How is workers' comp insurance cost calculated?

Workers' compensation insurance is a must for small businesses. A number of factors can impact your workers' compensation insurance costs. Learn how workers' comp insurance premiums are calculated, and how you can keep your costs low.

What is workers' compensation insurance?

Workers' compensation insurance is one of the few small business insurance coverages regulated at the state level. In most states, employers must provide workers’ compensation benefits even if they only have one full-time employee.

The workers' comp policy covers medical treatment and disability benefits resulting from your employees' workplace accidents and related illnesses. If an employee has a temporary or total disability from a workplace injury, workers’ comp helps offset their lost wages.

When insurance companies calculate your workers’ compensation insurance cost, they look at a few factors:

- The type of work done by your employees (workers' comp class codes)

- Your claims history (experience modification rating)

- Your payroll

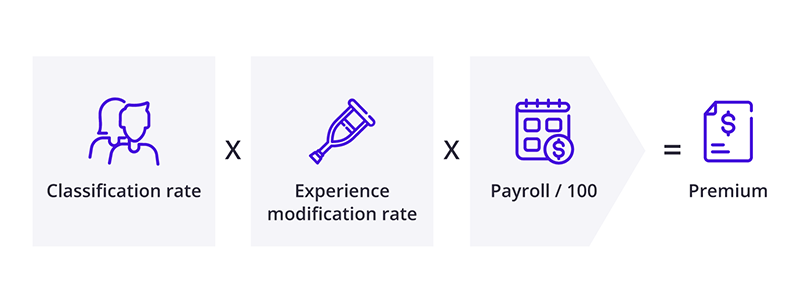

Each factor becomes a number that they use in a formula to calculate workers' comp premium:

It may look complicated, but it's just a way for insurers to assign concrete numbers to your business's risks. Let's take a look at each one in detail.

Your workers’ compensation classification rates

The National Council on Compensation Insurance (NCCI) has more than 700 numerical workers' comp class codes for different job types. Each one of your employees is given a code based on their specific type of work, such as accounting or lawn care. Each code has a rate associated with it, with higher rates for more risky types of work.

Basically, the insurer looks at a table and uses the rate assigned for that code in the formula for workers' comp. That's how it ends up costing less to insure an accountant than a lawn care contractor, who is more at risk of physical injury.

Most states use the standard NCCI system, while 10 states use a modified version. Five states use their own method: California, New Jersey, New York, Delaware, and Pennsylvania. Learn more about workers’ compensation laws in your state.

Your experience modification rating (EMR or e-mod)

Your experience modification rating represents your company's history of workers' compensation claims. It shows insurers whether they can expect your company to make a claim on a workers' compensation policy, based on your track record.

A new business without a history of claims would start with an EMR of 1.0, which is the industry average. That number could increase after several claims, or drop after several years without a claim.

For example, a company with several workers' comp claims could have a rating of 1.25, while a company with a clean history of claims could earn an EMR of 0.75. The lower number results in a lower premium when entered into the formula, which is another good reason to avoid workers' comp insurance claims. Even with no-fault coverage, maintaining a clean claims history helps control premium costs and reflects a commitment to workplace safety.

Your payroll

As part of its workers’ comp calculator formula, the insurance company will use your existing payroll, or your projected payroll if you’re starting a new business. You’ll pay a certain amount of premium for every $100 in payroll, based on the average weekly wage of your employees.

These rates vary by state, so your location can also end up impacting your workers' comp premium.

How does my business location factor into the cost of workers’ comp?

Workers' compensation insurance is regulated on the state level. Some states require workers’ compensation coverage as soon as you hire your first employee. Others require this coverage even for sole proprietors, especially if you’re in a line of business that’s considered a higher risk, such as building trades.

Some states maintain their own workers’ comp fund to provide this coverage. North Dakota, Ohio, Washington, and Wyoming require businesses to buy their insurance from the state fund. Several states give you the option of buying coverage from the state fund or through a private carrier.

Workers' comp is usually more expensive if you buy it from a state fund, rather than a private insurance company. On the other hand, if you can’t obtain coverage from private insurance carriers, you should be able to obtain it through the state fund.

Workers' compensation laws in your state

Get workers' comp quotes from trusted insurance providers with Insureon

Insurance can be a tricky thing to navigate on your own, which is why our industry-trained insurance agents do the hard work for you. We're already familiar with your state's workers' comp laws and can provide a free consultation to help you find the insurance policy that complies with those regulations.

Complete Insureon’s easy online application today to compare insurance quotes from top U.S. providers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Verified workers' compensation insurance reviews

How can I reduce the cost of workers' compensation coverage?

Workplace safety and reducing the frequency and severity of claims are key factors in reducing your workers’ comp premiums.

Here are a few steps you can take to help avoid more expensive rates:

- Have employee training for new hires and continuous training for existing employees, on the procedures and equipment they need to do their jobs safely. This is especially important when dealing with hazardous materials.

- Have the right tools and safety equipment. Make sure they are maintained and in proper working order.

- Alert your employees to safety hazards. Use the right signage and labels for hazardous materials and more ordinary problems such as potential slip-and-fall situations.

- Keep your workplace free of clutter. Make sure exit routes are clearly labeled and free of obstructions.

- Pay your premium annually, rather than in monthly installments. Many insurance providers offer discounts for those who pay their insurance premiums on an annual basis. For some small businesses, though, a pay-as-you-go workers' comp policy may be more cost effective.

- Check if you're eligible for a minimum premium workers' compensation policy, which sets your premium charges at the minimum premium (i.e., the smallest amount of money that an insurance company will sell to a business). Small businesses that benefit from this type of policy often have few risks and a small number of employees.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy