Cyber insurance cost

The cost of cyber liability insurance varies based on a number of factors about your business. Your premium is directly impacted by your policy limits, how much sensitive data your company handles, and more.

What is the average cost of cyber insurance?

Small businesses pay an average premium of $145 per month, or about $1,740 annually, for cyber insurance, also called cyber liability insurance or cybersecurity insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical cybersecurity insurance costs for Insureon customers

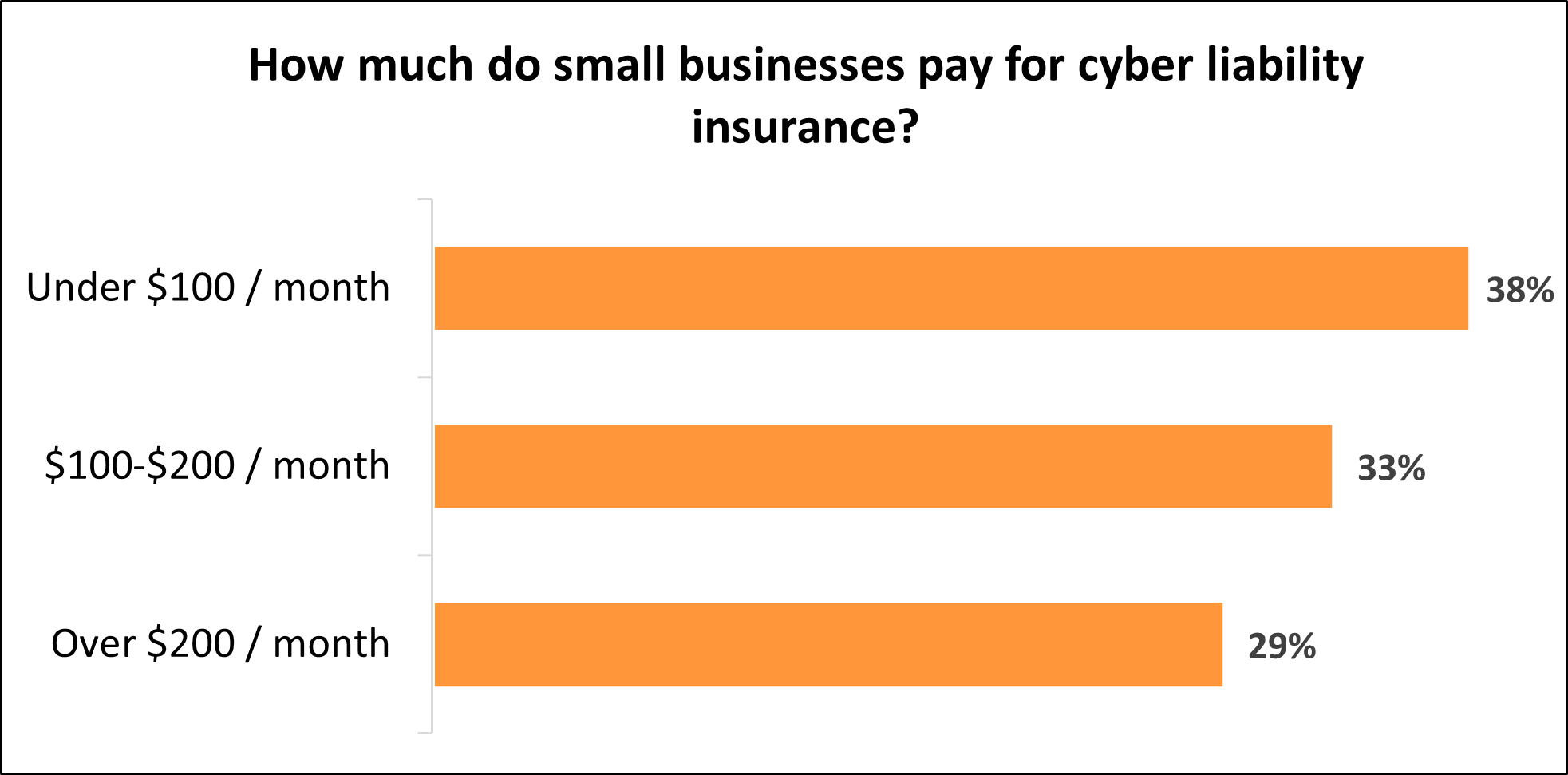

While Insureon's small business customers pay an average of $145 monthly for a cyber insurance policy, 38% pay less than $100 per month and 33% pay between $100 and $200 per month.

The cost varies for small businesses depending on their risks and the coverage they choose.

Factors that impact cyber insurance rates

As with other types of insurance, your provider calculates your cyber insurance premium based on a number of factors, including:

- Policy limits and deductible

- Types of coverage

- Amount of sensitive data handled

- Number of employees

- Claims history

- Cybersecurity risk management

- Industry risks

- Remote work security risk

Chat with a licensed insurance agent if you're unsure which coverage options to choose.

Policy limits and deductible

Businesses that face higher risks may choose to pay more for higher policy limits. Overall, the amount of cyber coverage your business needs depends on your industry, your type of business, and the type of customer data you handle.

