Commercial general liability insurance

What is commercial general liability insurance?

Commercial general liability insurance, often referred to simply as general liability insurance, protects your business from third-party lawsuits, injuries, and incidents.

General liability helps pay legal defense costs, medical expenses, property damage repair, and other expenses related to claims made by third parties.

Third parties include customers, vendors, suppliers, and prospective clients. Almost everyone who isn't directly employed by your business is a third party.

Examples of common third-party risks covered by general liability include a customer who slips in a restaurant and sues for injuries, or a vendor who claims a business defamed them and files a lawsuit to recover their damages.

Commercial general liability covers many risks, but not all. We will discuss what it covers, what it doesn't, if it's a good option for your small business, and other types of coverage your business may need.

Are commercial general liability and general liability the same?

Yes. Commercial general liability insurance and general liability are different names for the same policy.

General liability is also occasionally simply referred to as CGL insurance.

Commercial general liability insurance also used to be called public liability insurance, but this is now considered an outdated term.

What does a commercial general liability policy cover?

Commercial general liability insurance covers a variety of small business risks related to working with the general public.

These risks include:

Third-party property damage

A non-employee's property is damaged or destroyed while on your business property or working with one of your employees.

For example, a customer is receiving technical help from a computer repair shop. The employee bumps the computer and it falls on the floor, further breaking it. General liability insurance would help pay for the repair or replacement of the computer.

Third-party bodily injury

Someone is injured while on your property or interacting with your business or employees, and sues for medical expenses.

For example, a customer slips and falls at a coffee shop, breaking their arm. They sue the cafe for medical expenses. General liability insurance helps the business pay the medical and legal expenses.

Personal and advertising injuries

If your business is sued by a person or business claiming slander, libel, or copyright infringement.

For example, a management consulting firm is sued by their competitor claiming that malicious and untrue lies have been spread about the competing organization. General liability insurance would help cover the legal defense costs.

Product liability

A product that your business manufactures or sells causes damage or harm to a customer, such as food contamination. Not all CGL insurance plans have product liability coverage included, but many do.

For example, an Etsy shop that makes skincare products is approached by a customer who claims their products caused an allergic reaction. General liability would help pay for the medical expenses.

How much does commercial general liability insurance cost?

The average cost of a general liability insurance policy is $42 per month for Insureon's small business customers.

General liability insurance premiums are calculated based on a few different factors, including:

- Industry and risk factors

- Business operations

- Location

- Number of employees

- Policy limits and deductible

- Claims history

What is the standard general liability limit?

The majority of small businesses purchase a standard policy with a $1 million per occurrence limit, a $2 million aggregate policy limit, and a $500 deductible.

Essentially, this means your policy will cover up to $1 million for a single incident and up to $2 million over the course of the policy period, which is typically a year.

If you are in a high-risk industry or need additional protection, you can purchase a commercial umbrella policy, which can extend your policy limits for general liability, commercial auto liability, and employer's liability insurance (often included in workers' compensation insurance).

Additionally, risk management practices can help your business avoid claims, save money on insurance, and help you stay under your policy limits.

