How much does insurance cost for nonprofit organizations?

Several factors contribute to the cost of nonprofit business insurance, such as property size and number of staff. Cost estimates are sourced from policies purchased by Insureon customers.

General liability insurance costs for nonprofits

Nonprofit organizations pay a median premium of about $45 per month, or $500 per year, for general liability insurance. This policy provides financial protection for third-party bodily injuries and property damage, along with advertising injuries.

Insureon’s licensed agents typically recommend a business owner’s policy (BOP) over a standalone general liability policy. A BOP combines general liability insurance with commercial property insurance at a discount to protect your church, community center, or other nonprofit facility.

Professional liability insurance can also be purchased as an add-on to general liability insurance or a BOP.

The cost of general liability depends on your industry risks

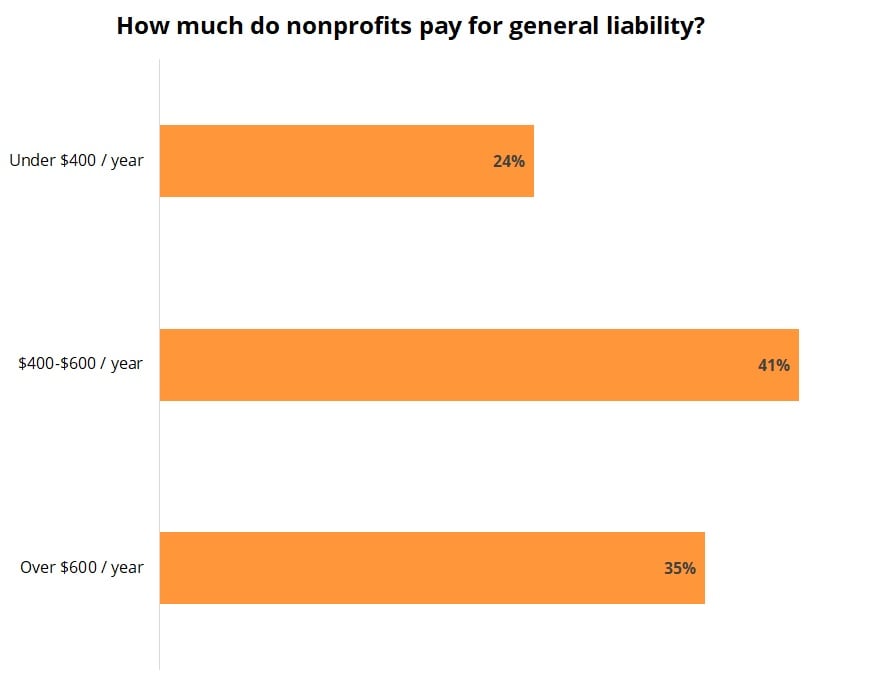

Among nonprofit organizations that purchase general liability with Insureon, 24% pay less than $400 per year and another 41% pay between $400 and $600 per year. The cost depends on the size of your nonprofit and your industry’s level of risk.

Common general liability policy limits for nonprofits

Policy limits determine how much your insurer will pay on covered claims. A per-occurrence limit is the maximum your insurer will pay for a single incident, while an aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year.

Most nonprofit organizations (96%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's general liability insurance cost analysis page.

Business owner’s policy costs for nonprofits

Nonprofits pay a median premium of less than $70 per month, or $810 per year, for a business owner’s policy. This policy combines general liability insurance with commercial property insurance, typically at a lower rate than if the policies were purchased separately.

The cost depends on several factors. Charitable organizations pay a median premium of $669 annually for a BOP, while churches pay a median of $889 and community centers pay a median of $1,088.

A BOP provides financial protection against third-party injuries and property damage, along with damage to your own business property. Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s licensed agents.

You can also add professional liability insurance to a BOP for increased savings and more complete coverage.

The cost of a BOP depends on your business property value

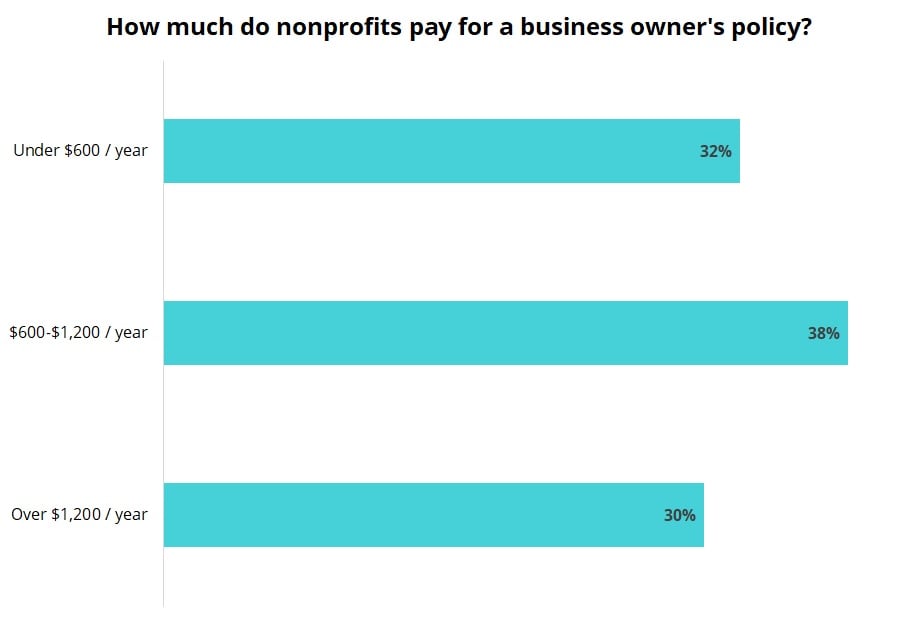

Among nonprofit organizations that purchase a business owner’s policy with Insureon, 32% pay less than $600 per year and another 38% pay between $600 and $1,200 per year.

The cost of a BOP is driven by the amount of property coverage included.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's business owner's policy cost analysis page.

Professional liability insurance costs for nonprofit organizations

Charitable organizations, churches, and other nonprofits pay a median premium of less than $50 per month, or $575 per year, for professional liability insurance.

This policy offers critical coverage for nonprofits, and can help pay for legal fees related to accusations of mistakes or negligence. It's also called errors and omissions insurance (E&O).

It’s common for nonprofits to add this policy to their general liability policy or BOP for additional savings and coverage.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's professional liability insurance cost analysis page.

Directors and officers insurance costs for nonprofits organizations

The median premium for directors and officers insurance (D&O) for nonprofit organizations is about $70 per month, or $855 annually.

This policy can protect your nonprofit’s directors and officers from legal costs related to mismanagement of funds, failure to comply with regulations, or failure to perform official duties.

Directors and officers policy limits for nonprofit organizations

Most nonprofit organizations choose a D&O policy with a $1 million limit.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's directors and officers insurance cost analysis page.

Workers’ compensation insurance costs for nonprofit organizations

The median premium for workers’ compensation insurance is about $80 per month, or $980 per year for nonprofits. This policy helps cover medical bills and partial lost wages when an employee suffers a work-related injury or illness.

Nonprofits with employees typically must purchase this coverage to fulfill state requirements and avoid penalties. Sole proprietors should also consider buying workers' comp, as health insurance providers can deny claims for work-related injuries.

The cost of workers’ comp depends on the size of your workforce

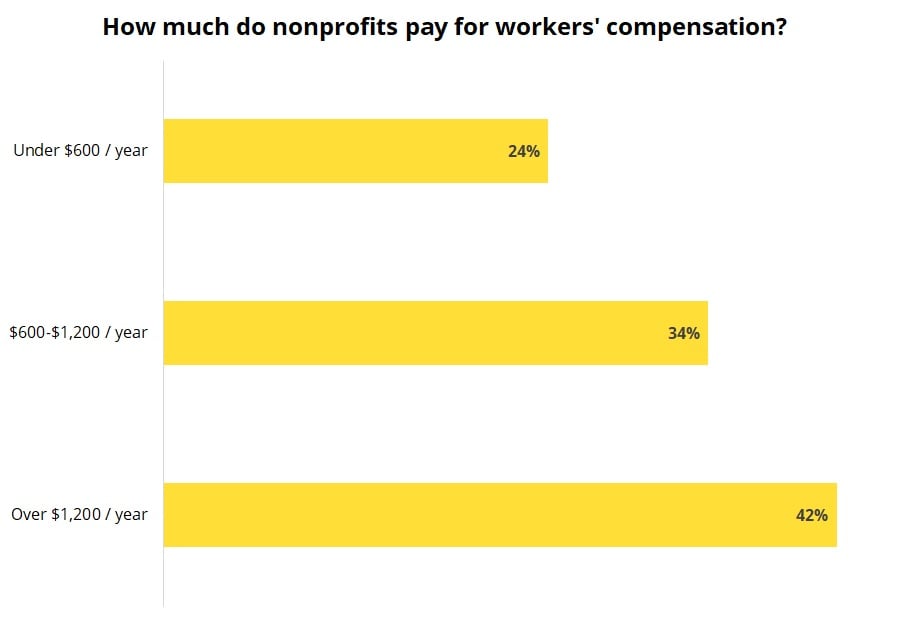

Among nonprofit organizations that purchase workers’ compensation insurance with Insureon, 24% pay less than $600 per year and another 34% pay between $600 and $1,200 per year.

The cost increases with the number of employees who work for your nonprofit and their occupational risk, among other factors.

Learn how workers' comp premiums are calculated and more on Insureon's workers' compensation insurance cost analysis page.

Compare quotes from trusted carriers with Insureon

Insureon’s nonprofit business insurance agents work with top-rated U.S. carriers to find affordable coverage that fits your organization. Apply today to compare multiple quotes with one free online application. Work with an account manager specializing in the unique risks of nonprofit organizations.