What is management liability insurance?

Management liability insurance, also called executive insurance, is a combination of policies that covers the many business risks faced by senior-level managers, including lawsuits and claims of discrimination, mismanagement, and fraud.

Recommended policies for small businesses

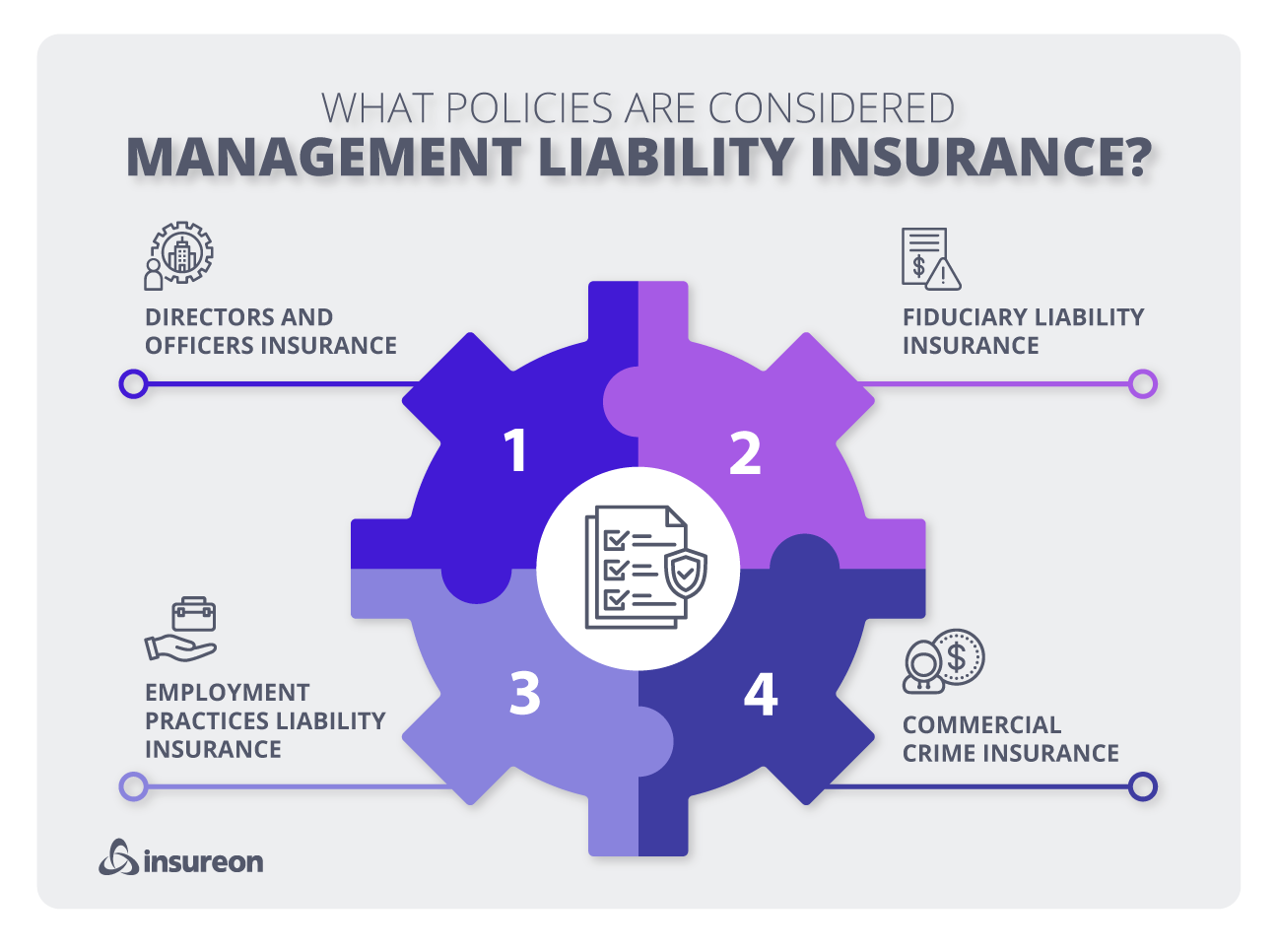

Insurance products that typically fall under the category of management liability insurance include:

Directors and officers insurance

D&O insurance covers your board of directors and officers against lawsuits if they’re sued over a decision that results in a financial loss to a company or nonprofit.

- Accusations of mismanaged funds

- Employee grievances

- Defamation claims

Employment practices liability insurance

Employment practices liability insurance, also called EPLI, covers your legal defense costs in case an employee accuses you of violating their rights.

- Mismanaging benefits

- Wrongful termination or discipline

- Discrimination lawsuits

Fiduciary liability insurance

Fiduciary liability insurance covers those who oversee employee retirement plans and other benefit plans from claims of mismanagement.

- Poor investment decisions

- Mishandled plan records

- Negligence in hiring plan service providers

Commercial crime insurance

Commercial crime insurance, also known as employee dishonesty coverage, insures your business against employee theft or fraud that impacts your clients and customers.

- Theft of money or property

- Fraud, such as computer fraud and wire transfers

- Forgery

Why do small businesses need management liability insurance?

As a small business owner, even frivolous lawsuits can have a huge impact on your bottom line and your company officers. In fact, there are many talented people who refuse to work with private companies or nonprofit organizations without some kind of liability coverage for their decisions.

Management liability insurance allows your executive team to focus on making the right decisions for your business, rather than worrying about their own risk management and protecting assets if they’re accused of wrongful acts. It lets people know that you take their roles seriously and are looking out for their interests.

Who needs management liability insurance?

Imagine the kind of impact that an expensive lawsuit or settlement could have on your company or nonprofit. Even if you win in court, you could rack up some expensive legal bills in the process.

Management liability insurance doesn’t just protect your bottom line, it also makes it easier for you to attract talent for your management team. Nonprofits, construction and contracting businesses, and manufacturers can all experience managements risks involving high-level decision making, employee liability, or cyber security.

Anyone you ask to serve as a director, manager, or officer might be reluctant to join your operation without some kind of indemnity or financial protection from their decisions. Otherwise, they could put their personal assets at risk.

Top professions that require management liability insurance

Don't see your profession? Don't worry. We insure most businesses.

How much does management liability insurance cost?

Factors that impact the cost of management liability insurance include:

- Potential for initial public offering

- Risk profile

- Deductible amount

What’s the difference between management liability and other insurance policies?

Management liability is different than general liability insurance, which covers standard business risks such as customer injuries, damage to a customer’s property, and advertising injury.

Whereas general liability covers your business itself from physical damages and injuries, management liability covers your business risks and exposures associated with executive-level decisions and those who make them.

Management liability is also different than professional liability insurance, an insurance policy that protects against the cost of client lawsuits over unsatisfactory work. This is also known as errors and omissions insurance.