Top installation contractors we insure

We also cover construction contractors.

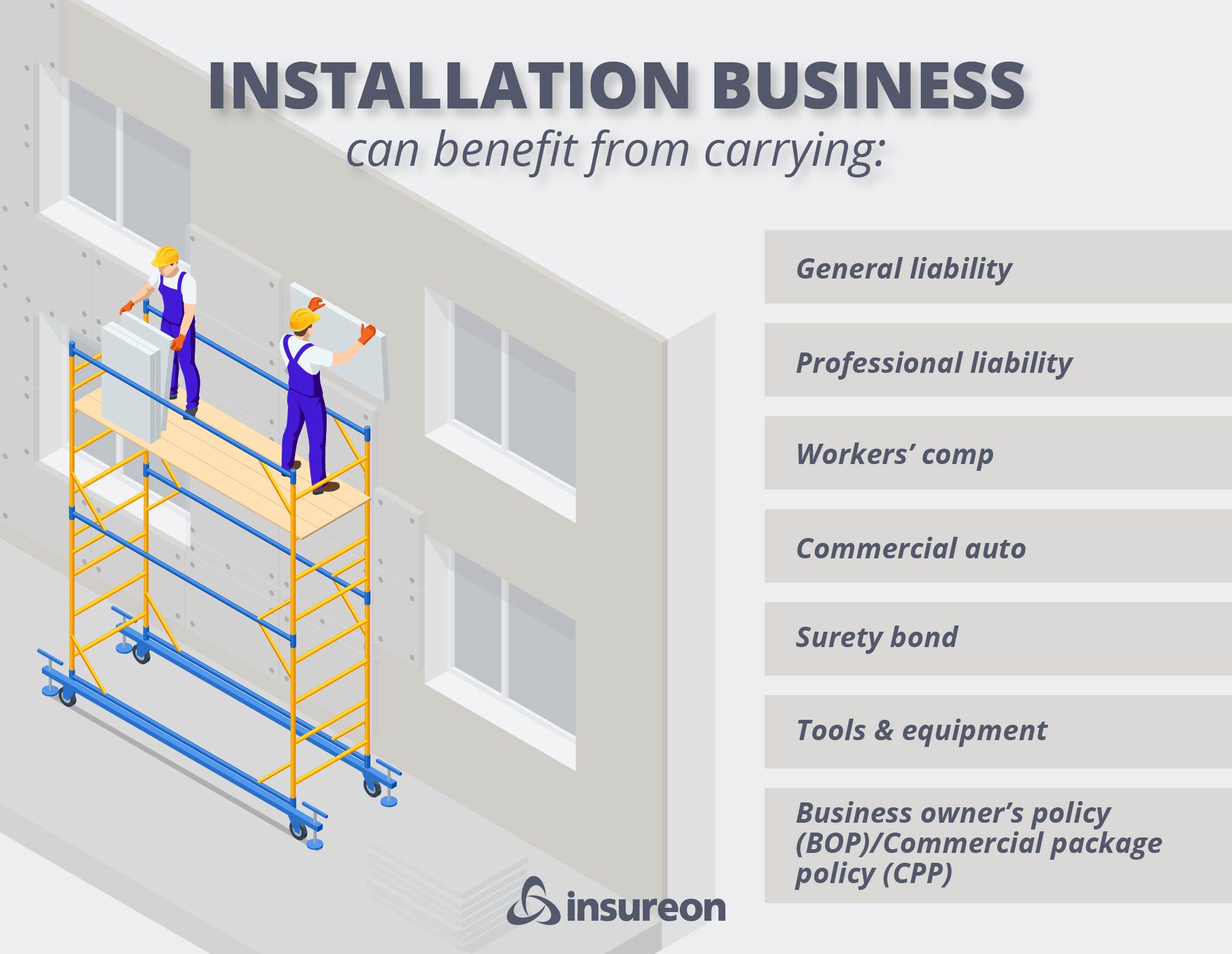

Recommended insurance policies for installation professionals

Whether you install ceilings, floors, or anything in between, an accident could lead to a devastating lawsuit. Insureon helps installers secure policies that match your unique risks.

General liability insurance

This policy covers basic installation risks, such as accidental damage to a client’s furniture. Bundle it with commercial property insurance for savings in a business owner’s policy.

- Slip-and-fall accidents

- Damaged customer property

- Product liability insurance

Business owner's policy

A business owner's policy, or BOP, is a cost-effective way for installation professionals to buy general liability coverage and commercial property insurance together.

- Accidental damage to customer property

- Customer injuries

- Business property damage

Workers’ compensation insurance

Most states require workers' comp for installation businesses that have employees. It also protects sole proprietors from work-related medical bills that health insurance might deny.

- Employee medical expenses

- Disability benefits

- Lawsuits from employee injuries

Commercial auto insurance

Commercial auto insurance covers financial losses from an accident involving an installation company's vehicle. It also covers vehicle theft, weather damage, and vandalism.

- Accidents involving a company vehicle

- Theft of a company vehicle

- Vandalism or weather damage to a vehicle

Contractor’s tools and equipment insurance

A type of inland marine insurance, this policy covers repair or replacement of an installation contractor's tools and equipment if they are lost, stolen, or damaged.

- Equipment less than five years old

- Mobile equipment, such as circular saws

- Small tools, such as hammers, wrenches, and trowels

Cyber insurance

Cyber insurance helps cover the cost of data breaches and cyberattacks, such as the cost of notifying affected customers. It's sometimes called cyber liability insurance or cybersecurity insurance.

- Data breach notification costs

- Fraud monitoring services

- Cyber incident investigations

How much does insurance cost for installers?

An installation contractor who works independently can expect to pay less for insurance than a larger business.

Several factors have an impact on installation insurance pricing, including:

- Products installed, such as HVAC systems, appliances, or flooring

- Business equipment and property

- Revenue

- Location

- Number of employees

- Types of insurance purchased

How do I get installation business insurance?

It’s easy to find insurance for your installation business, whether you’re a small business owner, contractor, or subcontractor.

Our application will ask you for your company's annual revenue and payroll, among other details. You can buy a policy online and get a certificate of insurance with Insureon in three easy steps:

- Complete a free online application

- Compare free quotes and choose a policy

- Pay for your policy and download a certificate for proof of insurance

Insureon's licensed insurance agents work with top-rated U.S. providers to find the right insurance coverage for your installation business, whether you specialize in fences, doors and windows, glass, siding, or other products.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Common questions about commercial insurance for installers

What is an installation floater policy?

Commercial property insurance doesn't cover items brought to job sites, which is why you may need installation floater insurance. This policy covers building materials and products while they are being installed by a contractor. It also protects materials in transit or temporary storage off-site.

Installation floater coverage helps pay for repair or replacement if materials are damaged by an incident such as vandalism, a fire, or a storm. This type of inland marine coverage provides crucial protection for installers who work at their clients' homes, offices, and construction sites.

Do I need a license for my installation business?

Whether you need a license or permit depends on the type of work you do, along with the laws in your state. For instance, general contractors may need a license to install drywall or work as a plumber or electrician in certain states.

In order to get a license, you may need to take an exam or have experience in your field. For example, HVAC contractor licenses usually require proof of education or experience, a background check, an application fee, and successful completion of the state licensing exam. They also need to take a test to gain EPA certification to work with air conditioning coolants.

Licensing requirements might also include that your business be bonded and insured, typically with a surety bond and commercial general liability insurance.

What other types of coverage do installers need?

Other types of contractor’s insurance purchased by installers include:

- Professional liability insurance: This policy covers legal costs related to work mistakes and oversights, such as using the wrong materials. It's also called errors and omissions insurance (E&O).

- Builder's risk insurance: A builder's risk policy provides coverage for a building under construction, along with temporary structures and scaffolding. It's sometimes called course of construction insurance.

- Contractors pollution liability insurance (CPL): CPL covers legal costs related to harm caused by pollution from a construction project. You may also see it referred to as environmental insurance.

- Commercial umbrella insurance: Umbrella insurance boosts the coverage on your general liability, commercial auto, and employer's liability insurance once the policy limit is reached.

Keep in mind that you may need endorsements for some specific coverages, such as earthquake and flooding.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy

Read our blog posts

The licensing, insurance, and bonding requirements for HVAC professionals vary by state. Having the right insurance and bonding can help keep you financially protected and may be required for some...

If a crack forms in the wall of one of your buildings or another issue becomes evident, clients will often look to your construction company for compensation. Learn who can be held liable, and how...