How much does business insurance cost for home-based businesses?

Several factors contribute to the cost of home business insurance, including the size of your business and its risks. Cost estimates are sourced from policies purchased by Insureon customers.

General liability insurance costs for home businesses

Small businesses pay a median premium of $42 per month (about $500 annually) for general liability insurance, but low-risk home businesses can expect to pay less. The cost depends on several factors, including business size, industry risks, and claims history.

This policy provides financial protection against third-party bodily injuries and property damage. It also protects against lawsuits related to copyright infringement, defamation, and other advertising injuries.

Insureon’s licensed agents recommend a business owner's policy (BOP) over a standalone general liability policy for its increased coverage and affordability.

General liability insurance policy limits for home businesses

Most home-based companies choose general liability coverage with a $1 million policy limit and a deductible of $500.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's general liability insurance cost analysis page.

Business owner’s policy costs for home businesses

Small businesses pay a median premium of $53 per month, or $636 per year, for a business owner’s policy, but low-risk home businesses can expect to pay less. For example, the annual median cost for a virtual office assistant is $495, while the median for an event planner is $182 – or about $15 a month.

This policy bundles general liability insurance with commercial property insurance, usually at a lower rate than if the policies were purchased separately.

Offering both boosted coverage and savings, a BOP is the preferred policy for comprehensive coverage. You can add endorsements like business interruption insurance to protect against loss of income and other risks.

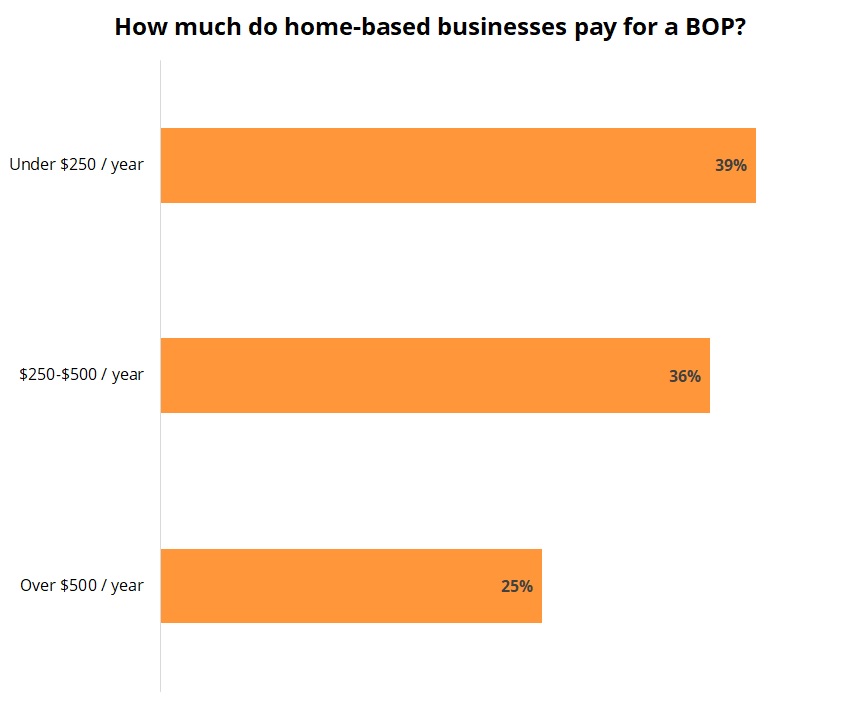

The cost of a BOP depends on your business property value

Among small business owners that purchase a business owner’s policy with Insureon, 39% pay less than $250 per year and 35% pay between $250 and $500 per year. The cost primarily depends on the value of your business equipment and your type of business.

Which business owner’s policy limits do home-based companies choose?

Most home-based businesses (90%) choose a business owner’s policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

Learn how to save money on your property coverage, which limits to choose, and more on Insureon's business owner's policy cost analysis page.

Professional liability insurance costs for home-based businesses

Small businesses pay a median premium of $59 per month, or $713 per year, for professional liability insurance. Low-risk home businesses will pay less for this policy, and may be able to add it to a BOP for further savings.

Also called errors and omissions insurance (E&O), this type of insurance offers critical coverage when you provide expert advice or a professional service. It can also help pay for legal fees related to accusations of mistakes or negligence.

Professional liability policy limits for home-based businesses

As with other business liability policies, the amount of protection you get depends on the limits you choose. Most home-based companies choose professional liability insurance policies with a $1 million limit and a deductible of $500.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's professional liability insurance cost analysis page.

Commercial auto insurance costs for home businesses

Small businesses pay a median premium of $142 per month, or $1,704 per year, for commercial auto insurance. This policy can pay for property damage and medical bills in an accident, along with vehicle theft, weather damage, and vandalism.

Businesses with company-owned vehicles must purchase commercial auto insurance. For personal, leased or rented vehicles used for business purposes, you may need hired and non-owned auto insurance (HNOA) instead.

Business coverage is important since your personal auto insurer could deny a claim for accidents involving business use. Additionally, state laws require you to carry a minimum amount of auto liability insurance for any vehicle.

A home business that owns one vehicle will pay less for commercial auto insurance than a company with a fleet of vehicles. The cost depends on the type and number of company vehicles, how often they are driven, and the coverage options you choose.

Learn how coverage limits and other factors affect the cost of an auto policy on Insureon's commercial auto insurance cost analysis page.

Workers' compensation insurance costs for home-based businesses

The median premium for workers’ compensation insurance is $47 per month ($560 per year) for small businesses, but home businesses with only a few employees can expect to pay less. State laws usually require this coverage as soon as you hire your first employee.

It's a good idea to buy this insurance coverage even when it's not required, given the high cost of medical care. Health insurance plans can deny claims for work-related injuries, which is why even sole proprietors should consider workers' comp.

This policy covers the cost of medical treatment for work-related injuries, and also provides disability benefits to injured workers.

Workers’ comp costs depend on the number of employees

The cost of workers' compensation depends on the number of employees and the risks they are exposed to in their work. For example, an IT consultant can expect to pay less for workers' comp than a business that relies on physical labor, such as landscaping.

Learn how workers' comp premiums are calculated and more on Insureon's workers' compensation insurance cost analysis page.

Cyber insurance costs for home businesses

Small businesses pay a median premium of $140 per month, or $1,675 per year, for cyber insurance. This policy is vital for home offices that handle sensitive information, such as credit card numbers or Social Security numbers.

Cyber liability coverage can help pay for legal fees, customer notification costs, and other expenses related to a data breach or cyberattack.

The cost of the policy depends on how much sensitive data your company handles, and how many employees can access it. A home business policy will cost less than cyber insurance for a large company.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's cyber insurance cost analysis page.

Get quotes from top carriers with Insureon

Insureon’s licensed insurance agents work with top-rated U.S. carriers to find affordable home-based business insurance. Apply today to compare multiple quotes with one free online application. Work with an account manager specializing in your unique business needs.