Workers' compensation insurance for truckers

Workers' compensation insurance covers costs if an employee at your trucking company is injured on the job. Almost every state requires this coverage for businesses that have employees.

Workers' compensation protects your drivers and your business

Even if you’ve taken precautions, you can’t protect your employees from every source of harm. Foremost is the risk of an auto accident, as your drivers are on the road every day. Lifting injuries, slip-and-fall injuries, and repetitive stress injuries are also common in the trucking industry.

A single injury can be financially devastating for a small trucking business. When an employee is injured, workers' comp insurance can pay for their medical expenses, provide disability benefits during their recovery time, and also protect against legal fees if the employee decides to sue.

Workers' comp provides coverage for employee injuries

In the event of a work-related accident, such as a highway collision or a fall from a truck's cab, workers' compensation insurance can cover a wide range of treatments and benefits, including:

- Immediate medical costs, such as an ambulance ride

- Ongoing medical costs, such as physical rehabilitation

- Disability benefits for employees who are unable to work

- Death benefits for fatal incidents

Workers' comp protects against employee injury lawsuits

If an employee suffers an injury on the job, such as hurting their back while loading or unloading freight from a truck, they could consider legal action against their employer.

Included in almost all workers' comp policies, employer’s liability insurance offers protection when a truck driver or other employee decides to sue the business owner over their injury.

Employer’s liability insurance can help cover:

- Attorney’s fees

- Court costs

- Settlements

- Judgments

Even if a lawsuit is frivolous, you could end up paying out of pocket for a costly legal defense. Employer’s liability insurance, however, does have limits on how much it will pay for a claim.

How much does workers' compensation cost for trucking companies?

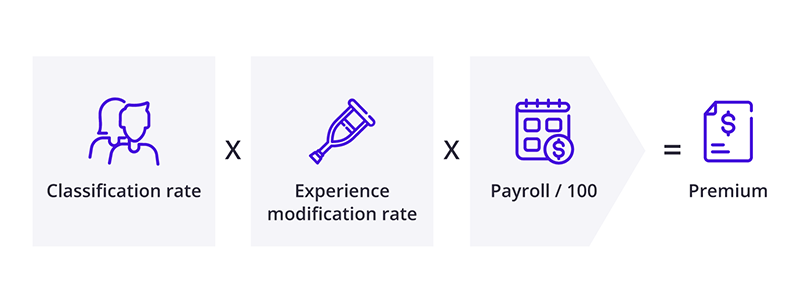

The amount you pay for workers' compensation is a specific rate based on every $100 of your business's payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

Workers' comp class codes for trucking businesses used to be more distinct based on where trucking routes were being driven. However, in 2018, the NCCI reclassified their codes to combine local truck driving and long-haul driving into one code.

It's important to make sure your classification codes are up-to-date and as accurate as possible to get the best workers' comp rate for your business and avoid penalties for underreporting your risk.

State laws set workers' comp requirements for trucking businesses

Each state has its own laws for when workers' compensation is required. For example, trucking companies in New York must carry workers' compensation insurance for their employees—even if they work part time. However, Alabama trucking companies are only required to carry workers' compensation when they have five or more employees.

Independent owner operators don’t have to carry workers' compensation insurance. But it's still a good idea for sole proprietors and independent contractors to carry this coverage for financial protection against work-related injuries, which health insurance might not cover.

Workers' comp can also help partially replace lost wages for owner operators while they are taking time off to recover from a work-related injury.

Workers' compensation laws in your state

What is a monopolistic state fund?

A monopolistic state fund is a government fund that is the only source of workers' compensation insurance in four states.

Truckers in the following states must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Insurance claims lead to an increase in your premium, which is one reason to avoid accidents in the first place.

Here are a few ways to boost employee safety at your trucking company:

- Supply workers with protective equipment, such as gloves and goggles.

- Teach ways to avoid common injuries, such as proper lifting techniques.

- Provide dollies, hand carts, and other moving equipment.

- Inspect trucks and equipment regularly for wear and tear.

- Make sure work areas are well lit and free of clutter.

- Avoid calling or texting workers while they are driving.

Through a safe work environment and risk management, you can reduce the likelihood of an injury. That means fewer claims—and a lower insurance premium.

Other important policies for trucking firms

Workers' compensation insurance for truckers is one of the most important types of coverage, but it's not the only policy you need. Small trucking companies often purchase:

General liability insurance: A general liability policy covers third-party injuries at your office, defamation lawsuits, and copyright infringement. It's often required for a commercial lease.

Business owner's policy (BOP): Low-risk trucking companies can bundle general liability coverage with commercial property insurance in a BOP for a discount. This package protects against common lawsuits and business property damage.

Commercial auto insurance: This policy covers the cost of accidents involving your company's trucks and other vehicles, including medical payments and legal defense costs. Most states require this coverage for vehicles owned by a business.

Trucking firms typically also purchase marine cargo insurance, which covers property while in transit that the firm is legally responsible for insuring, and trailer interchange coverage, which pays for physical damage to a trailer that the truck driver doesn't own.

Get free quotes and buy online with Insureon

Are you ready to safeguard your trucking business with workers' compensation insurance? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage and get a certificate of insurance in less than 24 hours. A licensed insurance agent is available to help make sure you get the right coverage at the best possible price.