Cheap commercial auto insurance

Commercial auto insurance is required in most states for small businesses that have company-owned vehicles. However, it can get costly depending on your risk factors, such as your driving history. Learn how you can pay less for auto insurance and still get the protection your business needs.

How do I find cheap commercial vehicle insurance?

Commercial auto insurance is a must-have coverage for any small business that owns or operates company vehicles. Whether your business relies on a vehicle like a food truck, requires you to transport equipment to multiple locations like a landscaping business, or has a fleet of tractor trailers, your drivers face risks every time they hit the road.

There are many ways for you to keep commercial auto insurance costs low and avoid more expensive rates. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from trusted carriers.

In addition, knowing your state's liability coverage requirements, choosing cost-saving options on your commercial auto insurance coverage, and managing your risks to avoid insurance claims can also help you pay less.

Table of contents

- Compare auto insurance quotes

- Manage risks and maintain a clean record

- How much does commercial auto insurance cost?

- Know your state's auto insurance requirements

- Customize your auto policy

- What does commercial auto insurance cover?

- What does this policy not cover?

- Cheapest states to purchase auto insurance

- Cheapest industries to buy auto insurance

- Get cheap auto insurance with Insureon

- Additional coverages to consider

Compare commercial auto insurance quotes

Insurance carriers offer different types of coverage options with a wide range of prices. And while you could reach out to each auto insurance company directly to ask for quotes on their business auto insurance policies, there’s an easier, faster way.

You can work with a digital insurance agency—like Insureon—to get commercial auto quotes from top-rated providers, such as The Hartford and Acuity, with a single online application.

Insureon's licensed insurance agents are available to help you customize a policy for your business's unique needs, making sure you comply with state laws and your profession's requirements.

Plus, an experienced agent can help you set appropriate limits and let you know which add-ons you can safely skip. Without expert help, you might not know if the policy provides too much coverage, or not enough.

Once you select the commercial auto insurance policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

Manage your risks and maintain a clean record

Your driving history is one of the biggest factors that impacts your commercial auto insurance premium. Even a tiny infraction can significantly increase your rate. By keeping a clean driving record for you and your employees, your insurance rates can remain at an affordable price.

Beyond an accident-free driving record, maintaining your business cars helps manage the risks you or your employees face when operating the vehicle. Staying on top of the maintenance and service schedules, as well as properly cleaning them, will provide a safer work area for vehicle operators.

Additionally, make sure to share tips for safe driving with your employees, such as avoiding calls and texts while on the road.

How much does commercial auto insurance cost?

The average cost of commercial auto insurance for Insureon's customers is $147 per month.