Verified general liability coverage reviews

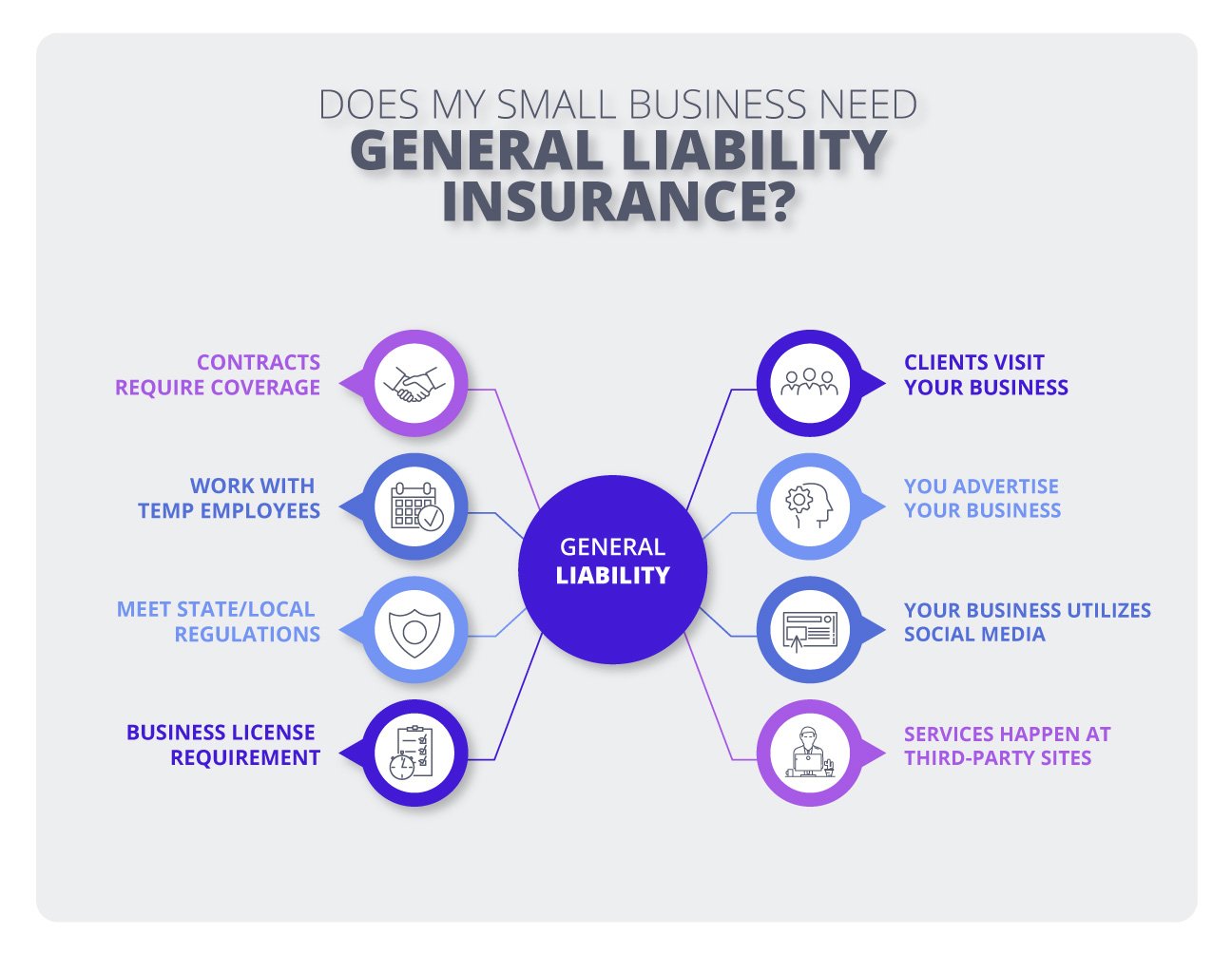

Do I need commercial general liability insurance for my small business?

General liability insurance is not typically a legal requirement for businesses.

However, depending on your location and industry, you may need general liability for licensing, contract, or rental purposes. For instance, it's usually required when you sign a commercial lease.

Do independent contractors need commercial general liability insurance?

Independent contractors are generally not required to carry general liability insurance.

However, some high-risk professions, such as general contractors, may be required to carry general liability in order to bid for contracts.

Top businesses that need general liability insurance

Don't see your profession? Don't worry. We insure most businesses.

What does commercial general liability insurance not cover?

While commercial general liability insurance coverage does cover many common small business risks, it doesn't cover everything.

For example, general liability doesn't cover:

- Employee injuries, such as an employee who trips and breaks their arm on the job. For this, you'd need a workers' compensation insurance plan.

- Professional service errors, such as an employee who misses a deadline. To protect against this, you'd need professional liability insurance (also called errors and omissions).

- Data breaches or ransomware attacks, where customer data is compromised. For this, you'd need cyber insurance.

- Car accidents in company vehicles. To protect company-owned vehicles, you'll need commercial auto insurance.

- Employment-related lawsuits, such as an employee suing over wrongful termination. For this, you'll need employment practices liability insurance.

- Damage to company property. For this, you'd need a commercial property insurance policy.

Workers’ compensation insurance

Professional liability insurance

Cyber insurance

Commercial property insurance

Commercial umbrella insurance

Other common questions about commercial general liability insurance

What are the three forms of commercial general liability?

Commercial general liability insurance includes three categories: Coverage A, Coverage B, and Coverage C.

- Coverage A includes legal expenses related to bodily injury and property damage liability

- Coverage B includes legal expenses related to personal and advertising injuries

- Coverage C includes medical payments for non-employees who are harmed at or by your business

What is the difference between personal liability and commercial general liability insurance?

Personal liability (such as private healthcare or personal auto) insurance does not provide financial protection for business incidents, injuries, and lawsuits.

For example, if you were injured at work and attempted to see your private doctor using your own healthcare insurance, your insurance likely would not cover the incident. You'd instead need to use your own (or your employer's) workers' comp policy.

This is also true for businesses that are run out of a private residence. Homeowners' insurance typically doesn't cover commercial property and other business liability claims.

Can I bundle commercial general liability insurance with other types of business insurance?

General liability coverage can be combined with a commercial property insurance policy into a common bundle called a business owner's policy (BOP).

These two policies combined cover many of the most common small business risks and exposures.

You can also add additional insured endorsements to your general liability policy to supplement your coverage. For example, you can add a professional liability endorsement to cover professional mistakes, or a liquor liability endorsement, which protects your business from incidents related to alcohol sales.

Speak to a licensed insurance agent if you have further questions about your bundling and endorsement options.

How to get commercial general liability insurance

Complete Insureon's easy online application to get free small business insurance quotes from leading U.S. insurance companies.

You can also contact our licensed insurance agents who can help you find the right types of business insurance for your business needs.

Our agents can help you find peace of mind knowing your business is protected from the high legal costs and financial losses associated with operating a small business.

After you pick the right policies for your needs, you can pay online and obtain a certificate of insurance. Policyholders typically begin coverage the same day.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy