employees, greater visibility, and more complex operations. Because of this, it increases the chances of an employment-related claim. Larger payouts may also be at stake when a claim arises, since attorneys and employees may pursue bigger settlements against higher-revenue businesses.

As a result, even if two companies have the same number of employees, the one with higher annual revenue will usually pay more for EPLI insurance.

Claims history

Your company’s past employee lawsuit claims play a major role in how much you’ll pay for EPLI coverage. Insurance providers view a history of frequent or severe claims as an indicator of higher future risk.

If your business has faced multiple employment-related lawsuits or settlements in the past, you can expect to pay more for a premium. On the other hand, companies with little to no claims history are generally seen as lower risk and may qualify for more affordable EPLI rates.

Do I need employment practices liability insurance?

Though it's not required by state law like workers' compensation, employment practices liability insurance is equally important when you have employees.

At any workplace, employee claims of sexual harassment are always a possibility. An employee could also misread your motivations in decisions related to hiring, firing, and promotions. For example, an employee might sue over wrongful termination due to age discrimination, which could lead to a costly legal battle.

When someone sues your business—even if it's a frivolous lawsuit—you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

EPLI covers all of these costs, which could save your business from bankruptcy. Because the premium is based upon your risk factors and your industry, many small businesses pay only a small monthly premium for this coverage.

Keep in mind that employment practices liability is a claims-made policy, which means this policy must be kept active in order to file a claim.

How can you save money on EPLI?

There are a few steps you can take to help reduce your EPLI premium and avoid more expensive rates:

Bundle policies. Many insurance carriers offer options to purchase different types of coverage together for a discount.

You can combine your EPLI coverage with other types of management liability insurance, most commonly directors and officers insurance (D&O). You can also add EPLI coverage as an endorsement to a general liability policy, or a business owner’s policy (BOP).

Shop around and compare quotes. Premiums can vary significantly between insurers, so it pays to get multiple quotes. Comparing coverage options ensures you’re getting the best protection at a competitive price.

Pay your entire premium upfront. You can typically pay your premium in monthly or annual installments. It might be tempting to go with a smaller monthly payment, but consider paying the full annual premium instead, as it's often cheaper.

Proactively manage your risks. If your business has no claims history, you can expect lower insurance rates. An effective way to avoid claims is to create a comprehensive risk management plan that reduces the chance of employment-related lawsuits. For example, you might:

- Provide harassment prevention training

- Maintain a human resources department

- Form internal protocols for hiring and firing employees

- Respond promptly to claims of harassment

- Discuss harassment and discrimination in your employee handbook

- Make sure your business follows all state and federal employment laws

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from leading providers, buy policies, and manage coverage online. By completing Insureon’s easy online application today, you can get free quotes for employment practices liability insurance and other business insurance policies from top-rated U.S. insurance companies.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.