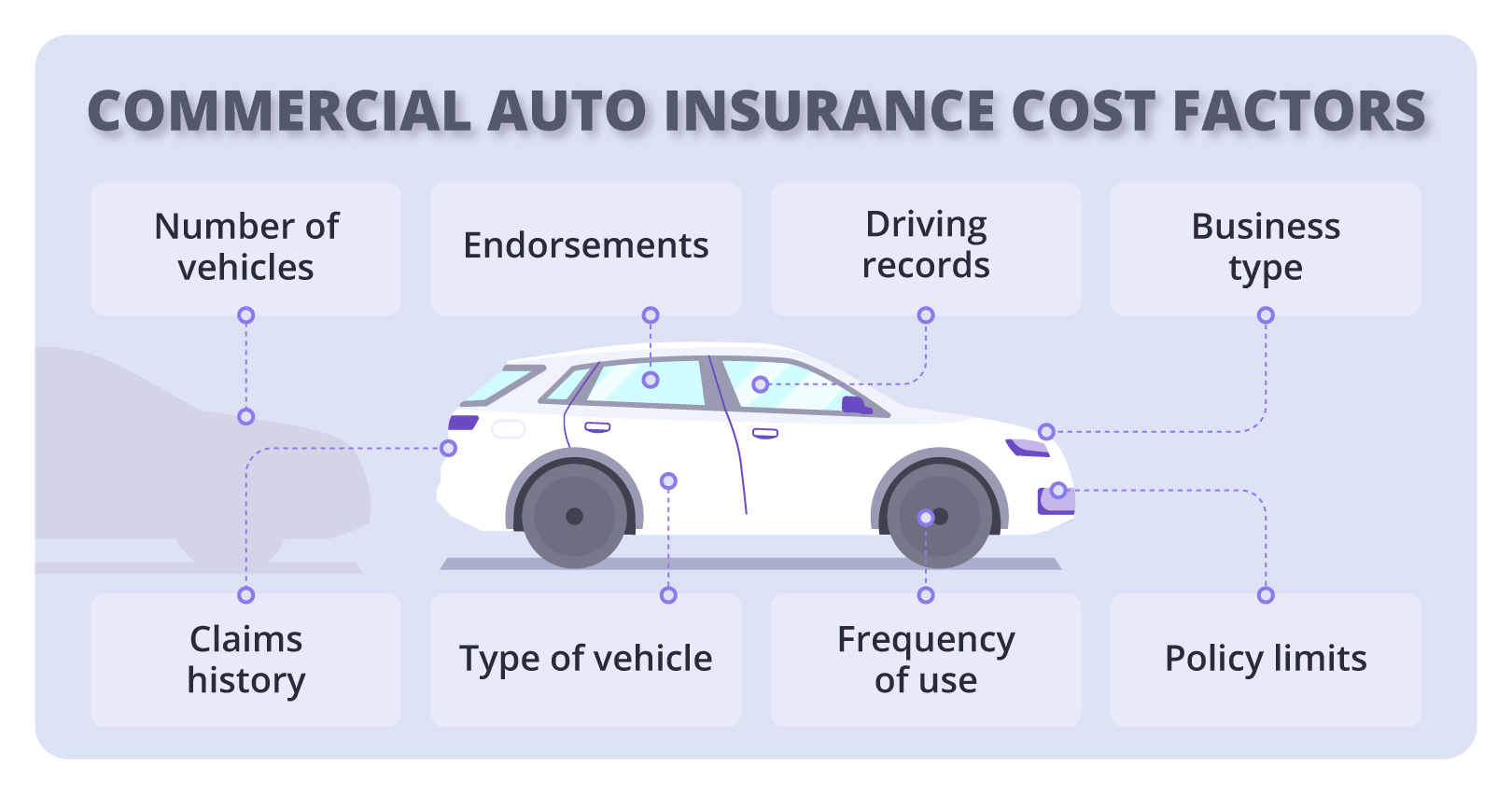

Commercial auto insurance premiums are calculated based on several factors, including:

- Number of vehicles

- Type of vehicles (SUVs, pickup trucks, etc.)

- Business use

- Level of risk involved

- Claims history

- Employee driving records

- Deductible and coverage limits

- Coverage options (e.g., fleet insurance)

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Know your state's auto insurance requirements

Each state regulates commercial auto insurance differently, so it’s important to know the requirements for your location.

Every state except for New Hampshire requires commercial auto insurance coverage for business vehicles. All states require you to prove your ability to compensate someone if you or an employee is at fault in an accident.

In addition, depending on the state you operate in, personal injury protection (PIP) insurance may be required. This coverage can often be added your commercial auto policy.

In most cases, if you use a personal vehicle for business purposes outside a commute, a personal auto insurance policy won’t cover you in the event of a work-related accident.

Find commercial auto insurance requirements in your state

Customize your auto policy

Another way to save on your commercial auto premium is by choosing less expensive policy options.

Here are a few areas you can adjust to save money:

- Choose lower policy limits. Lower per-occurrence limits and aggregate limits cost less. Keep in mind they also provide less coverage in an accident, since your insurer will cover costs up to your liability limits.

- Choose a higher deductible. Higher deductibles cost less, but make sure it's an amount you can easily afford. If you get into an accident, you'll have to pay the deductible before you can benefit from having insurance.

- Avoid unnecessary policy options. You can save money by opting out of pricier options, such as comprehensive coverage that pays for vehicle damage from any source.

Find cheap commercial auto insurance with Insureon

What does commercial auto insurance cover?

Commercial auto insurance typically provides financial protection from medical payments, property damage costs, or legal fees due to an automobile accident. You can also get coverage for vehicle theft, vandalism, and other damages.

Depending on the options you choose, your policy may cover:

- Auto liability: This helps pay for damages in an accident you caused, including vehicle repair costs and legal expenses if you’re sued over the other driver’s injuries.

- Medical payments coverage: Your policy would pay for medical bills for you and any passengers in your company vehicle, regardless of who caused the accident.

- Physical damage coverage: Collision coverage protects covered vehicles against damage from physical contact with another vehicle or object, such as an animal or fence. And comprehensive coverage insures against damage caused by something other than a collision, like fire or theft.

- Uninsured motorist coverage: This makes sure your business doesn’t have to pay for medical expenses or vehicle repairs from an accident involving an uninsured driver.

What does commercial auto insurance not cover?

Personal, rented, or leased vehicles

Hired and non-owned auto insurance (HNOA) is the appropriate policy for vehicles your business uses but doesn't own. This includes leased, rented, and personal vehicles.

Customer vehicles

If your business stores, transports, or services a customer's motor vehicle, like a towing company or mechanic, it would not be covered under your commercial auto insurance.

In this case, you should consider garage liability insurance to insure customer vehicles while they’re in your care, custody and control.

Delivery or transport services

If you run a courier, delivery, or transport service, you need to make sure you’re financially protected beyond your personal use car insurance, which most likely doesn’t include food delivery or rideshare coverage.

Cheapest states to purchase commercial auto insurance

| State | Commercial auto insurance cost |

|---|---|

$77 per month | |

$101 per month | |

$107 per month | |

$110 per month | |

$113 per month | |

$114 per month | |

$126 per month | |

$128 per month | |

$130 per month | |

$132 per month |

Cheapest industries to buy commercial auto insurance

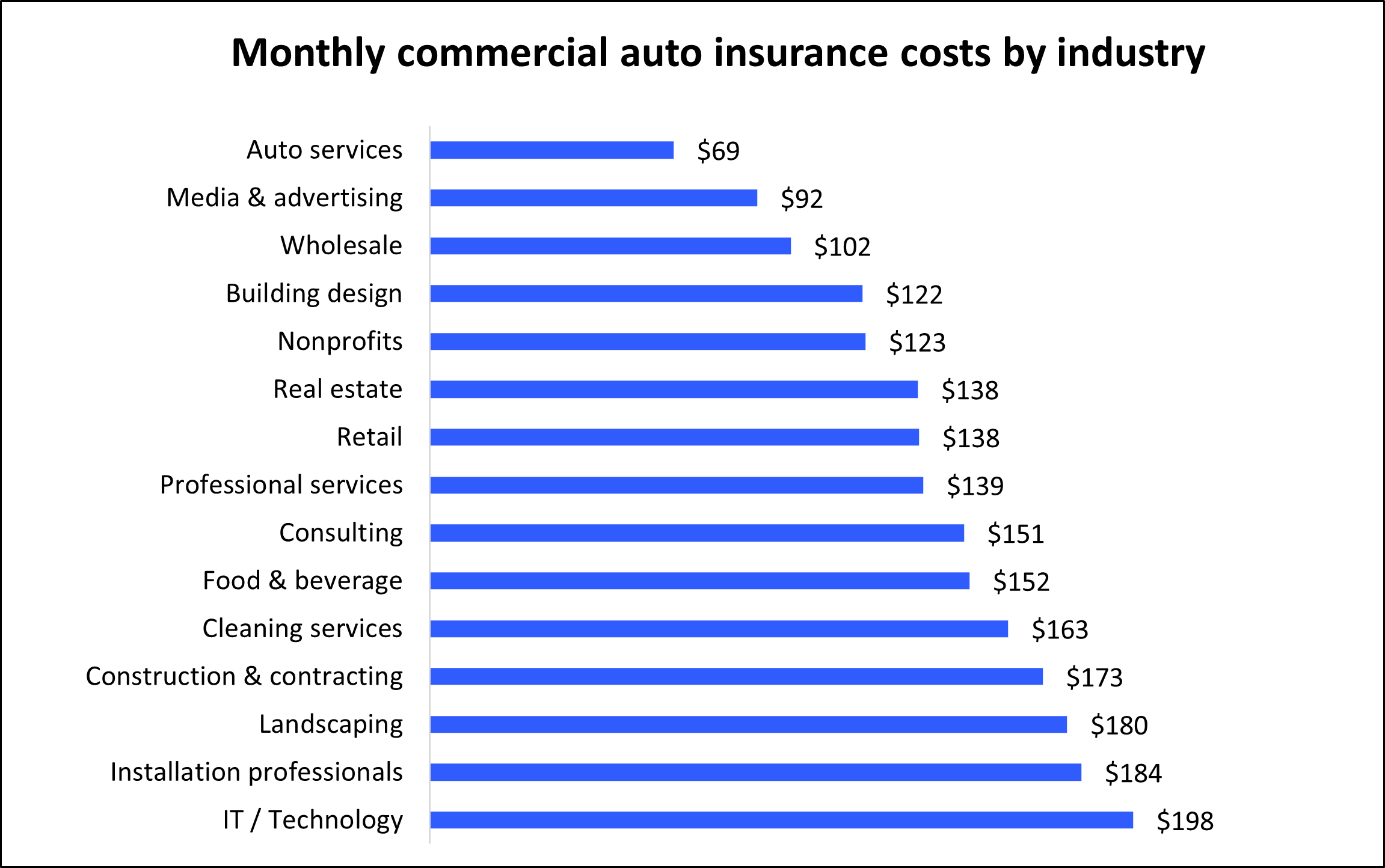

In addition to your location, your industry can affect how much you pay for commercial auto insurance. Generally speaking, industries that use their business vehicles frequently or travel to risky jobsites can expect to pay a higher premium.

For example, an HVAC installer who carries valuable inventory in their truck or a construction company that travels to dangerous work areas will likely pay more for their commercial auto insurance coverage than a graphic designer who works from a home office.

Among Insureon customers, industries such as auto services, media and advertising, and wholesalers tend to pay less compared to more on-the-road industries like landscaping and installation professionals.

Here's a look at commercial auto insurance costs for different types of businesses:

How to get cheap auto insurance with Insureon

Complete Insureon’s easy online application today to find affordable commercial auto insurance coverage from top-rated U.S. companies. You can also consult with an insurance agent on your business insurance needs, including finding affordable workers’ comp and E&O policies.

Once you find the right types of insurance for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours.