Environmental liability insurance cost

Environmental insurance costs vary based on a number of factors about your business. Your premium is directly impacted by the risk of environmental damage or pollution created by your business, your business location, and more.

What is the average cost of environmental insurance?

Small businesses pay an average premium of $223 per month, or $2,675 annually, for environmental liability insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Many small business owners obtain pollution coverage by adding it to an existing general liability policy, which typically has pollution exclusions from this type of coverage. Your premium will vary depending on whether you purchase this as a standalone policy or add it as an endorsement to your liability coverage.

Typical environmental liability insurance costs for Insureon customers

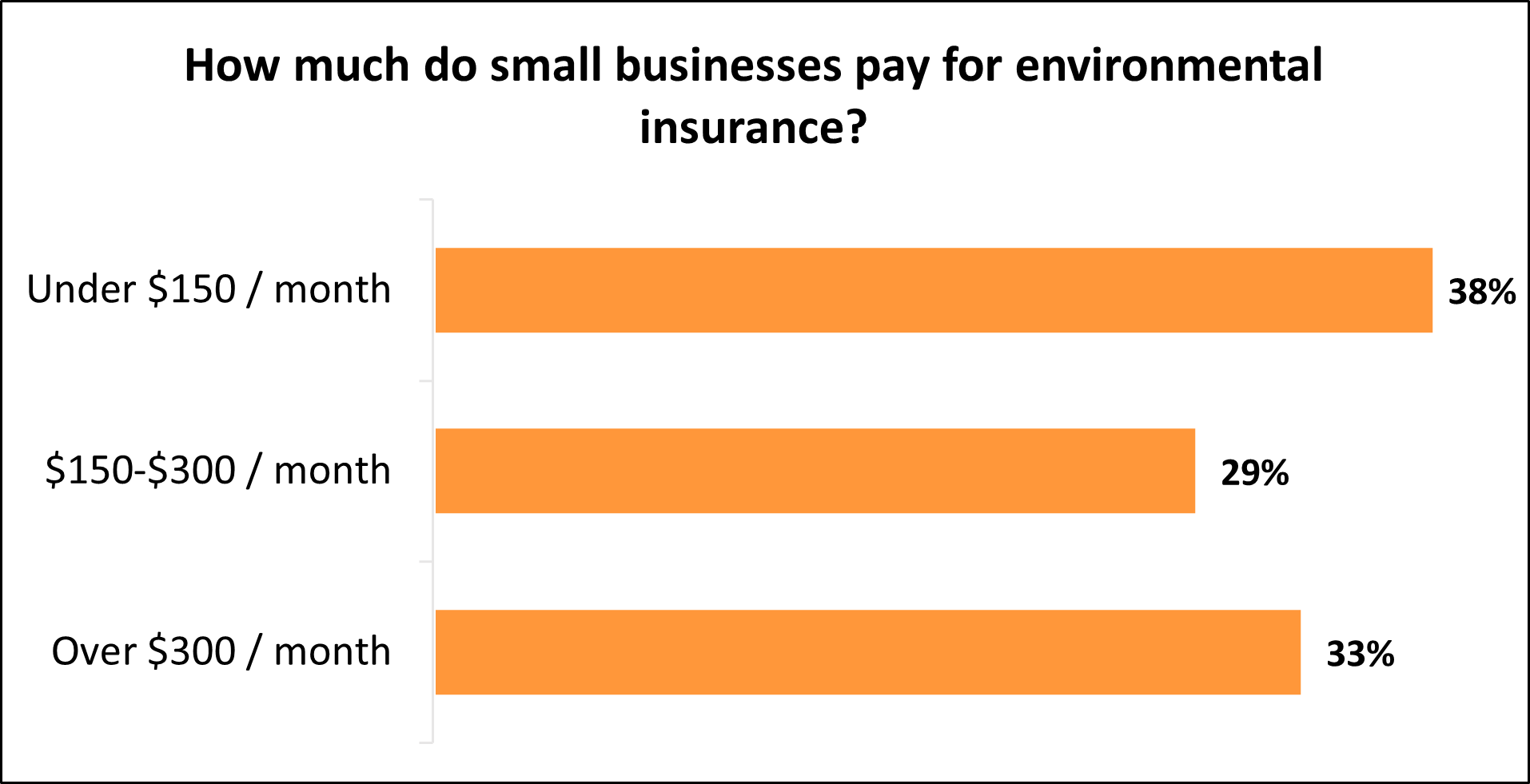

While Insureon's small business customers pay an average of $223 monthly for environmental liability coverage, 38% pay less than $150 per month and 29% pay between $150 and $300 per month.

The cost varies for small businesses depending on their risks and the coverage limits they choose.

Understanding environmental liability insurance cost factors

The cost of a pollution liability policy depends on specific business factors. One of the most significant is whether your business handles hazardous substances or is likely to have contact with them.

An insurance company will consider this and other relevant information about your business when setting your premium, including:

- Your industry

- Location of your business

- Age of your building and how it was constructed

- Any history of pollution events in the building and how they were addressed

- Number of employees and their exposure risk to pollutants

- Annual payroll of these employees

Let’s take a closer look at the key factors that could affect your environmental liability premium.

How does location influence the cost of environmental insurance?

Your business location plays a key part in determining the cost of your environmental coverage, because it has an impact on the types of claims you might face during a site pollution incident.

Whether you’re near a residential, commercial, or industrial area, the price of nearby real estate can have a tremendous impact on your pollution legal liability, as well as your likely remediation costs from dealing with any emissions caused by your business.

If you’re in an area of industrial or former industrial sites, or one that’s known for having polluted conditions, such as a brownfield site, hazardous disposal site, or industrial contamination site, this would increase your environmental risks and you’d be more likely to have pollution liability claims.

If your business is in close proximity to residences, this would also be a significant factor as it would increase the likelihood of property damage, expensive cleanup costs, third-party claims made by property owners, and legal defense costs.

Your claims would be even more expensive in the event of a bodily injury, or if neighboring properties experience a business interruption and sue you for a loss of income.

Find business insurance requirements in your state

How does your industry impact the cost of environmental insurance?

The type of industry you’re in gives the insurance company an idea of how likely you are to face a pollution insurance claim and how expensive it might be.

If your business has storage tanks or deals with industrial chemicals and solvents, this will have a direct impact on your premiums.

In the construction industry, for example, you might face asbestos remediation, lead paint, or any number of environmental claims. General contractors and other contracting professionals often see this coverage referred to as contractor's pollution liability insurance (CPL).

What if you need to buy pollution insurance coverage separately?

Some small business owners may decide to buy environmental liability insurance as a standalone policy. In this case, the company's environmental liability risks and coverage needs would play a large role in determining the cost of a policy.

For example, if an excavation contractor occasionally takes on jobs at sites that previously housed manufacturing or processing facilities, or involves visiting non-owned disposal sites, they may deem it necessary to protect themselves from uncovering any unexpected substances with an environmental insurance policy.

To determine the premium, the insurance provider would consider the contractor's liability exposure and potential risk of facing legal action over accidental release of pollutants or environmental damage.

While a standalone environmental policy may be more expensive than adding it as an endorsement to your general liability coverage, it is also likely to have fewer coverage gaps or exclusions, which could make it more suitable for your business needs.

Top industries we insure

Don't see your industry? Don't worry. We insure most businesses.

How to save money on an environmental liability insurance policy

There are a number of ways that small business owners can save on pollution insurance, including:

Bundle your coverage in a CPP. One way to save money on environmental coverage is with a commercial package policy (CPP), which combines your general liability insurance and commercial property insurance into one policy and is usually less expensive than buying these coverages separately.

A CPP is similar to a business owner’s policy (BOP), which also combines general liability and commercial property coverage. However, a CPP allows for more flexibility and the ability to add multiple endorsements, such as pollution liability coverage.

Pay your premium annually. Paying your premium annually, instead of monthly, can often earn you a premium discount with your insurance company.

Develop a risk management plan. Additionally, adopting a risk management program can reduce your risk of an expensive claim that would likely increase your premiums. Your plan might include:

- Testing the products you sell to make sure they’re environmentally safe.

- Following best practices within your industry for handling and storing hazardous materials and hazardous waste.

- Giving your employees the training and equipment they need to reduce the chance of a polluting incident.

- Making sure your employees follow all environmental safeguards required by state and federal laws.

Why do small businesses choose Insureon?

Insureon is your #1 independent marketplace for online delivery of small business insurance. We help business owners get quotes from top-rated insurance carriers, buy policies, and manage coverage online. By completing Insureon’s easy online application today, you can get free quotes for environmental liability insurance and other insurance products, with underwriting from top-rated U.S. insurance companies.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

What our customers are saying

Learn more about business insurance costs

Insurance premiums vary based on the type of commercial insurance policies you buy. See our small business insurance cost overview or explore costs for a specific policy.