Does workers’ comp insurance cover business owners?

Whether you’re a small business owner with employees or an independent contractor, you’re likely exempt from carrying workers’ comp insurance coverage for yourself. However, workers’ compensation can save you from significant out-of-pocket medical care expenses due to work-related injuries or lost income.

When is workers’ compensation insurance required?

Workers’ compensation insurance covers medical expenses and lost wages for injured employees, and it’s often required by state laws when you have employees.

Let’s say an employee slips and is injured or becomes ill due to harmful chemicals on the job. Their medical treatment and a portion of their lost wages would be covered by workers’ compensation insurance.

As requirements vary by state and industry, it’s important to check your state’s workers’ compensation laws regarding coverage and exemptions. Usually, the number of employees determines when you need workers’ compensation insurance. In most cases, it’s required as soon as you hire your first full-time or part-time employee.

General contractors and others in high-risk professions may need this coverage even when they work alone.

Workers' compensation laws in your state

Do business owners need workers’ compensation for themselves?

Required in most states, workers’ comp protects employees from on-the-job injuries.

And while self-employed individuals and independent contractors are exempt from coverage requirements, they might purchase a policy to fulfill a contract or cover medical bills and lost wages from a work-related injury.

In most cases, personal health insurance won’t cover work-related mishaps or lost income from an injury on the job.

Depending on your state, if you hire subcontractors, you may be required to provide workers’ compensation for them.

Finding the right policy is easy. Get workers’ compensation quotes from Insureon today. Click the link to get started.

Typically, independent contractors, self-employed individuals, and members of limited liability companies (LLCs) are exempt from purchasing workers’ compensation insurance. Additionally, employees who work nominal days or earn little are waived from workers’ comp. For example, employees who may fall under this exemption status include:

- Agricultural workers

- Volunteers

- Government workers

- Real estate agents

As the business owner, it’s up to you whether you waive your coverage or elect to carry workers’ comp. However, there are benefits to having this coverage even when you’re not required to carry it, such as:

- To fulfill a contract. Some jobs require anyone performing work to carry their own policies, including workers’ comp.

- To cover medical bills and lost wages. Even if you already have health insurance, most personal policies exclude work-related injuries and illnesses.

Do sole proprietors need workers’ comp?

A sole proprietor with no employees isn’t required to carry workers’ compensation insurance. However, it can be a wise choice because of the financial protection it provides and the ability to obtain certain jobs.

Do you hire subcontractors? Your state might view them as your employees and require you to have workers’ comp for them. If they suffer an injury while working, and the state says they should have been categorized as an employee, your sole proprietorship could be left with hefty fines and liability.

How much does workers’ compensation cost for business owners?

The average cost of a workers’ compensation insurance policy is $45 per month, or $542 annually, for small businesses. For an individual business owner, this cost may look different.

If you're a business owner and have employees, you’ll already be required to have a workers’ compensation policy. So, it might cost less than you think to bundle yourself into that policy.

Insurance carriers look at several factors to determine the cost of workers’ comp coverage, including:

- Industry you operate in

- Your claims history

- Total payroll

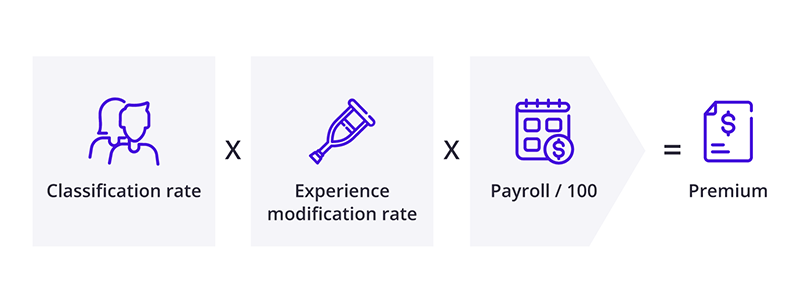

Each factor becomes part of a formula to calculate workers’ comp premiums:

Based on the different types of businesses, the National Council on Compensation Insurance (NCCI) will provide a numerical class code. Each class code has a rate assigned to it that is used when calculating your workers’ compensation premium.

Next, your experience modification rating (EMR or e-mod) is your history of compensation claims. If you have zero claims, you’d start with an EMR of 1.0. That number could increase after several workers’ compensation claims or drop after many years without a claim.

Finally, you’ll pay a certain amount of premium for every $100 in payroll, based on your average weekly wage.

How can I save money on workers’ compensation coverage?

A few different policy options can help you save money when it comes to insurance costs.

Pay-as-you-go workers’ compensation offers a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll.

Minimum premium workers' comp sets your insurance premium at the smallest amount of money an insurance company can allow.

Additionally, a workers’ compensation ghost policy can help you land clients and comply with state laws. This policy provides a certificate of insurance (COI) without having to pay for a full workers’ comp policy. However, to obtain a workers’ comp ghost policy, you must meet two requirements:

- You must be the business owner

- You can’t have any employees

A ghost policy provides no benefits, but lets you check the box for compliance in situations where businesses are required to carry workers’ comp.

How to get workers’ comp quotes with Insureon

Complete Insureon’s easy online application today to get insurance quotes from top-rated U.S. carriers. You can also consult with an insurance agent on your business insurance needs. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy