What do you need to start a microbusiness?

Entrepreneurs often start small when launching a business. While some grow their companies into larger ventures, many proceed as microbusinesses.

While modest in size, these microbusinesses make a big impact – accounting for 75% of all private sector employers. Let’s take a look at what a microbusiness is and what it takes to start one.

What is a microbusiness?

Definitions vary, but the term “microbusiness” generally refers to businesses with just a few employees. It often applies to startup businesses, freelancers, contractors, and many home-based businesses.

The U.S. Small Business Administration defines it as a business with nine or fewer employees, although others define a microbusiness as one with no more than five employees and less than $250,000 in revenue.

A microbusiness or microenterprise typically requires minimal startup capital and may begin as a side hustle or hobby that generates additional income for the owner.

Microbusinesses can be found across all professions, from architects to web designers, and may have a storefront, office, or home-based operation.

Microbusiness details

The difference between a microbusiness and other businesses comes down to size and investment. According to the SBA, a microbusiness typically takes about $3,000 to start, with the number of employees initially limited to a single owner or business partners. Other businesses usually require more startup capital and partners.

Examples of microbusinesses include:

- A house cleaning business with eight employees and three commercial vehicles

- A freelance technical writer working a side gig

- A management consultant who works alone

- A computer repair store with three employees

- A caterer with a storefront and a staff of six

- A handyman who’s self-employed

Microbusinesses are frequently structured as a sole proprietorship versus an LLC. That means if you are a microbusiness owner, you will be taxed at your personal tax rate, and file income taxes on your personal returns. If you’re a solopreneur, you may not even have to register your business – although you should verify the requirements in your area.

In addition, a microbusiness with employees would have to pay payroll taxes, just like any other business. You will also be required to carry workers’ compensation insurance in nearly every state.

Microbusiness ideas

Many microbusinesses begin without a business plan or a marketing strategy; just an idea to offer a service and make some money.

The good news is that almost any skill or talent developed through business experience or personal interest could be turned into an entrepreneurship opportunity. Here are just a few business ideas:

- An experienced executive could open a consulting firm, offering guidance and mentorship to others in their field.

- A person with strong computer skills might start a computer repair business.

- Someone with a flair for decorating and a talent for remodeling could launch a home improvement business.

- An entrepreneur with a green thumb could create a lawncare and landscaping business.

- A design pro with a passion for computers could open their own web design business.

- Someone with a background in maintenance could start a cleaning business.

Plus, there are many microbusiness opportunities to make money that would require little to no startup costs, such as babysitting, tutoring, or dog walking.

The good news is that almost any skill or talent developed through business experience or personal interest could be turned into an entrepreneurship opportunity.

Pros and cons of starting a microbusiness

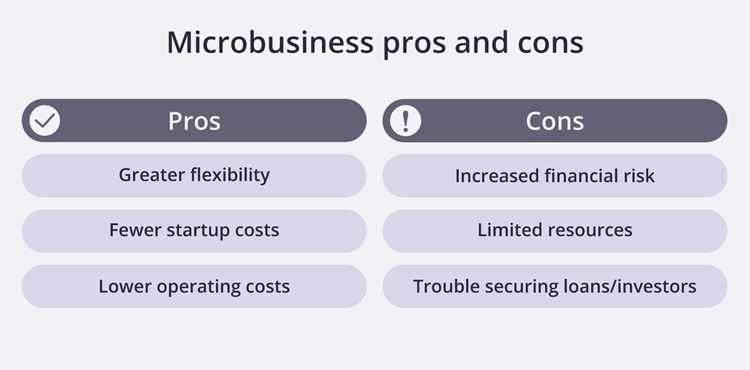

Like any business, microbusinesses come with both advantages and disadvantages.

The advantages of starting a microbusiness include:

- The freedom it allows. Microbusiness owners can often set their own hours and pursue whatever projects they think will bring the most personal and financial reward.

- A low-cost way to gauge interest in a project or service. Business owners can test the market to evaluate demand, before making a more significant investment.

- Easy adaptability. The diminutive size of microbusinesses allow their owners the flexibility to quickly adapt and fine-tune what they offer. They can change in ways that are difficult for larger companies.

- Lower operating costs than larger businesses. Microbusinesses have fewer employees and often start as home-based businesses, which means lower overhead and expenses.

There are a number of disadvantages that come with launching a microbusiness, too. These include:

- Increased financial risk. Any business has a significant risk of failure. Microbusiness owners typically form a sole proprietorship, which puts your personal assets at risk. Your personal savings or property could be used to satisfy a debt or lawsuit with this type of business structure.

- Difficulty securing business loans or investors. It can be hard for microbusiness owners to secure loans from financial institutions or attract outside investors.

- Limited resources. Microbusinesses have few employees to carry the workload, while larger businesses have plenty of people to specialize in tasks like handling marketing, bookkeeping, and so on.

- Trouble attracting top talent. Finding the right people to work with can be as important as offering the right service or product. Microbusinesses may have a hard time attracting workers, because they may not be able to offer the pay, benefits, or stability of their competition.

- Limited economies of scale. A microbusiness will also lack the economics of scale that larger businesses have, such as securing discounts for large purchases, obtaining loans, or securing investors. A microbusiness owner might have to draw on their own finances or use their own home as collateral in securing a loan.

How to protect your microbusiness

Every microbusiness comes with risks – whether you work alone, employ others, have an office, or work out of your home. While the types of risk vary, you should identify your biggest risks and develop a strategy to minimize them.

Small business insurance is an excellent way to protect your microbusiness and ensure that an unforeseen event doesn’t damage your business and your bottom line.

Let’s examine the insurance options that microbusiness owners should consider.

General liability insurance

General liability insurance policies cover common business risks from third-party claims such as customer injuries, property damage, and advertising injuries – such as if a competitor sues you over a flier or Facebook ad.

As a microbusiness owner, you might think you’re at low risk of a lawsuit, however it’s a good idea to protect yourself. A general liability policy can cover everything from lawyer’s fees to court-ordered judgments and settlements.

If a landscaper or janitorial service damages a customer’s property, or a client visiting a consulting business trips and falls at their office, a general liability policy would cover the costs of a lawsuit.

General liability insurance is also commonly required by lenders, for leasing an office or commercial space, and may also be required in client contracts.

Business owner’s policy

A microbusiness owner can save money on insurance with a business owner’s policy (BOP), that combines general liability insurance with commercial property insurance.

A BOP protects small businesses against the financial costs of customer accidents and damage to property, equipment, and inventory from incidents such as fires and burglaries.

Professional liability insurance

Professional liability insurance is also known as errors and omissions insurance (E&O). It protects your small business against lawsuits from clients who are unsatisfied with your work.

Some clients might require you to have this before they’ll do business with you, and may ask for a certificate of insurance as proof.

These policies are designed for those who make a living from their professional advice, such as:

Any mistake or oversight, such as a miscalculation, a missed deadline, inaccurate projection, or a negligence claim could result in an expensive lawsuit.

If this happens, your professional liability policy will cover your legal expenses, up to your policy limit.

Workers’ compensation insurance

Workers’ compensation insurance coverage is mandatory for employers in most states, and is worth considering even in states where it’s not required.

Workers’ comp provides coverage related to work-related illnesses or injuries. It helps pay for medical expenses like emergency room visits and physical therapy as well as lost wages during recovery.

Most workers’ comp policies also include employer’s liability insurance, which will pay for attorney’s fees, court costs, and any settlements or judgments if an injured employee sues you for negligence.

Cyber insurance

Any company is at risk of suffering a data breach or malicious software attack. This is especially true for any company that handles sensitive data or provides tech services, such as an IT consulting business or a network security company.

Microbusinesses are no exception to this, especially since they may lack the resources or the expertise needed to protect themselves from such threats. In fact, 60% of small businesses go under within six months of a cyberattack.

Cyber insurance can protect your microbusiness from the costs of such an attack. It covers things like customer notifications, credit monitoring, legal fees, and fines.

Commercial auto and hired and non-owned auto insurance

Commercial auto insurance offers protection for any vehicles your business owns. If you use a company vehicle to meet with clients or transport materials, it’s likely required in your state.

Commercial auto coverage can help cover the costs of medical expenses, theft, and physical damage from accidents, vandalism, and storms.

Hired and non-owned auto insurance (HNOA) offers liability protection for accidents involving any personal, rented, or leased vehicles used by you or your employees for business purposes.

If your or an employee causes an accident while making deliveries or meeting with a client, HNOA insurance would protect you from related lawsuits and the injured party’s medical expenses.

A homeowner's policy endorsement

Microbusiness owners might think they’re financially protected if they run their business out of the home, yet a typical homeowner's insurance policy provides coverage for just $2,500 in business equipment, according to the Insurance Information Institute.

This does not include liability protection from lawsuits, or insurance against lost income. You could be putting your new venture at considerable risk by leaving yourself underinsured, or with no insurance at all.

Your homeowner's insurance provider might be willing to increase your coverage for business equipment, such as computers, by adding to your existing premium with a homeowner's policy endorsement.

This would likely protect you if a client or delivery person is injured on the premises, such as a slip and fall on the front steps, though it’s important to verify this with your provider. These add-ons are typically offered to home businesses with few visitors.

Whatever type of microbusiness you’re thinking of launching, creating a business plan and evaluating your potential risks are a smart place to start. For help understanding what insurance coverage you may need, our expert agents are here to help.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.