Cyber liability insurance policies have two limits, which typically range from $1 million to $5 million:

- Per-occurrence limit. While the policy is active, the insurer will pay up to this amount to cover any single incident.

- Aggregate limit. During the lifetime of the policy (usually one year), this is the maximum the insurer will pay to cover claims.

The average deductible for a cyber liability policy is $2,500 for Insureon customers. A higher deductible results in a lower premium, but make sure it's an amount you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your claim.

Types of coverage

Different types of cyber insurance can impact the amount you'll pay for coverage.

Most businesses only need first-party cyber insurance, also called data breach insurance, to defend against cyber risks at their own business and may also benefit from a crisis management team. The cost depends on how much customer information they handle, such as credit card numbers or Social Security numbers.

Tech companies and consultants usually need third-party cyber coverage, which pays for legal costs if a client blames their business for failing to prevent a cyber incident. They can often combine this policy with professional liability insurance in a policy bundle called technology errors and omissions insurance, or tech E&O.

Amount of sensitive data handled

The more sensitive data your business handles, the higher your chances of vulnerabilities that can lead to a data breach or other security incident.

Insurance company underwriters will often determine higher rates for companies with more opportunities for data incidents, especially data that involves personally identifiable information (PII), credit card information, and healthcare records.

For example, a large healthcare facility with many employees and patients will pay more for cyber insurance than a small medical office with only a few staff and far fewer patients.

Number of employees

The number of staff you employ can impact your cyber insurance rates. This is due in part to the increased chance of security failure and breaches of cybersecurity measures when there are more employees with access to sensitive information.

Employee training to prevent cyber incidents should be mandatory for all of your workers who have access to private data, banking details, and other sensitive information.

Claims history

A lack of previous claims can help policyholders keep their insurance costs as low as possible.

A history of claims can signal a risk to insurance companies. Keeping your claims to a minimum can prevent future price hikes.

For example, a consulting business has a security breach due to a phishing scam and they make a claim to help with incident response and ransom payments. When their policy year ends, they notice the following year's cyber insurance is higher.

This increase is due, likely in part, to their claims history and having a claim filed on their insurance record.

Cybersecurity risk management

Your business's risk management strategies will likely directly impact your insurance rates. The more education, training, and safety measures you implement, the less likely your business is to experience a security breach and the lower your rates will be.

Having the right digital security measures in place, including implementing firewalls, multi-factor authentication, and a BYOD security plan can help your employees avoid inadvertent data breaches.

Keep costs low by adequately protecting your business and client information.

Industry risks

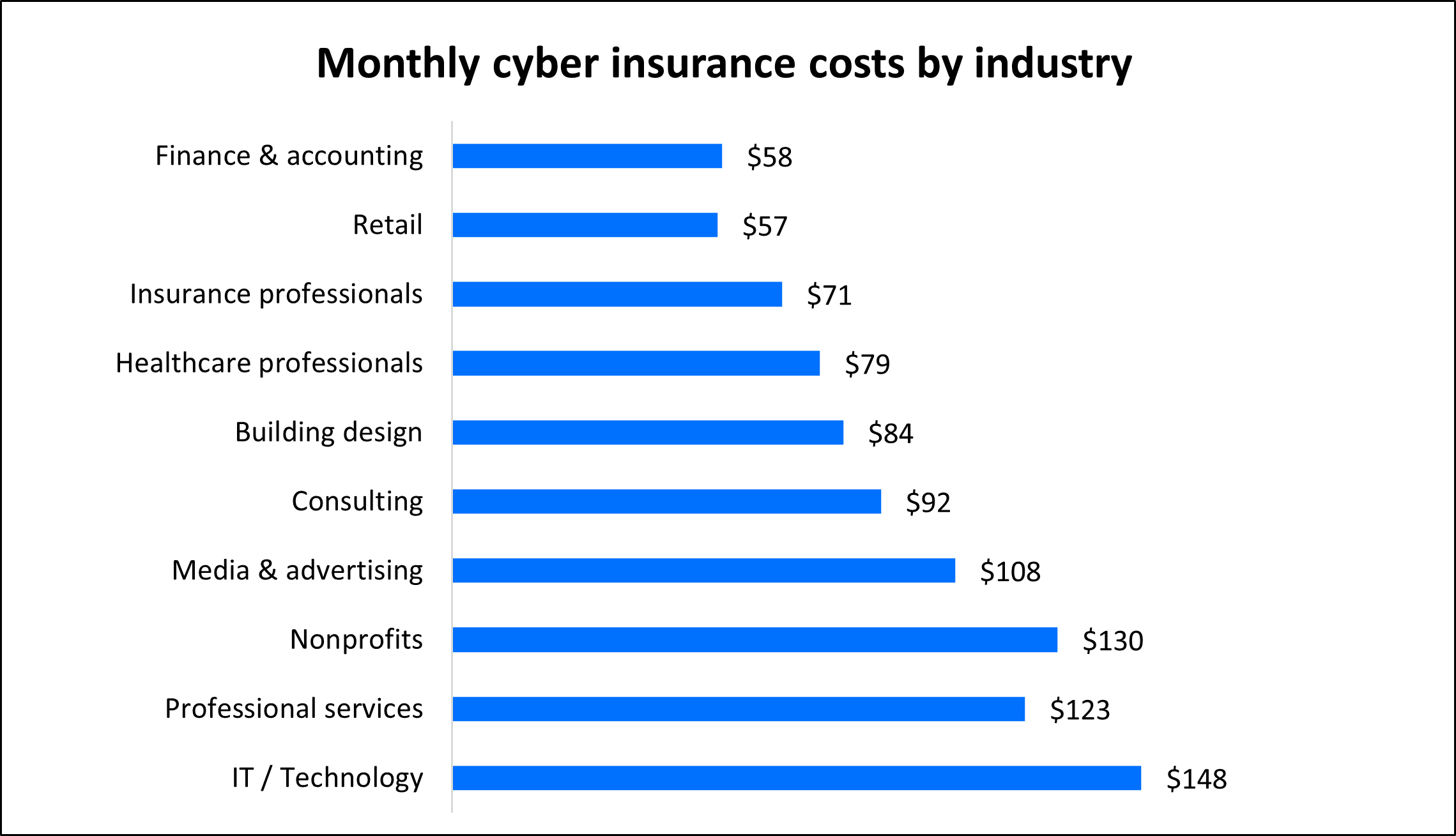

Your industry will undoubtedly impact the cost you can expect to pay for cyber liability insurance. Industries with higher risk typically result in higher premiums.

Cybersecurity companies, network security companies, IT consultants, and other businesses responsible for their clients' cybersecurity can expect to pay more for cyber insurance coverage.

For example, finance businesses pay an average $58 per month for cyber insurance, while IT businesses pay an average of $148 per month. This is due, in part, to the fact that the potential for financial losses and reputational damage resulting from cyber errors is higher for IT folks than it is for finance professionals.

Non-tech industries should carry cyber insurance as well, especially if they use POS systems, keep electronic client records, or do digital transactions. Even if they aren't managing major tech projects, employees can still fall victim to costly social engineering and phishing attempts, which can compromise client data.

Cyber insurance is just one policy that small businesses must consider. Depending on the industry that you work in, such as construction or cannabis, you may be required by your state to carry other types of insurance, most often general liability insurance.

Below you can find the average cyber insurance costs for a variety of industries:

Top industries we insure

How do I know if I need cyber insurance?

Many small businesses forgo insurance because they assume they’re at low risk for cybercrime. However, cybercriminals often target small businesses as they have fewer resources to protect themselves. In fact, 98% of cyber insurance claims come from small and medium businesses.

Here's how these costs can escalate at a small business:

- A hacker brings down the software that a company relies on for customer transactions. The company misses three business days of work while the software is unavailable. Cyber liability insurance can pay for the business interruption caused by the outage.

- A cybersecurity consultant is sued for failing to prevent a ransomware attack on a client. The consultant has to pay the cyber extortion demand required to recover the client's data, on top of legal defense costs.

- A data breach exposes the personal information of hundreds of customers at a small retail shop. The retailer has to pay for a credit monitoring service for all those customers for several years, as well as any costs associated with the state-required notification for each customer. They may also have to invest in a public relations campaign to help fix their reputation.

As you can see, cyber insurance is an important part of risk management for businesses of all sizes that handle sensitive information.

Get the right cyber insurance coverage for your business

WARNING! WARNING! WARNING! WARNING! WARNING!

Cyberattack! Cyberattack, oh yeah!! It's a cyberattack!

Don't worry, you have cyber liability insurance. Your small business is protected from cyberattacks and data breaches that can cost thousands of dollars.

Got it bad! Got it bad! Got it bad! Cyberattack!

What the heck, man? So, no encore? I'm gonna need a ride home. Can someone call my mom?

You can get all the coverage your business needs by following this link. Protection is peace of mind.

How can you save money on cyber liability insurance?

Cyber liability insurance costs vary based on several factors. In addition to choosing lower coverage limits, there are a few steps you can take to help reduce your cyber insurance premium and avoid more expensive rates:

Bundle your insurance policies

Businesses can often save money by bundling policies purchased from the same insurance provider.

For example, tech companies often choose to buy technology errors and omissions insurance, also called tech E&O. This policy bundles errors and omissions insurance with cyber liability insurance to protect against lawsuits related to mistakes, including failure to prevent a data breach on a client's system.

You can usually choose to pay your cyber liability insurance premium in monthly or annual installments. While it’s tempting to go with monthly payments because they require less cash upfront, many insurance companies offer businesses a discount for paying the entire annual premium at once.

Manage your cyber liability risks

If your small business has no cyber liability claims history, you could save money on your premium. You can also save money by implementing security measures at your business. For example, you might:

- Routinely change your business’s account passwords

- Invest in secure equipment and software

- Teach employees to recognize and avoid malware and phishing attempts

- Implement multi-factor authentication for employees

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. Our licensed agents help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing Insureon’s easy online application today, you can compare free quotes for cybersecurity insurance and other policies from top-rated U.S. insurance companies. Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Learn more about business insurance costs