A guide to workers' comp benefits for employers

Workers’ compensation insurance provides financial benefits like lost wages and medical care to employees who suffer a work-related injury or illness. Most states require employers to carry this coverage. Unlike health insurance, this benefit only applies to workers who become sick or injured on the job.

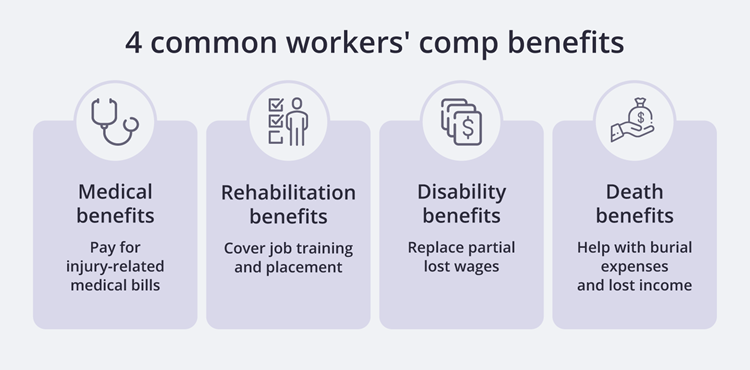

Workers' compensation benefits fall into four categories:

Let’s take a look at the four types of workers’ comp benefits that are available to injured workers, and how they work.

1. Medical benefits

The workers’ comp process involves several steps. Employees are responsible for reporting an on-the-job injury or work-related illness. As the business owner, you’re usually responsible for filing the workers’ compensation claim. Once a claim is approved, your insurance company will cover the employee’s medical expenses resulting from the injury or illness.

These medical costs may include:

- Doctor’s visits

- Hospital, emergency room care, and surgery

- Medications

- Physical therapy

- Equipment, such as crutches and wheelchairs

- Chronic pain management

Workers’ comp insurance medical benefits aren’t subject to deductibles, co-pays or overall financial limits – although some state laws do limit coverage of medical bills based on what treatment has been authorized. For example, the insurer may approve a certain number of physical therapy treatments.

Medical expenses are generally covered until the injured worker reaches maximum medical improvement (MMI), which is the point where additional treatment won’t further improve their condition. For example, a worker who suffered a leg injury may now walk with a limp and have trouble standing for extended periods of time, and no additional surgery or amount of physical therapy will fix that.

Once MMI is reached, covered medical costs may be limited to only treatment that helps maintain MMI, and time limits on benefits may apply. At this point, an employee may be assigned an impairment or disability rating, ongoing work restrictions may be defined, and the workers’ comp settlement process often begins.

Medical expenses are generally covered until the injured worker reaches maximum medical improvement (MMI), which is the point where additional treatment won’t further improve their condition.

2. Disability benefits

If an injured employee is unable to work, disability benefits can replace part of their wages lost from a work-related injury. The amount of wage replacement depends on the employee’s earning capacity, the type of disability, and state regulations. It’s usually based on the employee’s weekly pay before the injury.

For employees who need time to recover or seek medical treatment, these disability benefits can replace some of their lost income until they’re back on the job. If an employee suffers a permanent disability, this workers’ compensation benefit could be for life.

Some states limit workers’ comp disability benefits to a specified number of weeks, a maximum dollar amount, or until an employee reaches a certain age.

Whether disability benefits are temporary or permanent depends on the employee’s level of impairment. Temporary disability benefits and permanent disability benefits each come in two forms, total or partial:

Temporary total disability: The employee is unable to work for a period of time, but is expected to resume their job duties, such as an employee who requires surgery or suffers a broken bone.

Temporary partial disability: An employee can still work, but at a limited capacity or on a part-time basis. For example, an employee who suffers a broken arm might still be able to perform some of their duties.

Permanent total disability: The employee suffers a permanent injury and will never return to their previous role, such as an employee who loses their vision and is unable to return to their former job in any capacity. Some states require these benefits to be paid for the life of the employee. Other states restrict the amount of time the benefit is paid – allowing benefits for a limited number of weeks or ending benefits at retirement age.

Permanent partial disability: The injury is permanent and the employee can resume working, but at a reduced capacity that prevents them from earning their income before the injury. For example, an employee who suffers from hearing loss might still find work, but perhaps at a lower income level than before the injury.

How benefits are calculated

The amount of benefits an employee is eligible for varies by state and is based on a percentage of the employee’s average weekly wages (AWW) for the previous 12 months. In most states, benefits are set at two-thirds of the employee’s AWW. Some states set their maximum level for disability benefits based on the AWW of the entire state.

Employees must go through a waiting period before they can receive weekly benefits. This varies by state but is typically between three and seven days.

3. Rehabilitation benefits

Vocational rehabilitation provides support for injured workers who are permanently disabled and unable to return to their former job.

Vocational rehab may go by other names, such as supplemental job displacement in California. This benefit usually covers costs like:

- Job training

- Skills assessment and testing

- Resume assistance

- Job development and placement

- Tuition

- Books and other expenses

Rehabilitation benefits cover the cost of retraining, so an employee can acquire new skills or certifications needed to resume work at a job that pays as close to their previous earnings as possible.

These benefits are required by most states and may include up to two years of vocational training or education.

4. Death benefits

Workers’ comp death benefits are sometimes called survivor’s benefits and are similar to life insurance. If an employee dies from a work-related injury, workers’ comp provides benefits to the employee’s dependents, such as a spouse, minor children, or elderly parents living in their household.

Death benefits pay for burial costs and funeral expenses in nearly every state. They may also help cover lost income. Benefits vary by state, and may be paid in installments or as a lump sum.

Death benefits may also be payable years after an injury, if an employee’s death is related to the work injury or illness. For example, a worker exposed to toxic chemicals may develop terminal cancer years later.

Factors that may affect workers’ compensation benefits

Workers’ comp is a “no-fault” system, which means an employee who is injured on the job is eligible for benefits even if they’re responsible for causing the injury. This benefits the worker because they receive benefits regardless of fault. It also benefits employers, because the injured employee is typically unable to sue for benefits in court and must seek compensation through the workers’ compensation system.

There are, however, certain circumstances where an employee could be ineligible for workers’ comp benefits, or face a reduction in benefits, such as:

- If the employee injures themselves on purpose

- If the employee’s injury was related to the use of alcohol or drugs

- If the employee refused to wear required safety equipment

An injured worker might also claim that their employer’s negligence caused their injury and file suit. Most workers’ comp policies include employer’s liability insurance, which will cover the employer’s:

- Attorney’s fees

- Court costs

- Any judgments or settlements

Are workers’ comp benefits taxable?

Workers’ compensation benefits are generally considered tax-exempt, although it depends on whether the employee is receiving other means of financial support.

If the injured employee is receiving workers’ comp benefits, plus Social Security disability, retirement benefits, or some other form of supplemental income, their workers’ compensation benefits could be taxable under the law.

Employees are encouraged to consult with an attorney or tax professional about their benefits, as it could have a significant impact on their financial health.

Complete Insureon’s easy online application today to compare quotes for workers’ compensation and other kinds of business insurance from top-rated U.S. carriers. Once you find the right policy, you can get coverage in less than 24 hours.