Professional liability vs. malpractice insurance

Professional liability and malpractice insurance both protect against professional liabilities a business might face. However, they cover two separate types of claims, and you may need to purchase one or both policies depending on your risks.

What is professional liability insurance?

Professional liability insurance, also called errors and omissions insurance (E&O), focuses specifically on lawsuits that stem from professional services.

Though this policy is especially important for service providers to carry, most small business owners can benefit from its coverage. That’s because professional liability coverage shields you from third-party lawsuits alleging you:

- Provided negligent professional services

- Failed to uphold contractual promises

- Provided incomplete or substandard work

- Made mistakes or omissions

Also, your business doesn’t have to be at fault to be sued. An unhappy client could name your business in a lawsuit in an attempt to recoup losses that may or may not be your fault.

Your professional liability policy ensures you won't have to pay the defense costs, regardless of whether the liability claim is valid.

What is malpractice insurance?

Malpractice insurance, like professional liability, is sometimes used interchangeably with errors and omissions insurance. However, malpractice was developed to protect legal and medical professionals against patient or client lawsuits.

Medical malpractice is a must when making decisions that affect the health of your client. This policy can protect you from claims of negligence, including:

- Failure to provide quality care

- Causing pain, suffering, or mental anguish to a patient

- Economic damages from a patient's lost wages or healthcare costs

- Medical errors and oversights

- Missed appointments and undelivered services

- Unfounded claims of sexual misconduct

- Expenses related to HIPAA proceedings

Even when it's not required, malpractice coverage is a key part of risk management. Even the most experienced healthcare providers can make a mistake or be sued for a claim of substandard care, such as misdiagnoses, surgical mistakes, and medication errors.

Is malpractice insurance the same as a professional liability insurance policy?

Malpractice insurance is a type of professional liability insurance. While the terms are often used interchangeably, they’re not exactly the same.

Professional liability relates to a healthcare provider’s business activities, while malpractice covers your legal fees and settlement costs if you’re accused of causing a patient’s injury or death.

If a patient accused you of an error in their treatment that resulted in pain or expensive additional care, it would likely fall under your medical malpractice insurance.

If a customer accused you of a documentation error that cost them money, it would probably be covered under your professional liability insurance.

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "Malpractice vs. professional liability insurance: What's the difference?"]

MALE VOICEOVER: Insurance policies can be called by multiple names. And while the coverage may be similar, they aren't always the same. For example, professional liability insurance is sometimes called malpractice coverage.

[video: an illustrated header displays the text: "Professional liability insurance can also be called malpractice insurance."]

They both protect businesses from professional liabilities. However, they cover two separate types of claims.

[video: an illustrated header displays the text: "Both protect businesses from professional mistakes. However, they cover different claims."]

Professional liability insurance typically relates to claims of negligent professional services, unmet contractual promises, substandard work, and mistakes or omissions.

[video: an illustrated header displays the text: "Professional liability covers claims of:"]

[video: Under above header, four bullet points display the text: "Professional negligence"; "Substandard work"; "Mistakes and omissions"; "Privacy violations"]

Should a procedure not deliver the promised outcome or if your business is accused of violating a patient's privacy, a professional liability policy would cover the claim.

Medical malpractice insurance covers legal fees and settlement costs if you're blamed for causing patient pain, suffering, or mental anguish, as well as misdiagnosing or providing incorrect medications.

[video: an illustrated header displays the text: "Malpractice covers claims of:"]

[video: Under above header, four bullet points display the text: "Pain, suffering, and mental anguish"; "Misdiagnoses"; "Medication errors"; "Missed appointments"]

If you're accused of giving the wrong medication or missing a drug interaction in a patient's medical history that causes an adverse reaction, a malpractice policy would cover that claim. Because malpractice insurance and professional liability insurance cover two different types of claims, you may need to purchase both policies for your business.

[video: an illustrated header displays the text: "You may need both policies to meet your risk management needs:"]

Find out which policies you need from the experts and get the right coverage for your practice with Insureon today.

