Construction insurance vs. surety bond: What’s the difference?

Customers take a leap of faith when they hire someone to provide professional services, including construction work. They can look at your portfolio and your client testimonials, but at the end of the day, there's no way to completely guarantee or predict how a project will go.

But when your construction business has a surety bond, it does help establish trust and give the customer peace of mind. The bond ensures contractors will live up to their end of an agreement and that their work will comply with federal, state, and municipal regulations. In fact, most governments require licensed contractors to have these bonds for that reason.

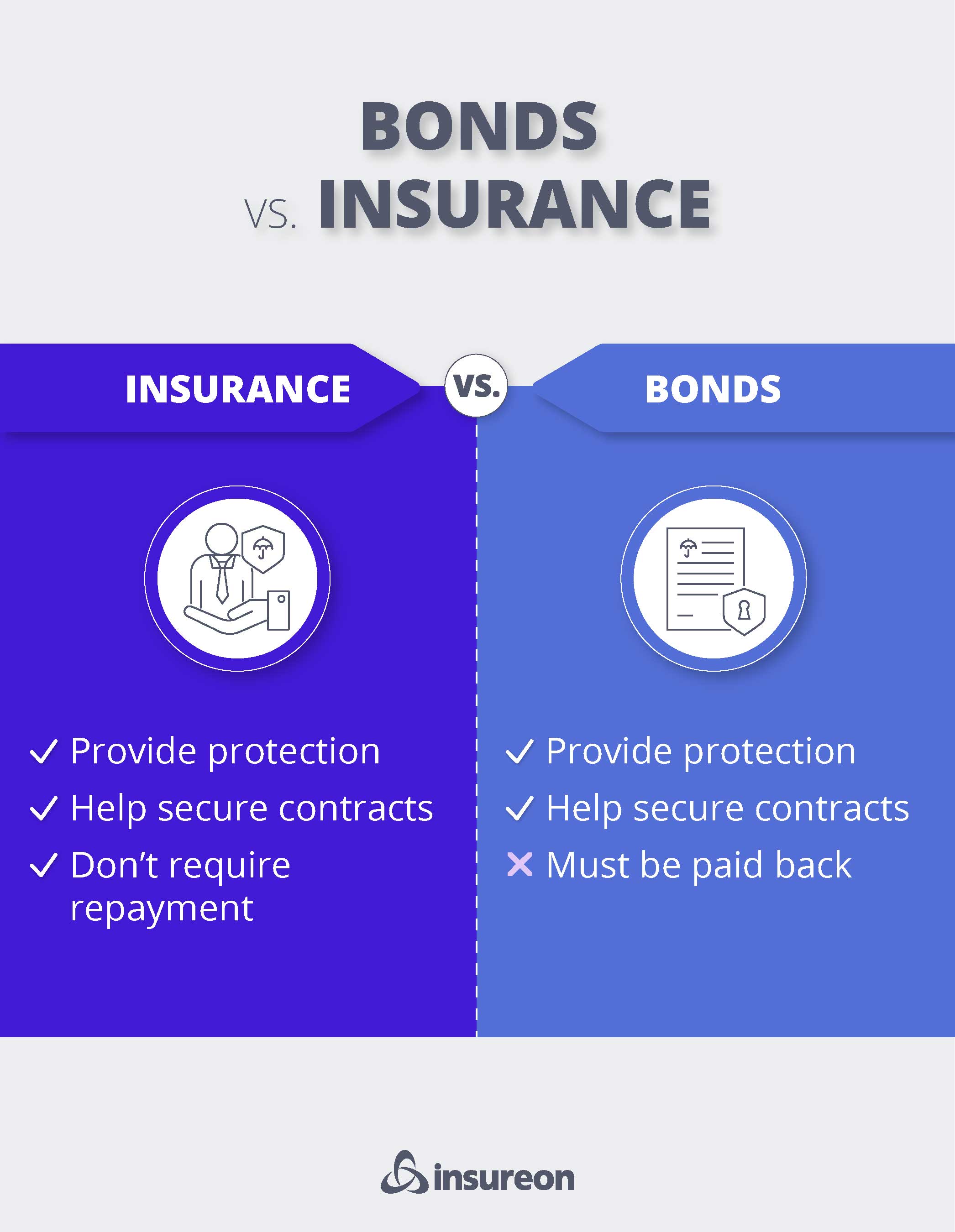

Many people mistakenly think that a surety bond is another type of insurance, but it's not. Let's take a closer look at construction insurance and surety bonds, what coverage each provides, and how they differ.

What is construction insurance?

Construction insurance protects you, the business owner. In exchange for the premium you pay for coverage, your insurance provider will pay for certain lawsuits or events that would otherwise leave your business in a financial bind.

There a few common construction insurance policies that business owners typically choose, including:

General liability insurance covers third-party property damage and bodily injuries. For contractors, it also includes liability protection in case the services you provide or products you produce harm someone.

Commercial property insurance pays to replace damaged or stolen business property, such as your tools and equipment. It also covers the building where they are kept, if you own it.

Inland marine insurance / contractor's tools and equipment is a type of commercial property coverage that covers your tools while they're in transit or at a job site. It also protects mobile equipment, like forklifts and bulldozers.

Depending on where your mobile equipment is being operated or driven, such as a public road, you may also need add a mobile equipment endorsement.

This endorsement can be added to a commercial auto insurance policy, which is a policy that can help cover legal bills, medical expenses, and property damage if a business vehicle is involved in an accident.

Workers' compensation insurance covers costs related to work illnesses or injuries. Most states require businesses with employees to purchase workers' comp, especially in high-risk industries like construction.

Builder's risk insurance / course of construction helps pay for damages when a fire or windstorm damages or destroys a building in progress. It also covers theft of construction materials from a job site.

You can learn more about other types of construction insurance on our construction and contractors insurance main page.

What is a surety bond?

A surety bond is required in industries like construction to ensure that you abide by any rules, regulations, or laws governing your industry, such as maintaining a valid contractor or roofing license. Surety bonds also act as a safeguard against poor performance or dishonest behavior.

For example, if you walked off the job halfway through building a home, the surety bond you purchased would reimburse the homeowner with the funds they need to pay someone else to finish it.

If you are bonded (i.e., have purchased a surety bond), it sends a message to customers and any relevant governing authorities that you are safe to do business with because of the financial security the bond provides.

How construction insurance works

Construction insurance is a contract between two parties – you and the insurance company. As the business owner, you purchase policies from an insurer to provide financial protection for issues such as:

- Employee injuries

- Damaged or stolen equipment

- Work that causes bodily harm

In exchange for coverage, you pay your insurance company a monthly premium. If you experience a covered incident – like stolen equipment – you file a claim with your insurance company. The insurance company's financial obligation is to you, the policyholder, for covered claims.

How a surety bond works

Unlike construction insurance, a surety bond is actually a contract between three parties:

The principal. That's you or your business.

The obligee. This is typically the local, state, or federal authority that requires the surety bond in the first place. It could also be a client.

The surety provider. This is who underwrites the bond and ensures that you will do your best to meet the contractual conditions required by the obligee.

You don't need to pay the full amount of a surety bond in order to purchase it. To be bonded, you only need to pay a small fraction of the full cost. This is known as the bond premium. The amount varies, but is typically 1% to 5% of the full value of the surety bond. If you have bad credit, though, bond premiums can run as high as 5% to 20% of the bond value.

How a surety bond is different from construction insurance

As we explained earlier, construction insurance is a contract between your business and the insurance company. When you make a claim on your policy and it's covered, you aren't expected to reimburse the insurer. It's fully on the insurer to pay.

That's not the case with a surety bond. The bond essentially functions like a line of credit. If a claim is made, it's the borrower (you) that needs to pay, not the lender (the surety provider).

Here's how it works:

- The impacted party files a claim.

- The surety provider conducts an investigation.

- If the claim is valid, the surety provider will cover the initial claim costs.

- The surety provider then goes after the principal (again, that's you) to pay back those claim costs.

So if you are a contractor and file an insurance claim, your insurer picks up the tab. If a surety bond claim is filed, you have to pay the insurer back.

This is why consumers place a lot of faith in companies that can say they are "bonded and insured." It means that you aren't likely to flake out on them because if you do, it will cost you – big time.

Get quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to compare quotes for construction business insurance from top-rated U.S. carriers. Once you find the right policy, you can get coverage in less than 24 hours.

Hannah Filmore-Patrick, Contributing Writer

Hannah is a contributing writer with a diverse writing and content building background. She's worked on topics from technology to insurance. She's competent with both language and SEO, and continues to work with a variety of business verticals to create engaging, optimized content.