Workers’ comp insurance for landscaping and tree service businesses

Workers' compensation insurance covers medical costs and lost wages for work-related injuries and illnesses at your landscaping company. This policy is required in almost every state for businesses that have employees.

Workers’ comp protects your landscaping workers

Landscaping involves physical work that could cause an employee injury. If a lawn care company's employee has an adverse reaction to a pesticide, or a tree trimmer is hit by a falling branch, it could lead to costly medical bills.

Workers’ compensation insurance covers medical expenses from workplace injuries and illnesses. It also helps pay for wages while the employee is recovering.

Sole proprietors might decide to buy this coverage for themselves, as it provides financial protection against work injury claims that health insurance could deny.

Workers’ compensation can help pay for an injured employee’s:

- Immediate medical care, such as an ambulance ride or emergency room visit

- Ongoing medical costs, including medication

- Disability benefits while the employee is unable to work

Workers’ compensation protects landscaping business owners

Employer’s liability insurance, which is usually included in a workers’ comp policy, protects landscape designers, irrigation companies, and other landscaping businesses if an employee decides to sue a business owner over a work-related injury.

Employer’s liability insurance typically helps cover:

- Attorneys' fees

- Court costs

- Settlements

Even when a lawsuit is without merit, you could end up paying for an expensive legal defense if uninsured.

How is workers' comp calculated for landscapers?

The amount you pay for your workers’ compensation coverage is a specific rate based on every $100 of your business’s payroll.

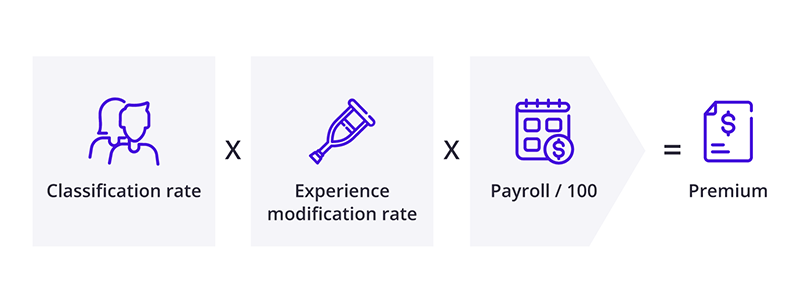

Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers’ comp requirements for landscaping businesses

Each state has its own laws for workers’ compensation requirements. For example, every landscaping or tree service business in California must carry workers’ compensation insurance for its employees – even part-time workers.

On the other hand, North Carolina landscaping businesses are only required to carry workers’ compensation when they have three or more employees.

While independent contractors, sole proprietors, and partners don’t have to carry workers’ compensation insurance coverage, you can purchase a policy to protect yourself, too.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, landscaping businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Lower workers’ comp costs with risk management

Tree trimming, gardening, and other landscaping work are filled with risks involving hazardous equipment, tools, and chemicals. You can create a safer work environment with:

- Employee safety training

- Proper equipment, such as gloves and goggles

- Equipment maintenance

Through risk management and a safe work environment, you can decrease workplace accidents. That means fewer workers' compensation claims – and potentially a lower insurance premium.

Additional ways to save money on workers' comp are to customize your policy to fit your needs, like choosing a pay-as-you-go policy, and selecting the correct classification codes.

Learn more about other ways to reduce your workers' compensation insurance costs.

How much does workers' comp for landscaping businesses cost?

Most landscaping companies pay an average of $169 per month, or $2,029 yearly, for workers' comp insurance. However, you could pay more or less depending on your risks.

Insurance costs for landscaping professionals are based on several factors, including:

- Landscaping services offered

- Business equipment and property (lawn mowers, hoes, etc.)

- Revenue

- Location

- Number of employees

Other important insurance policies for landscapers

A workers’ compensation policy offers protection for your employees and to some extent your business, but it doesn’t cover every risk.

Landscaping business owners should also consider:

- General liability insurance: This policy covers expenses related to customer injuries and property damage, such as accidental damage to a customer's fence.

- Tools and equipment insurance: A type of inland marine insurance, this policy covers a landscaping contractor’s business property if it is lost, stolen, or damaged while it's in transit, stored off-site, or in use at a client's home or other jobsite.

- Business personal property (BPP): This endorsement to your general liability policy covers items owned by your business that are kept at a designated location, though your business might not have a building.

- Business owner's policy (BOP): A BOP bundles general liability coverage with commercial property insurance at a discount. It includes coverage for fires, theft, and other common property claims at your building.

- Commercial auto insurance: Required in most states, commercial auto insurance covers vehicles owned by your business. It can pay for injuries and property damage in an accident, along with vehicle theft, weather damage, and vandalism.

- License and permit bonds: Landscapers might need a surety bond to get a license in their state, or to do specific types of work.

Get free landscaping insurance quotes and buy online with Insureon

Are you ready to safeguard your irrigation, landscape design, tree service or other lawn care business with workers' comp coverage?

Complete Insureon’s easy online application to compare quotes from top U.S. insurance companies. A licensed insurance professional is available to discuss the best types of insurance coverages for the landscaping industry and answer all of your questions.

Once you find the landscaping business insurance policies that fit your unique business needs, you can begin coverage and get a certificate of insurance in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy