Liquor liability insurance cost

Liquor liability insurance (sometimes called dram shop insurance) costs vary based on a number of factors about your business. Your premium is directly impacted by your type of business, the extent of coverage, your alcohol sales, and where your business is located.

What is the average cost of liquor liability insurance?

Small businesses pay an average premium of $45 per month, or about $542 annually, for liquor liability insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical liquor liability insurance costs for Insureon customers

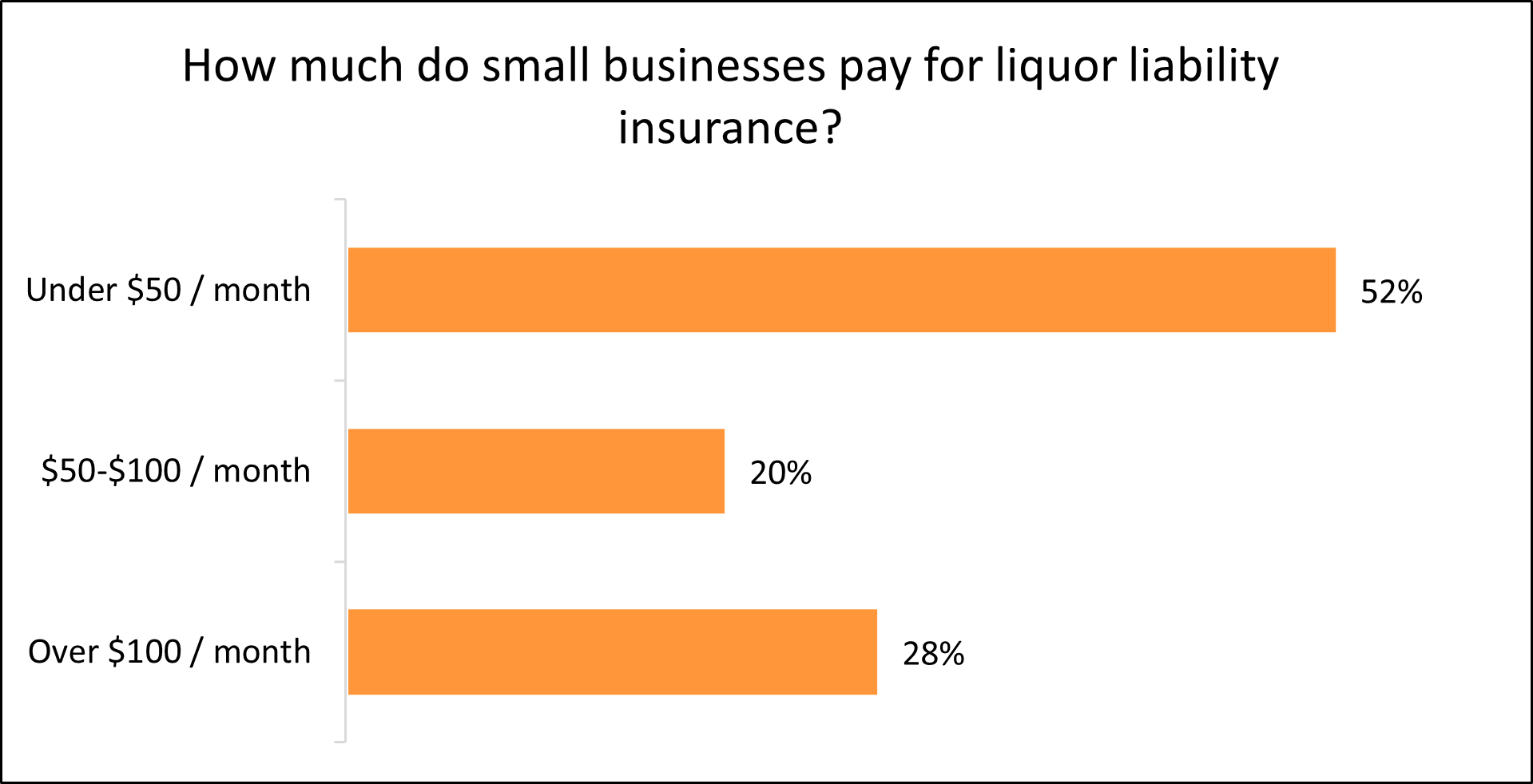

While Insureon's small business customers pay an average of $45 monthly for liquor liability coverage, 52% pay less than $50 and 20% pay between $50-$100.

The cost varies for small businesses depending on their risks and the coverage they choose.

How do policy limits impact liquor liability insurance costs?

Your coverage limits influence how much you’ll pay for liquor liability insurance. Higher limits cost more, but also provide more coverage.

For Insureon customers, the average limits for liquor liability insurance are $2 million for bars and $1 million for restaurants.

Liquor liability insurance covers legal fees, settlements and medical expenses, up to the policy limit, if alcohol is sold to an intoxicated individual who then causes harm or damages property.

This policy is often required for any small business that serves alcohol, such as liquor stores or taverns, in order to obtain a liquor license.

To protect your small business from all risks, you should consider purchasing additional liability coverages, such as a general liability insurance policy for financial protection against third-party bodily injuries and property damage.

View our recommended insurance policies for food and beverage businesses.

Top professions that need liquor liability insurance

Don't see your profession? Don't worry. We insure most businesses.

What other factors affect liquor liability insurance costs?

Your policy limit is just one factor mentioned that will impact the cost of your liquor liability insurance policy.

Your insurance provider will also look at a number of other factors when calculating your premium, such as your deductible, alcohol sales, and location.

How does your deductible influence cost?

The deductible you choose impacts the cost of your liquor liability coverage. The higher your deductible is, the less expensive your premium will be.

Selecting a more costly deductible is an easy way to save on your premium, but be sure to choose one that you can still afford. If you can’t pay your deductible, you can’t collect on a claim.

How do your liquor sales affect cost?

The cost of liquor liability insurance is influenced by what percentage of your sales are made from alcohol. The cost goes up for businesses with a higher percentage of alcohol sales.

This often means bars pay more for liquor liability insurance than restaurants, grocery stores, pharmacies, and other businesses that sell food and other items as well.

For larger liquor sales events, such as fundraisers, weddings, or festivals, you may want to consider special event insurance. This policy is great for vendors who don't need to carry insurance all the time and want to save money on an annual policy, but still need short-duration coverage in the event of an incident.

How does your business location impact cost?

Some state laws specify how much liquor liability coverage a business must have if it allows alcohol consumption on its premises.

For example, businesses in South Carolina that serve alcohol after 5 p.m. are required to carry a minimum of $1 million in liquor liability insurance. Oregon businesses that sell alcohol are required to carry at least $300,000 in liquor liability coverage. Some states increase their minimum coverage limits every year.

Other states, like California, do not have any liquor liability requirements, but small businesses should still consider the policy to navigate the risks associated with selling alcohol.

Below are average liquor liability costs in different states based on Insureon customers:

- Illinois: $19

- Michigan: $20

- Florida: $34

- Oregon: $34

- Washington: $34

- North Carolina: $34

- California: $39

- Texas: $58

- Colorado: $66

- New York: $130

How does your claims history influence cost?

Insurance companies will consider your claims history to determine how risky you are to insure. Companies that have made past liquor liability claims will pay more for insurance than those with a clean history, while past alcohol-related claims could increase your premiums.

How can you save money on liquor liability insurance?

Here are three steps you can take to reduce the cost of your liquor liability insurance coverage.

Bundle your insurance policies

Businesses can sometimes find discounts when they purchase multiple insurance policies from the same provider, rather than a standalone policy. For example, if you own a small, low-risk business, you may qualify for a business owner’s policy (BOP).

A BOP bundles general liability insurance and commercial property insurance together at a reduced rate – and you can add liquor liability insurance as an endorsement. If you don’t qualify for a BOP, then you can add liquor liability as an endorsement to your commercial general liability policy.

Your liquor liability policy premium can typically be paid in monthly or annual installments. It might be tempting to go with a smaller monthly payment, but consider paying the full premium. Many insurers offer discounts on the full annual premium.

Manage your risks

If your small business has a clean claims history, expect to pay lower insurance rates. An effective way to do this is to create a comprehensive risk management plan.

For example, you might:

- Provide your bartenders and caterers with alcohol service training, including on dram shop laws and how to deal with an intoxicated customer

- Encourage patrons to consume food with alcohol by offering discounted food items

- Serve water alongside alcoholic beverages

- Engage in safety measures to minimize the potential for drunk driving

- Minimize hazards on your premises

Insuring your small business doesn't have to cost a fortune. At Insureon, we help you find affordable coverage that meets the unique needs of your small business, through a single online application. That way you can get peace of mind without breaking the bank.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for small business owners who need coverage from America's top insurance carriers. We help business owners evaluate their needs, buy policies, and manage their different types of policies online.

By completing Insureon’s easy online application today, you can compare liquor liability insurance quotes from top-rated U.S. carriers. You can also shop for general liability coverage and all other types of business insurance. Insureon insurance agents are available to help answer any questions about the types of insurance coverage your insurance needs.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

What our customers are saying

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. See our small business insurance cost overview or explore costs for a specific type of policy.