How much does insurance cost for technology businesses?

Tech companies and IT professionals can save money on business insurance by comparing quotes from different providers with Insureon. Your premium depends on the type of policy, coverage limits, deductibles, and factors such as your business's location and number of employees.

Top IT business insurance policies and their costs

Here are the top policies purchased by technology businesses and contractors and their average monthly costs:

- Technology errors and omissions insurance (tech E&O): $67 per month

- Cyber insurance: $148 per month

- General liability insurance: $30 per month

- Fidelity bonds: $107 per month

- Workers' compensation: $34 per month

- Commercial auto insurance: $198 per month

Our figures are sourced from the median cost of policies purchased by Insureon customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Protect your technology business with the right insurance coverage

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "Do I need tech business insurance?"]

JENNIFER CROMLY, DIRECTOR OF STRATEGIC PARTNERSHIPS AND CUSTOMER SEGMENTATION: Hacking attempts are on the rise and lawsuits affect every profession. We are the leaders in protecting the technology industry. We've been meeting the needs of the technology industry since 1997.

[video: an illustrated header displays the text: "25+ years of experience"]

Technology professionals are drawn to our website due to our ease of use. Technology insurance is very specialized. The most important thing is that when you are looking for an insurance carrier, you make sure that they are able to provide you with the coverages that meet the needs of your business.

We have licensed agents in all 50 states.

[video: an illustrated header displays the text: "Licensed agents in 50 states"]

They specialize in the technology industry. They will work with you and walk you through every step of the process, making sure that the exposures specific to your business are covered.

We work with web developers, we work with IT consultants, integration specialists and more.

[video: an illustrated header displays the text: "Insureon covers:"]

[video: Under above header, four bullet points display the text: "Web developers"; "IT consultants"; "Integration specialists"; "Other tech businesses"]

On our website, we offer many policy recommendations. Two of those most popular coverages include cyber liability and technology errors and omissions.

[video: an illustrated header displays the text: "Key IT insurance policies:"]

[video: Under above header, two bullet points display the text: "Cyber insurance"; "Tech E&O"]

When you come to us, we will make sure that we provide you with the most comprehensive coverage. Starting a quote is very easy. Contact Insureon today to start a quote, talk to a licensed agent, and get your policy bound with the certificate of insurance the same day.

[video: an illustrated white header displays the text: "Insureon is your #1 agency for small business insurance"]

[video: an animated header displays the Insureon logo]

Technology errors and omissions insurance

Tech companies and contractors pay an average of $67 per month, or $807 annually, for tech E&O insurance. This policy bundles errors and omissions insurance with cyber insurance at a lower cost than buying the policies separately.

Errors and omissions insurance, also known as professional liability insurance, provides financial protection against mistakes and oversights that impact clients, such as service disruptions at a SaaS company or managed service provider (MSP).

Tech E&O adds third-party cyber insurance to this coverage, extending protection to errors that cause a client to suffer a data breach or cyberattack.

This is the average E&O policy for IT companies and contractors who buy from Insureon:

Insurance premium: $67 per month

Policy limits: $1 million per occurrence; $1 million aggregate

Deductible: $2,500

Several factors will influence your tech E&O premium, including the type of business you have, your claims history, and the policy limits you choose.

Your level of risk drives the cost of tech E&O insurance

The cost of E&O insurance depends on your risk of a lawsuit related to your work performance, such as a software defect that causes a client to lose money. When your errors and omissions insurance include cyber insurance, then the amount of sensitive data handled by your company will also affect your premium.

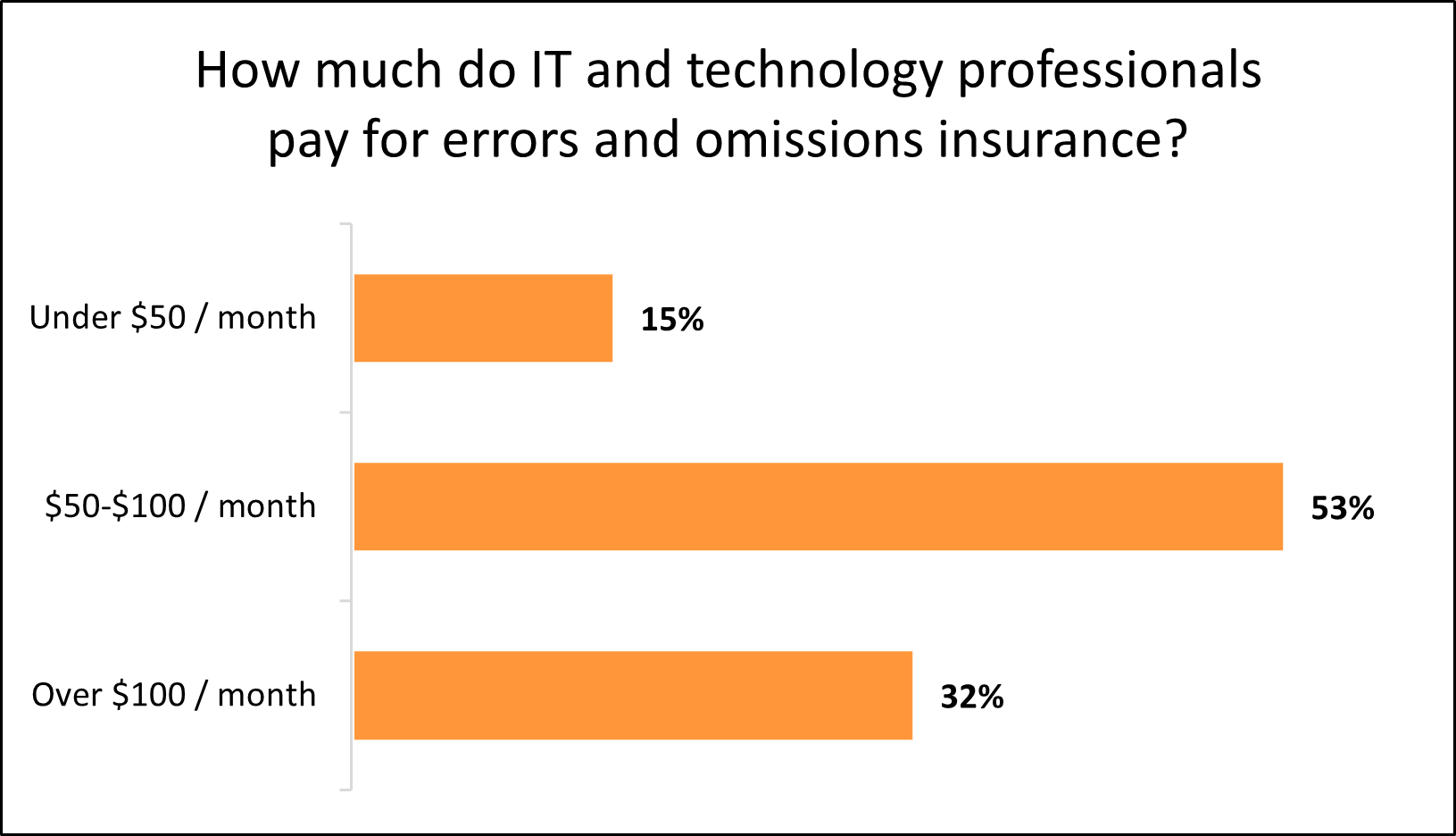

Among IT businesses that purchase technology errors and omissions insurance with Insureon, the majority (53%) pay between $50 and $100 per month.

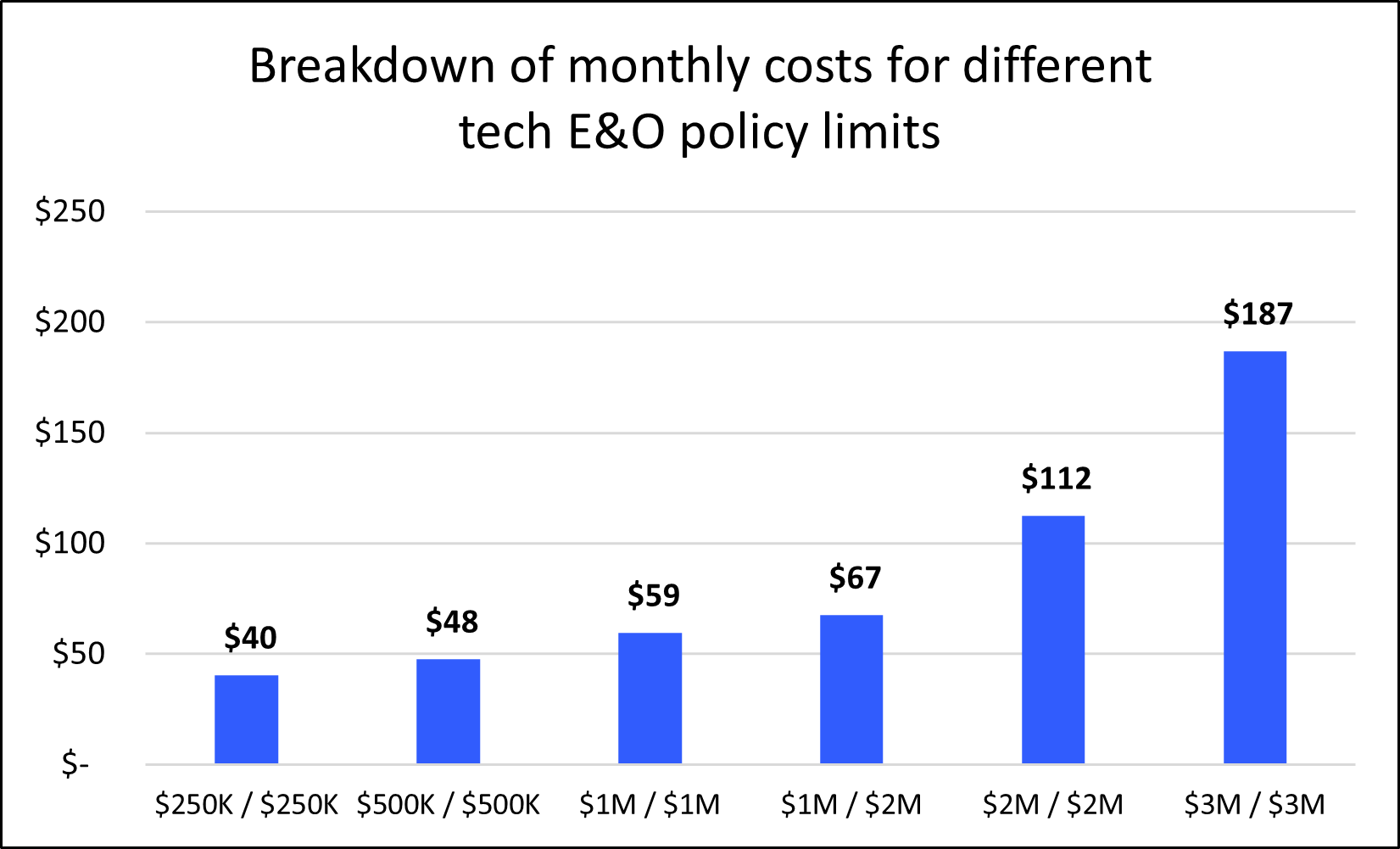

Policy limits affect the cost of tech E&O insurance

Policy limits are the maximum amounts your insurance company will pay for covered claims. The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay for all claims during your policy period, typically one year.

Most IT businesses (56%) choose errors and omissions insurance policies with a $1 million per-occurrence limit and a $1 million aggregate limit. Another 12% of IT businesses choose policies with a $2 million per-occurrence limit and a $2 million aggregate limit.

As with other small business insurance costs, the amount you pay for E&O insurance increases with your policy limits.

Cyber insurance

IT professionals pay an average of $148 per month, or $1,775 per year, for cyber insurance. This policy is vital for IT businesses that store personal information, such as customers' credit card numbers, Social Security numbers, or email addresses.

Cyber insurance covers the cost of complying with your state's data breach laws after a cyber incident. It can pay for legal fees, customer notification costs, and other expenses related to a data breach or cyberattack. You may also see this policy referred to as cyber liability insurance or cybersecurity insurance.

Cyber insurance costs depend on your digital information

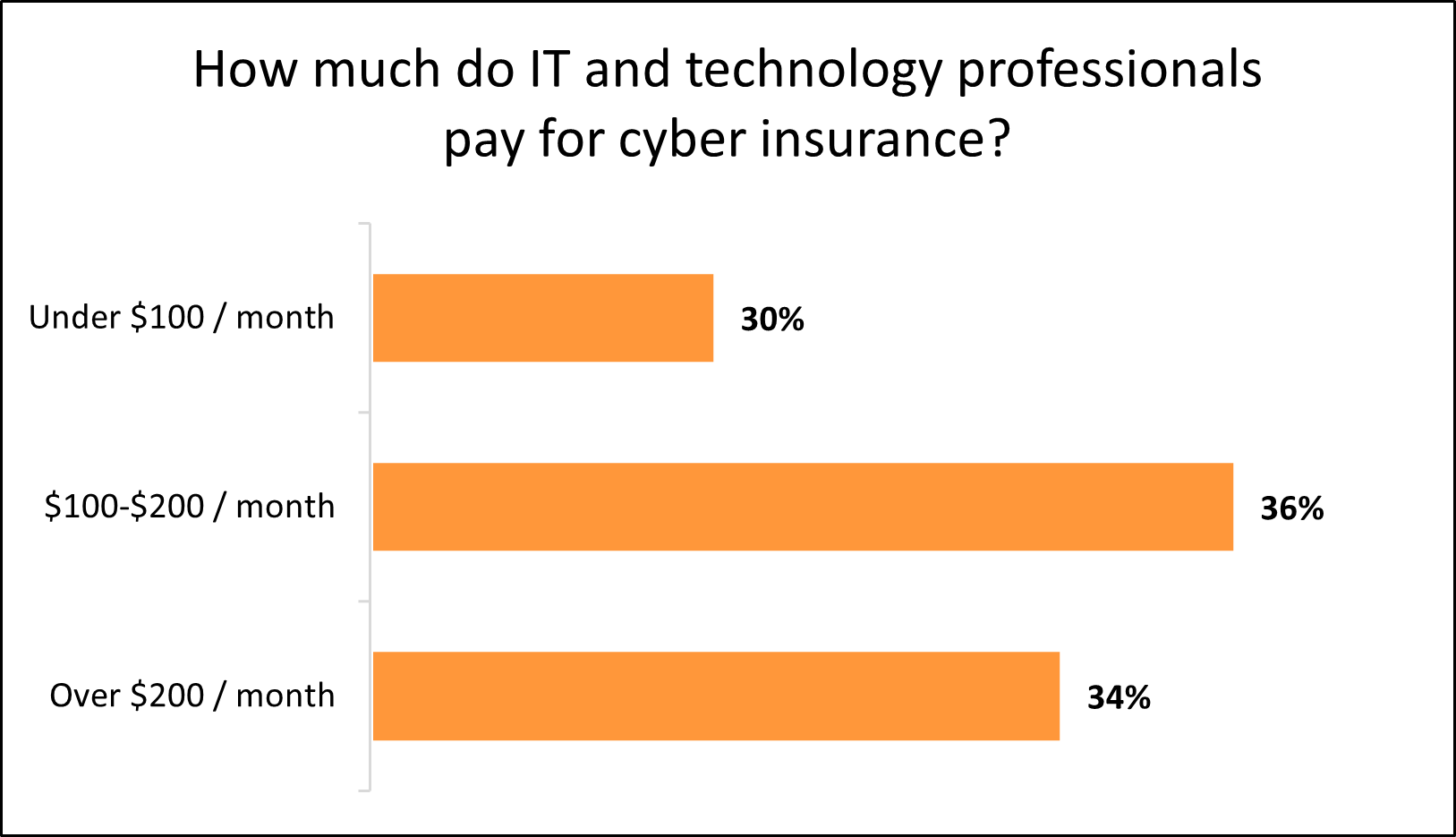

Among technology businesses that purchase cyber liability insurance with Insureon, 30% pay less than $100 per month. Another 36% pay between $100 and $200 monthly.

The cost of cyber insurance primarily depends on the amount of personal information handled by your tech company.

General liability insurance

IT businesses pay an average of $30 per month, or $363 per year, for general liability insurance. This policy helps pay for legal defense costs from accidental damage to a client's property or a client's bodily injury. It also covers lawsuits related to slander and libel.

This is the average general liability policy for IT professionals who buy from Insureon:

Premium: $30 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Insureon’s licensed agents typically recommend a business owner’s policy (BOP), which combines general liability insurance with commercial property insurance at a discount to protect your computers and other business property.

For technology professionals, the average premium for a business owner's policy is $46 per month or $550 per year. You can also add business interruption insurance to protect against financial losses from a forced closure due to a fire or storm.

Industry risks affect the cost of general liability insurance

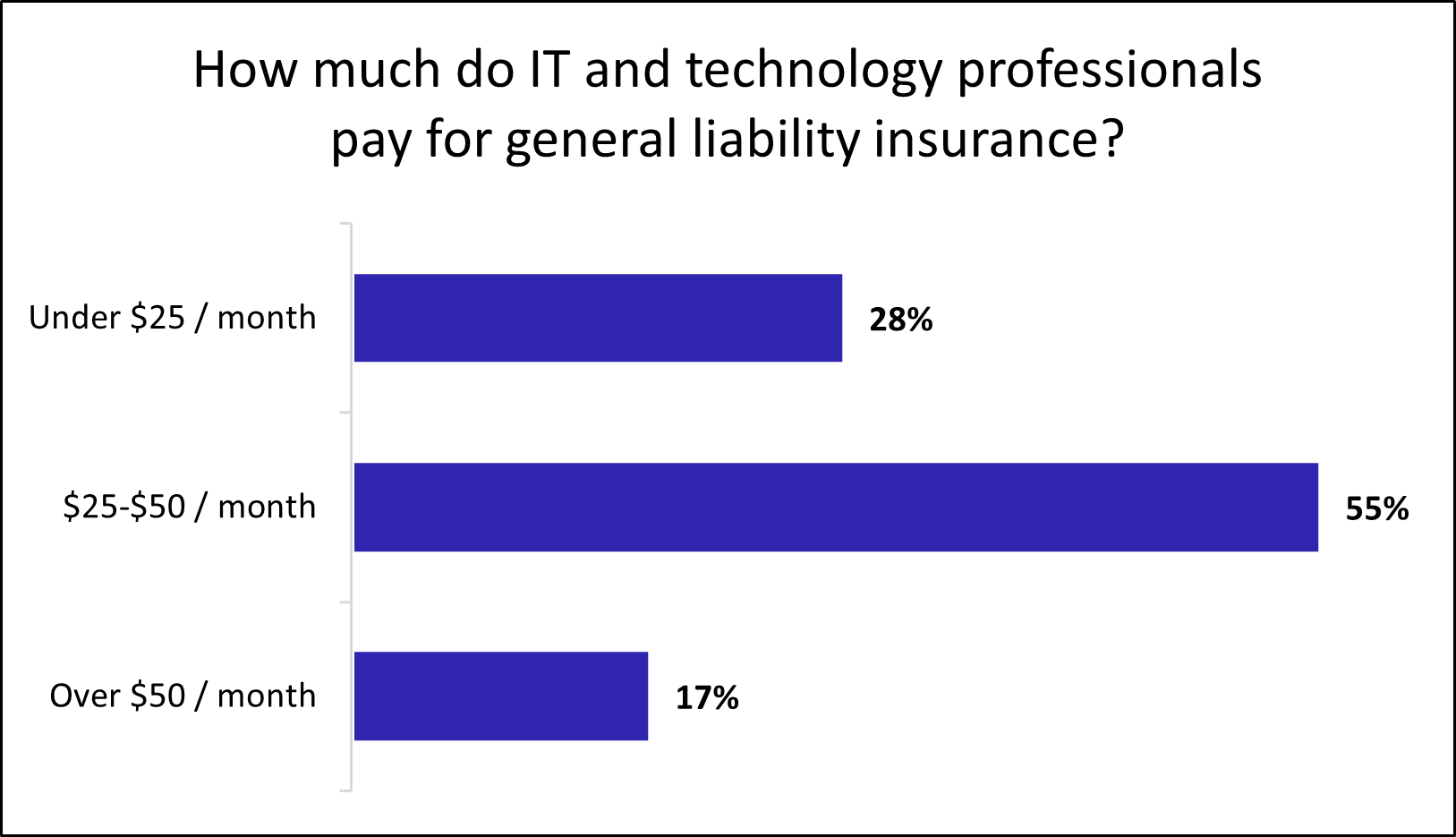

Among IT professionals who purchase general liability coverage with Insureon, 28% pay less than $25 per month and 83% pay less than $50 per month.

Factors that affect your premium include whether your business has a storefront, handles customer property, or has frequent interactions with clients. For example, a computer repair shop would likely pay more for general liability insurance than a data center with infrequent visitors.

Choose policy limits that match your tech company's budget

Policy limits are the maximum amounts your insurer will pay on covered claims. Most technology business owners (88%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit.

As your small business grows, you may need to increase your policy limits. You can add commercial umbrella insurance to boost the limits of general liability and other liability insurance policies.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's general liability insurance cost analysis page.

Fidelity bonds

The average cost of a fidelity bond is $107 per month for an IT company, or $1,283 annually. You may need a bond to work with certain clients.

Fidelity bonds reimburse your client if one of your employees commits fraud, theft, or forgery, including illegal electronic funds transfer. Unlike technology insurance policies, this amount must be paid back to the surety company.

The cost of a fidelity bond is typically a small percentage of the bond amount.

Workers' compensation insurance

IT businesses and contractors pay an average of $34 per month or $412 annually for workers' compensation insurance. This policy covers medical expenses and disability benefits when you or an employee suffers a work-related injury or illness.

Tech companies that have employees typically must purchase workers' comp to comply with state requirements and avoid penalties. It's also recommended for sole proprietors, as health insurance plans can deny claims for injuries related to your job.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to workplace injuries.

The cost of workers' comp depends on the number of employees and their occupational risks, among other factors.

Commercial auto insurance

Small business owners who work in IT pay an average of $198 per month, or $2,375 per year, for commercial auto insurance. This policy can pay for property damage and medical bills in an accident involving your company vehicle. It can also cover vehicle theft, vandalism, and weather damage.

Most states require this type of coverage for vehicles owned by a business. For personal, rented, and leased vehicles used for work purposes, look to hired and non-owned auto insurance (HNOA) instead.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, coverage options, the value of your vehicle, and the driving records of anyone permitted to drive.

Top IT and tech professionals we insure

Don't see your profession? Don't worry. We insure most businesses.

How do you buy technology business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable tech insurance coverage, whether you own a website business or startup, or work from home as an IT consultant or PC builder.

Apply today to get free quotes with one easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right type of business insurance and answer any questions. Typically, you can get a certificate of insurance within 24 hours of submitting your application.