What is an employee?

Knowing who is considered an employee of your small business under the law can be confusing – especially if you have a mix of independent contractors, subcontractors, and employees that keep your business running.

It’s important that you have a good understanding of employment relationships and who to count among your employees. If you don’t, there could be legal or financial implications, particularly when you’re buying small business insurance or handling taxes. Even a mistaken misclassification could result in a lawsuit, fines, or penalties.

How the law defines employees

The most basic common law definition of an employee is someone you hire and pay regular wages to perform a specific job, with the employer controlling how the work is performed.

For employees, an employer must withhold income taxes and pay Social Security, Medicare taxes, and unemployment taxes on any wages paid. Of course, this information must be documented in accordance with federal law and any applicable state regulations.

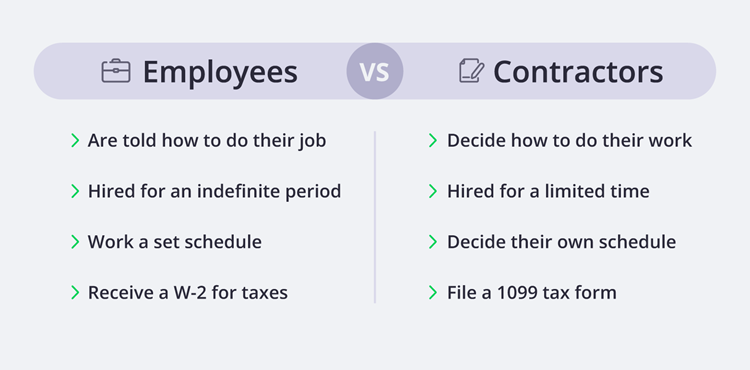

Employees receive a W-2 form listing their taxes, Medicare, and Social Security contributions withheld by the employer. Employees also:

- Are hired for an indefinite period of time

- Use the employer’s equipment

- Typically maintain a set schedule

- Are directly supervised, and told what to do and how to do it

- May receive benefits like health insurance and a pension plan or 401(k)

The most basic common law definition of an employee is someone you hire and pay regular wages to perform a specific job, with the employer controlling how the work is performed.

How contract workers differ from employees

Independent contractors, freelancers, and gig workers are self-employed and contracted to do a project according to their own methods, usually for a limited period of time. They have a greater degree of control than employees, because their clients specify what needs to be done, but not how it gets done.

Unlike employees, independent contractors are subject to self-employment taxes and must take care of their own tax withholdings or prepayments to state and federal tax authorities. They typically work under a written contract signed by both parties, and usually aren’t eligible for unemployment insurance.

Independent contractors or freelancers use a 1099 tax form, pay their own self-employment taxes, and are responsible for paying their own Social Security tax (FICA) contributions.

Typically, independent contractors:

- Are hired for a set period

- Sign a contractor agreement with their client

- Must provide their own equipment

- Receive a flat fee

- May work for several clients simultaneously

Are owners and partners considered employees?

Business owners and their partners are not typically considered employees of their business. To count yourself as an employee, you must receive some type of regular wage. Whether this is an option depends on your business structure. For example:

- Sole proprietorships and partnerships don’t receive a salary or wages and must pay self-employment taxes to the Internal Revenue Service via a 1099 form.

- If you form a corporation, you can pay yourself a salary and receive a W-2 form, just like any other employee of your business.

- If you form a Limited Liability Company (LLC), you may enjoy some of the benefits of a corporation, although you’ll still have to pay self-employment tax contributions towards Medicare and Social Security.

Regardless of the business structure you choose, the cost of your business insurance is likely tax deductible.

Why you need to know who’s considered an employee

As a small business owner, you need to know who is considered an employee according to the IRS, because you’re responsible for withholding payroll taxes and FICA contributions for them. Failure to do so could result in criminal or civil penalties against you.

Beyond the tax implications, businesses are also required to carry workers’ compensation insurance for employees in nearly every state. In fact, most states require this coverage as soon as you hire your first employee.

You should also check the workers’ comp law in your state, because some states require you to carry coverage for other individuals, such as volunteers for nonprofits.

As a small business owner, you probably won’t have to buy workers’ comp for yourself, although there are exceptions. For example, in California, if you’re a roofer, you’re required to have workers’ comp coverage even if you’re a sole proprietor.

Keep in mind that your general liability policy only covers injuries to third parties, not your employees. If someone is injured on your property, you’ll need to know if that person would be covered by workers’ comp or your general liability policy.

Properly identifying your employees is also important when applying for small business insurance, as you’ll have to identify how many employees you have. Your employee count should usually include the number of people you pay a wage to and withhold taxes for, and exclude you, your business partners, and any contractors you hire.

Does it matter if employees are part-time or full-time?

Whether your employees are part-time or full-time can impact things like pay and employee benefits. Generally speaking, part-time workers aren’t eligible for overtime under the Department of Labor’s Fair Labor Standards Act, or offered benefits like health insurance.

Part-time employees are typically identified as those who work less than 40 hours per week, although some employers consider an employee to be eligible for benefits like paid time off and retirement plans if the employee regularly works at least 32 hours per week.

Under the Affordable Care Act, employers with 50 or more full-time employees working at least 30 hours per week must provide health insurance benefits to all employees working 30 or more hours per week.

While your employees’ full-time or part-time status matters for labor laws, it makes no difference for tax purposes. You must still withhold FICA contributions and provide employees with a W-2.

For workers’ compensation insurance, you must carry coverage regardless of whether employees are full-time or part-time. Your costs will probably be lower with part-time employees, because workers’ comp premiums are calculated based on payroll.

The bottom line

Of course, any agreements between you, your employees, and your contractors must follow state and federal laws. The first step to staying compliant is knowing who’s considered an employee, how to categorize any working relationships you have, and what your obligations are under the law.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.