Cheap workers' compensation insurance

There are several ways your small business can save money on workers' compensation insurance, including correctly classifying your employees, managing workplace risks, and more. Learn how you can pay less for workers’ comp and still protect your business.

How can I find cheap workers' comp insurance?

Workers’ compensation insurance protects you, your employees, and your business in the event of a workplace injury or illness. Required in most states, workers’ comp covers medical expenses and lost wages for employees who are injured or get ill on the job.

Starting at $20 per month, a workers' compensation insurance policy can be affordable for small businesses.

There are many ways for you to keep costs low and avoid more expensive rates. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from trusted carriers.

In addition, correctly classifying your employees, choosing pay-as-you-go or lower premium plans, and managing your risks to avoid insurance claims can also help you pay less.

Table of contents

- Compare workers' comp quotes

- Classify your employees correctly

- How much does workers' comp insurance cost?

- Choose a pay-as-you-go plan

- Qualify for a lower premium policy

- Manage workplace risks

- State laws for workers' compensation

- Cheapest states to buy workers' comp

- Cheapest industries to purchase workers' comp

- Get affordable insurance with Insureon

- Additional coverages to consider

Compare workers' comp insurance quotes

Insurance companies can offer different coverage options with a wide range of prices. And while you could reach out to each insurance provider directly to ask for quotes on their workers' compensation insurance policies, there’s an easier, faster way.

You can work with a digital insurance agency—like Insureon—to get workers' comp quotes from top-rated providers, such as The Hartford and Chubb, with a single online application.

Insureon's licensed insurance agents are available to help you customize a policy for your business's unique needs, making sure you meet state laws and your industry's requirements.

Plus, an experienced agent can help you set appropriate limits, recommend endorsements that match your risks, and let you know which add-ons you can safely skip. Without expert help, you might not know if the policy provides too much coverage, or not enough.

Once you select the workers' compensation policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

Ensure your employees are classified correctly

The National Council on Compensation Insurance (NCCI) is an organization that gathers data and helps establish workers’ comp insurance rates based on the type of work you and your employees perform.

The Council utilizes more than 700 workers’ compensation class codes to denote the amount of risk and hazard each job might entail, assign a value based on these conditions, and help insurance providers determine the cost of workers’ comp policies.

It’s important for business owners to audit their workers’ comp classifications as new employees are hired, current employees are promoted, business duties are reassigned, or employees leave the company.

Whether intentional or accidental, misclassifying one of your workers could lead to overpaying for your insurance policy, or underpaying. This could lead to hefty fines and penalties, and an outstanding balance owed to the insurance provider after the premium recalculation.

By ensuring each worker is properly classified as either a contractor or an employee (full- or part-time), and listed under the appropriate class code, you can save money and avoid potential legal action.

How much does workers' compensation insurance cost?

The average cost of workers' compensation insurance for Insureon's customers is $45 per month.

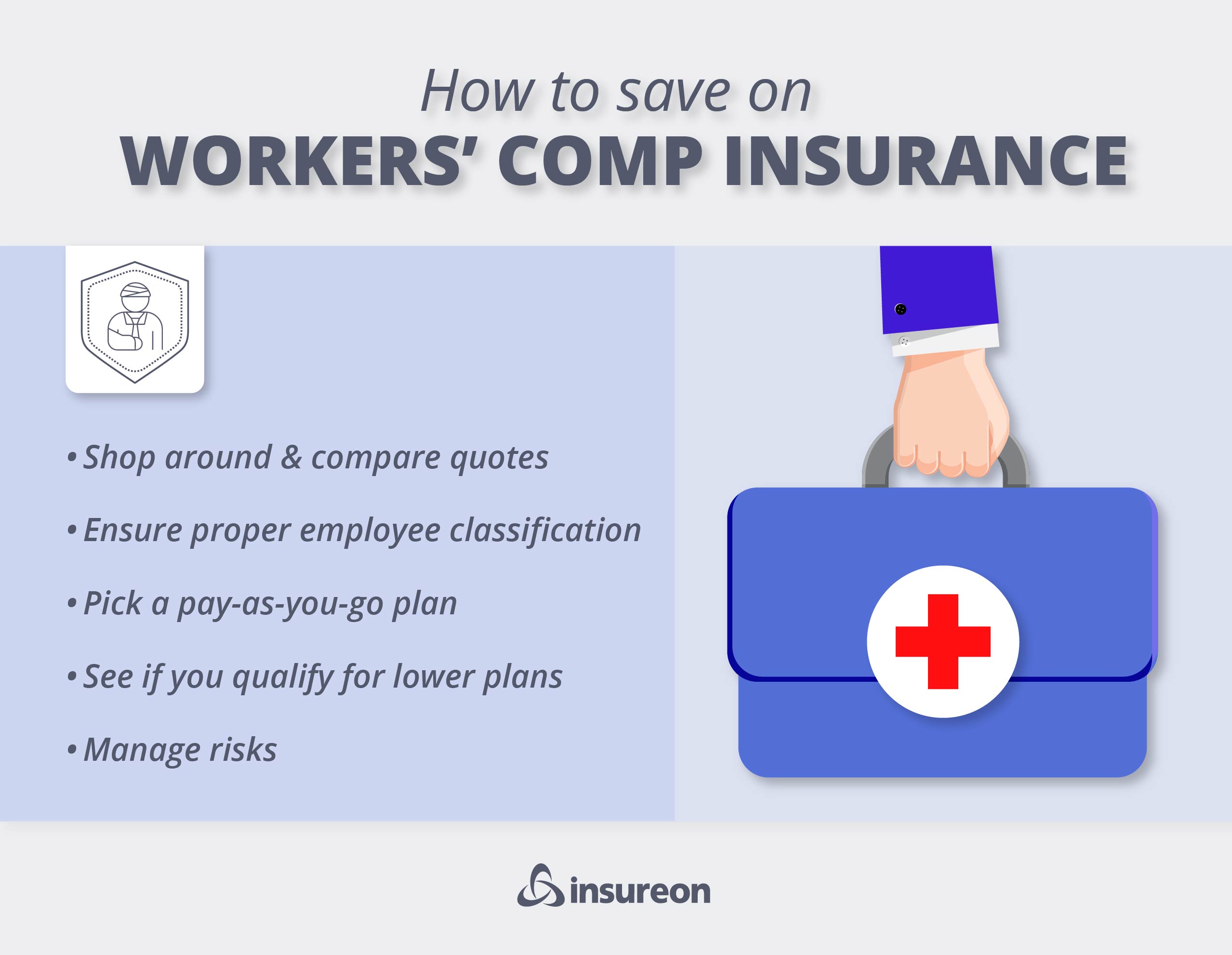

Workers' compensation insurance premiums are calculated based on several factors, including:

- Payroll

- Location

- Number of employees, contractors and subcontractors

- Industry and risk factors

- Coverage limits

- Claims history

Verified workers' compensation insurance reviews

Choose a pay-as-you-go workers' comp plan

Pay-as-you-go workers’ compensation insurance offers flexible premiums that change throughout the year. These premiums rely on any changes to your number of employees, as well as your payroll data over the course of one year.

This is a great option for small business owners looking to pay less for workers’ comp, since the initial down payment is likely to be more affordable than a traditional plan.

What's more, it’ll reduce the guesswork in estimating your insurance costs. Every time you run payroll, you’ll know exactly how it affects your insurance rates.

Find cheap workers' compensation insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

There are a few types of lower premium policies, including:

- Minimum premium workers' comp policy

- Workers' comp ghost policy

- Occupational accident insurance (OAI)

A minimum premium policy and a ghost policy fulfill the obligation to carry a workers’ compensation policy. However, a ghost policy provides zero workers’ comp coverage, and the availability of these policies is dependent on the state your business operates in.

OAI is a voluntary coverage that provides benefits similar to workers' compensation.

A minimum premium policy is the lowest premium an insurance company will sell a policy for, regardless of your payroll or amount of coverage.

For small business owners, this could mean your premiums would be the same if you expanded from one to two employees.

Workers' compensation ghost policy

A ghost policy is ideal for self-employed business owners or sole proprietors with no employees who need to show proof of workers’ compensation insurance coverage to either win a new contract or satisfy a state requirement.

This type of policy covers no one and provides no healthcare benefits. It only offers a certificate of insurance (COI).

Occupational accident insurance

Occupational accident insurance isn't a type of workers' comp, though it provides many of the same benefits. This voluntary policy is often purchased by freelancers and contractors, especially truckers and motor carriers.

As with workers' comp, it can cover medical bills and disability benefits in the event of a workplace injury. Because it doesn't provide the same level of coverage as workers' comp, it's typically about 30% to 50% cheaper.

Manage workplace risks

In most cases, a safer working environment equates to fewer workers’ compensation claims against your business, as well as a lower insurance premium.

There are several ways you can promote workplace safety and minimize injuries:

- Establish safety procedures and training to reduce workplace accidents

- Provide the proper gear and require adequate footwear

- Post hazard signs and labels

- Maintain tools and equipment and a clean workspace

- Consider ergonomic furniture and equipment

Businesses with good safety records will see this reflected in a low Experience Modification Rating (EMR Rating), which translates into lower rates for their workers’ compensation coverage.

An EMR is one way for insurance carriers to adjust their premiums, based on the expected losses from workers’ comp claims for each company they insure.

The average EMR is 1.0, which means a business is no more or less risky than similar businesses in their profession. A higher rating would mean a riskier business and higher premium, while a lower rating would mean a less risky business and lower premium.

How do state laws impact workers' compensation insurance requirements?

Since workers’ compensation is regulated on the state level, each state has its own requirements and penalties.

Workers' compensation insurance is required in nearly every state, and some states require employers to buy workers’ compensation insurance through a state insurance fund.

These states require all workers’ comp policies be purchased through a state fund:

However, there are a few exceptions. In some cases, specific types of workers and business structures, such as independent contractors and limited liability companies (LLCs), are exempt from carrying workers’ comp insurance.

Also, South Dakota and Texas are different than most other states because workers’ compensation insurance isn’t generally mandated. Employers without this coverage usually must notify the state and their employees.

Even though your business might be able to save money by not buying workers’ compensation, it’s usually a good investment. Private health insurance won’t cover any work-related injuries or illnesses, which could leave you on the hook for expensive medical bills.

It's important to note that some states mandate workers' comp insurance based on your profession. For example, Florida workers' compensation law states that even self-employed workers in the construction business must have workers' compensation insurance.

Most policies include employer’s liability insurance, which protects your business against lawsuits from injured workers.

Workers' compensation laws in your state

Cheapest states to buy workers' compensation insurance

| State | Workers' comp insurance cost |

|---|---|

$32 per month | |

$32 per month | |

$33 per month | |

$34 per month | |

$38 per month | |

$42 per month | |

$43 per month | |

$44 per month | |

$45 per month | |

$45 per month |

Cheapest industries to purchase workers' compensation insurance

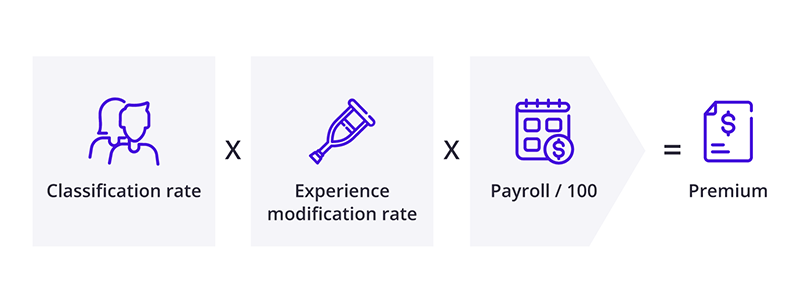

In addition to your location, your industry can affect how much you pay for workers' comp insurance. Generally speaking, industries that have a higher risk of employee injury or illness can expect to pay a higher premium.

For example, an electrician who handles dangerous electrical wiring on a daily basis will likely pay more for their workers' compensation coverage than a tax preparer who works on their laptop from a home office.

Among Insureon customers, industries such as finance and accounting, IT / technology, and insurance tend to pay less compared to higher risk industries like construction and installation.

Here's a look at workers' comp insurance costs for different types of businesses:

Top professions that need workers' compensation insurance

Get affordable workers' compensation insurance with Insureon

Complete Insureon’s easy online application today to find cheap workers' compensation insurance coverage from top-rated U.S. companies. You can also consult with an insurance agent on your business needs, including how to find affordable general liability and commercial auto insurance.

Once you find the right types of insurance for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours.