How much does insurance cost for media and advertising professionals?

The cost of media and advertising business insurance depends on several factors, including the size of your business and its risks. Cost estimates are sourced from policies purchased by Insureon customers.

Top media and advertising business insurance policies and their costs

Here are the top commercial insurance policies purchased by media and advertising businesses and their average monthly costs:

- General liability insurance: $33 per month

- Business owner's policy (BOP): $56 per month

- Media liability insurance: $78 per month

- Workers' compensation insurance: $43 per month

- Cyber insurance: $108 per month

- Commercial auto insurance: $250 per month

Our figures are sourced from the median cost of small business insurance policies purchased by Insureon customers in the media and advertising industry. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

The cost of business insurance depends on a number of factors, including the types of professional services you offer, your annual revenue, the value of your equipment and property, your location, number of employees, claims history, and policy limits and deductibles.

General liability insurance

Media and advertising businesses pay an average of $33 per month, or $394 per year, for general liability insurance.

A general liability policy helps cover legal fees related to common third-party lawsuits from clients, including those related to customer bodily injury and damage to a client's property.

This is the average general liability policy for media and advertising companies that buy from Insureon:

Insurance premium: $33 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

The cost of general liability insurance depends on several factors, such as the coverage limits you choose, the size of your business, the amount of foot traffic you have, location, and any endorsements you may add, such as an additional insured.

Your industry risks affect general liability costs

General liability insurance costs depend on your risk of a customer lawsuit.

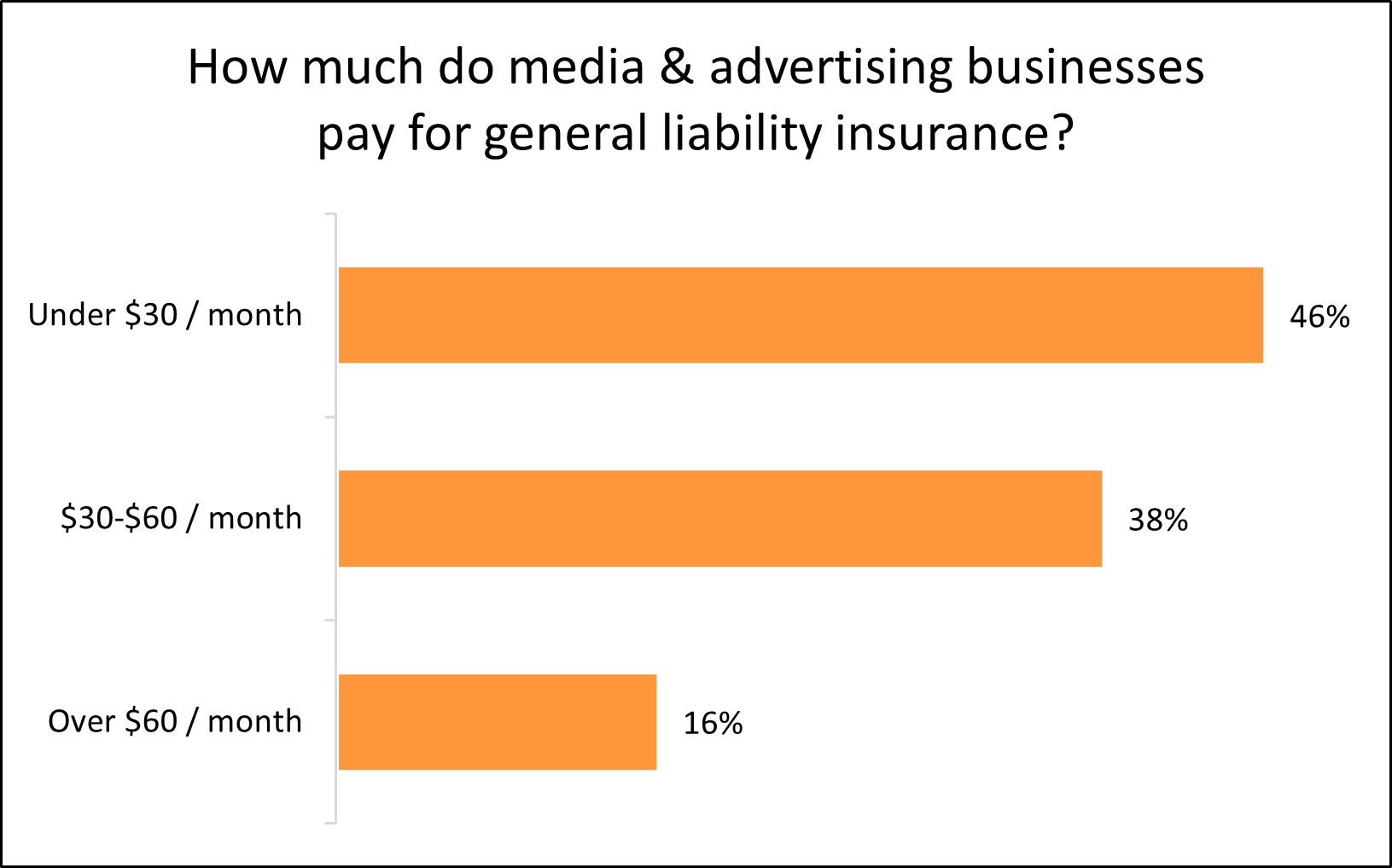

Among media and advertising businesses that purchase general liability insurance with Insureon, 46% pay less than $30 per month and 84% pay less than $60 per month.

Across all media and advertising professions, learn how to find affordable general liability insurance.

Policy limits impact the cost of general liability insurance

Policy limits are the maximum amounts your insurance company will pay for covered claims.

The per-occurrence limit is the most your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year.

Most media and advertising businesses (84%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

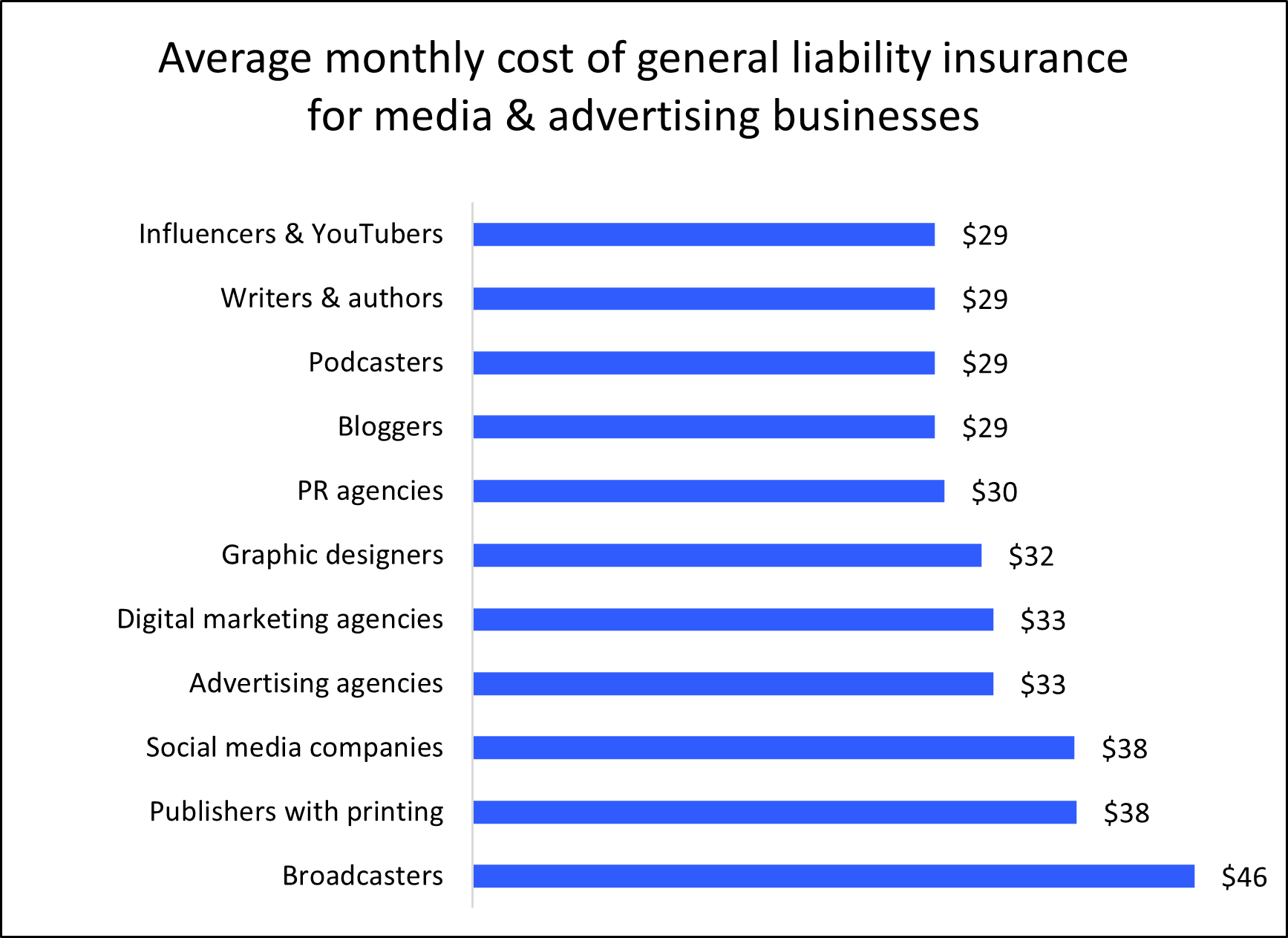

Your business type influences the cost of general liability

Businesses that interact with many customers typically pay more for general liability insurance.

For example, TV and radio broadcasters can expect to pay more for general liability insurance than authors and other lower risk professionals. The average monthly cost for a broadcasting business is $46, while the monthly average for a writer is $29.

As you can see, the cost varies across different media and advertising professions:

Business owner’s policy

Media and advertising professionals pay an average of $56 per month, or $670 per year, for a business owner’s policy.

A business owner's policy, or BOP, bundles general liability coverage with commercial property insurance to cover both third-party risks and your business property. It typically costs less than purchasing each policy separately.

A BOP protects against customer injuries and property damage. It also covers damage to your physical building and media equipment and inventory. Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s agents for small business owners who rent or own an office.

This is the average BOP for media and advertising businesses that buy from Insureon:

Insurance premium: $56 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Small, low-risk media and advertising companies are often eligible for a business owner's policy.

Media small business owners may see higher costs if they choose to add endorsements to their policy. Insurance endorsements, such as business interruption insurance or equipment breakdown coverage, are often recommended to help avoid financial losses if a fire or power outage forces your business operations to cease for an extended period of time.

The cost of a business owner's policy is based on a number of factors, including the value of your property, where you are located, the number of employees you have, and your specialty.

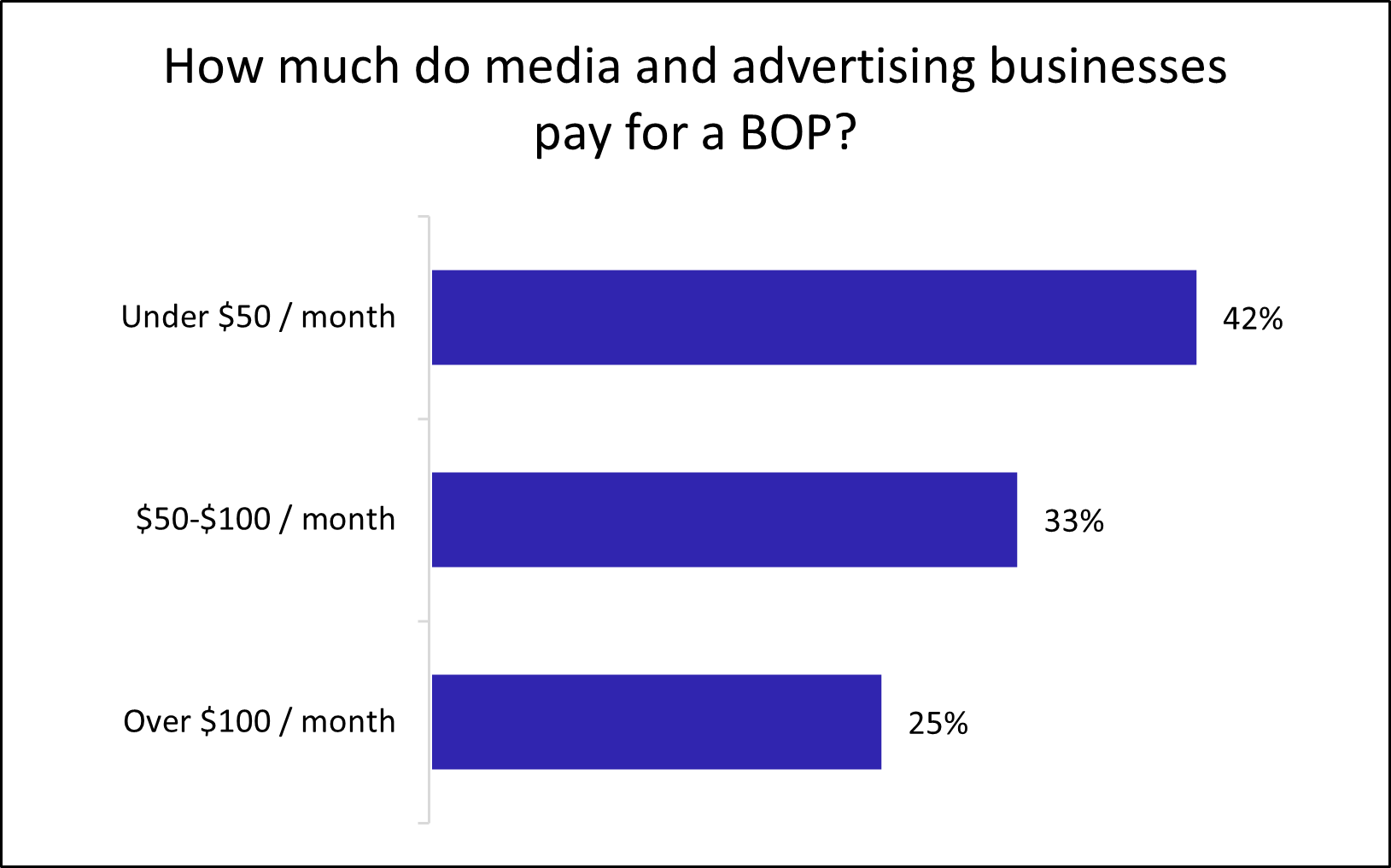

The cost of a BOP depends on your business property

Among media and advertising businesses that purchase a business owner’s policy with Insureon, 42% pay less than $50 per month and 75% pay less than $100 per month.

Businesses with larger or more expensive business property will typically pay more for a BOP than media and advertising businesses with smaller premises or lower value business property. Your industry risk, years in operation, and claims history will also affect your premium.

Media liability insurance

Advertising and media professionals pay an average premium of about $78 per month, or $930 per year, for media liability insurance. This policy is also called professional liability insurance or errors and omissions insurance (E&O).

A media liability insurance policy offers critical coverage for media and advertising companies by paying for legal costs of accusations related to missed deadlines, mistakes and oversights, and breach of contract.

In addition, this policy covers advertising injury, trademark infringement, intellectual property infringement, plagiarism, and copyright infringement claims. For example, if a competitor claims that your content caused them emotional distress due to defamation or invasion of privacy, media liability insurance would cover your legal defense costs and any other fees.

This is the average media liability insurance coverage for media and advertising businesses that buy from Insureon:

Premium: $78 per month

Policy limits: $1 million per occurrence; $1 million aggregate

Deductible: $1,000

The cost of media liability insurance for media and advertising professionals depends on several factors, such as the type of media content you produce, your claims history, and the policy limits you choose.

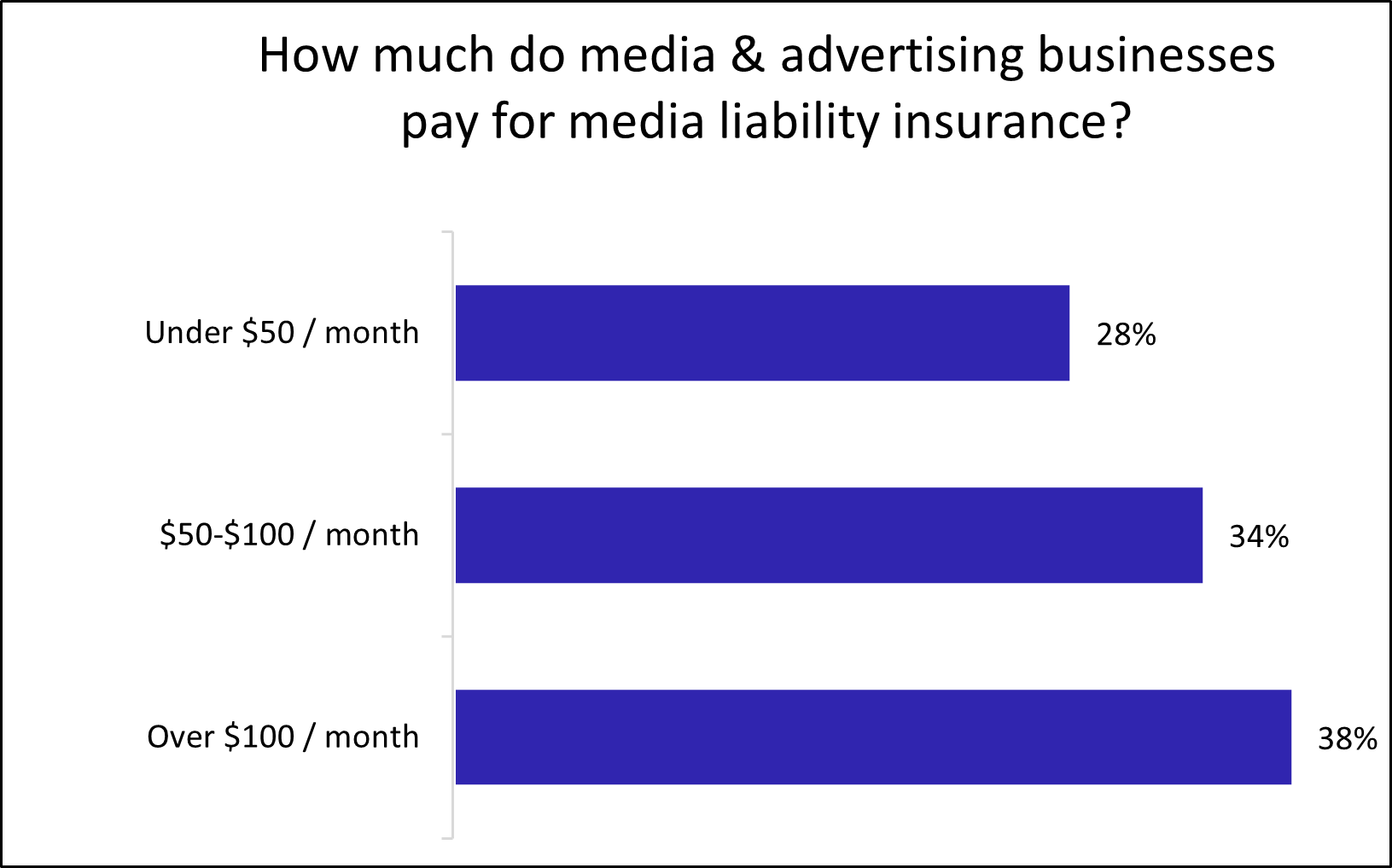

Your level of risk affects the cost of media liability

Among media and advertising businesses that get media liability coverage with Insureon, 28% pay less than $50 per month and 62% pay less than $100 per month.

Media and advertising professionals who have been sued in the past or own a large company may pay more for this insurance coverage. Providers will also look at the type of professional services you offer when determining your premium.

Common media liability limits for media and advertising businesses

Policy limits determine how much your insurer will pay on covered liability claims.

Most media and advertising businesses (70%) choose professional liability policies with a $1 million per-occurrence limit and a $1 million aggregate limit.

As your small business grows, you may need to increase your policy limits for full coverage.

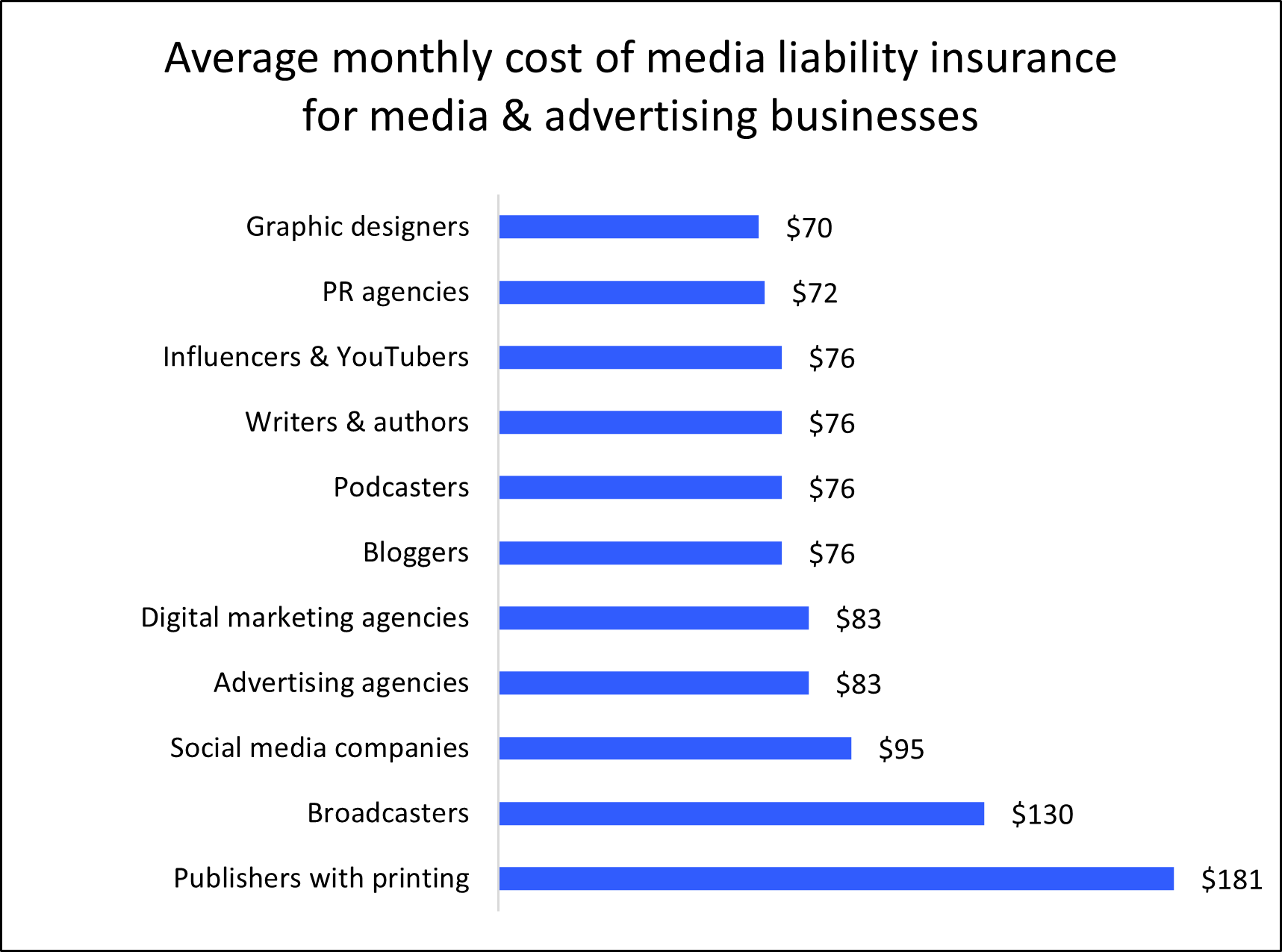

Your industry can affect the cost of media liability insurance

High-risk businesses typically pay more for media liability insurance than low-risk businesses. In industries where a work mistake can have serious financial repercussions for a client, such as publishing or social media, you may find yourself paying more for this policy.

For example, the monthly average media liability premium for a publisher with printing is $181, while the monthly average cost for a graphic designer is $70.

Below, you can see how media liability insurance costs vary significantly depending on your profession:

Workers’ compensation insurance

For media and advertising companies, workers’ compensation insurance costs an average of $43 per month, or $519 per year.

This business insurance coverage helps pay for medical expenses when an employee is injured on the job. It also provides disability benefits while they're recovering and unable to work.

To comply with your state’s requirements and avoid penalties, media and advertising businesses typically must purchase this coverage for their employees. It's also recommended for sole proprietors, as health insurance plans can deny insurance claims for medical bills when an injury or illness is related to your job.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to employee injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' compensation insurance depends on several factors, including the number of employees you have and the level of risk involved with their jobs.

Get more information on how to find affordable workers' compensation coverage.

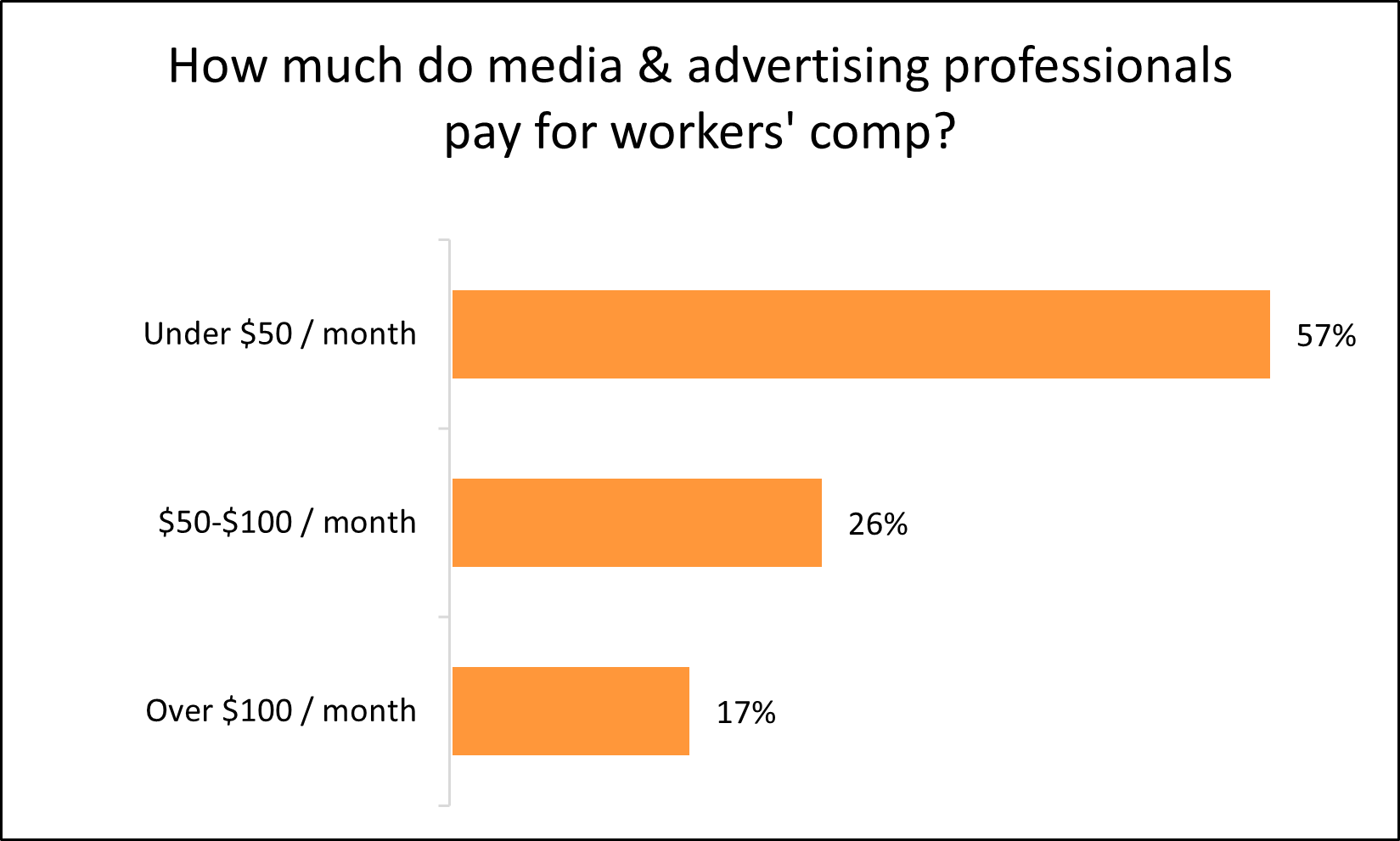

The cost of workers’ compensation insurance depends on the number of employees

Among media and advertising companies that buy workers’ compensation insurance with Insureon, 57% pay less than $50 per month and 83% pay less than $100 per month.

Workers' comp costs depend on the number of employees you have in your small business. A larger workforce brings a higher risk of worker injuries, which is why bigger businesses tend to pay more for this type of insurance.

Cyber insurance

Media and advertising business owners pay an average of $108 per month, or $1,295 annually, for cyber insurance. You might also see this policy called cyber liability insurance or cybersecurity insurance.

Cyber insurance helps media and advertising agencies recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other expenses necessitated by state data breach laws.

The cost of cyber insurance depends on the amount of personal information handled by your media and advertising company, such as customer credit card numbers, along with the number of employees who can access that information.

Commercial auto insurance

Media and advertising professionals pay an average of $250 per month, or $2,996 annually, for commercial auto insurance.

Most states require this coverage for vehicles owned by a media and advertising business. For personal, rented, and leased vehicles used by your business, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto policy provides financial protection in the event of an accident involving your business vehicle. It can help pay for property damage, medical costs, and legal expenses.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, coverage options, the value of the vehicles, the driving records of anyone permitted to drive, and additional insured endorsements you select.

Learn more about how to find affordable commercial auto insurance coverage.

Top media and advertising businesses we insure

Don't see your profession? Don't worry. We insure most businesses.

How do you buy media and advertising business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable insurance coverage for your media and advertising business, whether you work independently as a YouTuber, or own a digital marketing agency with several employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of coverage for your insurance needs. They can also discuss media and advertising insurance requirements, expected liability insurance quotes, and any exclusions in your policies.

Typically, you can get a certificate of insurance within 24 hours after submitting an application, offering instant peace of mind.