Nevada workers' compensation insurance

Nevada law requires all employees to have workers’ compensation insurance coverage. This policy covers the costs of medical treatment and lost wages resulting from workplace injuries and occupational diseases.

Who needs workers' compensation in Nevada?

Every state has different requirements for workers’ compensation insurance. Nevada's workers’ compensation law mandates this coverage for all employers, even if the company only has one employee.

Under Nevada statutes [PDF], any person, firm, voluntary association, private corporation, and public service corporation that hires employees needs to carry this coverage. An “employee” is anyone hired by an employer or through a contract of hire or apprenticeship.

Employees include:

- Minors

- Elected and appointed paid public officers

- Members of boards of directors while providing service to corporations

- Musicians playing music for hire, members of bands and orchestras

Casual employees who worked less than 20 days at a total cost of less than $500 are exempt from this requirement if the employment is not in the course of trade, business, profession, or occupation of the employer – except for construction trades.

Do sole proprietors need workers' compensation insurance?

Unlike most other states, Nevada does not exclude sole proprietors, independent contractors, subcontractors, and their employees from workers' compensation requirements. They are deemed employees unless they are an "independent enterprise [PDF]" as defined by the Nevada Division of Industrial Relations (DIR).

Health insurance providers can deny claims for occupational injuries, so buying this coverage can help protect against expensive medical costs. Workers' comp benefits can also help keep your business afloat while you recover from a work injury.

What does workers' comp cover for Nevada businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- An owner-operator truck driver is injured in an auto accident and hospitalized, but never recovers enough to return to work. They receive permanent disability payments, in addition to compensation for their medical expenses.

- A retail store employee slips on a wet floor and hits their head. In this instance, workers' compensation would cover their emergency room trip, head MRI, and any follow-up medical expenses during their recovery.

- A fast food worker burns themselves while preparing an order for a customer. Workers' comp would cover their medical treatment and pain medication.

- A janitor suffers from respiratory problems after years of using harsh cleaning chemicals. After filing a workers' comp claim, they receive permanent disability payments for their ongoing lung issues.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers' compensation insurance cost in Nevada?

The average cost of workers’ compensation in Nevada is $48 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as Las Vegas, Carson City, or Reno

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

How is workers' compensation purchased in Nevada?

Business owners in Nevada have a few choices when it comes to buying a workers' compensation policy:

- Private insurance companies. You could contact each workers' compensation insurance carrier independently to compare their products and rates, but that's where agents and brokers like Insureon come in. As the nation's leading digital insurance agency, Insureon partners with 30+ top-rated insurance carriers to deliver the right coverage for your business. Fill out an easy online application to get started.

- If denied, you can obtain coverage from the assigned risk pool. Businesses with higher risks can buy coverage from the Nevada Assigned Risk Pool, which is administered by the National Council on Compensation Insurance (NCCI).

- You can self-insure your business. Employers who meet certain requirements, including a tangible net worth of $2.5 million, can apply to the Self-Insured Workers’ Compensation Section of Nevada's Department of Business and Industry for approval. This is primarily an option for large corporations and others with the financial resources to handle claims themselves.

Verified workers' compensation insurance reviews

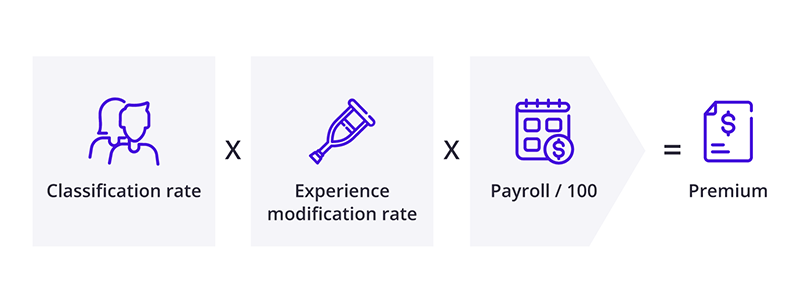

Insurance providers use a specific formula for calculating workers' comp premiums:

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, tree trimmers, and others with a higher rate of injuries. Like most other states, Nevada relies on the National Council on Compensation Insurance (NCCI) database.

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rate is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to determine your workers' compensation rate. Workers' compensation audits are typically done each year to ensure your business pays the right premium for this coverage.

How can Nevada business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure. This also helps you avoid misclassification fines.

In some cases, small business owners can choose to buy pay-as-you-go workers' compensation. This type of workers' comp policy has a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll. It's useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, including Nevada. A ghost policy is a workers' comp policy in name only. It provides no protection or medical benefits, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers' compensation work in Nevada?

Workers' compensation insurance covers the cost of medical treatment and partial lost wages for injured employees.

The doctor, chiropractor, or therapist must be an authorized medical provider chosen by the insurer. The employee must submit a Notice of Injury form and Report of Initial Treatment form.

In Nevada, workers' compensation benefits include:

- Medical care

- Temporary total disability benefits

- Temporary partial disability benefits

- Permanent total disability benefits

- Permanent partial disability benefits

- Vocational rehabilitation

- Death benefits for fatal incidents

- Other related expenses, such as mileage reimbursement

Most workers' comp policies include employer's liability insurance, which can help cover legal expenses if an employee blames their employer for an injury. However, the exclusive remedy provision in most workers' comp policies prohibits an employee from suing their employer if they accept workers' comp benefits.

For details, read the state's Employee Guide [PDF] for injured workers.

What are the penalties for not having workers' comp insurance in Nevada?

If an employer fails to obtain or maintain workers’ compensation insurance in Nevada, it could be charged a fine up to $15,000, in addition to premium penalties and a stop-work order until insurance is obtained.

The employer would also be financially liable for any injuries that happen during the period when an employee is uninsured. Additionally, if a work-related injury results in substantial bodily harm or death, the employer could be held criminally responsible.

Nevada workers' compensation laws for death benefits

If an employee dies as a result of a work-related injury or illness, death benefits can be awarded to surviving dependents.

Surviving dependents include any child under 18, a child under age 22 who is a full-time student, or a child of any age who is incapable of self-support. A living spouse is always entitled to death benefits.

If the deceased worker has no spouse or children, benefits could be awarded to their dependent parents or minor siblings, as well as other family members who were dependent on the person for financial support.

The deceased worker’s spouse can receive 66% of the worker’s average monthly wage, up to a maximum that changes each year. This benefit is for the spouse and children and is divided if the spouse is not the parent of the children. If that’s the situation, the spouse would receive half of the benefit and the children would share the other half.

Workers’ comp benefits also include burial costs up to $10,000.

Workers' comp settlements in Nevada

A workers’ compensation settlement is an agreement between the parties that will resolve your workers’ compensation claim. This benefits both the employee and the employer. A settlement in a workers' comp claim is a full and final resolution.

Most states pay workers’ compensation settlements in a lump sum. In the state of Nevada, lump-sum settlement payments are only allowed for some types of benefits.

Permanent partial disability (PPD) benefits are awarded when your claim is accepted or you’ve received the award from a workers’ compensation judge. This is when a worker has a permanent impairment but can still work to some degree.

If you’re entitled to PPD benefits, you can request a lump-sum payout. In most cases, though, a PPD benefit is paid in installments until the worker reaches age 70. There are specific circumstances when you can collect a partial lump sum based on your disability rating and the date of your injury.

Nevada also allows for vocational rehabilitation benefits. If a worker is eligible for job retraining, education, or assistance finding a job, they might qualify for these biweekly maintenance payments while receiving services. The worker has a right to these services but could choose to forfeit them and accept a lump-sum payment instead. This lump sum must be at least 40% of the amount of the maximum vocational rehabilitation benefits to which they’re entitled.

Workers' compensation statute of limitations in Nevada

An injured worker is encouraged to notify the employer of the injury as soon as possible, but state law requires notice within seven days. The employee then has 90 days from the date of injury to submit a form to the state if they missed work because of the injury or illness or sought medical treatment.

If the workplace injury results in death, the survivors have one year from the worker’s death in which to file a Nevada workers' compensation claim.

Get free workers' comp quotes with Insureon

If you are ready to buy a workers' compensation policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy