Care, custody, and control

Care, custody, and control (CCC) is an exclusion in general liability and commercial auto insurance policies that bars coverage for someone else’s property that is damaged while in your care, custody, or control.

What is the care, custody, and control exclusion?

Your general liability insurance or commercial auto insurance coverage normally pays for damage you cause to someone else’s property.

However, if that property is temporarily in your safekeeping (for example, leased equipment used in your business), your insurance company won’t pay the property owner for any damage that you cause.

When does the care, custody, and control exclusion apply?

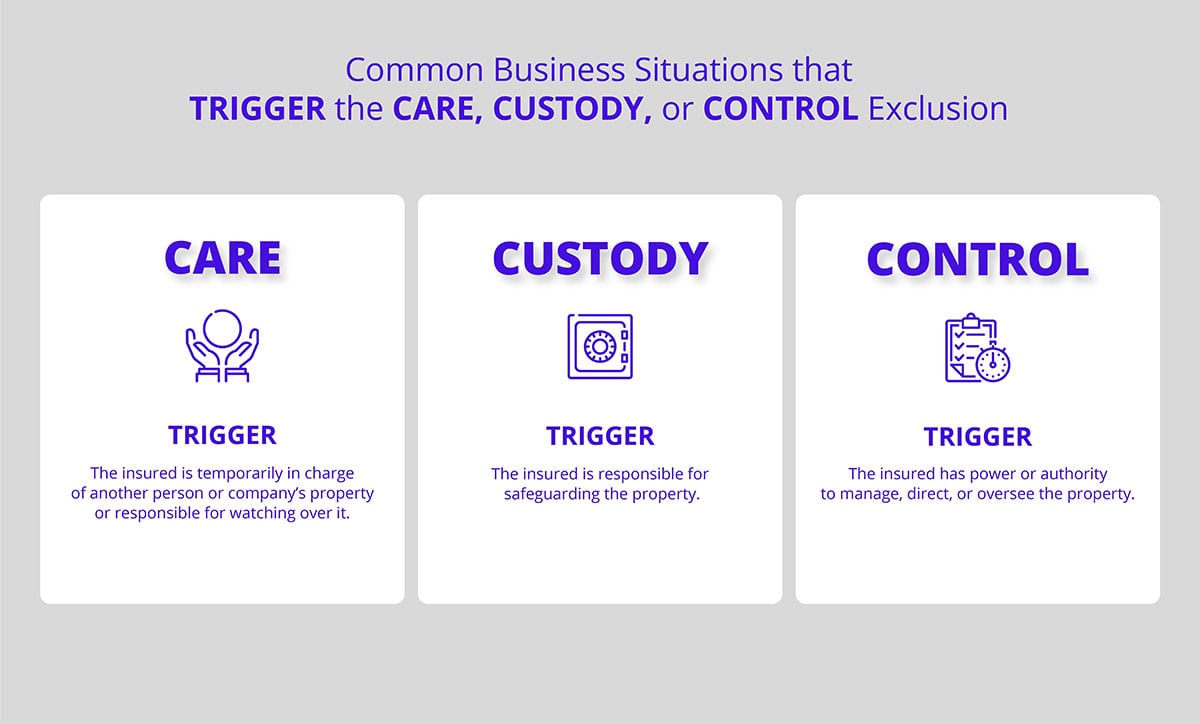

The exclusion applies if any of the following conditions are true:

- Care: You are temporarily in charge of someone else’s property, or responsible for watching over it.

- Custody: You are responsible for safeguarding the property.

- Control: You have power or authority to manage, direct, or oversee the property.

For any damage caused during the above situations, your insurer will not reimburse the property owner or cover any legal costs if the property owner sues your business.

What situations can trigger the CCC exclusion?

Several common scenarios could activate the care, custody, and control exclusion for property under the control of the insured. For example:

- An accounting firm damages leased business equipment, such as a photocopier.

- A restaurant with a coat check service loses a customer’s jacket.

- A mechanic at an auto body shop damages a customer’s car when a tool slips.

- A computer repair technician drops a customer’s laptop onto the floor, cracking its screen and ruining the hard drive.

- A pet sitter or dog walker damages a customer’s belongings, or the dog is injured while under the insured’s care. Pets are considered personal property under the care, custody, and control exclusion.

In the above cases, the businesses had someone else’s property under their care, custody, or control. Because of the CCC exclusion, their general liability insurance policy would provide no coverage for these incidents.

Does this exclusion apply to all types of third-party property under your care, custody, or control?

The care, custody, and control exclusion doesn’t apply to real property, which includes buildings and any permanently attached fixtures to the land. You may still have coverage for such damage under the real property section of your commercial general liability policy.

What policies could fill the care, custody, and control exclusion gap?

There are specialized insurance policies designed to cover property damage that could be impacted by the care, custody, and control exclusion.

If you are in the freight industry or auto service industry, you can purchase dedicated motor truck cargo insurance or garage keepers insurance that will protect you in case you damage a customer’s property.

Bailee coverage is a type of inland marine insurance that provides coverage for someone else’s property that’s been entrusted into your care, custody, or control for transportation, storage, or maintenance.

Consult an insurance agent if you need help finding care, custody, and control insurance coverage for your business.

Get small business insurance quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to get insurance quotes from top-rated U.S. carriers. You can also consult with an insurance agent on your business insurance needs. Once you find the right policies for your business needs, you can begin coverage and receive your certificate of insurance in less than 24 hours.