A variety of factors can impact the cost of professional liability insurance, including your level of experience and the services you offer.

Professional liability insurance provides crucial coverage against lawsuits

Professional liability insurance (also called errors and omissions or E&O insurance) is an essential policy for businesses that offer professional services or advice.

Because the nature of your work can be subjective, a client could sue you simply because they didn't like the outcome of your completed project. Or they might sue you over a legitimate mistake or oversight on your part that caused them financial losses.

When these unavoidable situations or meritless claims happen, your professional liability policy can spare you the high cost of attorney's fees, court-ordered compensation, and other legal expenses. So how much can you expect to pay for this valuable coverage?

That depends on several factors.

When you apply for an insurance quote, your provider will need to assess how much risk it's taking on by insuring you. This evaluation will determine your professional liability premiums.

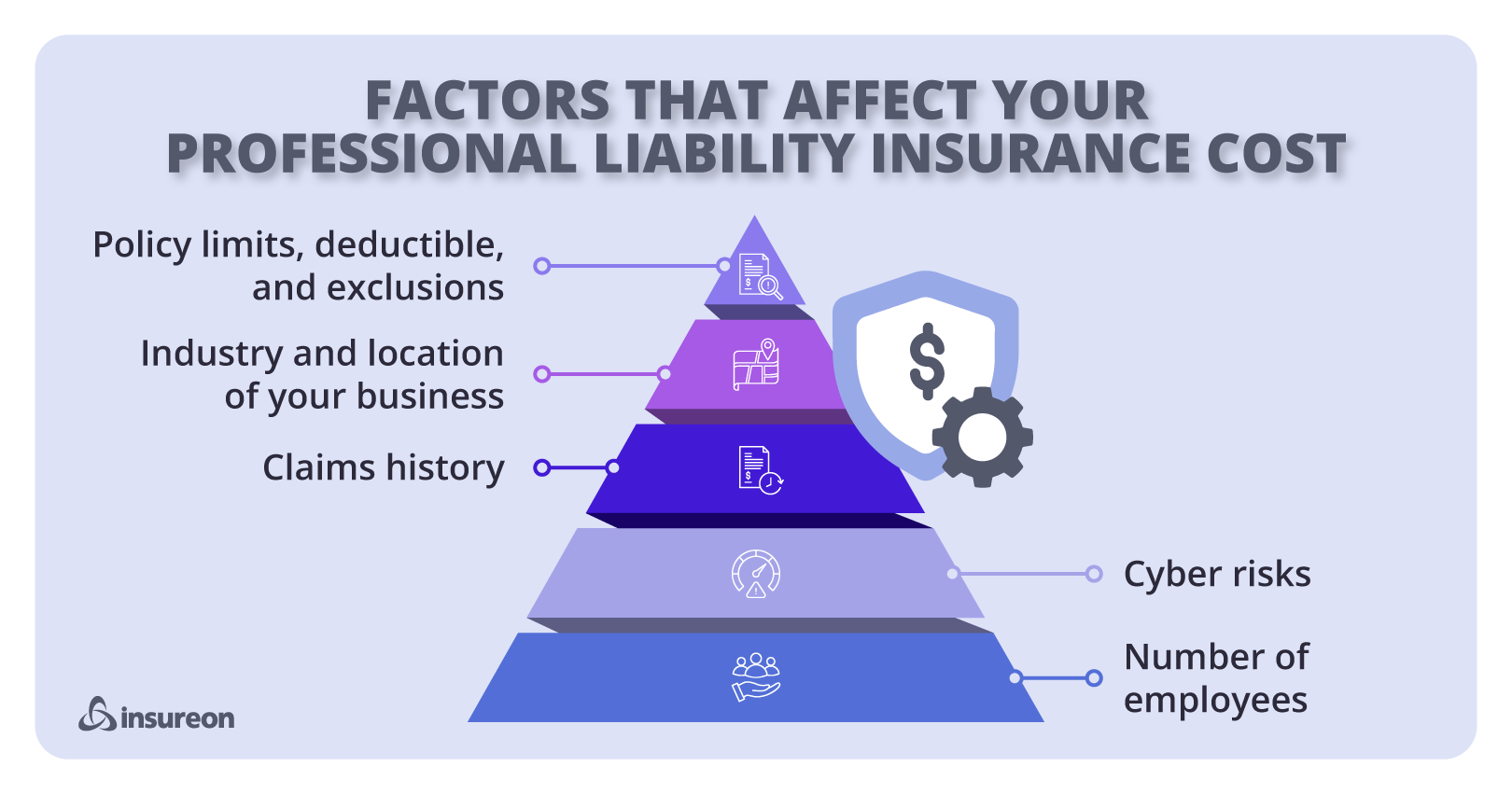

Some of the factors that help your provider weigh your risks are:

1. Your industry and the services you offer

The risk profiles of industries and professions vary considerably. For example, an optician generally has less potential for losses than an ophthalmologist, even though they both belong to the allied health field.

As a rule, the more potential damage your services can cause, the more you can expect to pay for E&O coverage.

2. Experience in your field

If you've only been in business for a couple of years, your professional liability quote may be a little higher. Many carriers work under the assumption that the less experience you have, the more risk you present.

By contrast, if your business has been established for several years and you have a history of financial stability, your E&O premium may be lower than you expected.

Remember, professional liability insurance is a claims-made policy, which means you can only file a claim while the policy is active. You may want to set a retroactive date to avoid gaps in coverage.

3. Types of clients

If your clients invest a considerable amount of money in your services and stand to lose a lot if something goes wrong, your insurance premium may reflect these high stakes.

Let's say you develop software for clients that processes a high volume of financial transactions. If they decide you're the reason they lost money, they could sue you over these losses. And because these losses could amount to millions of dollars, you'll need more E&O protection to cover the claim.

This is why your insurance application may ask how much you charged for your biggest project.

4. Type and number of key employees

The number of key employees you cover with your errors and omissions plan can increase your rates. That's why it's important to let your agent know if you terminate or hire employees later on. You don't want to keep paying for an employee's coverage if they no longer work for you.

If you employ independent contractors, you may need to include them under your policy if they don't have their own professional liability insurance.

5. Business location

Your carrier may adjust your professional liability insurance rates based on the litigation costs and market conditions associated with your business's location.

6. Policy limits

Some states require that some professions (such as healthcare professionals) carry a minimum amount of professional liability insurance (often called malpractice insurance in that field). Regardless of your field, keep in mind that the amount of per claim / aggregate limits you choose will directly affect your premium.

7. Deductibles

Many providers allow you to increase your deductible (the amount you pay out of pocket before your insurance benefits kick in) as a way of lowering your policy's annual premium.

Remember that the deductible payment is required in full before the claim will be defended. Choose an amount you can easily afford, so you can rely on your E&O coverage without jeopardizing your business finances.

8. Inclusions, exclusions, and policy features

Depending on your profession, you may be able to customize your professional liability policy with other types of coverage, such as:

Additional protection means a higher premium. Make sure to read the policy to make sure it doesn't exclude essential protection (such as coverage for lawyer's fees) or include extra coverages you don't need. Remember, not all policies are created equal, and one provider may include coverages in its standard plans that others don't.

9. Claims history

Though many carriers evaluate claim histories on a case-by-case basis, most will still increase premiums for businesses with a track record of losses. However, a spot-free record can help keep prices low.

10. Payment plan

Though you can save money by paying for your professional liability coverage in annual installments, many small business owners opt for monthly payments because it is more budget-friendly.

How much does professional liability insurance cost?

Finding a professional liability insurance policy that fits your budget might be easier than you think. Shopping around and bundling policies are just a couple of many strategies that you can use to find cheap professional liability coverage and help your business avoid more expensive rates.

Visit our professional liability insurance costs analysis page to get an idea about what our customers typically pay for this coverage.

Get professional liability insurance to protect yourself from claims that you didn't deliver on a deadline, or made a costly mistake.

Some clients require you to have this policy. It can protect you from expensive lawsuits for only about 60 dollars per month.

Don't put your business at risk. Apply for your policy today!

Alert. Alert.

Find quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to compare quotes for professional liability and other types of insurance from top-rated U.S. carriers. A licensed insurance agent can help you find the best policy for your business. Once you buy a policy, you can begin coverage in less than 24 hours.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy