Insurance for hair salons and stylists in Illinois

Learn about business insurance requirements and the most common policies for beauty salons and hair stylists in Illinois.

Which policies are required for hair salons and stylists in Illinois?

If you have a commercial lease, your property manager may require you to purchase general liability insurance. Commonly purchased by hair salons and stylists in Illinois, general liability insurance can protect your business from expenses associated with common mishaps, such as client property damage and injuries.

State law in Illinois requires every small business with employees to provide workers’ compensation insurance, which covers medical bills for work injuries. Illinois also requires commercial auto insurance for all vehicles owned by a business.

What are the most common policies for hair salons in Illinois?

The most common policies for hair salons and stylists in Illinois vary depending on revenue, client contracts, partnerships, and other factors.

General liability insurance

General liability insurance is the foundation of a hair salon’s business protection, with coverage that extends to client injuries, client property damage, and advertising injuries. Most commercial leases require you to have this coverage.

Business owner's policy (BOP)

Hair salons in Chicago and elsewhere in Illinois often qualify for a business owner’s policy. This package helps your business save money by bundling commercial property insurance with general liability insurance at an affordable rate.

Professional liability insurance

Professional liability insurance protects beauticians and hairstylists from lawsuits brought by dissatisfied customers. This policy, also called errors and omissions insurance, can help cover legal expenses if a customer sues over an unsatisfactory haircut or a negative reaction to a beauty product.

Workers' compensation insurance

If you own a hair salon in Illinois that has employees, you are required to carry workers' compensation coverage. If you are a sole proprietor, the coverage is optional. However, if you slip and break an arm in your salon, or develop carpal tunnel syndrome after years of repetitive work, you can turn to your workers’ comp policy to help pay your medical bills and lost wages.

Cyber insurance

Cyber insurance covers the cost of data breaches and cyberattacks. Salons that store credit card numbers, email addresses, and other customer information should carry this coverage. It's also called cyber liability insurance or cybersecurity insurance.

Commercial auto insurance

Commercial auto insurance covers the costs of accidents involving a vehicle owned by your salon. It can help pay for legal defense costs, property damage, and injuries from an accident, along with vehicle theft and vandalism.

What do hair salons in Illinois pay for insurance?

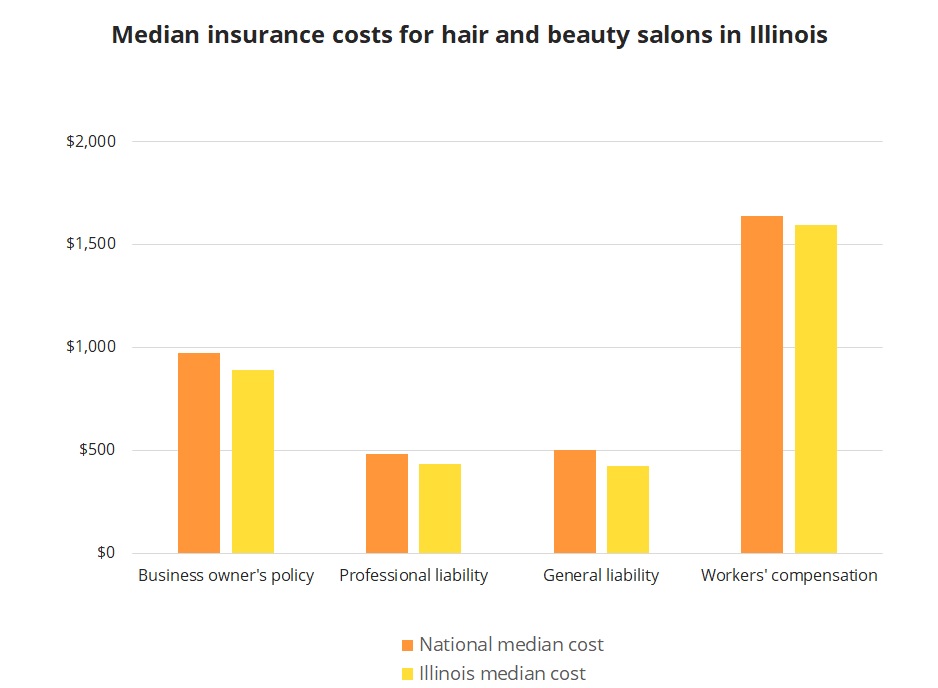

According to an analysis of Insureon applications, the typical hair salon in Illinois can expect to pay less than the national median for business insurance.

For example, the median annual cost of workers’ compensation for a beauty salon in the state is $1,595, slightly less than the national median of $1,641. Similarly, the median annual premium of a business owner’s policy for a hair salon in the state is $890, less than the national median of $975.

Save time and money with Insureon

Insureon’s industry-leading technology helps hair salons and hairdressers in Illinois save time and money shopping for insurance by comparing policies from top U.S. carriers. Start a free online application to review quotes for the policies that best fit your business. Our insurance agents are licensed in Illinois and can answer your questions as you consider coverage.

To make the application go quicker, have this information ready:

- Workforce details, such as the number and types of employees

- Current and projected revenue

- Business partnerships

- Insurance history and prior claims

- Commercial lease insurance requirements

Apply for free insurance quotes for beauty salons today.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.