Inland marine insurance cost

The cost of inland marine insurance coverage varies based on a number of factors about your business. Your premium is directly impacted by the value of your business property, your policy limits, industry risk, and more.

What is the average cost of inland marine insurance?

Small businesses pay an average premium of $29 per month, or about $350 annually, for inland marine insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Understanding inland marine insurance cost factors

How does the type of inland marine insurance affect the cost?

Different types of property may need different types of coverage. Policies designed to cover less expensive items will cost less than policies intended for valuable items.

Here are the most common types of inland marine insurance:

- Contractor's tools and equipment insurance, sometimes called equipment floater insurance, is designed to protect newer contractor's equipment and tools valued at less than $10,000. Because it protects lower value items, this policy is often very affordable.

- Bailee's customer coverage is recommended for businesses that handle customer property, in case the items are damaged while in your care, custody, or control.

- Installation floater insurance covers building materials and other moveable property while they're being installed or built at a construction site. That could include an HVAC system or roofing materials.

- Builder's risk insurance is a more comprehensive policy that covers damages during a construction project. For example, it would cover costs if a fire damages a structure in progress and building materials at a construction site.

- Motor truck cargo insurance provides liability coverage for freight or goods while they are being transported by a motorized carrier. Trucking businesses often use this policy to provide protection for client cargo while it is in transit.

How do policy limits affect the cost of inland marine insurance?

As with commercial property insurance, the cost of inland marine insurance depends primarily on the value of the items you want to insure. For example, it'll cost more to insure high value items such as fine art, motor truck cargo, bulldozers, and forklifts.

Your policy's coverage limits should be enough to cover a potential claim, whether that's a fire in a food truck's kitchen or a camera dropped by a photographer at a wedding. Higher coverage limits cost more, but will cover bigger losses.

Note that your deductible also affects the cost of insurance. A higher deductible will result in a lower premium, but you'll have to pay that amount before your insurer will cover a claim.

How does your industry impact the cost of inland marine insurance?

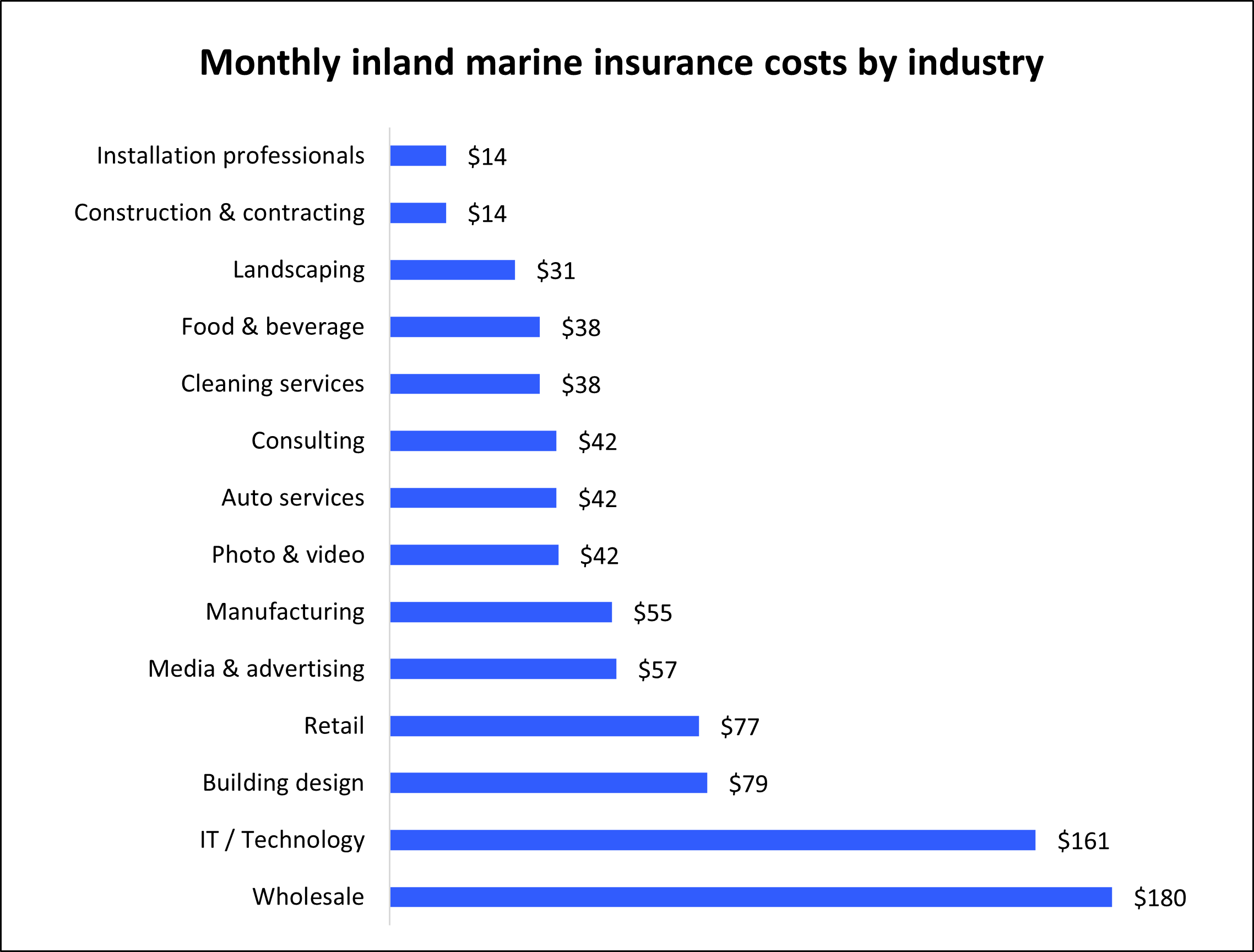

Professionals with expensive equipment choose higher limits and pay more for increased protection. Because your profession determines what kind of property you need, you can estimate how much you'll pay for insurance based on your type of business.

For example, landscapers, installation professionals, and contractors typically need to insure tools and other equipment brought to job sites. They often buy contactor's tools and equipment insurance, which isn't an expensive policy.

On the other hand, technology businesses and wholesalers can expect to pay more for inland marine insurance. That's likely a reflection of the cost of insuring expensive electronics and shipping valuable merchandise.

The chart shows how much you can expect to pay for inland marine insurance based on your profession.

Top industries we insure

Don't see your profession? Don't worry. We insure most businesses.

Inland marine coverage provides affordable protection for property on the move

An inland marine insurance policy is a must-have for property brought to client's homes, stored off-site, or used at a photo shoot or other event away from your office. That's because a commercial property insurance policy only covers items at a business's fixed location, such as an office or storefront.

Professionals who bring their own equipment to job sites depend on this coverage. If a landscaper's tools are stolen from their truck, or a business's vending machines are damaged by vandalism, commercial property insurance won't cover the damages.

Inland marine insurance covers your business equipment wherever it goes and while it's in transit. Because the premium depends on the value of the insured property, small businesses and contractors don't have to pay a lot for this coverage.

How can you save money on inland marine insurance?

There are a few ways to save money on your inland marine policy:

Bundle your insurance policies. Small, low-risk businesses can bundle property coverage with another policy, most often general liability insurance or a business owner's policy (BOP). A bundle typically costs less than buying each policy separately.

Pay the annual premium. Insurance providers usually offer a discount when the policyholder pays the annual premium as opposed to the monthly payments.

Lower your risks. Insurance claims will increase your premium, so it's best to avoid claims through risk management. For inland marine insurance, you might:

- Purchase padlocks to secure tools and equipment.

- Invest in a security system for off-site locations.

- Store items away from pipes and other possible hazards.

- Train employees to be vigilant against possible theft.

Get your property appraised. An accurate estimate of your business personal property (BPP) tells you how much insurance you need. Not enough coverage could leave you paying for damages, while too much coverage could mean you're overpaying for insurance.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing Insureon’s easy online application today, you can compare free quotes for commercial inland marine insurance and other policies from top-rated U.S. insurance companies. Once you find the right policy, you can begin coverage in less than 24 hours and get a certificate of insurance to show clients, lenders, and landlords that you're insured.

An insurance agent can help you every step of the way if you have questions about coverage options or your business insurance needs.

What our customers are saying

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. See our small business insurance cost overview or explore costs for a specific type of policy.