Cheap commercial property insurance

You can save money on commercial property insurance by limiting your property damage risks and by comparing insurance quotes from different providers.

How do I find cheap business property insurance?

Commercial property insurance covers your business’s location and other assets like equipment and inventory. It pays to repair or replace these assets in case they’re stolen, lost, or damaged.

Your homeowner’s insurance won’t cover items that belong to your business, or it may provide limited coverage, which is why you may need this policy.

Starting at $29 per month, a commercial property insurance policy can be affordable for small businesses.

There are many ways for you to keep costs low and avoid more expensive rates. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from trusted carriers.

In addition, bundling your commercial property policy with other insurance products, choosing cost-saving options on your commercial property insurance coverage, and managing your risks to avoid insurance claims can also help you pay less.

Table of contents

- Compare property insurance quotes

- Bundle business property insurance with other policies

- How much does commercial property insurance cost?

- Customize your property policy

- Manage your risks to avoid claims

- Cheapest states to purchase property insurance

- Cheapest industries to purchase property insurance

- Find affordable property insurance with Insureon

- Additional coverages to consider

Compare property insurance quotes from multiple providers

Getting quotes from multiple insurance companies is one of the best ways to find affordable commercial property insurance. You could go straight to the source and contact each carrier directly, or you could work with an online insurance agency like Insureon for a simpler and easier experience.

At Insureon, you can get commercial property insurance quotes from top-rated providers, such as The Hartford and Liberty Mutual, with a single online application. Our licensed insurance agents are available to help you customize a policy for your business's unique needs, making sure you meet state laws and your profession's requirements.

Once you select the commercial property insurance policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

Bundle your business property insurance with other policies

One easy way to save money on your policy is to buy two types of insurance in a combined package. A business owner’s policy (BOP) combines commercial property coverage and general liability insurance in one policy. It’s usually less expensive than buying property and liability coverage separately.

A BOP typically provides coverage for:

- Injuries to customers, clients, and other third parties visiting your property

- Damage to property owned by your business or a third party

- Product liability insurance for items your business makes, sells, or distributes

- Libel, slander, and copyright infringement

How much does commercial property insurance cost?

Insureon’s small business customers pay an average of $67 per month, or about $800 per year, for business property insurance.

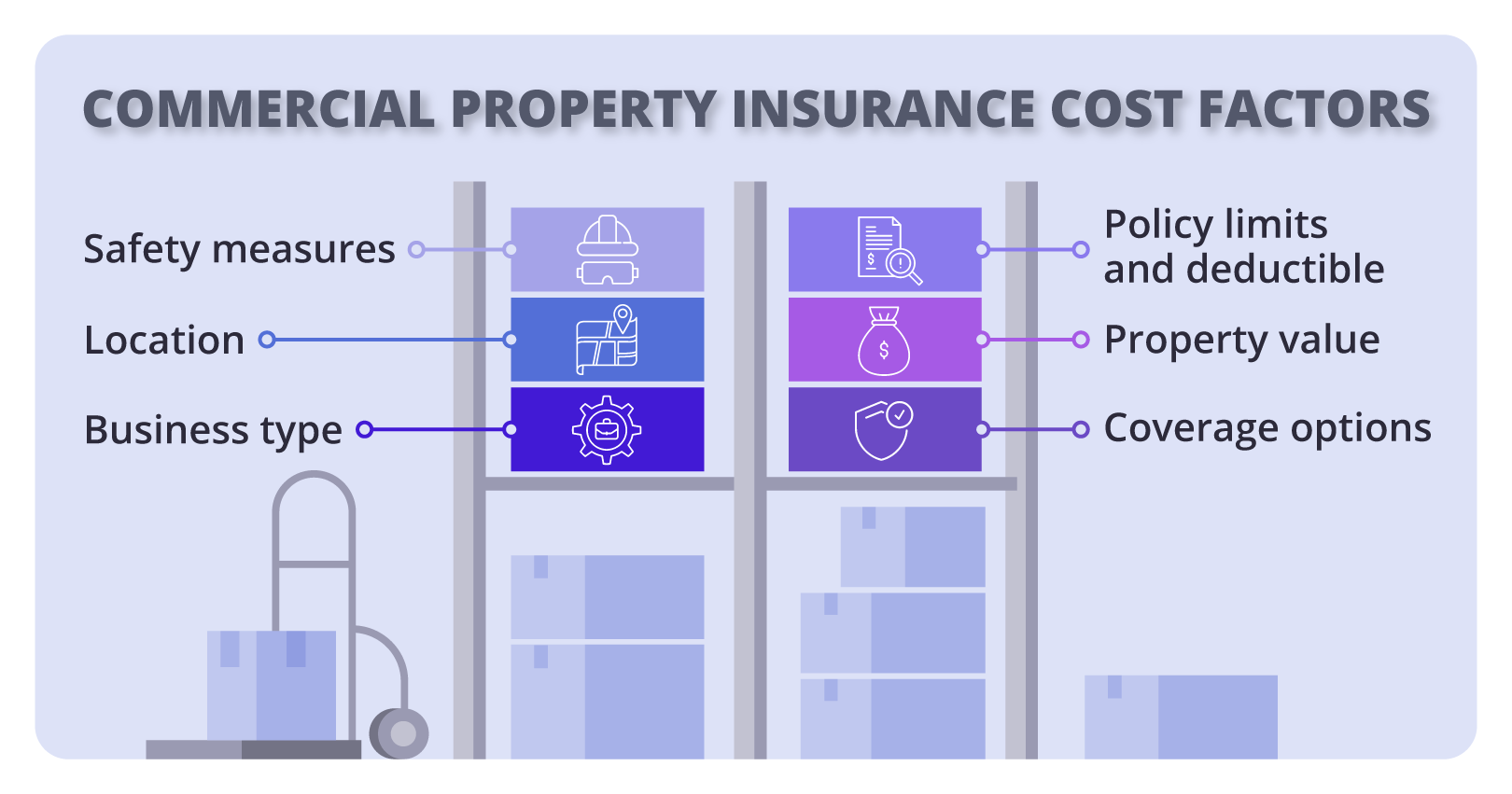

Key factors to determining the cost of commercial property insurance include:

- Your type of business

- Business location

- The size and type of property you have, including business assets

- Property value, including your equipment and inventory

- Safety measures, such as sprinkler systems

- Deductible, policy limits, and other coverage options

Verified commercial property coverage reviews

Customize your commercial property insurance policy to reduce costs

Choose lower policy limits

The policy limit is the maximum amount your insurer will pay on a claim. For property insurance, your limits should match the value of your business's property. That includes your building and your business personal property, such as inventory, office equipment, and furnishings.

Lower coverage limits cost less, but leave you open to financial risk. You'll want to consider both the cost of insurance and how much you can expect to pay for a claim after a fire, storm, or other incident.

Choose a higher deductible

Your policy's deductible is the amount you pay on a claim before your insurance coverage takes over. Higher deductibles are more affordable, but make sure it's an amount you can afford in a crisis.

For example, a fire might damage your commercial building and computers. The cost of repairing the damage is estimated at $75,000 while your deductible is $1,000. You would pay the first $1,000. The insurance company would cover the remaining $74,000 in damages.

If your business losses are small enough that they fail to meet your deductible, you would have to cover any claims yourself. Some small business owners believe a higher deductible is worth it in the long run, as it reduces your premium while maintaining coverage in case of a significant loss.

Examine your policy's exclusions

Every insurance policy comes with exclusions, which stipulate the kind of claims it won’t cover. For property insurance, common exclusions include risks like floods and earthquakes.

When you buy a policy, check to make sure it doesn't have any exclusions for coverage that you might need. You can often purchase an endorsement for your policy, which provides additional coverage for certain risks. For example, if you store or sell perishable items, you would need spoilage insurance, to protect against damage from power outages or equipment failure.

An insurance agent can help you determine the risks your business needs to cover, and the ones you can safely exclude to save money.

Choose the option for actual cash value

There are two types of reimbursement for a business property claim:

- If you insure your business property for its replacement cost, your insurance company will cover the cost of replacing your lost or damaged property with entirely new items.

- Insuring for the actual cash value means your insurance will cover your physical assets for their depreciated value (the value of the used items) after a loss.

Replacement value coverage costs more, but pays out more on a claim. Insuring for actual cash value lowers your premium, but depreciation reduces the amount your provider would pay on a covered loss.

Opting to pay your entire insurance premium once a year, rather than monthly, can earn you a discount from your insurance company. If you can afford it, it's one of the easiest ways to save money on insurance.

While it might be tempting to drop your property insurance coverage occasionally to save money, this can wind up being more expensive in the long run.

Insurance companies tend to increase premiums for those who frequently start and restart their coverage. You also leave yourself exposed to an expensive loss that your business would have to cover on its own, without insurance.

Find cheap commercial property insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

Manage your risks to avoid claims

The right approach to risk management can save you money on commercial property claims and help keep your premium low.

Install sprinkler systems and burglar alarms

Many insurance providers offer a discount on commercial property insurance if a business has a sprinkler system, smoke alarms, a central burglar alarm, and other safety features.

You may want to check with your insurance company before installing a system, to make sure you get one that qualifies. It’s also a good idea to check your local building codes to see if particular systems are required.

Inspect your property

Routine inspections of your property can help you spot potential problems and address them before they turn into an expensive claim. Make sure your burglar alarms and sprinkler systems are working properly, as well as your entrances and security doors.

It’s also a good idea to consider your surroundings and the exterior risks to your business. Examine features like tree limbs and power lines to make sure they don’t pose a threat in case of a windstorm or similar event.

Whatever risks you might face from wildfires, severe storms, floods, tornadoes, or hurricanes, could have increased over the past few years. Do what you can to protect your property from these risks and make sure you’re adequately insured.

Cheapest states to purchase commercial property insurance

Though it may not be the primary factor, policyholders in certain states can expect to pay less for commercial property insurance than others.

By bundling your commercial property coverage with general liability insurance in a business owner's policy, you can save money in several states compared to purchasing each of these coverages separately.

Here are some states where commercial property insurance costs are lower than average, along with their costs for business owner's policies:

| State | Commercial property insurance cost | Business owner's policy cost |

|---|---|---|

$29 per month | $63 per month | |

$29 per month | $58 per month | |

$36 per month | $58 per month | |

$42 per month | $63 per month | |

$42 per month | $62 per month | |

$42 per month | $72 per month | |

$45 per month | $61 per month | |

$48 per month | $68 per month | |

$48 per month | $87 per month | |

$48 per month | $51 per month |

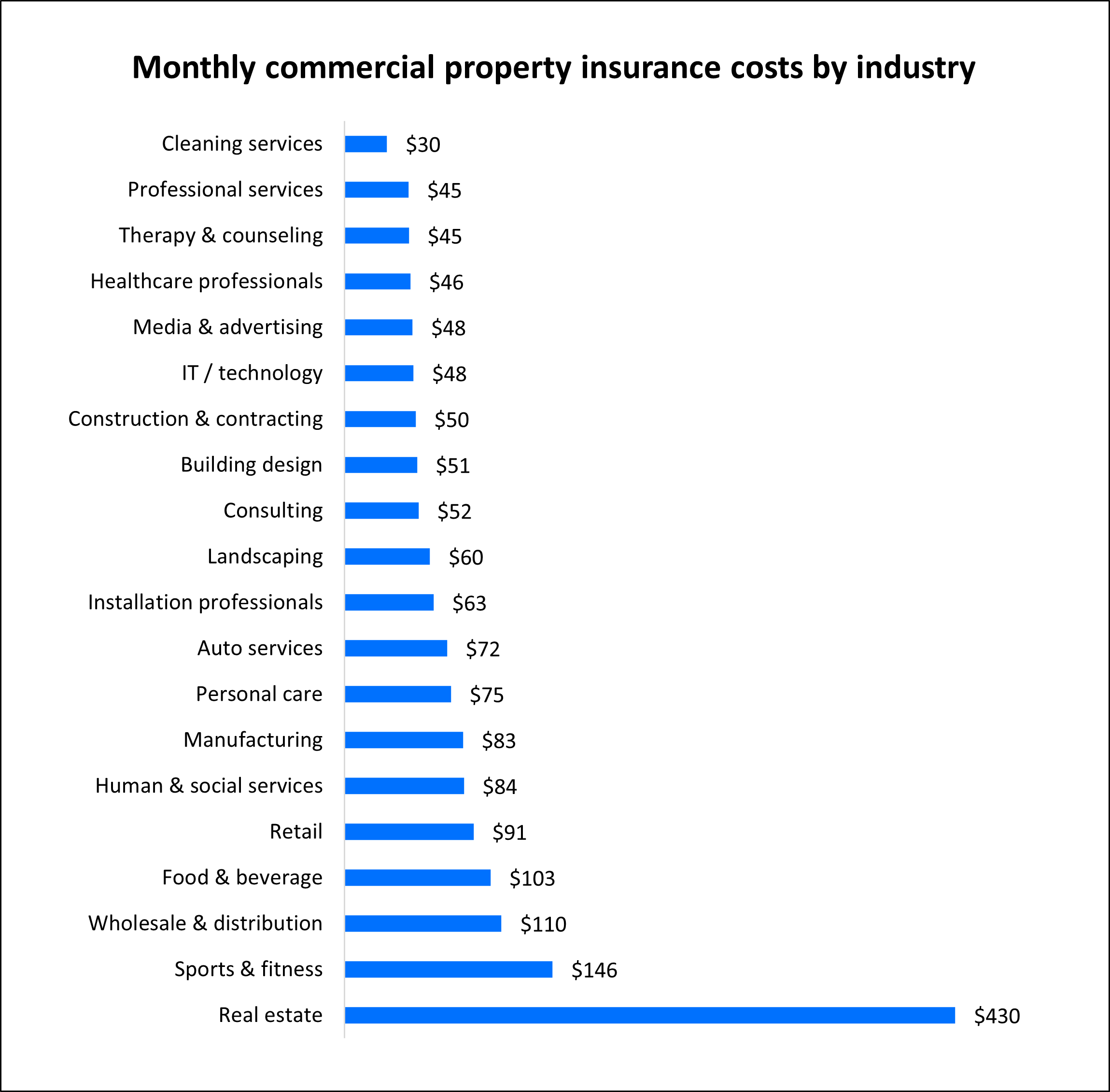

Cheapest industries to purchase commercial property insurance

In addition to your location, your industry can affect how much you pay for commercial property insurance.

Generally speaking, industries that tend to have business property that is lower in value and have less risk of property damage can expect to pay a smaller premium. For example, an IT consultant who works from a home office or a wellness counselor who has a home-based business would pay less than a retail business owner who has a storefront.

Among Insureon customers, industries such as cleaning, therapy and counseling, and those that offer professional services tend to pay less compared to more public-centered industries like real estate and sports and fitness.

Here's a look at commercial property insurance costs for different professions.

Find affordable property insurance with Insureon

Complete Insureon’s easy online application today to get free quotes for commercial property insurance coverage from top-rated U.S. companies. You can also speak with an agent about the types of coverage your business needs and if there are any discount bundles available for commercial property and other types of business insurance.

Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.