Steps to get your cleaning business bonded and insured – and how much it costs

Cleaning businesses face a variety of different risks. Employee injuries, property damage, and employee theft can seriously hurt your business and your bottom line.

Cleaning business insurance and bonds can protect your cleaning business from potential pitfalls and liabilities. Here’s what you need to know about how to get bonded and insured, and how much it will cost you.

What does it mean to be bonded and insured?

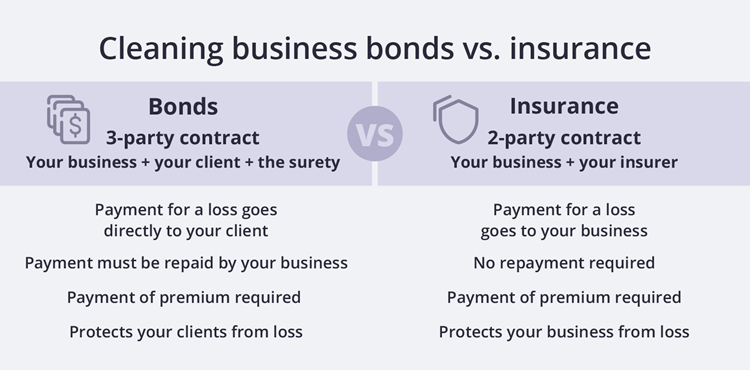

To be bonded and insured means that your cleaning business has purchased a surety bond, most likely a janitorial bond, along with business insurance coverage. Together, bonds and insurance protect your business, your employees, and your clients from common risks of doing business.

Although bonds and insurance are often grouped together, they offer different types of protection. Simply put, bonds safeguard your clients from theft, and insurance shields your business and employees from risks like bodily injury, property damage, and lawsuits.

Cleaning business insurance and janitorial bonds are typically required for client contracts, as well as agreements with landlords and lenders. Being bonded and insured can help attract clients because it shows that your company is reputable. It gives prospective customers peace of mind that they’re protected if they hire you.

How do I get bonded and insured?

1. Research requirements for your cleaning business

First, you’ll need to know what insurance coverage or bonds may be required by your city, county, or state. Start by contacting your local chamber of commerce to learn about the legal requirements in your area. At a minimum, you will need to get a janitorial business license. The agency can also explain any other commercial insurance or bond requirements.

For example, the state of Florida requires small business owners with five or more employees to carry workers’ compensation insurance, as well as commercial auto insurance for any business-owned vehicles.

If your business rents office space or cleaning equipment, your lease or rental agreements may also require you to carry insurance coverage. Check with your landlord and any equipment suppliers to learn what coverage you may need to carry.

Clients may also require you to carry a bond or insurance before they’ll hire you. It reassures them that they’ll be protected in the case of theft or property damage.

2. Determine your insurance budget

You probably have a limited amount to spend on cleaning insurance protection. That’s why you’ll need to figure out how much your business can afford to pay for coverage, and weigh the costs against the risks your company faces.

Keep in mind that getting the right types of cleaning business insurance will likely involve choosing several options to cover a range of business risks. You may be tempted to set aside the bare minimum for insurance protection, but underestimating your risks could hurt your business in the long run.

We’ve provided a summary of how much you can expect to pay for different cleaning business insurance policies and bonds below.

3. Evaluate and prioritize your biggest risks

Cleaning businesses face a variety of business risks. Here are some of the most common hazards cleaning companies face, and the types of insurance or bonds that will protect you:

- Third-party property damage: Imagine that you own a house cleaning company and your employee accidentally knocks over an expensive vase while dusting a shelf in a client's home. The client could sue your company for property damage. In this case, a general liability insurance policy would cover your legal fees and the replacement cost.

- Client injuries: If a client is injured on your property or because of your actions, it can lead to a costly lawsuit. For example, if you own a carpet cleaning business and the homeowner trips over a vacuum cord and breaks an ankle, your business could be liable. Fortunately, a general liability policy would cover the related medical expenses.

- Employee injuries or illness: Certain janitorial businesses, like window cleaning companies, can put employees at high risk of injury. If an employee falls off a ladder and gets hurt, you’ll need workers’ compensation insurance to cover the costs. Workers’ comp coverage is required in almost every state for businesses with employees.

- Business vehicle accidents: Say that you own a pool cleaning business and your employees travel to jobs in company-owned vans. Commercial auto insurance would cover the costs of vehicle or property damage, or injuries due to an accident. If your employees use their personal vehicles for business travel, you’ll need to consider hired and non-owned auto insurance.

- Employee theft: Unfortunately, dishonest employees are not uncommon. If one of your employees is caught stealing from a client, janitorial bonds will reimburse the client directly for their loss.

The best approach may be to make a list of the biggest risks your business faces, along with what coverage you’re required to carry by law or by contract. You’ll need to weigh these against your other business needs to determine the coverage that’s right for you.

4. Contact Insureon for assistance and get quotes online

If you need assistance figuring out your risks and prioritizing coverage, Insureon’s expert agents can help.

You can also find the best coverage options by answering three simple questions in our policy finder tool. Once you’ve determined the types of coverage that are right for your business, you’re ready to apply for insurance. Insureon will deliver you multiple quotes from top insurance companies.

How much will insurance and bonds cost?

The cost of bonding and insuring your cleaning business depends on a number of factors, such as:

- Size of your business

- Your location

- Risks your company faces

- Number of employees

- Deductibles and coverage limits you choose

You’ll probably choose to purchase several different types of protection for your business, and the cost will vary based on the coverage. Here’s a run-down of what you can expect to pay for each of the most common commercial cleaning business insurance policies.

General liability insurance

General liability insurance safeguards your business from common business risks, such as:

- Third-party injuries

- Third-party property and client property damage

- Advertising injuries such as libel or slander

General liability coverage is often required in client contracts and lease agreements.

The average cost of general liability insurance for a cleaning company is $48 per month, which adds up to about $580 per year. However, keep in mind that the type of cleaning services and the associated risk can impact your business insurance costs.

For instance, the average monthly cost of general liability insurance for a pressure washing business is $75, while the cost for a house cleaning business is $44 per month.

Most business owners choose a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit. The per-occurrence limit is the highest amount of money your insurer will pay for one claim. The aggregate limit is the maximum your insurance company will pay for all claims during your policy period (usually one year).

A general liability insurance policy is often combined with a commercial property insurance policy into what's commonly referred to as a business owner's policy (BOP).

Commercial auto insurance

Commercial auto insurance covers medical bills, property damage, and legal costs resulting from an accident in a business-owned vehicle. If you own a company vehicle, like a septic tank truck or pool cleaning van, it’s required by law in nearly every state, including New York, California, and Texas.

It may be that your employees use their personal vehicles for work purposes. If so, you should consider hired and non-owned auto (HNOA) insurance. It also covers rental and leased vehicles.

The average cost of commercial auto insurance for cleaning companies is about $173 per month, or about $2,075 per year. Hired and non-owned auto insurance policies cost about the same.

Commercial auto insurance premiums are calculated based on factors like:

- The type of vehicles your company owns

- The number of vehicles you own

- Your employees’ personal driving records

Workers’ compensation insurance

Workers’ compensation insurance covers an employee’s medical bills and lost wages from a work-related injury or illness. It’s required in nearly every state for cleaning businesses with employees.

The average cost of workers’ compensation insurance for a cleaning services company is $136 per month or about $1,627 per year. Insurers look at the number of employees you have and their occupational risk when calculating your premium.

Coverage requirements for workers’ comp vary by state. Make sure you know your state’s workers’ comp requirements before you purchase a policy to avoid penalties and fees.

Commercial umbrella insurance

Commercial umbrella insurance can boost coverage on these cleaning business liability policies:

- General liability insurance

- Commercial auto insurance

- Employer’s liability insurance (typically part of a workers’ comp policy)

Once the underlying policy’s limit is reached, your commercial umbrella policy will kick in to provide additional coverage.

Your small business may need this policy to satisfy the requirements of some client contracts.

The average cost of a commercial umbrella insurance policy for a cleaning business is $67 per month or about $801 per year. The rate you will pay depends on the amount of coverage you buy. Commercial umbrella insurance is usually sold in $1 million increments.

Janitorial bonds

A janitorial service bond is a type of surety bond that reimburses your clients for employee theft. Unlike insurance, your bond carrier (surety) will expect you to pay them back for any claims that are paid.

Residential or house cleaning companies are often asked to secure this bond by clients to protect in the event that an employee steals from a job site.

Janitorial bonds are usually inexpensive. The average bond cost is about $11 per month, and 78% of cleaning businesses pay between $100-$150 annually. If you run a high-risk business, expect to pay more.

Cleaning business bonds are available in various amounts. Over 50% of cleaning professionals choose a janitorial bond worth $10,000, and about 20% choose a bond worth $1,000. High-risk businesses should consider a larger janitorial bond for more protection.

Getting insured and bonded is well worth the cost. Without this protection, your business is vulnerable to common risks and costly lawsuits that can have a major impact on your company’s reputation and bottom line.

Get free insurance quotes for your cleaning business

Complete Insureon’s easy online application today to compare free quotes for business insurance from top-rated U.S. insurance companies. Our licensed insurance agents can help you find the right policy for your business needs and budget.

Once you pick your policies, you can receive your certificate of insurance and begin coverage. Most cleaning business owners begin coverage in less than 24 hours.

Kate Sortino, Content Specialist

Kate is passionate about all things related to content, marketing, and SEO. She enjoys taking complicated topics and making them delightfully readable. Kate has a background in software content marketing and has professionally written about many topics, including finance, SEO, and mental health. Before becoming a full-time writer, Kate worked in social services and healthcare. When Kate’s not sitting in front of a computer, she’s typically exploring the outdoors with her husband and puppy.