Nursing insurance in Pennsylvania

Learn about business insurance requirements and the most common policies for nurses in Pennsylvania.

Which insurance policies are required for Pennsylvania nurses ?

Whether you're a registered nurse (RN), nurse practitioner (NP), or licensed practical nurse (LPN), contracts and state laws may require you to carry certain types of insurance.

If you have a commercial lease, your property manager may require you to purchase general liability insurance. Commonly purchased by nurses in Pennsylvania, general liability insurance can protect your business from expenses associated with common mishaps, such as client property damage and injuries.

State law in Pennsylvania requires every small business that has employees to provide workers’ compensation insurance, which covers medical bills for work injuries.

Commercial vehicles and vehicles used primarily for work must be covered by commercial auto insurance. This policy helps cover legal costs and medical bills in the event of an auto accident.

Top nursing professionals we insure

Don't see your profession? Don't worry. We insure most businesses.

What are the most common insurance policies for nurses in Pennsylvania?

Nurses in Pennsylvania most often buy the following types of insurance. Which policies you need depends on the specifics of your business, such as the number of employees, ownership of a business vehicle, and the terms of any leases or contracts.

General liability insurance

General liability insurance is the foundation of a nurse’s business protection, with coverage that extends to client injuries, client property damage, and advertising injuries. Most commercial leases require you to have this coverage.

Business owner's policy

Nurses sometimes qualify for a business owner’s policy (BOP). This package helps your business save money by bundling commercial property insurance with general liability coverage at an affordable rate.

Workers' compensation insurance

Businesses in Pennsylvania that hire employees are required to carry workers’ compensation insurance. This policy covers the cost of medical treatment and disability benefits for workers who are injured on the job.

Workers' comp is optional for sole proprietors. However, it's still recommended, as health insurance can deny claims for injuries related to your work.

Professional liability / medical malpractice insurance

Professional liability insurance protects against claims that your work caused harm. That could include accidentally administering the wrong medication, or a baseless claim that you mistreated a patient. This policy is sometimes referred to as medical malpractice insurance.

Commercial auto insurance

Business vehicles in Pennsylvania must carry enough commercial auto insurance to meet the state's minimum requirements for auto liability insurance.

Pennsylvania's auto insurance requirements are:

- Bodily injury liability: $15,000 per person / $30,000 per accident

- Property damage liability: $5,000 per accident

- Medical benefits: $5,000

This policy helps pay for medical bills, legal fees, and property damage when a business vehicle is involved in an accident.

Cyber liability insurance

Nurses handle sensitive patient information on a daily basis, which is why cyber liability insurance is so important for this profession. This policy helps cover the costs of data breach notifications, fraud monitoring services, and other necessary responses to data breaches and cyberattacks.

How much does business insurance cost for nurses in Pennsylvania?

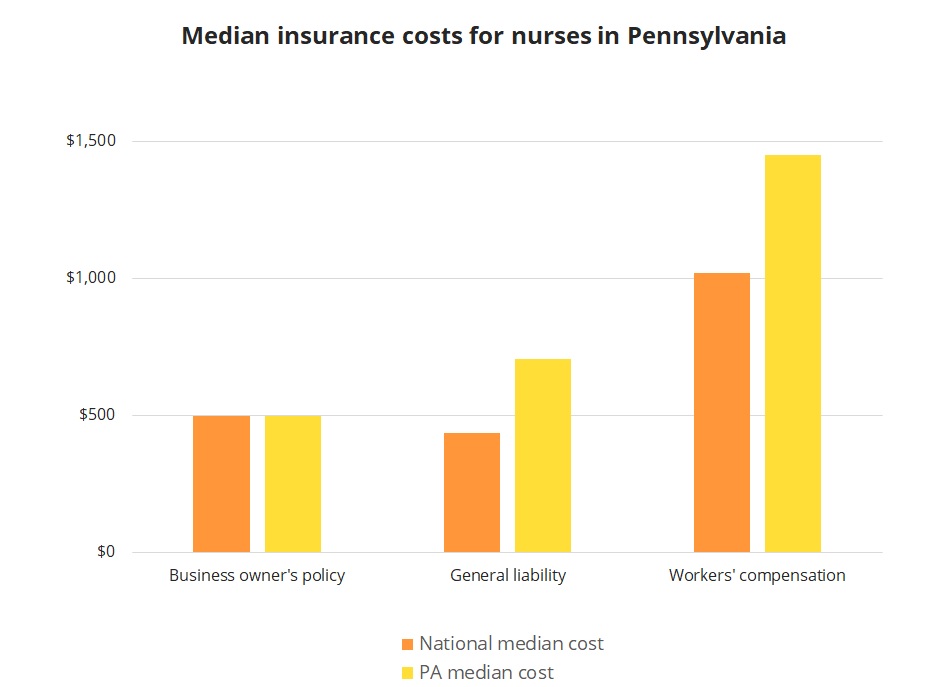

According to Insureon's customer data, nurses in Pennsylvania can expect to pay more than the national median for some policies.

For example, the median annual cost of workers’ compensation insurance for a nurse in the state is $1,451, while the national median is only $1,019.

The cost of a BOP for nurses in Pennsylvania is the same as the national median: $500 annually.

Save time and money with Insureon

Insureon’s industry-leading technology helps nurses in Pennsylvania save time and money shopping for insurance by comparing policies from top U.S. carriers. Start a free online application to review quotes for the policies that best fit your business. Our insurance agents are licensed in Pennsylvania and can answer your questions as you consider coverage.

To make the application go quicker, have this information ready:

- Workforce details, such as the number and types of employees

- Current and projected revenue

- Business partnerships

- Insurance history and prior claims

- Commercial lease insurance requirements

Apply for free insurance quotes for nurses today.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.