[video: an illustrated white header displays the text: "Insureon is your #1 agency for small business insurance"]

Click the link to get started.

[video: an animated header displays the Insureon logo]

Complete Insureon’s easy online application today to compare professional liability and other small business insurance quotes from leading insurance companies.

For medical malpractice policies, you can consult with our dedicated insurance agent via email at [email protected] or phone at 312-854-2919.

Are you required to carry medical malpractice insurance?

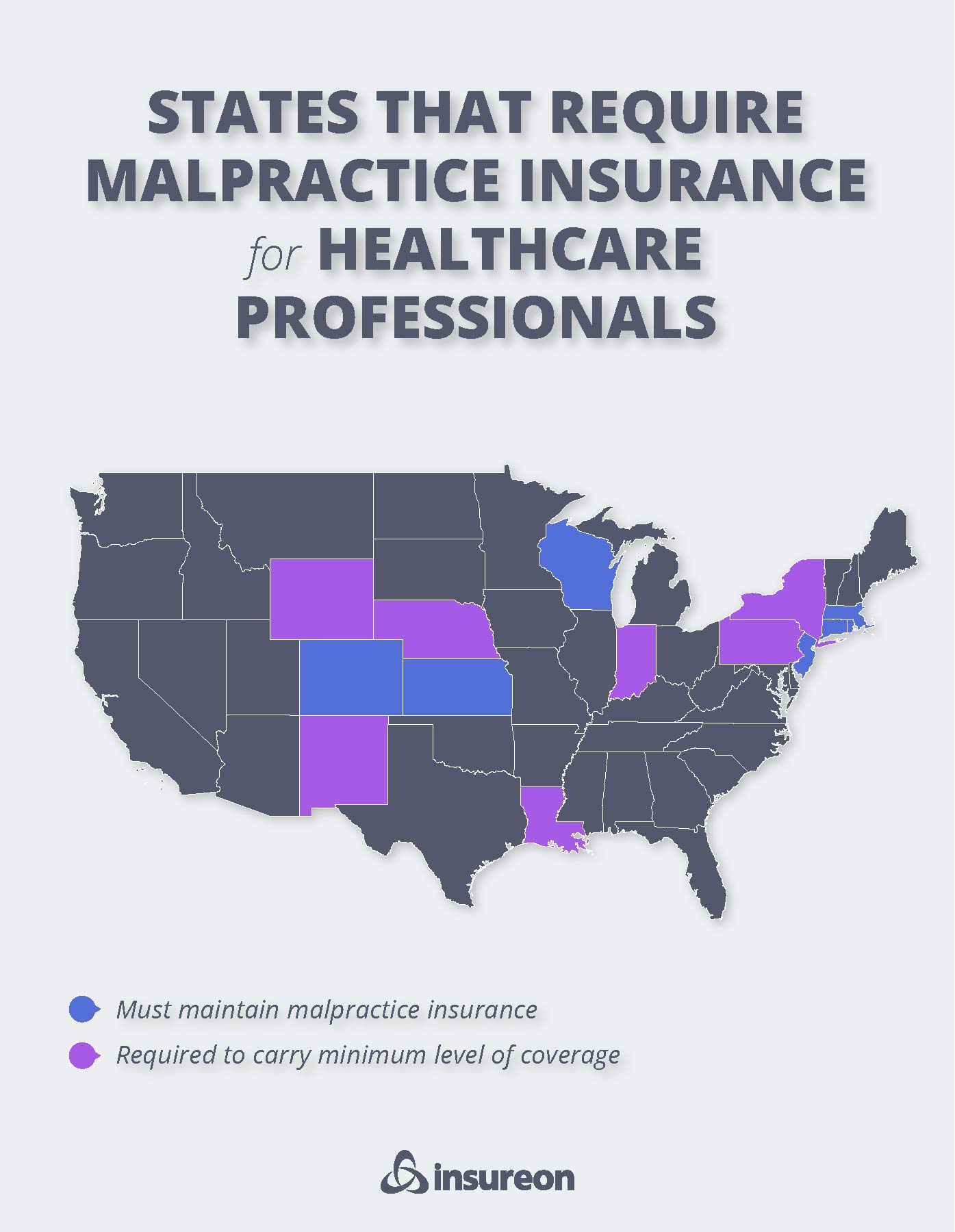

Though there’s no federal requirement, many states have professional liability or medical malpractice insurance requirements in place for healthcare professionals, especially doctors with admitting privileges.

States that require certain levels of coverage include:

| Must maintain malpractice insurance in: | Required to carry a minimum level of coverage in: |

|---|---|

Additionally, in California, physicians are only required to carry malpractice insurance if they perform outpatient surgery. Florida also has certain stipulations healthcare professionals must meet in order to be exempt from insurance.

The cost of malpractice insurance varies widely depending on your state, along with other factors.

Who typically carries malpractice insurance?

Because malpractice is an error made by a professional, any person who is skilled or has received special training to perform a job can be held liable for providing less than stellar services.

When someone outside of your business feels you have committed malpractice, they can file a claim against your business in an effort to recoup their financial loss.

It's easier to understand malpractice coverage by the professionals who specifically need it, compared to industries that use the terms E&O and professional liability. Let's take a look at how they differ:

Health and legal professions

Malpractice insurance is commonly used to refer to cases involving medical practices (including therapists and counselors), lawyers, and public officials.

For example, a dentist should be able to recognize a cracked tooth and recommend treatment. Likewise, a lawyer is expected to provide sound legal counsel to clients.

Tech and math-based professions

Errors and omissions (E&O) insurance is often used in fields that involve some kind of technical or mathematical finesse, such as accounting or IT.

Ultimately, an architect should be able to design a new building without structural flaws, and deliver the contracted service in the agreed upon timeframe.

Consulting and professional services

Professional liability insurance is the most common term concerning professional mistakes.

Consultants are often hired to strategize for clients and make predictions and projections based on performance metrics. But if a miscalculation or poor advice leads to financial losses for a client, you may be sued.

What are the two different types of malpractice insurance coverage?

There are two types of medical malpractice insurance coverage: claims-made and occurrence-based.

Businesses will find most medical malpractice policies are claims-made policies, which cover incidents and claims that happen while the policy is active. If you face a lawsuit after canceling your policy, it won't be covered.

Because claims must be filed while the policy is active, it's important to maintain continuous coverage.

However, some insurance companies offer occurrence-based policies, which can be more extensive. Because of their steeper costs, occurrence-based policies are fairly uncommon.

An occurrence policy covers losses during the policy period, even if the policy is no longer in effect when you file a claim. If you canceled this policy, you'd still be covered for any incidents that happened during the coverage period.

What is the difference between general liability insurance and malpractice insurance?

For many small business owners, general liability insurance is often the first coverage they buy. It insures you against common business risks such as accidental customer injuries, customer property damage, and advertising injuries. Plus, it’s often required to sign leases and contracts.

If a patient or a visitor suffers a bodily injury by accident, such as tripping on a rug at your office, it would be covered by your general liability policy.

But if a patient is injured during a medical treatment, procedure, or from a misdiagnosis, this type of claim would most likely be covered by your medical malpractice insurance policy.

Protect your business with the right liability policies with Insureon

It's easy to get free quotes for professional liability and malpractice insurance with Insureon. We'll ask for basic facts about your business to help find the best coverage to match your risks, budget, and state requirements.

For most policies, you can get quotes through our online application. If you're not sure what types of insurance policies your business needs, you can speak with a licensed insurance agent. Once you choose your insurance plan, you can usually get coverage and your certificate of insurance within 24 hours.

If you're looking for malpractice coverage, contact our dedicated medical malpractice insurance specialist for more information or to get started.

Verified professional liability coverage reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy