Product liability insurance

Product liability insurance

Product liability insurance can help cover your legal expenses if someone claims that a product you sold, made, or distributed caused an injury or property damage.

Why is product liability insurance important for small businesses?

If you sell, make, or distribute products, you likely need this policy. Any business in the supply chain could be blamed if a product causes harm, and there are few limitations on who can file a product liability lawsuit.

If a product allegedly hurts someone or causes them financial loss, product liability coverage will help pay your legal fees, judgment, or settlement.

This insurance is sometimes called products-completed operations coverage. “Products” refers to the items you make or sell. “Completed operations” refers to completed work, such as a roof or deck built by your construction company.

What do product liability claims typically cover?

- Manufacturing defects

- Design defects

- Marketing defects, such as labeling errors or lack of warnings

- Allergic reactions

- Food contamination

- Strict liability, for claims when you are not at fault

Insurance companies usually include product liability insurance with a commercial general liability insurance policy. Some retailers or manufacturers may need to buy this coverage as an endorsement.

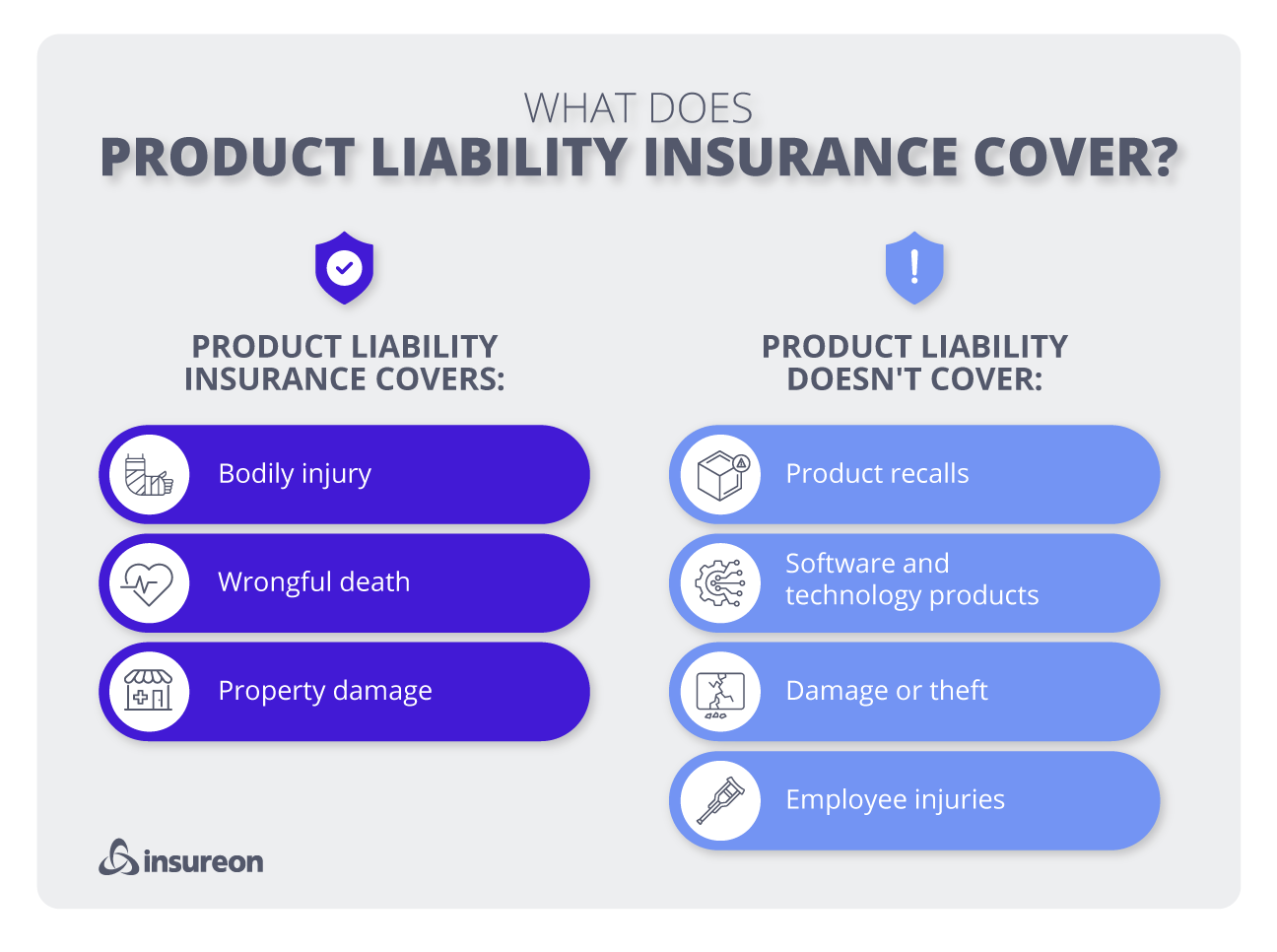

What does product liability insurance cover?

Product liability insurance helps pay for legal expenses when a product that you made, sold, or distributed causes a personal injury, property damage, or other loss.

Specifically, a product liability insurance policy can provide coverage for:

Injury caused by a product

If an item that you made or sold causes a bodily injury, product liability insurance can cover the cost of hiring an attorney. It would also cover the resulting settlement or court-ordered judgment.

Property damage caused by a product

Product liability insurance provides coverage when an item you sell or manufacture damages a customer’s property. The damage could be related to a product defect or a mistake in an instruction manual that led it to be used incorrectly.

Illness caused by a product

This insurance coverage protects against illnesses caused by products sold or manufactured by your business. That includes everything from expired food that sickens a customer to a beauty product that causes an allergic reaction.

Wrongful death caused by a product

Product liability insurance also covers lawsuits, burial costs, and other expenses related to a death caused by your product.

How much does product liability insurance cost?

The cost of product liability insurance is usually included in your general liability insurance premium. General liability costs an average of $42 per month.

Your cost is based on certain factors, including:

- Industry and exposures

- Business size and location

- Foot traffic

- Claims history

- Policy limits and deductible

Verified product liability insurance reviews

Who needs product liability insurance?

Product liability insurance offers crucial protection for any business that manufactures or sells goods, along with distributors, importers, and any other business that touches a product.

Product liability is not a product guarantee or product warranty. This policy protects against design flaws and other product liability risks and may be required by clients and partners.

Specifically, businesses in the following industries should carry this coverage:

Manufacturers

Manufacturers rely on this coverage for protection against manufacturing defects and similar risks.

For example, a furniture manufacturer accidentally produces a series of chairs with improperly tightened screws. If one of the chairs breaks when a customer sits on it, the company's product liability policy would pay for their medical treatment, along with legal defense costs if they file a lawsuit.

Note that this coverage may cost more for manufacturers, as they face higher risks than other industries.

Retailers, distributors, and wholesalers

Product liability insurance is important for every business in the supply chain, especially if you deal in pharmaceuticals or other high-risk products. Retailers, distributors, and wholesalers can be held liable for damages caused by products, even if they weren't directly responsible.

For example, an Amazon seller might sell a lotion, perfume, or other product containing essential oils that sickens a customer with severe allergies. When the customer sues to recoup their medical expenses, a product liability policy would cover the legal costs.

Tradesmen

Products-completed operations insurance is a crucial part of risk management for general contractors and other construction and installation professionals. They need this coverage in case their work is linked to an injury or property damage after it’s completed.

For example, if a homeowner sues because their newly installed sink leaks and damages their flooring, this policy would cover the contractor's legal costs.

Beauty and cosmetology

Professionals who work in the beauty and cosmetology industry should also invest in product liability insurance. If a product that you sell or apply to your customer causes an adverse reaction, this coverage can help pay your legal defense fees and the cost of a settlement.

For example, a hair salon might sell another company's bottled hair dye. If a customer has a serious allergic reaction to the dye, this policy would cover the salon's legal fees.

Food services

Restaurants and other food service businesses rely on food product liability insurance to protect against legal costs related to contaminated food and food allergies.

If a customer gets sick after eating at your restaurant, food service liability insurance can help pay for attorney's fees, court-ordered judgments, and other costs.

For example, a deli might serve expired cold cuts to a customer, who gets severe food poisoning. This policy would cover costs when the customer sues over their medical expenses and missed days of work.

Cannabis

Product liability insurance is vital for cannabis businesses, as your products carry a risk of panic attacks and other adverse reactions. In fact, some state laws mandate this coverage for licensed cannabis businesses.

For instance, a cannabis dispensary might sell edibles that have a higher THC content than stated on the label. If a consumer gets into a car accident after ingesting the product, the dispensary could face expensive medical costs or legal fees.

Business owner’s policy

Workers’ compensation insurance

Professional liability insurance

Commercial auto insurance

Cyber insurance

Top professions that need product liability insurance

Don't see your profession? Don't worry. We insure most businesses.

How do you buy product liability insurance?

We're on top of your small and medium-sized business insurance needs. We'll help you find policies that protect what you've worked so hard to build.

Start here. Tell us about yourself. Questions? We've got your back. The info you share is secure. We'll double-check it and a pro with experience in your field will be in touch.

Fast? You can compare quotes from leading insurance providers in seconds and get a certificate of insurance the same day.

Always online, always on your side. Helping protect your business.

It's easy to buy product liability insurance with Insureon. In fact, it's usually included in your general liability insurance. Fill out our free online application to get quotes from top-rated providers.

When you purchase a policy, you’ll get a certificate of liability insurance as proof of insurance for the policyholder.

What does product liability insurance not cover?

Product liability insurance coverage protects against the most common risks associated with products, but it doesn't provide all the protection you need. Your policy will not cover the following types of claims:

Product recall costs

Product recall insurance covers the cost of recalling a defective product. Contact an Insureon agent to find out more about this coverage.

Damaged or stolen products

The commercial property insurance included in a business owner’s policy (BOP) protects your own business property from theft, fires, and other losses. It includes protection for your building and its contents, including inventory.

Employee injuries

If an employee is injured by a product sold or manufactured by your business, workers’ compensation insurance would cover the employee’s medical expenses. It would also cover your legal costs if the employee sues over the injury.

Business interruption incidents

If your business is forced to close temporarily, business interruption insurance can cover day-to-day expenses until your business reopens. The closure typically must be tied to a property insurance claim, such as a fire or burst pipe.

Contingent business interruption insurance provides financial protection if the loss of a supplier affects your ability to do business. For example, it would cover costs if a supply chain disruption temporarily shut down a manufacturing plant.

FAQS product liability insurance

Get answers to frequently asked questions about product liability insurance

What's the difference between product liability insurance and general liability insurance?

Though they are often purchased together, these two policies are not the same.

General liability insurance, sometimes called public liability insurance, provides coverage against the most common small business claims. It covers accidental damages, such as a customer slipping in a puddle at your shop and breaking an arm (or their phone). It also helps pay for lawsuits that claim you damaged a competitor’s reputation or copied their logo.

A product liability policy covers damages related to your products or completed services. That’s why manufacturers, retailers, and contractors need both types of coverage.

Does product liability insurance cover problems with software or an app?

Product liability insurance is not designed for software, applications, and similar IT and technical products. Small business owners who produce these types of products should carry errors and omissions insurance (E&O) to protect against coding mistakes and software errors.

If a problem with your software could lead to property damage or physical injuries, you might want to invest in product liability insurance as well. For instance, this policy would cover legal costs if your software caused a battery to overheat and injure someone.

Where can I learn more about product liability insurance?

If you want to learn more about this policy, you can find additional information in our frequently asked questions about product liability insurance.

For any other questions about product liability coverage or other types of insurance, you can contact an Insureon insurance agent. You can also request product liability insurance quotes through our easy online application and compare policies from the best carriers for this coverage.

Do you still need product liability coverage even if your business does nothing wrong?

Yes, for several reasons.

First, your business might be unaware it sold a defective product. Every business in the supply chain can face a product liability claim, even if they didn't design or manufacture the product.

Second, a customer might also claim your business provided insufficient warnings or inaccurate instructions. If they get injured using your product incorrectly, they could blame your company.

Finally, a customer could sue because they’re unhappy with your product. Even when a lawsuit is frivolous, your small business still needs to pay for a legal defense. Product liability insurance will give you peace of mind against a range of potential legal issues resulting from the products you sell.