What to do when your client wants to cancel a policy

When a client wants to cancel an insurance policy, it’s not a done deal. It simply means it’s time to step up and put your powers of persuasion to work.

It’s your job to:

- Understand the reasons why your client wants to leave;

- Explain the possible risks of cancellation;

- Explore how you could potentially meet their evolving needs and keep them as a client.

If your client is unhappy with customer service, coverage, or costs, you may be able to turn the relationship around. And with the right retention strategies, you can help limit cancellation threats and reduce churn across your business.

How do you know if your clients are happy? Easy: just ask them.

Below you’ll learn what to say when a customer wants to cancel, strategies for customer retention, and tips for handling cancellations with professionalism.

Prevent cancellations by creating loyal customers

The insurance industry is a competitive market. To retain customers, you need to keep them happy.

When a customer is happy, they’re much more likely to renew their policy. They may even sing your praises in person and on social media, helping drive new business for you.

You can keep your customers satisfied by offering affordable rates, top-notch customer support and service, and flexible policies that adapt to their needs over time.

But how do you know if your clients are happy? Easy: just ask them.

The most effective way to retain insurance clients is to check in with them on a regular basis with phone calls or email.

As a rule of thumb, call your clients once each quarter to ensure their policies are still meeting their needs. Find out if any circumstances have changed that might affect their coverage needs. And for business clients, track their industry news to see if any trends could increase their risk.

Being proactive in your communication makes clients feel valued, which builds loyalty and improves retention. But even the best customer service can’t always prevent a customer from wanting to cancel.

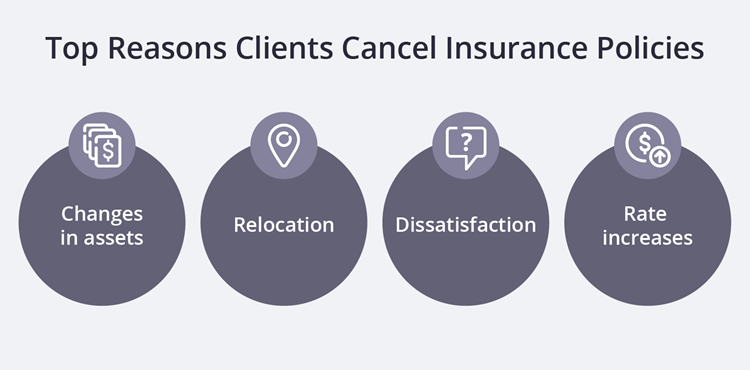

How to address common reasons customers want to cancel their policies

Ernst & Young's "Reimagining Customer Relationships" shows that about 66% of insurance customers say they are likely or very likely to recommend their former providers. So why do clients leave in the first place?

Even if you’re using the right retention strategies, you’re still going to have clients who want to cancel. It’s the nature of the insurance business.

When you get a cancellation request, don’t take it personally. Clients have many different reasons for wanting to cancel their policy. It’s not necessarily a reflection on you or your agency. But once a client mentions cancellation, try to salvage their business before admitting defeat.

These tips can help address clients’ common reasons for canceling, counter frequent objections, and help you prevent unnecessary cancellations.

Reason #1: A change in assets

Often, you’ll hear that a business owner needs to cancel a policy because they’re permanently closing. But for those that remain open and wish to cancel because they’re selling a property or downsizing, policy adjustments can usually resolve the issues.

Tell your customer that you can likely modify their existing insurance policy to fit their new needs. You’ll need to discuss whether they’ll need increased or reduced policy limits, or perhaps the addition of new coverages. But they probably don’t need a brand-new policy.

Reason #2: Relocation

A client may inform you they’re canceling due to a move to a new residence or business location. They may think a new policy is the easiest option, but it isn’t always their best course of action. Whether they’re moving within the state or to the other side of the country, you probably don’t have to lose their business.

For out-of-state relocations, some insurance will require a new policy due to state regulations. But most carriers offer insurance nationwide. You can likely set up your client with the new policy they need.

For intrastate moves, a new policy isn’t required. But policy premiums may be affected due to changing risks. If your client is unhappy due to a rise in premium payments, you can adjust their coverage to find the right price for their budget.

In any case, warn your client that even a brief lapse in coverage could damage their reputation in the eyes of insurers and make getting a new policy more costly. Let them know you can lower their coverage limit until they've resettled. Instead of dropping their policy altogether, reducing their coverage will lower their rate so they’re not wasting money on insurance that’s not being used.

Reason #3: Rate hikes

A customer may say they’re jumping ship because of a premium increase. Customers will often go in search of a better deal when costs go up.

Answer by offering to help them find a better deal, or adjust their coverages to lower their rate.

Reason #4: Poor service

A client may consider canceling as a result of customer service issues. Clients put some of their most valued assets in your care. Emotions can run high when something goes wrong. Poor communication can impact customer satisfaction, causing even loyal customers to look for a new agent.

You should strive to understand the cause of your client’s unhappiness. If it’s a service issue or something else you can address, apologize and explain how you’ll fix the issue and make sure it doesn’t happen again. When you show your commitment to making things right, they may reconsider canceling.

Unfortunately, the cause of customer dissatisfaction is sometimes beyond your control. That’s why you’ll want to consider protecting yourself and your business with your own professional liability insurance such as errors and omissions coverage. The amount of professional liability insurance you’ll want to carry will vary based on your book of business.

No matter the reasons clients choose to cancel, there are always risks involved. Help your customers weigh those risks.

Whether they have business insurance, personal insurance, or both, the cancellation risks can be costly. Sharing those risks could potentially change their mind.

Handling other common objections for canceling personal insurance

For personal insurance, canceling a policy often does more harm than good, especially without a new policy lined up. If your client wants to cancel a personal insurance policy, here’s what they need to know:

- Many mortgage lenders require borrowers to purchase and maintain homeowners insurance over the life of the loan.

- Driving without state-mandated auto insurance can result in heavy legal fines and penalties, not to mention devastating out-of-pocket costs for your client if they cause an accident.

- Stopping and starting insurance coverage is a red flag for any insurance provider, and it may result in higher premiums down the road.

Handling other common objections for canceling business insurance

- In almost every state, businesses with employees are legally required to purchase workers' compensation insurance. Depending on the industry, client contracts or local regulations might also require a business to carry surety bonds.

- For any type of business insurance, your customer probably isn’t entitled to a full refund for prepaid premiums if they cancel. In addition, they might end up paying more for new coverage in the future.

- They could lose their business licenses and permits.

- While uninsured, they’ll be responsible for the costs of any damaged or stolen property.

- They could default on their loans, mortgage, or lease agreement if their lenders require business insurance.

- They may be required to pay out-of-pocket for the costs of an employee’s on-the-job car accident.

When you can’t change their mind: How to deal with clients who cancel

Even if you do your best to try to keep a client’s business, some cancellations are unavoidable. But even then, you should take steps to leave the door open on the possibility of getting that customer back.

Take the cancellation in stride, and send every canceled client a “sorry to see you go” email to thank them for being a valued customer. It’s important to end on good terms and keep the lines of communication open for future opportunities.

In the email, ask them to provide honest feedback on their experience as a customer, whether positive or negative. Was your client happy with their rate, policy options, and customer service they received?

You can use that feedback to improve customer service from you and your support team (if you have one). And if you’re receiving similar feedback from multiple clients, you may need to consider broader changes to your business. When you make customer experience a priority, your retention rates will naturally improve.

Your long-term success as an insurance agent depends as much on retaining existing customers as it does on finding new ones. That’s why client satisfaction needs to be a top priority. So does knowing how to turn a threat of cancellation into a potential opportunity.

By honing your customer service and objection handling skills, you can keep your customers happy, your revenue up, and your business running smoothly.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Desiree DeNunzio, Contributing Writer

Desiree is a writer and editor with a passion for bringing relevant content to readers. She's edited and written content for online and print publications such as Wired magazine, PCWorld, CNET News, and more.