Commercial crime insurance

Commercial crime insurance offers protection from employee theft or fraud that impacts a client.

What is commercial crime insurance?

Commercial crime insurance, also referred to as fidelity insurance, financially protects your business from criminal acts committed by employees against customers or clients.

If one of your employees (or anyone else working on your behalf) steals from a customer or client, crime insurance provides them with reimbursement for the amount that was stolen.

There are two types of commercial crime coverage: first-party coverage and third-party coverage.

What is first-party crime insurance coverage?

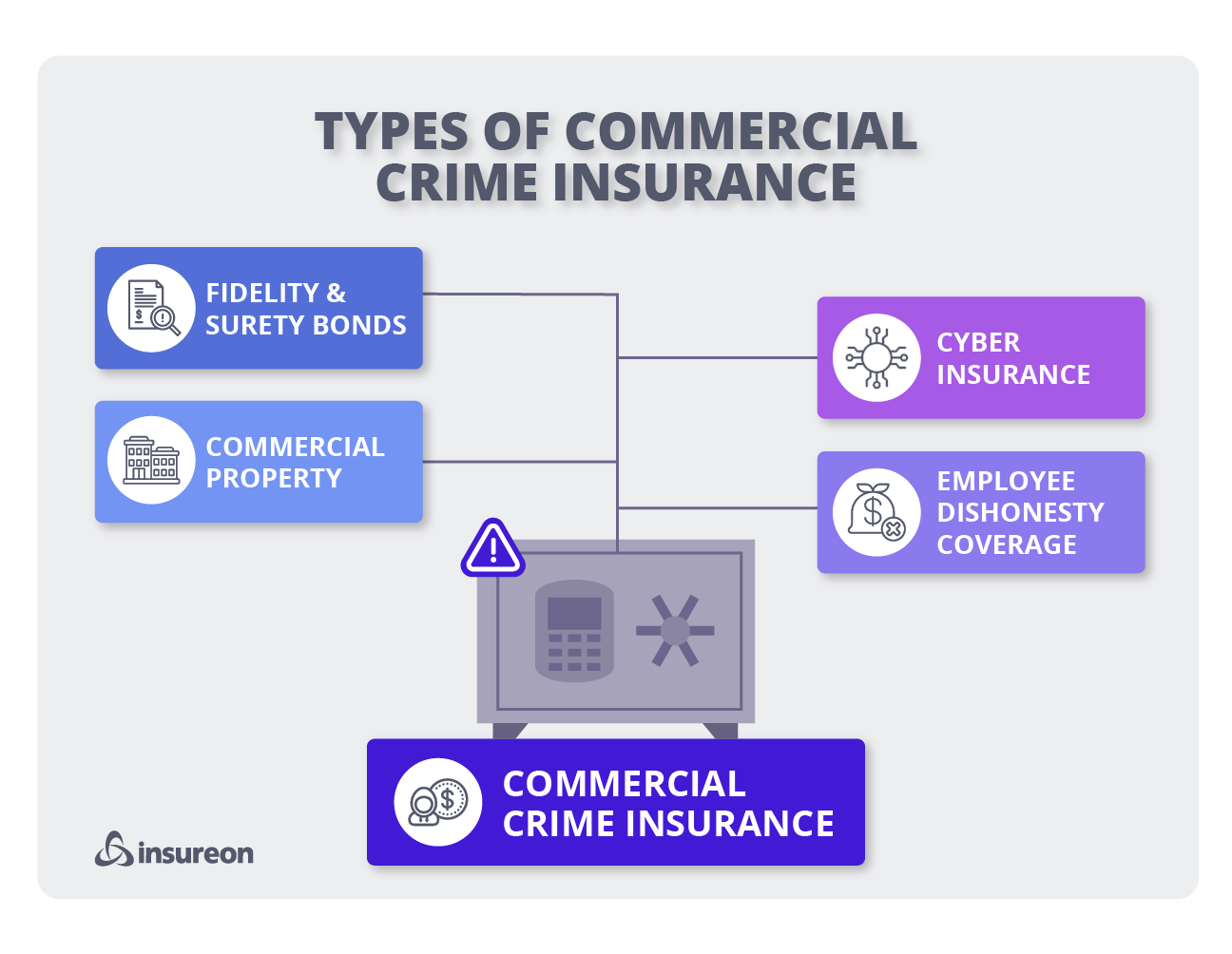

First-party coverage can protect your company against any losses resulting from employee theft. First-party coverage is typically written through:

- A crime coverage policy

- An endorsement to commercial property insurance, business owners' policy (BOP), or commercial package policy (CPP)

- A fidelity bond

This type of coverage is sometimes referred to as a first-party bond. Commercial crime also covers employee theft against the insured, if the policy includes first-party coverage.

What is third-party crime insurance coverage?

Third-party coverage can protect a client against losses resulting from theft by an employee. This type of coverage typically comes in the form of a fidelity bond. Essentially, fidelity bonds serve as a type of crime insurance coverage.

What does commercial crime insurance cover?

The criminal acts typically covered by a commercial crime policy include:

- Theft of money or property, including embezzlements

- Fraud, including computer fraud and funds transfer fraud

- Forgery

Employee dishonesty coverage can be added to a commercial property or business owner's policy as an endorsement. When added to one of these policies, employee dishonesty coverage acts like traditional insurance coverage and less like a typical surety bond, in which the insured has to pay back any covered losses.

How much does commercial crime insurance cost?

Commercial crime costs can vary depending on the type of coverage. For a bond, the cost is a certain percent of the total bond amount.

Factors that affect costs include:

- Amount of coverage or size of the bond

- Deductible, if any

- Personal and financial information handled

- Number of employees with access to sensitive information

- Your credit rating

What our customers are saying

Who needs commercial crime insurance?

Any small business that handles financial transactions with customers could benefit from a crime insurance policy. It can cover losses when employees misuse sensitive financial data, such as a client's credit card or Social Security number.

While any business can fall victim to employee crime-related losses, a couple of specific industries are especially at risk, including:

- Finance and technology businesses: Many owners of finance and tech companies purchase commercial crime coverage to protect their business because their employees can access sensitive personal data.

- Cleaning businesses: Cleaning companies often rely on janitorial bonds to protect against employee theft of client property.

If your employees handle financial records and transactions, or if they are trusted with valuable client property, you and your business partners could use this coverage as part of your risk management program and to gain client trust.

What does commercial crime insurance not cover?

While commercial crime insurance covers many aspects related to employee theft or fraud, it does have some exclusions. This includes:

Noncriminal mistakes and oversights

Professional liability insurance, also called errors and omissions insurance (E&O), covers the costs of lawsuits over mistakes or oversights. Professional liability insurance also covers the costs of lawsuits over professional negligence.

Employees with criminal records known to employers

If you hire an employee with a known criminal record and they commit fraud or theft, commercial crime insurance will not be applicable.

Crimes by business owners or senior management

A commercial crime insurance policy insures your business only against employee theft or fraud. This does not include business owners or senior management.

Indirect financial losses

Indirect financial losses, such as business interruption, loss of income, or legal expenses, are not covered under commercial crime insurance. For protection against indirect financial losses, you should get business interruption coverage.

Data breaches

If a data breach occurs at your business by an employee, commercial crime insurance would not provide coverage for related expenses, such as customer notifications. You should get data breach insurance, also known as cyber insurance, for this protection.

Other common questions about commercial crime insurance

Can I add commercial crime coverage to an existing policy?

Yes. You probably already carry commercial property insurance coverage, included in a business owner's policy (BOP) or commercial package policy (CPP), to cover the cost of stolen, lost, or damaged business property. However, this policy does not include protection against employees who steal from your business.

Small business owners can add employee dishonesty coverage that covers employee theft of business property to their commercial property policy, BOP, or CPP. This endorsement provides coverage if an employee steals from your cash register, forges your signature, or makes off with valuable computers or other equipment owned by your business.

As an add-on, employee dishonesty coverage works like standard insurance coverage and less like a typical surety bond, in which the insured has to pay back any covered losses.

When is commercial crime insurance required?

In the tech industry, your clients may require you to purchase commercial crime business insurance in the terms of a contract. This coverage gives them peace of mind that they'll be reimbursed in the event of employee theft or fraud.

Similarly, clients may ask cleaning companies to secure janitorial bonds before they'll allow your staff on their business premises.

They’re also mandatory under the Employee Retirement Income Security Act (ERISA) for businesses that manage an employee benefit plan, such as a 401(k).

The amount of coverage you need depends on your client's requirements, typically outlined in a contract.

How to get commercial crime quotes from trusted carriers with Insureon

Complete Insureon's easy online application today to compare insurance quotes from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.