Alaska workers' compensation insurance

Alaska requires every business with one or more employees to obtain workers’ comp insurance, unless the employer has been approved to self-insure their workers’ compensation claims.

Who needs workers’ comp insurance in Alaska?

Nearly all workers in the state of Alaska must be covered under a workers’ compensation insurance policy.

Workers' compensation benefits pay for the medical treatment of ill or injured employees when the cause is related to their job. It also provides death benefits in the event of a workplace fatality.

Alaska’s governing workers' comp statute requires employees to be covered under certain special circumstances, including:

- Work-study high school students receive workers’ comp coverage as if they were state employees.

- Volunteer emergency medical technicians (EMTs) are treated as state employees.

- Special public safety officers named by the Commissioner of Public Safety receive state workers’ comp protection.

- Members of state boards and commissions are treated as state employees.

- Volunteer firefighters receive coverage as if they were local fire department employees.

- Civil defense and disaster relief workers receive state workers’ comp benefits.

- Anyone called into active duty with the Alaska State Defense Force receives state workers’ comp coverage.

Who is exempt from workers' comp in Alaska?

Employees who do certain types of work are exempt, including:

- Babysitters working part-time

- Noncommercial cleaning employees

- Workers hired to harvest crops and other similar part-time or transient employees

- Sports officials working amateur events

- Entertainers working under contract

- Workers engaged in commercial fishing

- Taxicab drivers working under contract

- Individuals receiving state temporary assistance benefits and who are engaged in required work activities

- Professional hockey team players and coaches as long as they have health insurance

- Real estate agents working under contract

- Transportation company drivers

Do you need workers’ compensation in Alaska if you are self-employed?

If you're self-employed, you don't need workers’ compensation, but you should still consider buying it. Sole proprietors, independent contractors, and business partners aren't considered employees, so they don't fall within the state's requirements for this policy.

Additionally, if Alaska employers hire construction contractors or subcontractors, they must provide them and their employees with workers’ compensation coverage unless the contractor can provide proof of insurance.

If you hire a contractor or subcontractor who lacks workers’ comp insurance and one of their workers gets hurt, you may be liable for that person’s medical expenses under your own workers’ comp arrangement.

Given the high cost of medical care, buying workers' comp is often a smart business decision even when it's not required. It would provide coverage for lost wages and other important benefits if a workplace injury occurs.

Is workers’ comp required for contractors and subcontractors in Alaska?

Alaska employers who hire construction contractors or subcontractors must provide them and their employees with workers’ compensation coverage unless the contractor can provide proof of insurance.

If you hire a contractor or subcontractor who lacks workers’ comp insurance and one of their workers gets hurt, you may be liable for that person’s medical expenses under your own workers’ comp arrangement.

Do Alaska business owners need to be covered by a workers’ compensation insurance policy?

Business owners should always consider buying workers' comp for themselves, as your health insurance plan might deny a claim for a work-related injury. However, the requirements depend on your ownership status.

Members of a limited liability company (LLC) who have at least a 10% ownership interest are exempt from coverage.

Executive officers of municipal or religious organizations or legally registered nonprofit corporations are exempt unless their corporation wants to cover them.

Executive officers with at least a 10% ownership share are exempt from workers’ comp coverage.

Although the above individuals can opt out of their firm’s workers’ comp plan, they must still maintain coverage for all of their employees, as well as for any family members or friends who work with them (subject to the exceptions listed earlier).

Even if you qualify for an exemption, it's always a good idea to carry this coverage, as it can protect you from unexpected medical bills and provide part of the wages you'd lose while recovering from a work injury.

Nearly all workers in the state of Alaska must be covered under a workers’ compensation insurance policy.

What does workers' comp cover for Alaska businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- A retail store employee slips on a wet floor and hits their head. In this instance, workers' compensation would cover their emergency room visit, MRI of their head, and any following medical expenses during their recovery.

- A wholesale stocker develops a back injury from many years of lifting and moving heavy stock onto pallets and trucks. Workers' comp covers their medical provider appointment and pain medication, as well as any retraining.

- A nurse trips on a cord in their patient's room and breaks their wrist. Workers' comp covers the cost of the ER visit, surgery, medications, and then two months of physical therapy to help them recover.

- A barista burns their hand while preparing a hot beverage for a customer. Workers' comp covers their doctor's appointment and pain medication, as well as provides disability benefits to replace part of the wages they miss while they're recovering.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers' compensation insurance cost in Alaska?

The average cost of workers’ compensation in Alaska is $34 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as Juneau or Anchorage

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

How do you buy workers' compensation insurance in Alaska?

Employers in Alaska have several options when it comes to buying workers' compensation insurance:

- You can purchase workers’ comp from an authorized commercial insurance company. Insureon provides an easy online application to compare quotes from top insurance carriers and licensed agents with expertise in insurance for Alaska businesses.

- Larger businesses can opt for self-insurance. Employers must have at least 100 employees or $10 million in assets to qualify for self-insurance, as well as provide a deposit of $600,000 or 125% of the total accrued workers' compensation liability, whichever is greater, according to the Alaska Department of Labor and Workforce Development Workers' Compensation Division.

- You can buy insurance through an assigned risk plan. Alaska offers businesses the option to get workers' comp coverage with the NCCI's Workers' Compensation Insurance Plan (WCIP) program if unable to acquire insurance from a private company.

Verified workers' compensation insurance reviews

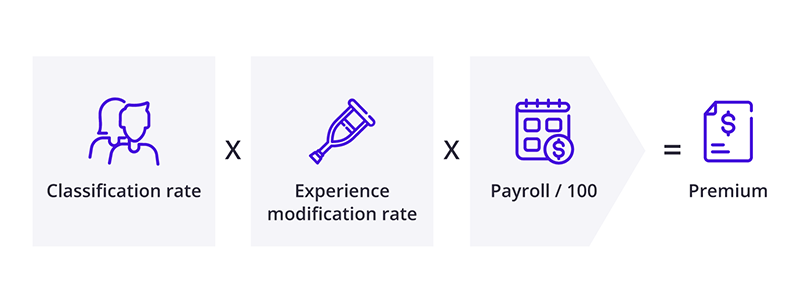

Insurance providers use a specific formula for calculating workers' comp premiums: Classification rate x Experience modification rate x (Annual payroll / $100).

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, tree trimmers, and others with a higher rate of injuries. Most states, including Alaska, rely on the National Council on Compensation Insurance (NCCI).

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rating is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to come up with your workers' comp premium. Your insurance company will perform an insurance audit annually to adjust your policy and premium accordingly.

How can Alaska business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure. This also helps you avoid misclassification fines.

In some cases, small business owners can choose to buy pay-as-you-go workers' compensation. This type of workers' comp policy has a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll. It's useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, though not encouraged for businesses to use in Alaska. A ghost policy is a workers' comp policy in name only. It provides no protection, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers’ comp work in Alaska?

Workers' compensation insurance pays for medical treatment and part of the employee's wages after a job-related injury or illness.

Workers' compensation benefits in Alaska include:

- Temporary total disability benefits

- Temporary partial disability benefits

- Permanent total impairment benefits

- Permanent partial impairment benefits

- Reemployment benefits

- Death benefits for fatal incidents

Policies usually include employer's liability insurance, which can help cover legal expenses if an employee blames their employer for an injury. However, the exclusive remedy provision in most workers' comp policies prohibits an employee from suing their employer if they accept workers' comp benefits.

What are the penalties for not having workers’ comp insurance in Alaska?

Employers in Alaska who fail to maintain workers’ compensation insurance for their employees will be subject to a variety of civil penalties from the Alaska Workers' Compensation Board, including:

- Penalties of up to $1,000 per employee, per day in which they fail to provide workers’ comp coverage

- Being shut down by the state (stop-work order)

- Having to pay $1,000 in additional penalties for each day they violate a stop-work order

- Being barred from pursuing job contracts with the state of Alaska

- Being liable personally to pay benefits for sick or injured workers who should have had workers’ comp coverage at the time of their workplace injury or illness

- Possible criminal fines of $10,000 and one year in prison

Workers’ compensation death benefits in Alaska

The families of Alaska employees who died after sustaining a work-related injury or illness are entitled to receive a death benefit of $10,000 for funeral expenses and $5,000 for the employee’s surviving spouse and / or children.

In addition, workers’ comp insurance must pay weekly benefits to dependents. The total benefit must equal the deceased employee’s compensation rate for total disability. Widows, widowers, and children are considered to be dependents.

Children living in the worker's household or who had been supported by a deceased worker, regardless of parentage, are also handled as dependents. Unmarried dependent children are eligible to receive benefits until age 19 or older while attending high school or while in their first four years of trade, technical, or college education.

If there is no widow, widower, or child, then parents, grandchildren, or brothers and sisters who depended on the deceased worker become eligible for benefits.

All questions of dependency are determined at the time of injury or death.

Workers’ comp settlements in Alaska

A workers’ comp settlement, also known as a “compromise and release,” resolves a disputed workers’ comp claim. In exchange for an agreed-upon sum, employees agree to give up some or all of their claimed benefits.

In Alaska, lump-sum payments of permanent total disability benefits, which the state’s workers’ compensation board has granted, are not permissible unless the employee establishes that it is in their best interest.

If the state approves a settlement, employees can also consider receiving their payment in the form of a structured settlement. This involves splitting the payment into a series of installments over time.

Alaska law presumes that waiving future vocational rehabilitation or medical care benefits to which a worker is entitled is not in the person’s best interest. However, the state will allow waivers of future rehab or medical benefits if an employee shows it’s in their best interest.

Workers’ compensation statute of limitations in Alaska

The maximum time allowed for filing a workers’ comp claim other than those relating to occupational disease is four years from the date of injury.

Get free workers’ comp quotes with Insureon

If you're ready to buy a workers' compensation policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy