Employee dishonesty insurance

Employee dishonesty insurance protects a business owner or their clients against theft and other financial losses caused by their employees.

What is employee dishonesty insurance?

Employee dishonesty coverage can refer to two different types of protection against theft by your staff:

- First-party coverage: This protects your own business from employee theft. You can add this coverage to a business owner's policy (BOP) as an endorsement to commercial property insurance.

- Third-party coverage: This protects your clients from dishonest acts committed by employees at your business. It's usually called a fidelity bond or a business service bond.

You may see both kinds of protection referred to more broadly as commercial crime insurance or employee theft coverage.

Protect your own business with a BOP endorsement (first-party)

If your employees can access your company's finances, issue checks, or handle valuable business property, you should consider adding employee dishonesty coverage to your commercial property insurance coverage or BOP.

If an employee forges a check or steals from the cash register, this coverage will pay you back for the loss up to your policy limits. This includes the theft of property or cash, along with illegal electronic funds transfers.

For entrepreneurs learning how to start a mechanic shop, employee dishonesty coverage can be especially important because small automotive businesses often handle cash, customer payments, and expensive parts and tools that could be targeted.

Note that general liability insurance won't protect your business against employee dishonesty. However, it's likely the first policy you need for its broad protection against third-party accidents.

Protect your clients with a fidelity bond (third-party)

Fidelity bonds protect your clients from employee theft. If one of your employees steals from a client, a fidelity bond will compensate the client for the amount that was stolen.

A fidelity bond is not like a typical liability policy. It reimburses the client directly for their loss, and the insurance company will then typically pursue recovery of that amount from the dishonest employee, a process known as subrogation.

Fidelity bonds are most common in the tech industry, where clients often request them in the terms of a contract. Independent contractors may also need this coverage to work with certain clients.

Why is employee theft insurance crucial for small businesses?

While most employers want to trust the people they hire, there is always risk involved. Small businesses are especially vulnerable to employee theft and other dishonest acts, as they may lack the internal controls and systems needed to prevent crime.

Employee fraud and theft cost U.S. organizations billions of dollars annually. Employee theft can come in many forms:

- Someone stealing merchandise, office equipment, or taking cash from the register may be easy to spot.

- An employee diverting company checks or wiring funds to their personal bank account could be harder to track.

- More complex schemes involve an employee accepting kickbacks from a vendor to secure a business deal.

What does employee dishonesty insurance cover?

Employee theft and dishonesty insurance covers various financial losses caused by dishonest employees. This coverage typically includes:

- Stolen property, such as inventory and office equipment

- Theft of cash, securities, checks, money orders, and other financial instruments

- Forgery, fraud, and embezzlement

- Unauthorized wire transfers

- Credit card fraud by an employee

- Theft by all workers for your company, including seasonal, temporary, and full-time employees

What does employee dishonesty insurance exclude?

Employee dishonesty insurance excludes claims that relate to your commercial property insurance, errors and omissions insurance (E&O), and other types of business insurance. Exclusions often include:

- Criminal acts by individuals outside your business

- Theft committed by a company’s owner

- Losses caused by an employee when you knew, prior to the loss, that the employee had committed theft against any previous employer or your business

- Any wages and benefits the employee received

- Your loss of future income from the theft

- Indirect losses, such as business interruption

- Accounting errors

- Data breaches and computer fraud from outside the company

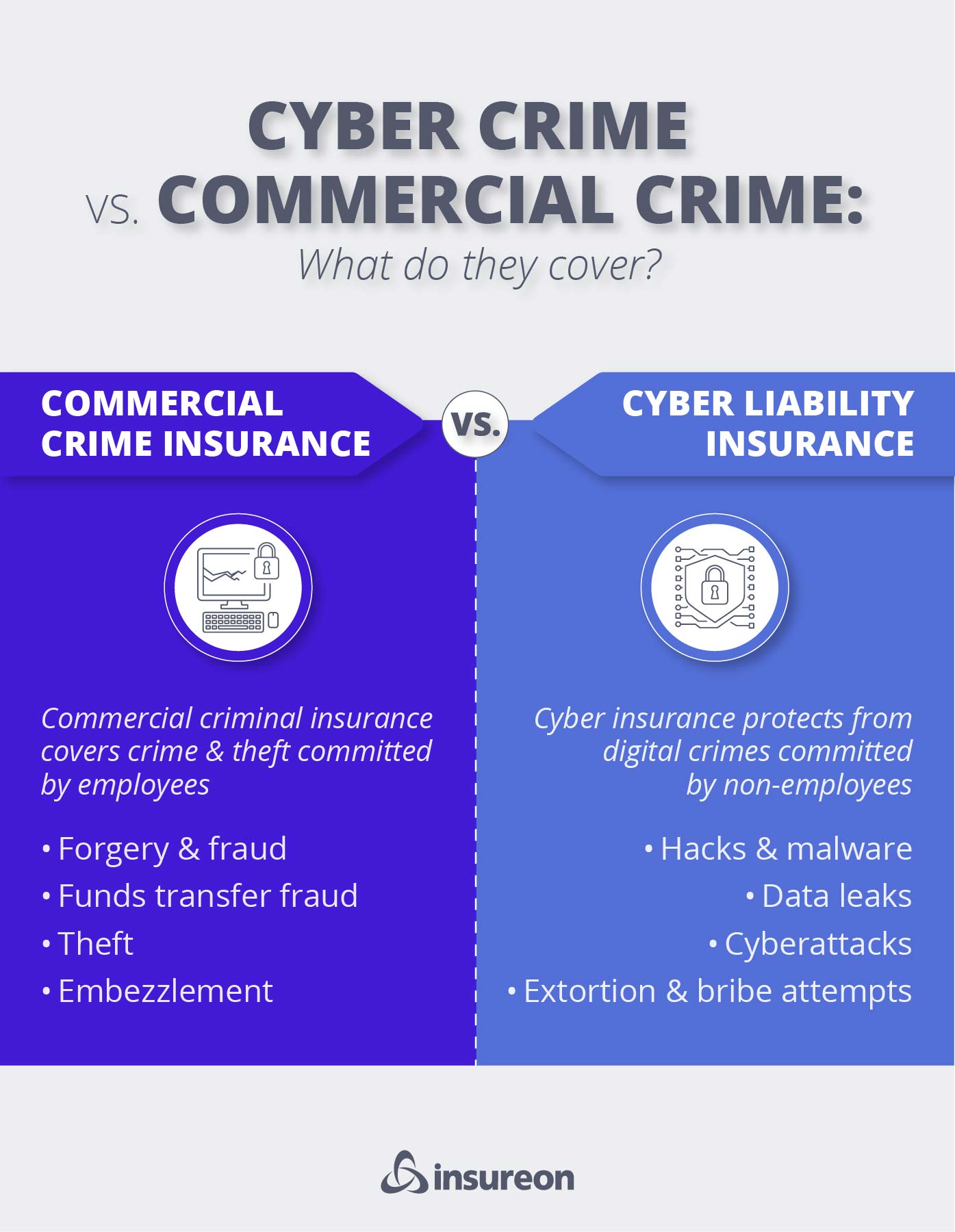

What's the difference between commercial crime and cyber insurance?

It's common for business owners to confuse commercial crime insurance with cyber insurance, but they protect against different types of financial harm. Using the wrong policy in a crisis could leave you without coverage.

| Policy | What it protects | Primary threat focus |

|---|---|---|

Commercial crime insurance | Money, securities, and physical property | Insiders (employee theft/fraud) and social engineering (tricking staff into sending money) |

Cyber insurance | Digital data, systems, and customer privacy | External hackers (data breaches, ransomware, system attacks) |

The critical distinction:

- Commercial crime insurance is designed to cover the direct financial loss of your tangible assets like cash, securities, and inventory – whether it's stolen by an employee or fraudulently transferred.

- Cyber insurance is designed to cover the costs and legal liabilities that arise from a digital attack. This includes hiring IT forensic teams, notifying affected customers after a data breach, and covering legal fees from lawsuits related to a security failure.

You need both because an exclusion in one policy often places coverage within the other. For example, your crime policy typically excludes losses related to data breaches, which is exactly what a cyber policy covers.

Get employee dishonesty insurance from trusted companies with Insureon

Complete Insureon's easy online application today to compare insurance quotes from top-rated U.S. companies. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy