Workers' compensation insurance cost

The cost of workers' compensation insurance varies based on a number of factors about your business. Your premium is directly impacted by your business location, the number of employees you have, industry risks, and more.

What is the average cost of workers' comp insurance for small businesses?

Small businesses pay an average of $45 per month, or $542 annually, for workers' compensation insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes high and low premium outliers, like high-risk installation businesses that pay much more for workers’ compensation.

The average workers' compensation claim is $41,353, according to the National Safety Council. By comparison, paying for a workers' compensation policy that covers medical expenses, disability benefits, death benefits, and other costs related to a workplace injury, is probably a much better deal for your business. That’s why small business owners may purchase it even when it’s not required by state law.

Understanding workers' comp insurance costs

Careful! Workers compensation insurance covers medical expenses, ongoing care costs, and lost wages due to work related injuries for you and your employees.

It can handle the cost of claims for only about 45 dollars per month.

Don't put your business at risk. Apply for your policy today!

Oh oh!

How much does workers' compensation insurance cost for Insureon customers?

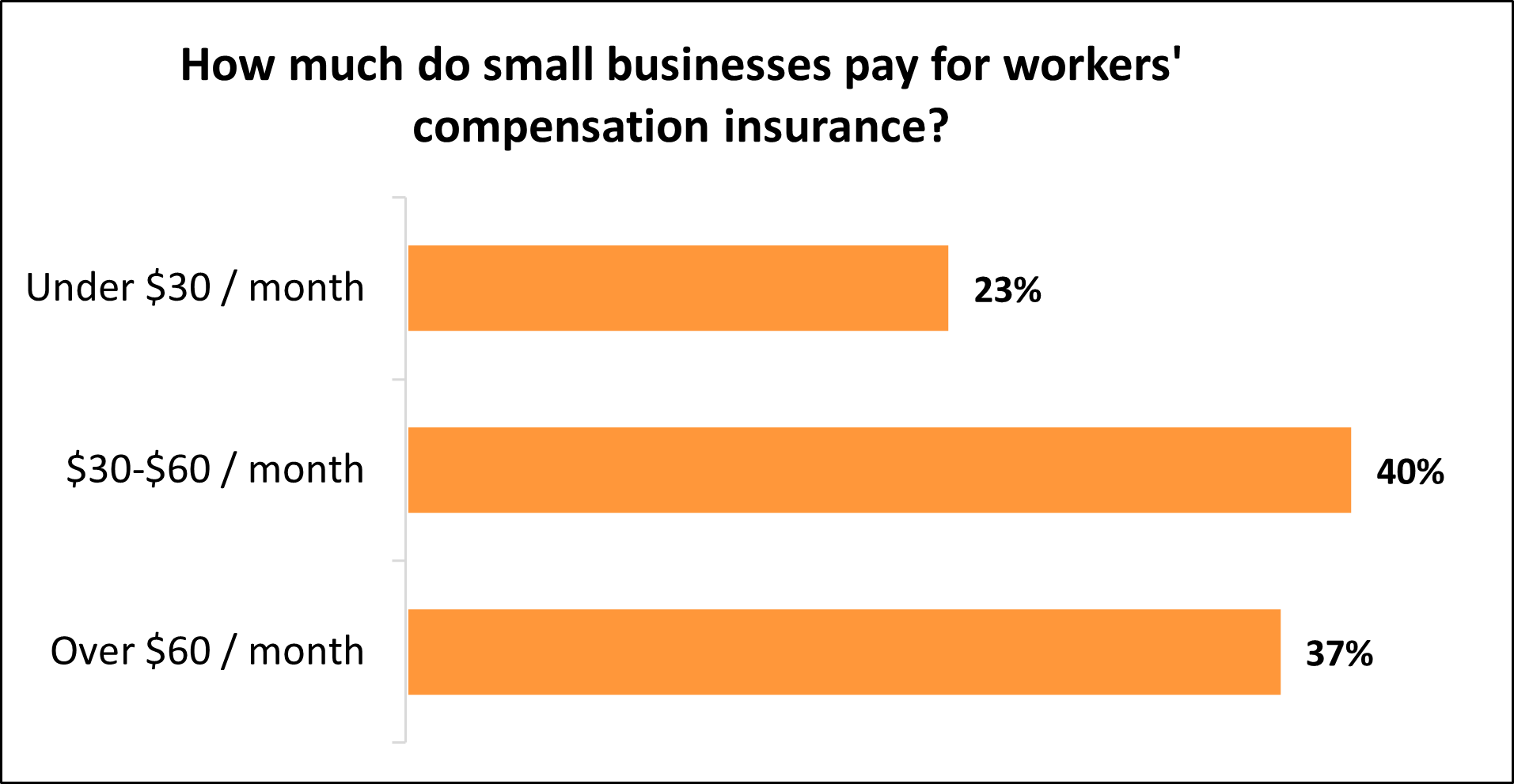

While Insureon's small business customers pay an average of $45 monthly for workers’ compensation coverage, 23% pay less than $30 per month and 40% pay between $30 and $60 per month. The cost depends on your type of business, its location, your claims history, and the number of employees you have.

Your workers' compensation insurance premium will depend on the following factors:

- The state(s) where your employees work

- The number of employees you have

- The type of work done by your employees

- Your total annual payroll

- Your workers' comp claims history

- Your industry

- Coverage limits

Physically demanding work usually results in higher premium rates – so does a history of workplace accidents. Workers' comp rates are unique because they tend to decrease over time, as overall workplace safety continues to improve.

Business location

The state where your employees work can have a big impact on the workers’ compensation premium you’ll pay. Each state has its own workers' compensation laws, and each state has a rating bureau that sets the baseline rate used in calculating how much you’ll pay in insurance premiums.

Some states also run their own insurance funds that sell workers' comp coverage. In four states – North Dakota, Ohio, Washington, and Wyoming – businesses are required to buy their workers' comp policy from the state fund, also called a monopolistic state fund.

Just as most states require by law that businesses with employees purchase workers' comp, they also typically mandate that small business owners carry commercial auto insurance if they have business-owned vehicles.

Below are some examples of the average cost of workers' compensation insurance across different states among Insureon policyholders:

| State | Workers' comp insurance cost |

|---|---|

$46 per month | |

$62 per month | |

$45 per month | |

$43 per month | |

$32 per month | |

$46 per month | |

$38 per month | |

$29 per month | |

$32 per month | |

$42 per month |

Workers' compensation laws in your state

Annual payroll

Workers’ compensation insurance is also calculated based on your total payroll because it reflects how many employees you have and the level of risk involved in their jobs.

Insurers apply a rate—usually expressed as a dollar amount per $100 of payroll—based on your industry classification. For example, high-risk industries like roofing or other construction businesses have higher rates than lower-risk fields like accounting or consulting.

The more you pay your employees in total, the more your premium will cost. That’s because a larger payroll means a greater exposure to potential injuries or illnesses on the job.

Keeping your payroll records accurate and up to date is essential, especially since premiums are often audited at the end of the policy term to ensure you're charged the correct amount.

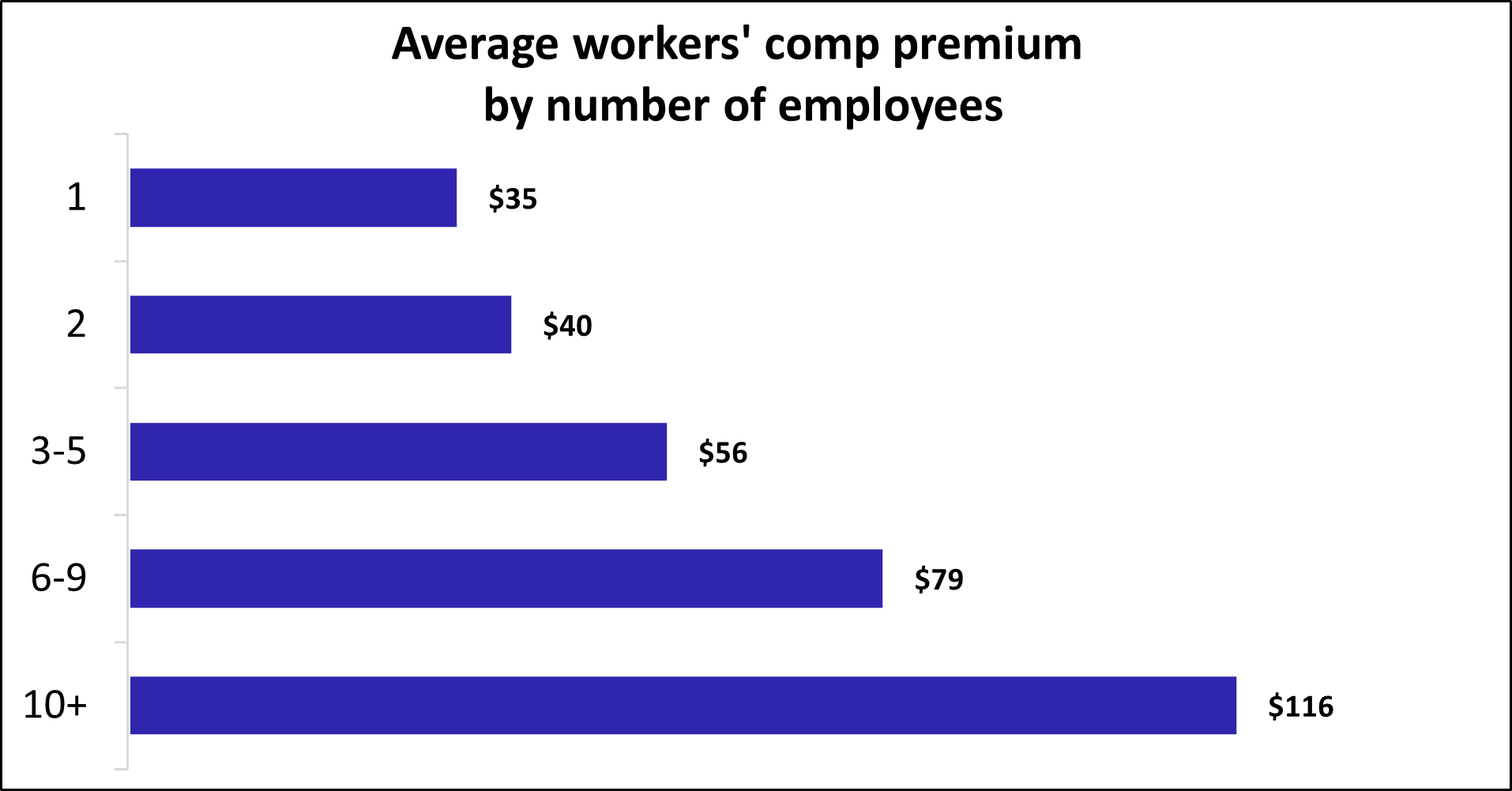

Number of employees

Businesses with a larger number of employees—including full-time, part-time, and contractors—pay more for workers’ comp. As your business grows, the odds that one of your employees could get injured at work go up, and so do your workers’ compensation rates.

For example, Insureon customers with three to five employees pay an average of $56 per month, while businesses with 10 or more employees pay $116 per month.

Claims history

Your business’s history of workers’ comp claims—both the frequency and severity—plays a major role in your insurance costs. If you've had multiple claims, or even a few high-cost claims, insurers may consider your workplace higher risk. This can lead to higher premiums, surcharges, or difficulty finding affordable coverage.

On the other hand, a clean claims history is a strong signal your business prioritizes safety and risk management. Many insurance companies reward low-risk businesses with lower premiums, discounts, or eligibility for dividend or group rating programs.

Investing in workplace safety training, maintaining proper equipment, and responding quickly to hazards can help reduce claims and keep your insurance costs in check over the long term.

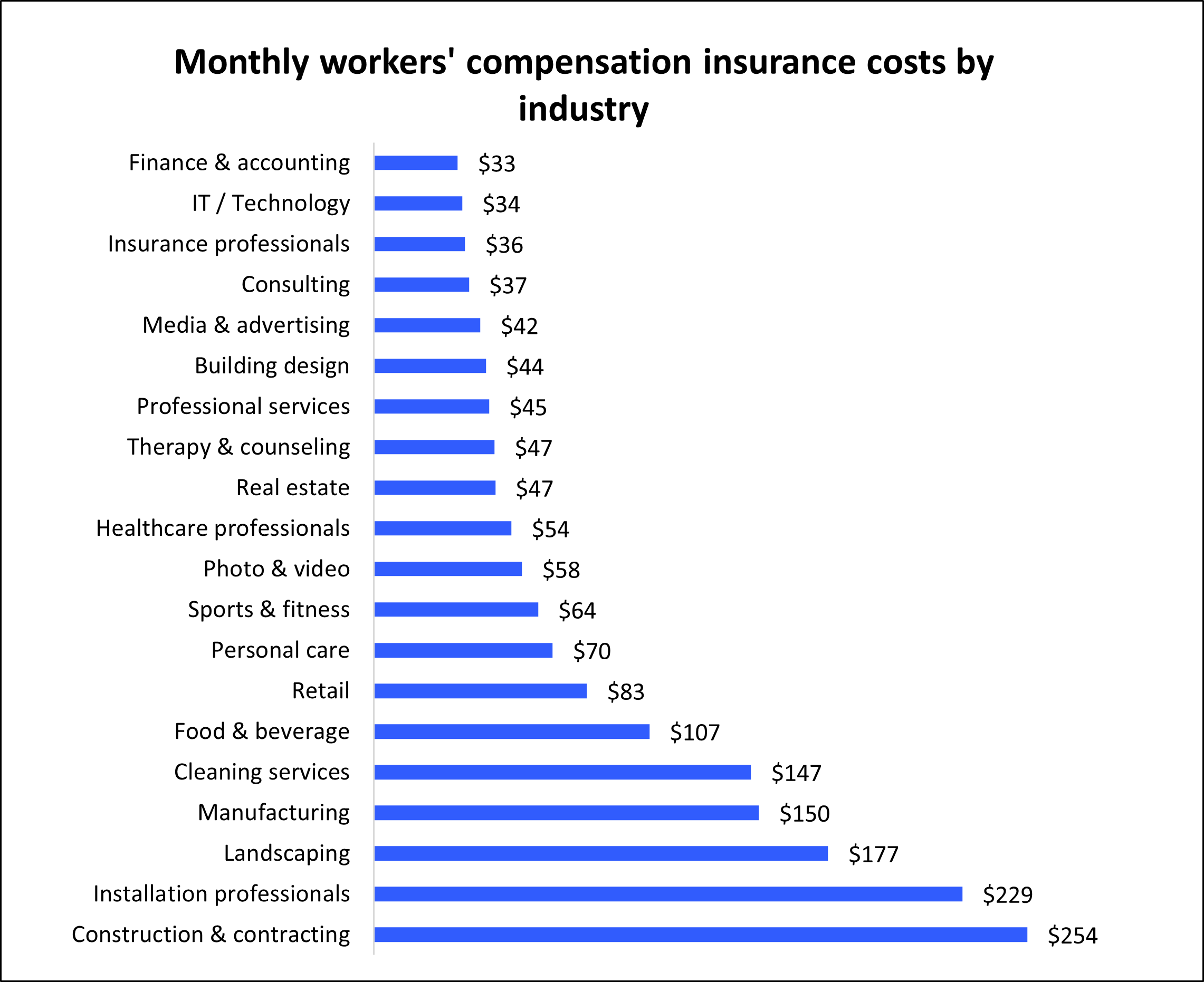

Industry

About 20% of worker fatalities in private industry occur in construction. The higher risk of an on-the-job accident means construction companies pay higher premiums, even though workers' comp is a no-fault policy. Likewise, businesses in an industry like finance and accounting have low premiums, because there’s minimal risk of a work-related injury. In fact, Insureon's finance and accounting customers pay a monthly average of $33, while construction and contracting businesses pay an average of $254 per month.

Depending on the industry that you work in, such as construction or cannabis, you may also be required by your state to carry general liability insurance. For other businesses, such as those in real estate, insurance, or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

Below is the average cost of workers' compensation coverage across different industries:

Top industries we insure

Don't see your industry? Don't worry. We insure most businesses.

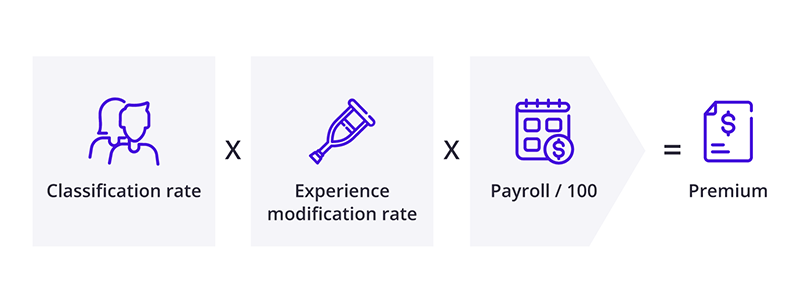

The amount you pay for workers’ compensation is a specific rate for every $100 of your company’s total payroll. Your workers' comp premium is calculated based on the type of work done by your employees (classification rate), your experience modification rating (claims history), and your payroll (per $100).

Workers' compensation insurance rates vary by state, ranging from a low monthly average of $32 in Texas to $119 in Alabama. However, these numbers are deceptively simple. They include all types of jobs, which means they don't reflect the different workers’ comp costs for low-risk versus high-risk work.

The formula for calculating a workers' comp premium is:

Many states set their workers’ comp rates based on guidance from the National Council on Compensation Insurance (NCCI), a workers' compensation insurance rating and data collection bureau. The NCCI analyzes trends and makes recommendations based on data from millions of claims and policies. It also has information on how workers' compensation insurance premiums are calculated in many states.

The NCCI has a searchable database of workers’ comp class codes online. Insurance companies use these classification codes to determine the level of risk for different job classifications, estimate workers' compensation rates, and set premiums.

How do you buy workers’ compensation insurance?

In most states, you can purchase workers’ compensation insurance coverage from a private insurer. With Insureon, you can compare workers’ compensation quotes from top U.S. insurance carriers.

Fill out our easy online application and we’ll send you workers' comp quotes that fit your business needs and budget. A licensed insurance agent is available to answer any questions you might have and will help you find the best coverage.

How can you save money on workers' comp?

Though you can't change your industry or the type of work your employees do, there are steps you can take to keep your workers' comp premium low.

Keep in mind that having coverage often saves you money in the long run. Beyond the obvious benefit of shielding you from medical care bills, proof of insurance can help you land contracts with potential clients. That's why some business owners who might be exempt still choose to carry coverage, such as independent contractors and sole proprietors.

Even when not required, workers' comp can financially protect self-employed individuals from lost wages and medical bills from a work-related injury that personal health insurance won't cover.

Here are a few strategies to help you reduce your workers' comp costs and avoid more expensive rates:

Improve workplace safety

To create a safer work environment and reduce the risk of work-related injuries, you can:

- Conduct employee training: Train employees on how to safely do their jobs, from proper lifting techniques to correct handling of hazardous materials.

- Outfit your employees with the right gear: Equip employees with safety equipment and properly maintain tools to help minimize risks.

- Identify any potential hazards: Use signs and labels to alert workers of potential safety issues, such as dangerous chemicals or slippery floors.

- Create a clutter-free workplace: Hallways, work areas, and exit routes should be free of debris and clutter like power cords and boxes to avoid tripping hazards.

When you purchase a workers’ compensation insurance policy, you have the option of paying monthly or annual premiums. Consider paying your premium in annual installments, as many insurers offer discounts to businesses that pay annually.

Get a "pay-as-you-go" insurance policy

For some small businesses, it may be more cost effective to get a pay-as-you-go workers' comp policy. This type of policy offers flexible premiums that change throughout the year, depending on changes to your number of employees and your payroll data throughout a 12-month span.

Some small business owners may be eligible for a minimum premium workers' compensation policy, which sets your charges at the lowest premium that an insurance company can offer a business. Small businesses that benefit from this type of policy often have few risks and a small number of employees.

For business owners who don't have any employees, such as independent contractors or sole proprietors, you may be eligible for a minimum premium policy called a workers' compensation ghost policy.

Prepare information for your insurance audit

Since it's normal for businesses to add and lose employees, your insurance carrier needs to make sure you have the right level of coverage for your business. Each year, your insurer will perform a workers’ comp insurance audit to confirm your workers' comp covers what it needs to without paying more.

Your insurance company uses this audit to adjust your premium for the previous policy term based on your actual payroll to make sure you’re paying for all the coverage you need.

You can make the process for a workers’ comp audit a lot easier by being prepared. You should keep detailed and organized records that you can easily access for the auditor.