Employment practices liability insurance

Employment practices liability insurance

If a business is sued by an employee over wrongful termination or another violation of employee rights, employment practices liability insurance (EPLI) can pay for legal costs. EPLI can be added as an endorsement to a general liability or business owner's policy.

Why is employment practices liability insurance important for small businesses?

Employment practices liability insurance (EPLI) protects your small business when a worker sues over employment-related issues.

Sometimes referred to as “EPL insurance,” this policy covers your legal defense costs when an employee or group of employees claim their civil rights were violated or they were unable to complete their work in a fair environment.

Even when you've done nothing wrong, a frivolous lawsuit can still prove costly, which is why all businesses with employees should consider this coverage.

When an employee sues over a violation of rights, EPLI pays for:

- Attorney's fees

- Court costs

- Witness fees

- Court-ordered judgments

- Punitive damages

- Settlements

What does employment practices liability insurance cover?

If an employee sues over wrongful termination, sexual harassment, equal pay, or another violation of employee rights, employment practices liability insurance helps pay for your legal costs.

This includes the risk exposures you might face if an employee files a complaint with the Equal Employment Opportunity Commission (EEOC), or a lawsuit involving the Family and Medical Leave Act (FMLA).

Specifically, your EPLI policy provides coverage for:

Mismanagement of employee benefits

Employment practices liability insurance protects your business if you improperly manage employee benefits, including health insurance, paid time off, and sick leave.

Sexual harassment

EPLI provides protection if your business is sued over sexual harassment in the workplace. For example, if an employee complains to HR about a manager's suggestive remarks but no action is taken, your business could face a lawsuit.

Wrongful discipline or demotion

EPLI coverage will help protect you if an employee alleges wrongful discipline, demotion, or termination. It protects against accusations of negligence related to hiring and promotion, as well.

Slander or libel

While slander or libel charges coming from non-employees are covered by general liability policies, EPLI coverage offers protection for employee claims of defamation.

Discrimination

Employment laws prevent businesses from discriminating against workers based on age, gender, religion, race, or other protected classes. Companies that violate these rules might face a lawsuit.

Breach of employment contract

When your company makes a candidate a job offer or hires a contractor, it is obligated to adhere to the terms of the agreement that both parties signed. Failing to do so could result in a lawsuit.

Invasion of privacy

When monitoring your business, take care not to cross the line into violating employee privacy or you risk a lawsuit.

Mental or emotional distress

If an employee at your business behaves in a way that causes another worker to suffer and you take no action, you could be held liable.

How much does employment practices liability insurance cost?

The average EPLI premium is $222 per month for Insureon customers. The cost of an EPLI policy depends on:

- Number of employees

- Revenue

- Industry

- Hiring and termination practices

- Employee turnover rate

- Risk profile

- Past EPLI claims history

What our customers are saying

Who needs EPLI coverage?

While EPLI is not mandatory by law, every business with employees should consider carrying this policy. Even in a small business, an employee conflict could lead to a costly lawsuit.

Regardless of whether you win in court, you'll still be responsible for costly legal fees, which is why employment practices liability insurance is so important.

Good candidates for EPLI coverage include the following types of businesses:

Retail

A computer and electronics store fails to pay unused vacation time when a technician accepts a new job, and the worker decides to sue.

Food services

A manager at a fast food restaurant regularly makes suggestive remarks to a cashier and follows up with unwanted advances. The employee complains to HR, but no action is taken. The cashier files a lawsuit against the restaurant for failing to prevent the harassment.

Professional services

A manager at a medical billing agency accuses a subordinate of stealing money in front of other employees. The employee denies wrongdoing and sues the business for slander.

Manufacturing

An older employee who has worked on the assembly line at a beverage manufacturing plant for over a decade is passed over for a promotion, which is awarded to a new, younger employee. The worker sues the factory for age discrimination.

Healthcare

A doctor makes crass jokes in the office, usually at the expense of a receptionist. When the HR department does not take their complaint seriously, the receptionist sues the business for sexual harassment.

How to get business insurance coverage today

Easily apply online, get quotes from top carriers in seconds, and get your certificate of insurance the same day.

We're on top of your small and medium-sized business insurance needs. We'll help you find policies that protect what you've worked so hard to build.

Start here. Tell us about yourself. Questions? We've got your back. The info you share is secure. We'll double-check it and a pro with experience in your field will be in touch.

Fast? You can compare quotes from leading insurance providers in seconds and get a certificate of insurance the same day.

Always online, always on your side. Helping protect your business.

What does employment practices liability insurance not cover?

While EPLI is an important part of risk management when you have employees, it does not provide all the protection you might need. For instance, your policy does not include coverage for:

Employee injuries

Workers' compensation insurance covers work-related injuries and illnesses. It helps pay for medical bills and provides disability benefits while an employee recovers.

Employee lawsuits over injuries

Employer's liability insurance, typically included in a workers' compensation policy, covers legal costs if an employee sues over a work injury or illness.

Third-party slander and libel lawsuits

General liability insurance covers legal costs if someone outside your business accuses you or an employee of slander, libel, or another advertising injury.

Professional negligence

Professional liability insurance, also called errors and omissions insurance (E&O), covers legal costs if your business is accused of professional negligence. It also covers missed deadlines and work mistakes.

While EPLI covers negligence in terms of hiring and other employment practices, professional liability covers negligence related to the work performed by your business. Another difference in employment practices liability vs. professional liability is that the lawsuits come from employees, not clients.

General liability insurance

Business owner’s policy

Professional liability insurance

Directors and officers insurance

Workers’ compensation insurance

FAQs about EPLI coverage

Review answers for frequently asked questions about employment practices liability insurance.

Why is continuous EPLI coverage important?

Employment practices liability insurance coverage is a claims-made policy, which means that a claim is covered only if your policy is active both when the incident occurred and when the claim is filed.

It's important to maintain continuous coverage with this type of insurance, as a lapse could leave you vulnerable to legal defense costs. You may want to set a retroactive date for coverage, which provides protection for work done in the past up to a specific date.

For example, your house painting business is forced to close, so you cancel your EPLI coverage. A few months later, a former employee sues you for discrimination, but since you no longer have an EPLI policy, the insurer likely won’t pay for lawsuit costs. Note that in some situations, you may be able to extend a policy beyond its original end date.

How common are EPLI claims and how much do they cost?

Unfortunately, employment-related claims are both common and costly. You're actually more likely to be sued by an employee than you are to have a fire at your office – even though more businesses carry insurance to protect against the fire, not the lawsuit.

The risk increases for businesses that are too small to have a human resource team. Businesses with a small staff often lack the time, energy, and expertise to resolve employee disputes before they become legal issues.

Employee lawsuits can devastate your reputation and finances. The Massachusetts Commission Against Discrimination gives examples of employment liability cases:

- $100,000 for an employee terminated because they could not perform all of their duties while in a wheelchair

- $70,000 for an employee who faced sexual harassment from a high level executive

- $230,000 for an employee terminated after requesting leave for hip surgery and planning to retire within three years

EPLI coverage keeps you from paying these high costs out of pocket. It can cover any legal defense costs, including a settlement or judgment if an employee presents a valid claim.

How can I save money on an EPLI policy?

One of the best ways to save money is to prevent employment practice claims to keep your costs low. This can include risk management strategies, such as having a robust employee handbook, ensuring your business prevents any discriminatory behaviors, and avoiding wrongful employment termination.

Bundles usually cost less than purchasing standalone coverage, and with EPLI you may have a few options depending on the carrier.

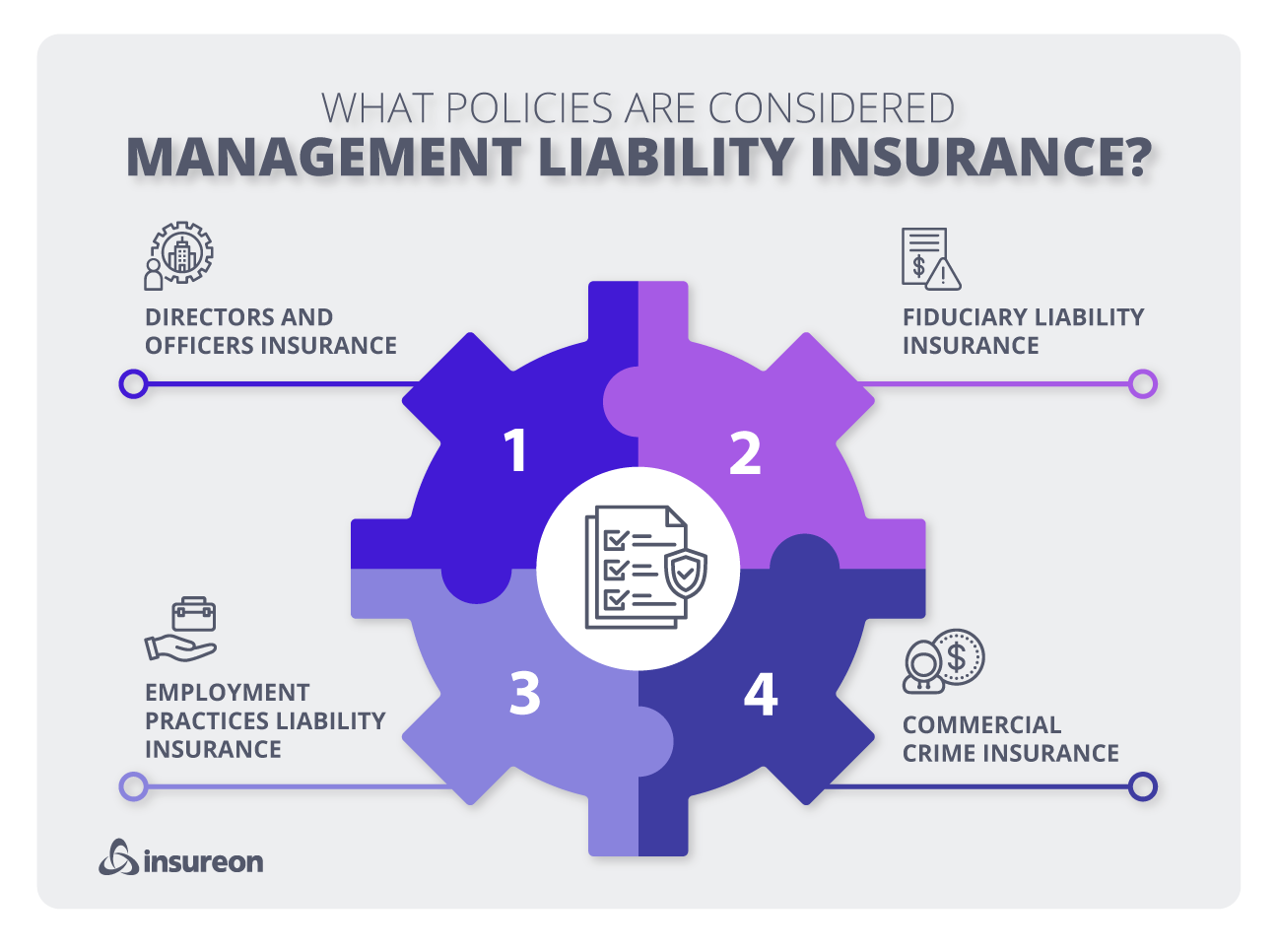

Small businesses can often bundle employment practices liability coverage with directors and officers insurance (D&O), another type of management liability insurance. D&O protects a business’s board members and officers against lawsuits over decisions they made on behalf of the company that resulted in financial loss.

Together, these two types of management liability insurance provide a broad base of protection against liabilities related to hiring and firing, employee rights, investment decisions, and employee benefits.

While businesses often purchase EPLI with D&O insurance, they also have the ability to add EPLI as endorsement to other policy bundles, such as a business owner's policy (BOP) or commercial package policy (CPP).

What should I know about EPLI deductibles, limits, and exclusions?

Most EPLI policies include a deductible, which is an amount that you pay out of pocket toward legal costs before an insurer contributes.

Some policies limit coverage during acquisitions or major staff reductions. Others stipulate that the insurance company will choose your attorney if a claim is filed, usually because the insurer wants a lawyer who has expertise with relevant cases.

Employment dispute lawsuits can be expensive, so keep that in mind when choosing your policy limits and options for what EPLI covers.

What's the difference between EPLI and employer's liability insurance?

Employment practices liability insurance covers lawsuits related to employment practices. Employer’s liability insurance helps pay for lawsuits over employee injuries.

Both policies protect business owners from employee lawsuits, which can cost your business more than $125,000. However, employer's liability insurance is a separate insurance policy that protects your business from legal defense costs if an employee claims your business's negligence caused their injury or illness.

Unlike EPLI, employer’s liability insurance is typically included in workers' compensation insurance.

What is the difference between employment practices liability and E&O insurance?

Both policies are important for protecting small businesses from common lawsuits and incidents, but they cover different types of risk.

EPL coverage protects business owners from lawsuits related to employment issues, such as harassment, discrimination, and wrongful employment termination.

E&O insurance covers policyholders from lawsuits relating to mistakes and oversights for professionals.

Many small businesses purchase both policies to ensure they're protected from a range of risks. Contact a licensed insurance agent to ensure that your company is protected with the right policies for your needs.