How do I get commercial auto insurance?

With Insureon, it's easy to get commercial auto insurance. But part of the process is making sure you get the right insurance for your business, so make sure to do a little research first.

Get the right auto insurance for your business

Commercial auto insurance is a must-have policy when your business owns a vehicle. However, there are a few things to keep in mind when buying this policy.

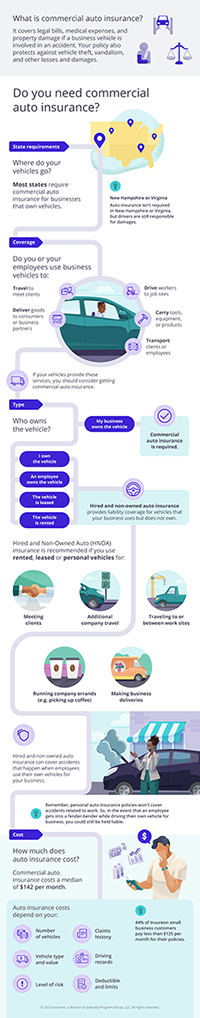

What is commercial auto insurance? This policy helps pay for accidents involving business vehicles. That's important, since personal auto policies don't cover work-related driving.

Do I need commercial vehicle insurance? Most states require this coverage for vehicles owned by a business.

What does commercial auto insurance cover? Commercial auto insurance covers legal costs, medical bills, and property damage caused by your vehicle.

What is business use car insurance? There are two types of insurance for vehicles used for business purposes. Commercial auto insurance protects business-owned vehicles, while hired and non-owned auto insurance (HNOA) covers personal, rented, and leased vehicles used for work.

Explore our infographic below to find out who needs commercial auto insurance and how premiums are calculated. When you're ready to buy, you can start an online application to get quotes customized for your business.

Top professions that need commercial auto insurance

Don't see your profession? Don't worry. We insure most businesses.

Get quotes and chat with a licensed agent

If you're ready to buy commercial auto insurance, fill out our free online application to get started. You'll need to provide basic facts about your business, such as revenue, location, number of employees, and types of vehicles. Our licensed insurance agents can help answer your questions and help you find the coverage you need.