Workers' compensation settlements: A guide for employers

Workplace accidents and injuries are an unfortunate fact of business life – and an expensive one.

Private employers reported 2.6 million nonfatal workplace illnesses and injuries in 2021, according to the U.S. Bureau of Labor Statistics. Each week, U.S. companies pay an estimated $1 billion on disabling workplace injuries.

To protect employers and workers from the financial risks of workplace injuries, nearly every state requires businesses with employees to carry workers’ compensation insurance. This no-fault coverage protects you from employee lawsuits related to injuries. It also protects injured workers by covering costs such as:

- Injury-related medical bills

- A portion of lost wages

- Disability benefits

Filing a workers’ comp claim can be simple. But settling one is often a different story.

When you and your injured worker understand workers’ comp settlements, the process will be smoother for everyone. To learn more, let’s take a look at:

- The basic workers' comp claims process

- What’s involved in the settlement process

- How settlements are calculated

- Why some cases end up in court and what to expect

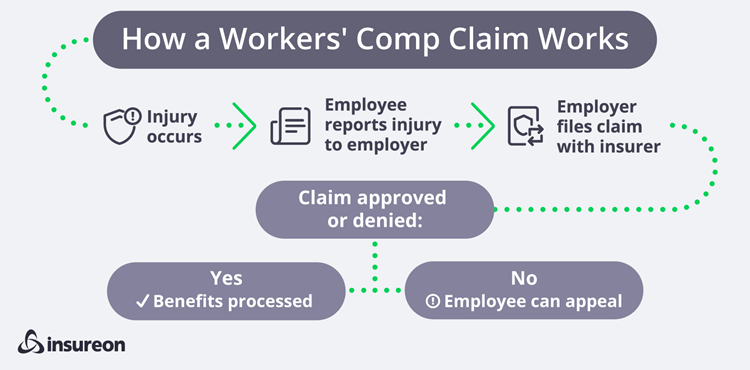

How the workers’ comp claim process works

Employers and employees each play an important role in the workers’ comp claim process.

When an employee suffers a work-related injury, they must quickly report it to their employer or risk losing benefits. States have various deadlines for reporting a workers’ comp injury, ranging anywhere from 72 hours to two years. Most typically require a report within 30 days to start the workers’ comp claims process.

As the employer, you should follow these steps once you’re told an employee was hurt:

- Get the employee medical attention. If you learn of an injury right away, help the employee receive the proper care.

- Investigate the accident. You have a duty to document what happened and identify possible safety issues. This may include asking witnesses for statements and taking pictures.

- File a claim. You’re usually responsible for filing a workers’ comp claim with your insurance provider. Rules vary, but you may also need to submit documentation to the state workers’ comp board.

Once a claim is filed, the workers’ comp insurance company will either approve or deny it. You may be involved if an investigation into where and how the injury happened is needed. The insurance company may also review medical files and accident reports.

What happens when a claim is denied?

Insurers usually deny claims for injuries that:

- Are self-inflicted

- Are caused by fighting or horseplay

- Occurred during an employee’s work commute

- Occurred while under the influence of alcohol or drugs, violating company rules, or committing a crime

The injured worker may appeal the denial and possibly hire an attorney to represent them. The appeal process typically involves an administrative hearing. You can learn more about the hearing process in the role of workers' comp hearings below.

What happens when a claim is approved?

If the workers’ compensation claim is approved, the insurance company will pay for any medical expenses related to the injury.

While an employee is unable to work, they will receive a portion of their wages as a weekly benefit. Your workers’ comp insurer will also pay these temporary total disability benefits (typically two-thirds of the employee’s regular pay).

Temporary total disability benefits end after an employee returns to work – even if they still have an open claim. For example, let’s say a worker trips and sprains their ankle on the way to get coffee in the office break room. They’re able to work, but they continue to receive physical therapy.

The insurance company would continue to pay for any medical bills related to the claim. Because the employee’s back at work, their temporary disability benefits would end.

Some employers also develop return-to-work programs to help get their injured employees back on the job. These programs come with significant benefits.

If an employee refuses an offer of light or modified duty work by an employer, in some states they may lose additional benefits.

What is a return-to-work (RTW) program?

Your goal should be to get your injured worker healthy and back on the job as quickly as possible. A return-to-work program can help.

This option typically lets an employee perform light or modified work that’s less taxing than their normal responsibilities. Be sure to formally document your plan.

For employees, benefits may include:

- Improved morale: Getting back in the saddle and connecting with people can help with recovery.

- Maintaining skills: Abilities can decline the longer a worker is away from the job.

- Financial security: Workers who return to work usually end up making more than the partial wages they receive while off work.

For you, the employer, the advantages can include:

- Employee retention: The longer employees are off work, the less likely they’ll return. Studies have found employees out of work for six months or longer have less than a 50% chance of ever returning. An RTW program can help you hold on to valuable workers.

- Reduced employment costs: Getting an employee back to work helps avoid the costs of hiring and training temporary replacements.

- Lower workers’ comp costs: The faster employees return to work, the lower your claim costs. This helps keep future premium rates down.

- Reduced litigation: Return-to-work programs allow for open communication and show employees you care, decreasing litigation costs.

Be sure your program encourages injured workers to return to work when they’re ready, and doesn’t pressure them to come back prematurely. Leave it to the medical professionals to make those decisions.

If an employee refuses an offer of light or modified duty work by an employer, in some states they may lose additional benefits. That’s why it’s critical for workers and employers to know employees’ rights in their state.

Done right, a return-to-work program can help pave the way for a smooth claim resolution.

How workers’ comp settlements are reached

If a worker recovers fully and goes back to work with no outstanding bills or unpaid benefits, the claim can simply be closed.

In many states, closing a claim involves a settlement negotiated between the insurer and the injured worker, often through their attorney. (If the parties can’t reach an agreement, a judge will need to decide after a hearing, described in detail in the next section.)

The settlement process typically begins with an offer from the insurance company and employer. This may include payment for unpaid benefits or medical bills, as well as costs of future treatment. If an injury leaves a worker permanently impaired, they may also be entitled to a disability award to compensate them.

A work injury settlement can be either a lump sum or a structured payment plan:

- Lump sum payment: The employee receives a one-time payment for all medical costs and benefits under the claim. Depending on the state, they may have to agree not to seek any future reimbursement for the injury.

- Structured payment: The employee will receive regular payments over a specified period of time. They may include a separate medical account to pay for future medical care.

Before a settlement is reached, the employee and their attorney calculate what they think the workers’ comp payout should be. It should be enough to cover previous medical care and future medical costs. The settlement should take into account:

- Balances on medical bills, including ambulance rides

- The likelihood of future treatments, such as surgery or physical therapy

- Lost wages or future wage loss

- Temporary or permanent disability payments

- Attorney fees

- State workers’ comp laws and restrictions

Once the calculation is finalized, the employee and their attorney will negotiate with the insurance company. Typically the final settlement is a compromise between the two parties.

In many states, a workers’ compensation judge must review the proposed settlement before it’s finalized. The judge will consider whether it’s fair to the employee, but it’s always helpful for the injured worker to have legal representation to protect their interests.

Your role is minimal during settlement negotiations. Still, keep the lines of communication open and stay updated on progress.

Settlements may take weeks or months to hammer out. During this time, be sure your employees know their return-to-work options. Injured workers who are kept informed and know their options are less likely to sue.

If the insurer and the employee can’t reach a settlement, then they’re probably headed to court for a hearing. That can be a bit of a gamble for both sides.

The role of workers’ comp hearings

Workers’ comp claims can land in court for two main reasons:

- If an injured worker has their claim denied, they have the right to appeal. States differ, but if the insurer still denies the claim, the injured worker can request an appeal hearing before a judge to consider their workers’ compensation case.

- For approved claims, if the parties don’t settle or aren’t willing to negotiate, the employee and their attorney may opt to let the court decide.

A workers’ comp trial to determine a fair settlement is usually called a workers’ comp hearing or lawsuit. At a hearing, both sides present their position.

Taking a workers’ comp case to trial can be risky for both insurers and injured workers. A judge may order a settlement that’s far below or above what either side was offering.

The judge evaluates the case and will decide on an appropriate settlement amount. The insurance company must follow the judge’s order to pay the claim, and the settlement is complete.

Taking a workers’ comp case to trial can be risky for both insurers and injured workers. A judge may order a settlement that’s far below or above what either side was offering.

You’ll have little involvement in the hearing process. Your main responsibility is providing each side with any necessary information.

Ideally, the goal is to resolve claims without a bitter court fight. The most important thing is to quickly get an injured worker back to health and back on the job whenever possible – for everyone’s benefit.

Building trust and cooperation can go a long way to encouraging a settlement and avoiding litigation.

Get quotes from trusted insurance companies with Insureon

Complete Insureon’s easy online application today to compare quotes for workers' comp and other business insurance policies from top-rated U.S. companies. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Jen Matteis, Content and Production Editor

Jen is an expert on small business insurance, a talented writer, and meticulous editor. She’s written and edited hundreds of articles to help inform small business owners about their insurance options. Prior to joining Insureon in 2018, Jen served as a senior copywriter at a digital marketing agency, and as a writer and editor for newspapers on both coasts. In her spare time, she writes fiction.