Fiduciary liability insurance

Fiduciary liability insurance protects individuals or entities who oversee employee benefit plans from claims they mismanaged those plans in breach of their fiduciary duty.

What is fiduciary liability insurance?

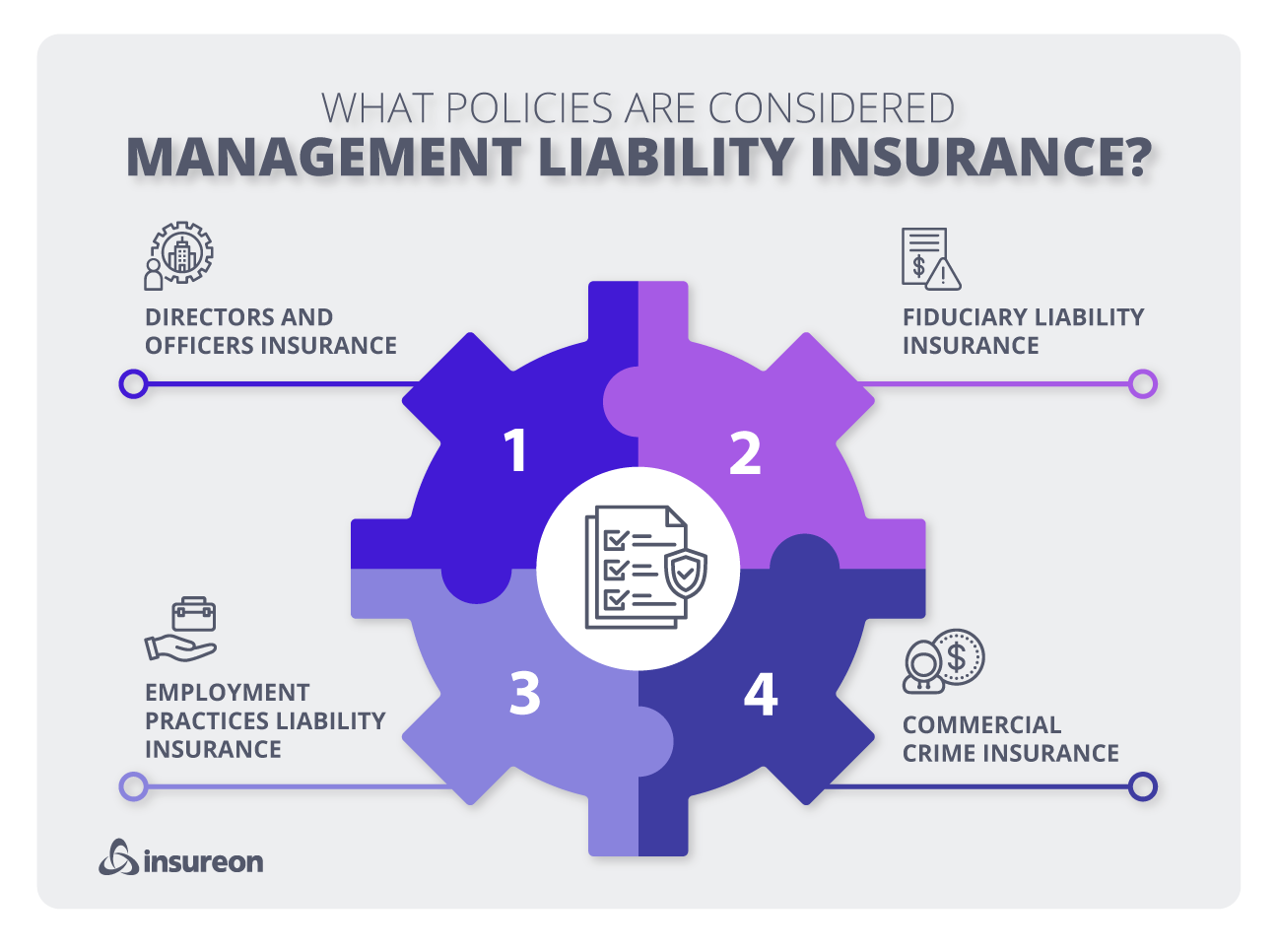

Fiduciary liability coverage is a specialized type of management liability insurance that protects employee benefit plan fiduciaries against claims they mismanaged plans or assets. When plan administrators make such mistakes, they can be held personally liable for any losses that plan participants suffer.

A fiduciary liability insurance policy serves as a financial buffer when employees file lawsuits to recover the losses they suffered as a result of a problem with their company retirement or health and welfare plan.

A policy can help pay for a legal defense or losses that arise when fiduciaries:

- Make poor or imprudent investment decisions

- Mismanagement of plan records

- Negligently hire plan service providers

What is a fiduciary?

A fiduciary is a person or entity that is responsible for managing a person’s or organization’s assets. A fiduciary has a legal duty to serve that party’s best interests, upholding the highest standards of good faith and trust.

For example, managing a company retirement plan, such as an IRA or 401(k), would be a fiduciary's responsibility.

Fiduciaries who fail to uphold their fiduciary duty leave themselves open to legal action from those they harmed.

How does fiduciary duty relate to small businesses that provide employees with benefits?

Small businesses that provide retirement plans or other types of employee benefits are subject to a Department of Labor regulation called the Employee Retirement Income Security Act of 1974 (ERISA). This federal rule imposes what it calls the “highest duty known to law” (i.e., a fiduciary duty) on those who manage retirement savings and other benefit plans.

Why is this significant for small business owners? ERISA law requires fidelity bonds for plan managers, and explicitly imposes liability on any person or entity that violates fiduciary duty. This means the plan fiduciary may be held responsible to reimburse employee financial losses.

ERISA does not allow pension or health and welfare plans to reimburse plan fiduciaries for their legal expenses, settlements, or judgments. As a result, fiduciaries involved with employer plans bear a tremendous amount of personal liability for their mistakes.

For this reason, fiduciary liability insurance is a crucial form of risk management and mitigation for plan fiduciaries. It protects their personal assets and from going personally bankrupt after their professional mistake financially harms plan participants.

What does fiduciary liability insurance cover?

Fiduciary liability insurance covers a wide range of fiduciary mistakes, including:

- Making improper changes in plan benefits (e.g. employee stock ownership plans, pension plans, etc.)

- Wrongfully denying benefits to employees or beneficiaries

- Providing improper or incorrect advice or counsel to the plan holder (employer) or participants (employees)

- Giving advice that benefits the fiduciary but harms the plan holder (conflict of interest)

- Making a poor decision regarding hiring plan service providers

- Failing to properly supervise service providers

- Making administrative errors while administering the plan

- Managing plan assets imprudently or failing to diversify those assets

When these and other problems occur, fiduciary liability insurance will pay for the fiduciary’s defense costs as well as any settlements or judgments that arise from legal action.

What doesn’t fiduciary liability insurance cover?

Fiduciary liability insurance does not cover crimes or other acts of intentional wrongdoing. It also does not cover embezzlement of small business funds.

To protect against these liabilities, along with others, you should consider getting additional insurance coverage.

How much does fiduciary liability insurance cost?

Factors that impact the cost of fiduciary liability insurance include:

- Potential for initial public offering

- Risk profile

- Deductible amount

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

What type of small business needs fiduciary insurance?

If you’re a solopreneur or have only a few employees for whom you don’t provide employee benefits, you probably don’t need fiduciary insurance.

However, if you have a significant number of employees and provide them with benefits, then you should consider protecting yourself with a fiduciary insurance policy.

Other important business insurance policies for fiduciaries

While fiduciary liability insurance covers major management risks, it does not provide complete protection. Other insurance products to consider include:

General liability insurance: A general liability policy covers common business risks like customer injury, damage to a customer’s property, and advertising injury.

Commercial auto insurance: This policy covers vehicles owned by your business. It typically pays for accidents and damages related to theft, weather, and vandalism.

Commercial umbrella insurance: Provides additional coverage for liability claims made on general liability, commercial auto, or employer’s liability insurance, once a policy's limit is reached.

Cyber insurance: Also called cybersecurity insurance, this policy can cover legal and other associated costs related to a data breach or software attack.

Workers’ compensation insurance: Workers' comp is required in almost every state for businesses that have employees. It can cover medical expenses for work injuries, which are not often covered by regular health insurance.

How to get fiduciary liability insurance quotes from trusted providers with Insureon

Complete Insureon's easy online application today to compare insurance quotes from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy