Workers’ compensation insurance for nonprofit organizations

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers’ comp protects employees at your nonprofit

From a dog bite at an animal shelter to a slip-and-fall injury at a community center, your employees might be vulnerable to serious risks. An injury could lead to major medical bills, starting with the cost of a trip to the emergency room.

Workers’ compensation insurance can cover an injured worker’s medical expenses, as well as part of the wages they might lose while recovering.

Workers’ compensation can help cover an injured employee’s:

- Immediate medical costs, such as an ambulance ride

- Ongoing medical costs, such as physical therapy

- Partial lost wages while the employee is unable to work

Workers’ comp protects nonprofit business owners

Usually included in a workers’ comp policy, employer’s liability insurance offers protection when an employee decides to sue the business owner over an injury. For example, a worker at a community center could file a lawsuit if unsafe shelving collapsed and caused an injury.

Employer’s liability insurance can help pay for:

- Attorney’s fees

- Court costs

- Settlements or judgments

If not properly insured, your business could end up paying exorbitant legal fees, even if the lawsuit is found to be frivolous.

How is workers' comp cost calculated for nonprofits?

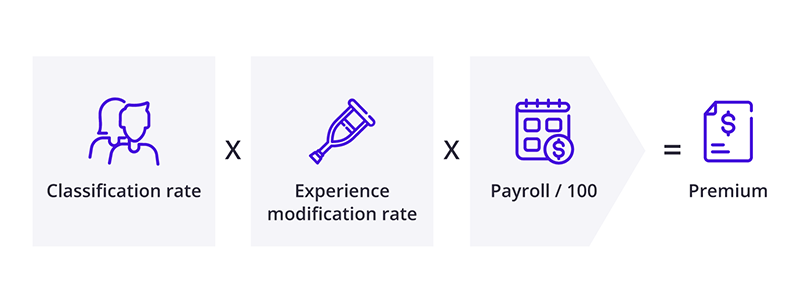

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers’ comp requirements for nonprofits

Each state creates its own laws for workers’ compensation requirements. For example, every nonprofit in Pennsylvania must carry workers’ compensation insurance for its employees – even part-time workers. However, Alabama nonprofits are only required to carry workers’ compensation when they have five or more employees.

Your state will also set rules on whether volunteers must be covered by workers’ compensation.

While independent contractors, sole proprietors, and partners don’t have to carry workers’ compensation insurance, they can purchase policies, too. It's a good idea to carry this coverage for financial protection against work injuries, which health insurance might not cover.

Monopolistic state funds for workers’ compensation

In certain states, nonprofits must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Workers' compensation laws in your state

Lower workers’ comp costs with risk management

Nonprofits can take on serious workplace risks. Each time a claim is filed on your policy, your rate might go up. To create a safe work environment, you could:

- Provide gloves and other protective gear to employees

- Fix uneven steps leading into your building

- Eliminate clutter and tripping hazards

By managing your nonprofit’s risks, you can decrease injuries during tours, fundraisers, and everyday operations. That means fewer claims – and a lower insurance premium.

How much does workers' comp cost for nonprofits?

Most nonprofits pay a median of $80 per month for workers' comp, but you could pay more or less depending on your risks.

Insurance costs for nonprofit businesses are based on a few factors, including:

- Nonprofit services offered, such as counseling or pet adoption

- Business equipment and property

- Revenue

- Location

- Number of employees

Other important policies for nonprofits

Workers’ compensation insurance shields your staff and to some extent your business, but it doesn’t cover common risks such as property damage and visitor injuries. Other recommended nonprofit business insurance policies include:

General liability insurance: This policy can pay for expenses related to customer property damage and injuries, such as a client stumbling at a counseling center and suffering an injury.

Business owner's policy: A BOP bundles general liability insurance with commercial property insurance, often at a lower rate than if the policies were purchased separately.

Professional liability insurance: Also known as errors and omissions insurance, this policy can help cover legal expenses related to errors and negligence, such as an animal shelter that adopts out an animal that was known to bite.

Directors and officers insurance: D&O insurance for nonprofits protects board members and officers against legal expenses if they are sued for misappropriation of funds or another decision that led to financial loss.

Employment practices liability insurance: If a nonprofit is sued by an employee over harassment, discrimination, or another violation of employee rights, EPLI can pay for legal costs.

Get free quotes and buy online with Insureon

Are you ready to safeguard your nonprofit with workers' compensation or another policy? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage in less than 24 hours.